Mooners and Shakers: Crypto market cap sinks below $1 trillion ahead of Fed; Rito lays down another rhyme

Getty Images

Mooners and Shakers is sponsored by Dacxi, the world’s first purpose-built Crypto Wealth platform.

You know it’s a bear market when… the crypto market cap is only down about 3% on the day and you’re fist pumping like a Wall Street trader cliché.

Okay, so the fist pump didn’t really happen. The fact the market’s entire valuation has now sunk below $1 trillion for the first time since January 2021 pretty much put paid to that forced imagery.

But enough of the Debbie Downer for half a minute, time for a raw hit of hopium…

Reasons to be cheerful, one, two three…

• Here’s a fun factoid for you: Bitcoin (BTC) has never been more oversold on a weekly timeframe than it was a little earlier today when it dipped to US$21k. (Take Crypto Rover’s urgent-sounding “benefit from it” message with a grain of salt… although probably decent advice for dollar-cost averagers.)

#Bitcoin has never been more oversold on the Weekly Time frame than RIGHT NOW!!!!!

We don't know how long this opportunity will stay but benefit from it. 👇🔥 pic.twitter.com/dWR07snuL2

— Crypto Rover (@rovercrc) June 14, 2022

• And doubling down on the “lowest-ever” stats, according to Rekt Capital, the original orange digital asset has also hit its nadir on the monthly RSI (relative strength index) price-momentum indicator.

It’s a classic bottoming signal if ever there was one. But… best still keep that salt handy – crypto’s never been in a broader, more complex macro bear market quite like this before. And past performance is not indicative of future resul… ah, you know.

#BTC has reached its lowest ever Monthly RSI value, eclipsing previous Bear Market Bottom levels of 2015 & 2018$BTC #Crypto #Bitcoin pic.twitter.com/X7WUawjm4X

— Rekt Capital (@rektcapital) June 14, 2022

• That said, as 2018’s crypto hit song Bitcoin Pls Go To Moon goes: “But Mr Novogratz say, we have baaaaatoooooommm-ed out…” Well, almost. The former Goldman Sachs man and Galaxy Digital CEO actually said the following at today’s Morgan Stanley conference in New York:

💥MIKE NOVOGRATZ: #Bitcoin is closer to bottom than stocks.

— Bitcoin Archive (@BTC_Archive) June 14, 2022

The LUNA-inked CEO also indicated that he expects Ethereum (ETH) to hold around US$1,000 and Bitcoin to be supported around the US$20k level.

That one’s probably a slightly weak reason to be cheerful, considering how wrong “Novregretz” got things with Terra. Having said that, he wasn’t exactly the Lone Ranger on that score and has made some pretty reasonable calls in the past – “the herd is coming”, for example.

Anyway, back to earth… let’s get lyrical…

Crypto cadence with Rito Rhymes

New York’s Rito Rhymes, the most intellectual crypto rapper we know (actually the only one we know), gives us his on-the-spot take on the current bull-fleeing market…

“It’s lookin’ like a matador’s market how the bulls flee unsungly…

‘Cos these bears want blood like bees want honey!

I’ll HODL if I can but my money’s running from me.”

Top 10 overview

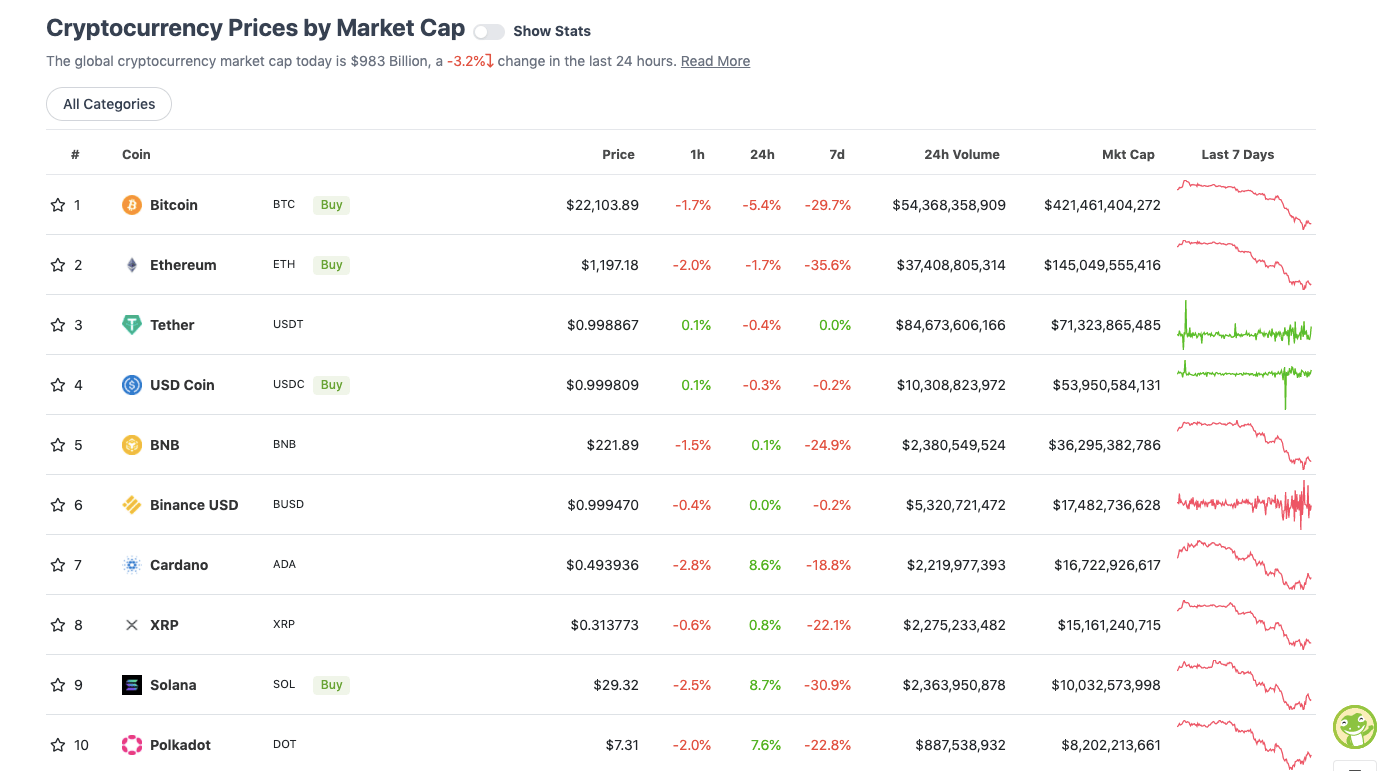

With the overall crypto market cap at roughly US$983 billion, down 3.2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Some slightly surprising alternative “layer 1” price action can be seen in the chart above, with Cardano (ADA), Solana (SOL) and Polkadot (DOT) “crushing” it on the daily timeframe.

Most Ethereum (ETH) rivals in the top 100 have been hammered prior to this over the past few days, so perhaps it’s not so surprising then to see them bounce a little on a more neutral day of trading (compared with yesterday’s bloodbath, that is).

That’s all well and good, but let’s stay on the OG crypto asset for now…

Bears still having a picnic ahead of Fed’s FOMC meeting

Bitcoin plunged to an intraday low of just under US$21k today, following yesterday’s low of about US$23,600. These are levels not seen since December of 2020 – pretty much eons ago in crypto terms.

But does this mean we’re actually nearing the bottom of the crypto bear market? The market seems a little split, as always, but we’ve seen that numerous analysts, including those at Tasmanian crypto-education platform Collective Shift, think the bear has a way to run yet.

$BTC 1D

No signs of reversal & I'm seeing thousands of #bitcoin inflow to spot exchanges to be sold. We are oversold but this is definitely capitulation.

I would not long here as "catching the falling knife" is dangerous and unpredictable.

19.7k next.#cryptocurrency pic.twitter.com/UDsTafnM4k

— Roman (@Roman_Trading) June 14, 2022

And don’t forget, the US Federal Reserve’s two-day FOMC (Federal Open Market Committee) meeting kicks off tomorrow. What fun for Jerome Powell and his market-moving pals. What will they absolutely boot us in the groin with this time?

Tomorrow is the Fed's rate decision…

Markets have already adjusted bets and expect a 75bps hike. Hopefully it's already "priced in" such that if it is 75bps, it doesn't shock the markets 🙏 pic.twitter.com/gBi01nDJOC

— Coin Bureau (@coinbureau) June 14, 2022

Have the markets (stonks and crypto) already been pricing in a 75bp rate-hike increase in response to the worst inflation level (8.6%) seen in the US pretty much ever? Guess that’s the question. Answer to come tomorrow. Trade it (or don’t) how you will, I guess.

Apparently the hunt on #Celsius wasn’t fulfilled yesterday, as #Bitcoin was the only one continuing the dump and now climbing back up.

Next; markets have priced in a 75bps hike tomorrow, which is unlikely to happen (as Powell stated).

Not favoring massive further downwards.

— Michaël van de Poppe (@CryptoMichNL) June 14, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$7.57 billion to about US$300 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

Erm, not 100 per cent sure what’s going on with the CEL token mooning here. Whales? (Pretty much a stock answer to everything.) This pump could be over in a flash, but we’ll keep an eye on it and update this story accordingly if there’s any significant update to the Celsius drama dominating crypto news this week…

$CEL with a very casual, organic, and normal intraday move. pic.twitter.com/zN9c6Fcmlh

— K A L E O (@CryptoKaleo) June 14, 2022

• Celsius Network (CEL), (market cap: US$296 million) +148%

• Bitcoin SV (BSV), (mc: US$1 billion) +19%

• Helium (HNT), (mc: US$980 million) +16%

• Elrond (EGLD), (mc: US$1 billion) +15%

• Theta Network (THETA), (mc: US$1.16 billion) +12%

JUST IN:

Theta Network $THETA flips The SandBox #SAND and ApeCoin #APE in market capitalization. pic.twitter.com/M0375H9Nqa— TechGuyK (@techguyk) June 13, 2022

DAILY SLUMPERS

• Chain (XCN), (market cap: US$1.93 billion) -34%

• Monero (XMR), (mc: US$2.26 billion) -12%

• TRON (TRX), (mc: US$5.49 billion) -9%

• DeFiChain (DFI), (mc: US$713 million) -6%

• Huobi (HT), (mc: US$871 million) -6%

Around the blocks

To finish, a selection of randomness that stuck with us on our daily journey through the Crypto Twitterverse…

#Bitcoin Fear and Greed Index is 8 = extreme fear.

“Buy when there is blood on the streets” 🤑 pic.twitter.com/XneSRzPlWb

— Bitcoin Archive (@BTC_Archive) June 14, 2022

Really looking forward to the next few months.

This chart really says it all. pic.twitter.com/NKPZgXpws9

— The Wolf Of All Streets (@scottmelker) June 13, 2022

As fun as this is to be bearish, understand that the unrealistic moonboy expectations will happen on the permabear Side.

– USDT will not crash

– $BTC will not go to 0

– We will most likely see ATHs once again.I’m not saying to buy now but I’m saying #crypto will stick around.

— Roman (@Roman_Trading) June 14, 2022

💥MicroStrategy has a $205m loan subject to margin call.

They also have BILLIONS in unused #Bitcoin collateral to satisfy the margin call.

Relax, they’re not getting liquidated.

Fake newz! 🙄— Bitcoin Archive (@BTC_Archive) June 14, 2022

#1 rule of bear markets is to survive.

— Dan Held (@danheld) June 14, 2022

An old Aussie classic this, for those who remember… Can you recall what it was actually advertising, though?

#Bitcoin https://t.co/4vhuniIRfc

— naiive (@naiivememe) June 13, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.