Mooners and Shakers: Crypto market cap rises back above $1 trillion USD as optimism abounds

Getty Images

Hello there, Coinheads. Well, that wasn’t such a bad weekend now, was it? Friday 13 superstitions easily side-stepped and a good old-fashioned crypto surge.

What’s leading the narrative? Optimism for a crypto bottoming (that old chestnut) and an improving macroeconomic landscape with regards to US inflation. (You can read last week’s Mooners & Shakers posts – thanks, Gregor – to get up to speed on that puppet mastery.)

Bitcoin, having ended the week just shy of US$19,000, added roughly US$2,000 to its stack over the past coupla days. In fact, it’s up a whopping 23% over seven of them. Not bad form for the geriatric (well, 13-year-old) crypto and, along with Ethereum and Cardano it’s just about the top performer in the top 10 across the week.

So, what’s possibly next? The beginning of a long trip to the moon from a bottomed-out platform? Or maybe a “dead cat bounce” and a false dawn? Let’s bung a chart here first, and then we’ll discuss – or at least find one or two analysts who’ve already done some discussing for us.

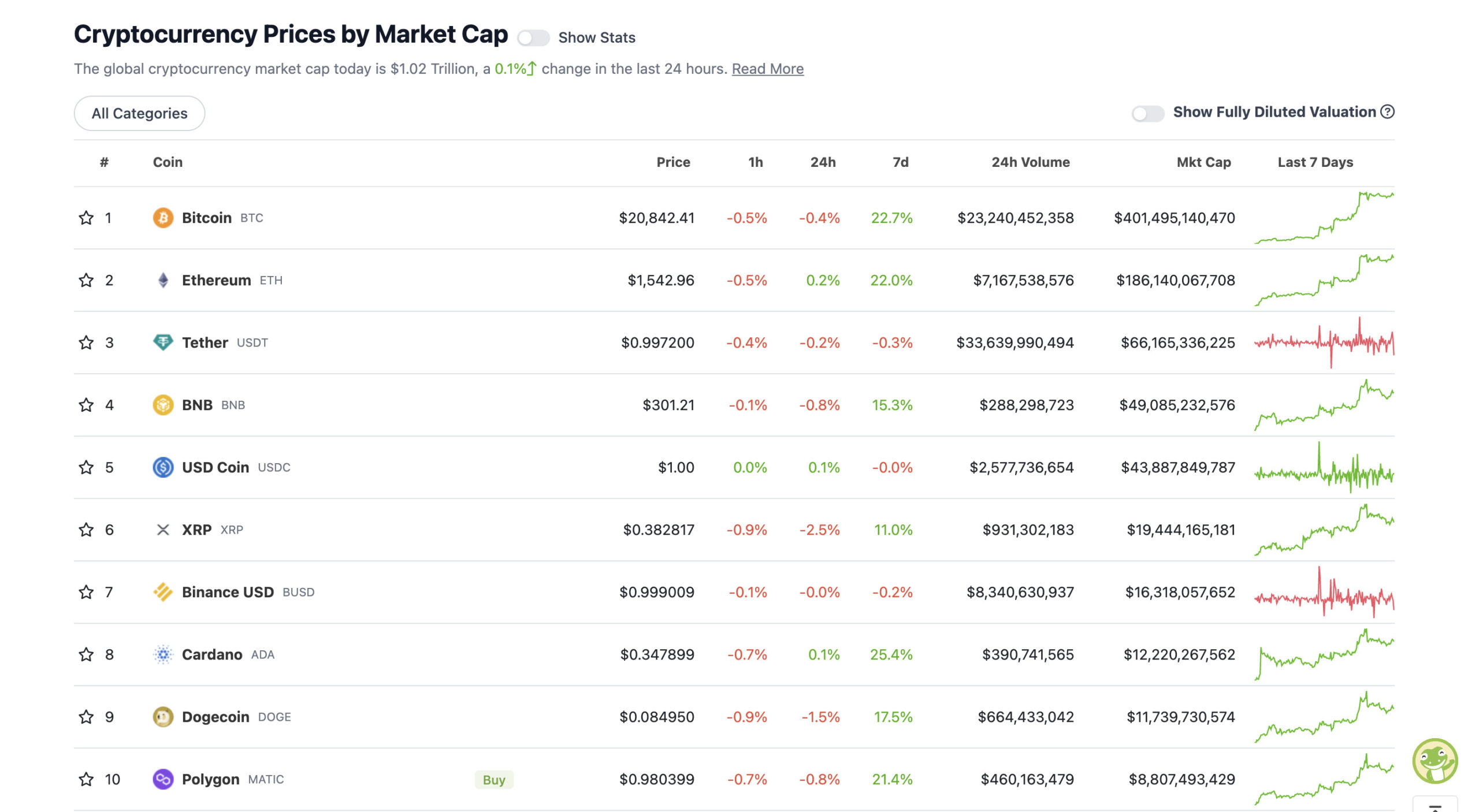

Top 10 overview: crypto back above $1 trillion

With the overall crypto market cap at US$1.02 trillion, up 0.1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

We typed a word just then. And it feels good. The entire crypto market cap is now back above US$1 trillion for the first time since early November when SBF’s FTX was doing its impression of a Spinal Tap drummer.

Cop that, Peter Schiff, Jamie Dimon and the rest of you (admittedly quite vast) band of naysayers. Okay, okay, we’d best not get ahead of ourselves.

Checking in with some Twitter-based analysis, up pops Dutch chart nerd Michaël van de Poppe with a good and not-so-good prognosis for the short term. Seems reasonable. What goes up, must come down and all that. But then up again?

Still a thesis on #Bitcoin I'd be looking at.

Coming months trend remains to be up and #altcoins are gathering more volume to be traded.

In that way, one more sweep to get those shorts out and then it's shortly time for longs to have some punishment.

CME gap at $19.5K too. pic.twitter.com/5igpIWZXyS

— Michaël van de Poppe (@CryptoMichNL) January 15, 2023

Then there’s Mr Capital – Rekt to his mates – who’s pulled a pinch or several of hopium from the box and stuffed it in the pipe for a three-year puff. Still, if history repeats or somewhat rhymes… “What if”, indeed.

What if this is the beginning of 3 bullish years for #BTC?$BTC #Crypto #Bitcoin pic.twitter.com/eYUG0BRk1K

— Rekt Capital (@rektcapital) January 15, 2023

It’s a far more palatable theory than the one his fellow analyst “Lemon” just dropped, which makes use of the popular “Wall Street Cheat Sheet” graphic. If he’s bearishly correct, then the macro bottom has a little way to go yet.

Sorry, I have to be true to my thoughts, I think we are here. #Bitcoin pic.twitter.com/c1nl32k7AZ

— Lemon 🍋 (@TheCryptoLemon) January 14, 2023

But what was it William Goldman said about Hollywood? Ah yeah – “no one knows anything”. Not saying that’s strictly true for crypto, but take what you need with a saline drip handy.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$8.5 billion to about US$374 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Frax Share (FXS), (market cap: US$616 million) +22%

• Decentraland (MANA), (mc: US$1.3 billion) +20%

• The Sandbox (SAND), (mc: US$1.14 billion) +10%

• Optimism (OP), (mc: US$395 million) +7%

• Helium (HNT), (mc: US$404 million) +7%

DAILY SLUMPERS

• Fantom (FTM), (market cap: US$834 million) -6%

• Solana (SOL), (market cap: US$8.5 billion) -6%

• Zcash (ZEC), (mc: US$589 million) -4%

• Huobi (HT), (mc: US$833 million) -3%

• Cronos (CRO), (mc: US$1.86 billion) -3%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse…

$BTC Weekly RSI is in the midst of crossing the 50 level signifying a long term momentum reversal from bear to bull

Complete weekly crosses have only happened 5 times since 2015 and each cross has led to a significant rally with an average gain of 1775% from cross to top pic.twitter.com/u7xXlFvASq

— Andrew Kang (@Rewkang) January 15, 2023

— EndlessGrind (@EGrind26) January 15, 2023

And, let’s hope the Bitcoin chart doesn’t follow this trajectory, eh?

Tom Cruise at 60y free-falling 6 times from a motorcycle for a movie.

whats your excuse? pic.twitter.com/eHd9DI6zUk

— doncrypto (@DonCryptoDraper) January 14, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.