Mooners and Shakers: Cooling US inflation helps crypto shrug off any Black Friday blues

Coinhead

Coinhead

Morning Coinheads! It’s an upbeat kinda Friday the 13th this morning, after financial markets (broadly) and crypto reacted well to positive signs in the US that inflation is cooling.

US Consumer Price Index data released overnight showed inflation slowing down to 6.5% – on its own, not great, but a definite sign that folks Stateside are unlikely to be paying $19 a gallon for milk any time soon.

The news put a solid puff of breeze into Wall Street, and crypto investors followed suit. Over the past 24 hours, the majors have enjoyed some chonky gains. BTC is up around 7.0% over the past 24 hours, pushing through the US$19,000 mark for the first time since SBF took a giant dump on the market’s chest.

The more volatile members of the crypto community (the coins, not the people… those dudes are a whole other kettle of fish) have posted nice, wallet-fattening double digit numbers.

That includes Aptos – yesterday’s fastest climber – which has put in a repeat performance over the past 24 hours, adding a 24.8% gain to yesterday’s 32.3% rise, and is showing an astonishing 71.7% rise for the past 7 days.

In fact, the entire cryptosphere’s market cap has lifted 4.7% since this time yesterday. Neato.

The details are all in the charts below, but for now, let’s look take a look at what’s making headlines this morning.

Like a pro-wrestling villain sneaking up on a rival mid-fight and belting them over the head with a folding chair, the SEC has entered the brawl between Gemini and Genesis with something of a show-stopper.

The US watchdog has filed a new set of charges against both Genesis and Gemini after they “raised billions of dollars’ worth of crypto assets from hundreds of thousands of investors” through Gemini Earn – the ill-fated collab between the two companies that has led to a hugely public and very ugly spat over an almost $1 billion “debt”.

The SEC says its looked into the program – which offered punters the chance to earn “up to 8%” on their investment – and concluded that the whole scheme amounts to an unregistered offering that qualifies as the sale of securities to retail investors.

Oops.

“We allege that Genesis and Gemini offered unregistered securities to the public, bypassing disclosure requirements designed to protect investors,” SEC Chair Gary Gensler said.

“Today’s charges build on previous actions to make clear to the marketplace and the investing public that crypto lending platforms and other intermediaries need to comply with our time-tested securities laws.”

Then Gensler (we assume) busted out his very best Judge Dredd voice to finish with: “Doing so best protects investors. It promotes trust in markets. It’s not optional. It’s the law.”

Tyler “not that one… the other one” Winklevoss beat a well-worn path to Twitter to complain about the SEC sticking its oar in at such a crucial point in the public mud-slinging that passes for negotiation between Genesis and Gemini.

1/ It’s disappointing that the @SECGov chose to file an action today as @Gemini and other creditors are working hard together to recover funds. This action does nothing to further our efforts and help Earn users get their assets back. Their behavior is totally counterproductive.

— Tyler Winklevoss (@tyler) January 12, 2023

It’s certainly a complication that neither party in that fight needed to deal with.

Speaking of counterproductive behaviour in the middle of trying to claw investor funds back from an apparent black hole, Decrypt is reporting that the team that has been tasked with tracking down and rounding up funds as part of the FTX / Alameda Research bankruptcy proceedings appear to have learned a valuable (but painful) lesson.

Turns out, some of this crypto stuff is actually super-complicated, and it’s easy to make some very costly mistakes.

According to decrypt, the team “recently attempted to move funds into an Alameda Research-owned multi-sig wallet but in the process lost 4 Aave Wrapped BTC (aWBTC), worth approximately $72,000”.

Pfft. Rookie mistake. What a bunch of dopes. Etc etc.

Even a four year old would know that Aave loans are built around deposited collateral, which the borrowers then borrow against – and that Aave loans need to be overcollateralized beyond a certain threshold, or the whole arrangement will be liquidated to protect the lender.

And that means that in order to unlock the collateral, the loan itself needs to be paid back in full – a fact that the liquidators were blissfully unaware of right up until they tried to withdraw the collateral without settling the loan, and around 4 WBTC (US $72,000 worth) evaporated before their very eyes.

Decrypt reports that the bumbling money-hunters have made a string of other mistakes as well, including “nine failed attempts to move $1.75 million worth of Lido (LDO) tokens that were still vesting”. At the time of writing, the wallet still has $3 million worth of LDO.

If only the team knew of someone who understands how it all works, who could guide them through the process, and who would have a vested interest in being seen to cooperate with authorities before he goes on trial for his role in the collapse of the company he built…

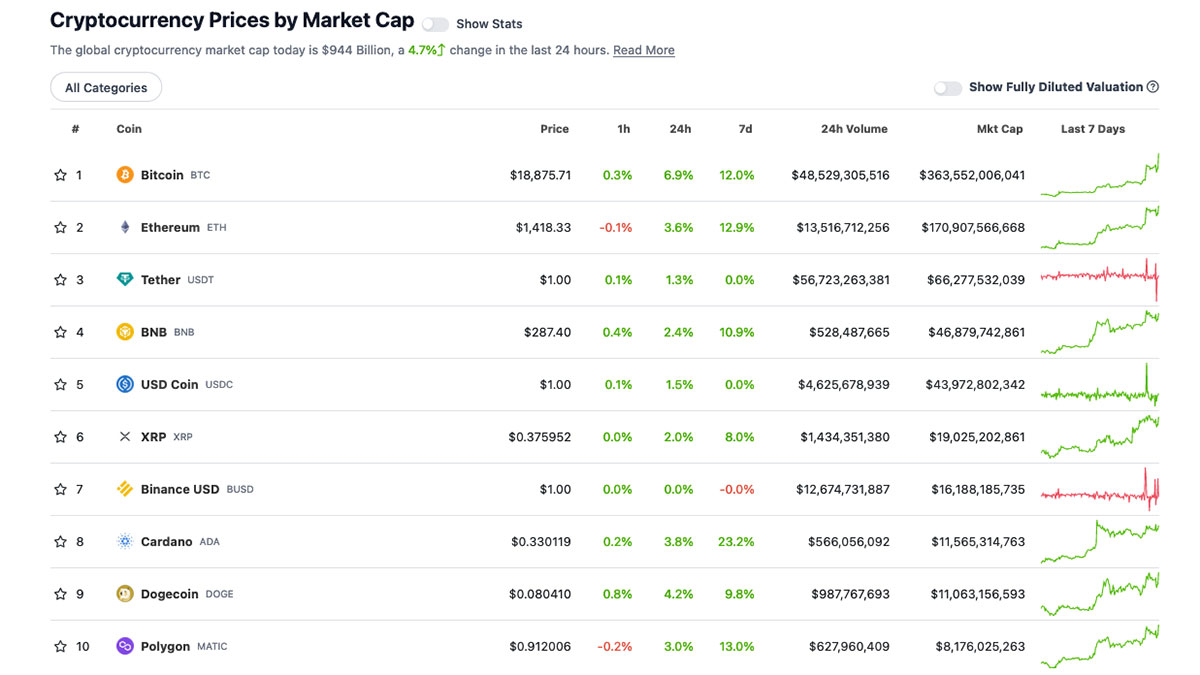

With the overall crypto market cap at US$944 Billion, up 4.7% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

DAILY PUMPERS

(Stats accurate at time of publishing, based on CoinGecko.com data.)