Crypto Espresso: Special DeFi logic edition

Via Getty

Good Morning Coinheads.

Like a bad card, I turn up at the smell of Kenny Rogers.

This morning he smells a little of blood, fear, honeysuckle, doubt and remorse, a combo which demands a special brew of bowel-shaking espresso of monster-truck force.

For more sense and sensibility on this, the actually very good Badman was eating his fingers and friends on Monday. This is the result.

Now is the winter of our dis-cointent

The combined market-cap of all cryptocurrencies, everywhere, crashed to $968.5 billion on Monday, data from CoinMarketCap shows.

The plunge-a-thon part of a delightful wider market wipeout has taken the total market cap of all cryptocurrencies back about 18 months.

That’s a drop of more than 200% from the now ionospheric heights of November ’21’s US$3 trillion. What a happy market bull run that was, back when Bitcoin could’ve reached out with its brave little hand and slapped US$69,000 on the booty.

But we’re the 14th of June now, and at the time of writing/screaming/drinking hot toddy with un-regal Chivas, the global crypto market cap is crashing below $938bn and not pausing for dramatic effect.

The total crypto market volume over the same period is US$150.84bn, which makes a 82.86% increase in activity.

The total volume in DeFi is currently US$10.77bn, 7.14% of the total crypto market 24-hour volume. And the volume of all stablecoins is now US$134.07 bn, which is 88.88% of the total crypto market 24-hour volume.

Bitcoin’s price is currently US$22,243.49. Bitcoin’s dominance is currently 45.46%, a decrease of 1.75% over the day.

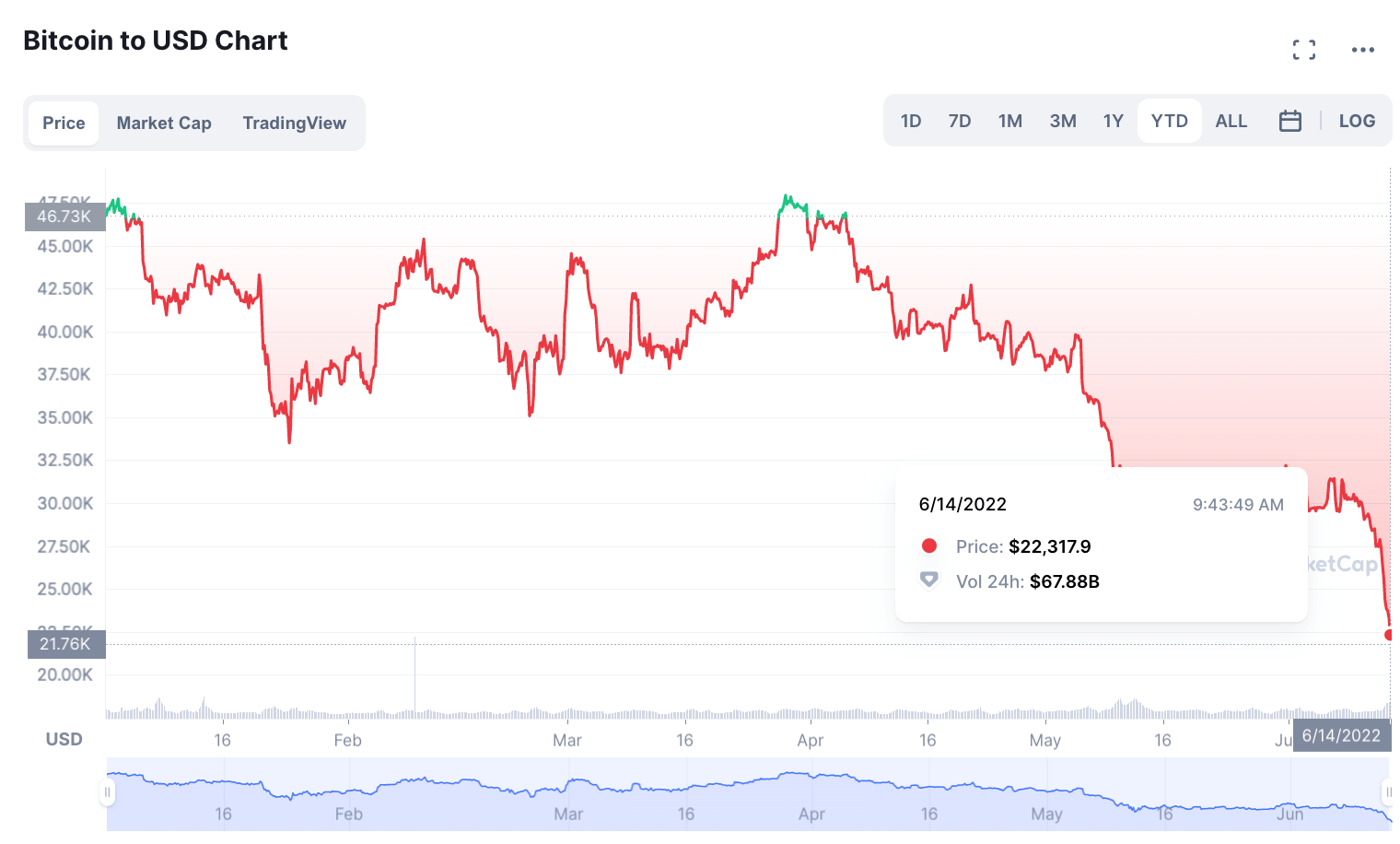

Bitcoin is having a difficult year:

Bitcoin (BTC) dropped below US$23,000 last night, and at 0900 Sydenham time, per CoinMarketCap; is now pushing at US$22k – a drop of over 17% on the day and over 25% in the past week.

The industry’s oldest cryptocurrency network, which once boasted a market cap of US$1.3 trillion, is now valued at a modest US$455 billion, per CoinMarketCap.

Ethereum, the world’s #2 crypto, shed more than 16% in value over the day and is now trading at US$1,190, while its market cap has been further trimmed to under US$146 billion.

Other big name cryptocurrencies, like Solana, Dogecoin, and the ill-named Avalanche, are all doing the same dance.

The perfect winter storm

The cruise-lining world of crypto started to list around the middle of the last week, when rising inflation and the broader economic decline morphed from doubt to despair, driving equities and crypto markets into a tailspin.

Already harried crypto investors copped another confidence coup de grace when crypto-lending platform Celsius Network stuck up its hand and locked down its bank, cutting off all withdrawals and transfers between accounts, in the name of “stabilising liquidity.”

Suddenly the regulatory burden known as the ‘Net Stable Funding Ratio’, doesn’t seem so onerous and ‘DeFi’ as a fiscal idea in general might need to be appended with ‘logic’ after the smoke clears.

Celsius Network: Temperature drops to freezing

Like free money and high speed internet, the offer looked like a no-brainer: Just give us your crypto, and we’ll return you circa 20% yield for the security we bring.

This then in a peanut shell, was the guarantee of Celsius Network. A promise of the greatness offered by DeFi.

Celsius (where the temperature always rises) might’ve been a quasi-experiment in the unknown topography of crypto-banking, but with more than one million customers post-haste, the network quickly emerged as a leader in the DeFi universe.

Now with around 1.7 million punters in for both pennies and pounds, it’s hard to reconcile that 2021 was the explosive birthplace of DeFi – a babe of just a few months, now at the centre of an almost US$100 billion industry, an industry which was already sucking up the best of venture capital oxygen as well as the then hyperventilating crypto-capitalists and mum and dad investors.

I mean who could resist the angelic face, the surefire gains and the linguistically-styled lovechild of a marriage of crypto (risk) and banking (safety).

The nomenclature was perhaps more attractive than the science.

When on Sunday night, the cryptocurrency price avalanche became too much to bear, Celsius was managing more than US$20 billion in assets.

Before the crypto-cherub became latest venture to buckle at the knees, announcing it was freezing withdrawals “due to extreme market conditions.”

In an email to all its customers which might’ve been a shock on a Sunday night, Celsius spake thusly:

“Due to extreme market conditions, today we are announcing that Celsius is pausing all withdrawals, Swap, and transfers between accounts. We are taking this action today to put Celsius in a better position to honor, over time, its withdrawal obligations.”

Fab. There goes the Celsius business plan – to operate like a bank, but with crypto instead of fiat money – how hard can collecting deposits and loaning be?

By the way: be careful says deVere

Overnight, and perhaps a few weeks too late, the chief executive of deVere Group Nigel Green is urging clients to exercise “caution and scrutiny” as the DeFi liquidity pond dries up.

“The wider crypto ecosystem has been rocked again – not by ‘real’ cryptocurrencies like Bitcoin, but by DeFi,” the deVere CEO says.

“There are legitimate and serious concerns about networks’ high yields, links to failed dollar-pegged stablecoin Terra, and reserves.

“The unprecedented move by Celsius is effectively blocking clients from accessing their assets which will do little to quell fears from critics that some DeFi platforms could be Ponzi schemes.”

deVere, the world’s largest independent financial advisory, asset manager and fintech fan with a lower case letter at the start of its name, is among a slew of institutional investors undoubtedly shooken to the core by one of the largest crypto lenders, just freezing out its nigh-on 1.7 million clients.

“I would urge people to exercise caution and scrutiny on crypto lending firms which offer clients lucrative double-digit yields on assets like Bitcoin and Ethereum. If it sounds too good to be true, it probably is.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.