Mooners and Shakers: Coinbase shares sink to new low; Bitcoin, Ethereum and total crypto market cap tumble

An actual photo of the crypto market, earlier. (Getty Images)

The dark, black cloud that’s formed over the crypto market ever since FTX imploded only seems to be spreading at the moment. Coinbase shares are at their lowest and Bitcoin’s below US$16k again.

Meanwhile Ethereum and most other cryptos are taking something of a dive, too. Is it ALL doom and gloom? It isn’t exactly where the vast majority of the crypto industry expected the market to be at this stage of the year, but it also isn’t the end of the crypto world, as the sector’s haters and doomsayers would have you believe.

Some might even see it as non-financially advised opportunity to ladder in at potential fire-sale levels on the cryptos they believe have the soundest of fundamentals. But they might want to make that call understanding that it’s entirely possible things get worse still, before they get better in the cryptoverse.

Coinbase stock plunges

The shares of Coinbase, which is the leading US cryptocurrency exchange, plummeted to a new low of US$40.61. COIN, like the rest of the crypto world, has been further roiled lately by the FTX exchange collapse.

The heady days of a US$429 COIN share price seem a distant memory now, but it was only April 2021 when it was at its peak. Suppose that is kind of an eternity in crypto years, however.

Does Coinbase have any direct exposure to the FTX sh*tstorm? No, nothing significant has come to light in that regard. There has been some concern about institutional crypto asset manager Grayscale being unwilling to partake in a public proof of reserves disclosure, and it’s common knowledge that it uses Coinbase’s custody service.

However, Coinbase Custody Trust has publicly confirmed for worried investors that it holds 635,000 BTC on behalf of the Grayscale Bitcoin Trust along with three million ETH for the Grayscale Ethereum Trust and 11.9 million Ethereum Classic on behalf of the Grayscale Ethereum Classic Trust, as of September 30.

4) All digital assets that underlie Grayscale’s digital asset products are stored under the custody of Coinbase Custody Trust Company, LLC. Read more from @Coinbase’s CFO Alesia Haas, and CEO of Coinbase Custody Aaron Schnarch: pic.twitter.com/InBP9zPDkC

— Grayscale (@Grayscale) November 18, 2022

Meanwhile, could somebody please check in on Cathie Wood?

JUST IN: Cathie Wood’s Ark Invest bought 1.3m shares of Coinbase worth $56m just this month – Bloomberg

— Bitcoin Archive (@BTC_Archive) November 21, 2022

FTX contagion: potential woes for Genesis deepen

The digital asset brokerage Genesis, which is owned by Digital Currency Group – also the owner of Grayscale (“it’s all connected, mannnn”) – is reportedly struggling to raise badly needed capital for its lending unit. A unit that last week made the decision to pause withdrawals from that part of the platform.

JUST IN: Crypto firm Genesis warns of bankruptcy without new funding, according to BBG

— Bitcoin Magazine (@BitcoinMagazine) November 21, 2022

Citing “people with knowledge of the matter”, Bloomberg reported that Genesis has been warning potential investors that it may need to file for bankruptcy if it fails to secure the cash it needs. It has reportedly been seeing at least US$1 billion.

Binance has apparently been sought as a potential investor, but nothing has been confirmed with regards to that at this stage, and nothing may well come from it.

Genesis Trading, while having no “material exposure to the collapsed FTX token FTT, had funds locked up on the FTX platform. On November 10, it confirmed that was about US$175 million, according to Investopedia.

Genesis has denied being on the verge of bankruptcy, with one of their spokespeople reportedly telling The Street:

“We have no plans to file bankruptcy imminently. Our goal is to resolve the current situation consensually without the need for any bankruptcy filing. Genesis continues to have constructive conversations with creditors.”

A Genesis bankruptcy filing would also affect the Gemini cryptocurrency exchange founded by twins Tyler and Cameron Winklevoss, wrote The Street. And that’s because Genesis is a partner of Gemini.

Fun times in Cryptoland, eh? When someone coughs, the whole space gets the damn flu.

[DB] Genesis Has Slashed Its Raise Target From $1bn to $500 Million: The Block

— db (@tier10k) November 21, 2022

Top 10 overview

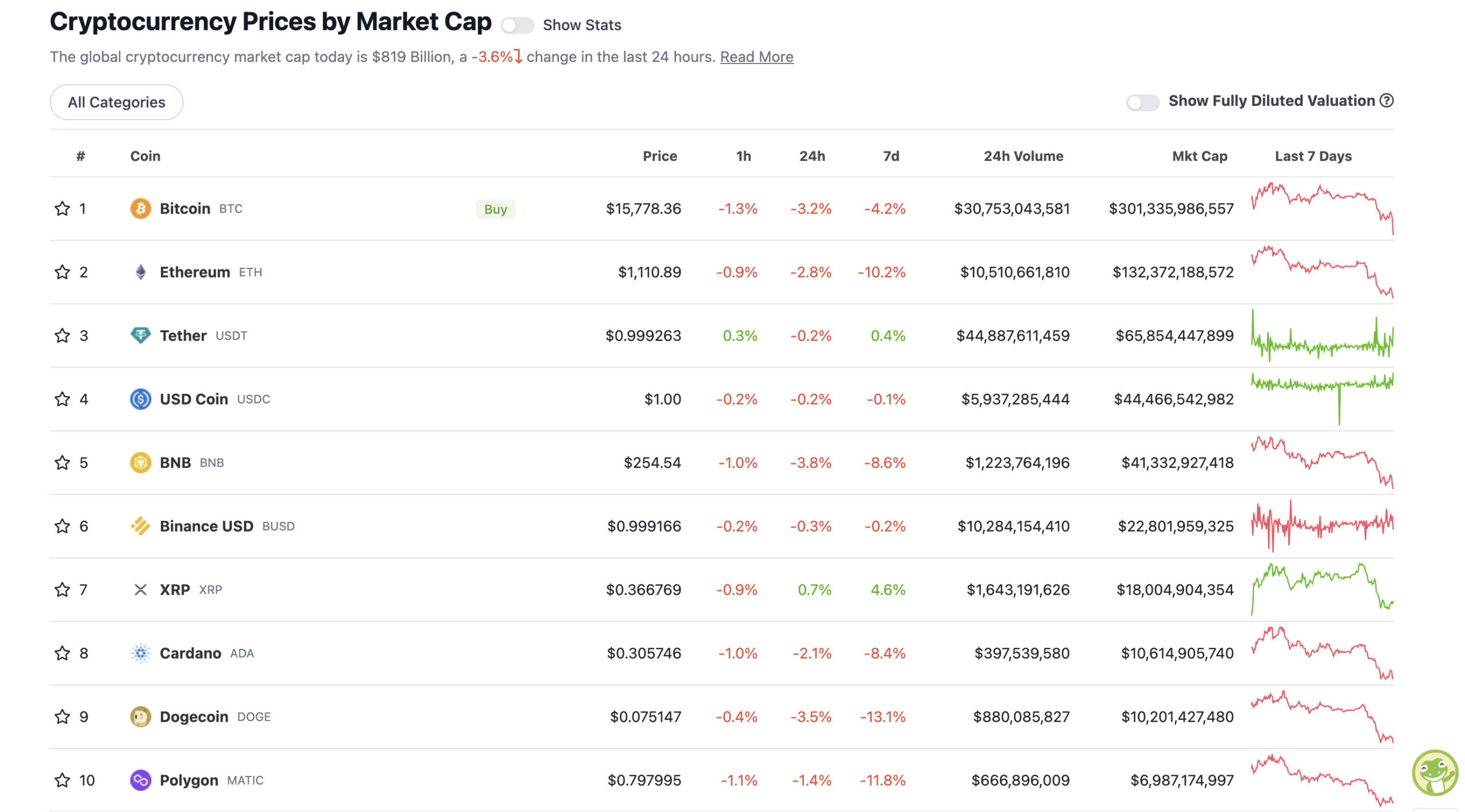

With the overall crypto market cap at US$819 billion, down 3.6% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

The total crypto market cap has shed more than US$20 billion since this time yesterday. But what’s several billion dollars between friends, eh?

At the time of writing, Bitcoin seemed to have found some support just above the US$15,500 mark, while Ethereum is clinging to US$1,100 by the skin of its teeth.

XRP, meanwhile, this is the only crypto major, in the top 10 at least, showing any semblance of positive green form.

Any recent news on XRP creator Ripple and its legal battle with the SEC? Just this, from attorney Jeremy Hogan, who follows the case like a hawk. Or legal eagle or something.

Accredify failed to file its Amicus Brief on behalf of the SEC by the deadline last night.

So that leaves the final tally at 14 for Ripple and 1 for the SEC.

For you Americans: Ripple scored 2 touchdowns and the SEC got a…one point safety? https://t.co/wGFfn4GNWR

— Jeremy Hogan (@attorneyjeremy1) November 19, 2022

Meanwhile, here’s Ripple CTO David Schwartz’s response to a tweet by former US congressional candidate-turned crypto podcaster David Gokhshtein about millionaires that “will be made in the next coming months” in the crypto space.

Gotta love a bit of gallows humour.

They'll be made out of billionaires.

— David "JoelKatz" Schwartz (@JoelKatz) November 20, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$6.1 billion to about US$297 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Huobi (HT), (market cap: US$620 million) +10%

• NEM (XEM), (mc: US$299 million) +7%

• EthereumPoW (ETHW), (mc: US$363 million) +5%

• ApeCoin (APE), (mc: US$986 million) +4%

• Trust Wallet (TWT), (mc: US$831 million) +2%

DAILY SLUMPERS

• Chain (XCN), (market cap: US$936 million) -11%

• LEO Token (LEO), (market cap: US$3.63 billion) -10%

• KuCoin (KCS), (mc: US$638 million) -6%

• Chiliz (CHZ), (mc: US$1 billion) -16%

• The Graph (GRT), (mc: US$399 million) -15%

Around the blocks

A selection of rumour, randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

Elon is working on a crypto wallet for Twitter

CZ invested 500 million

The writing is on the walls. Crypto and NFTs are coming to Twitter in a big way

All 350 million users will be in the Web3 ecosystem in 2 years

If you're reading this, you're earlier than you can imagine

— Alex Finn (@AlexFinnX) November 20, 2022

FUN FACT: FTX's new CEO is paid $1,300/hour.

— Watcher.Guru (@WatcherGuru) November 20, 2022

I'm hearing through the grapevine that something important is about to happen. Please recognize the fact that my elite social connections to people who are early to know things make me cool, and please help me validate my self-image of coolness.

— vitalik.eth (@VitalikButerin) November 21, 2022

I wasn't responding to you (I meant it when I say I don't subtweet single examples), just calling out a general pattern on CT I've found insufferable over the past week.

— vitalik.eth (@VitalikButerin) November 21, 2022

I saw a guy, who knows a guy, who said he knows a guy who said that #crypto is going to zero… sounds legit

— Lark Davis (@TheCryptoLark) November 21, 2022

$BTC Did you know that it took 5 weeks to finally hit the bottom once we started to capitulate in 2018?

Then it took 4 month of BORING PA before we saw the first God candle.

We barely started week 2 today.

This is a marathon, not a sprint. Get comfortable, it’ll be a while. pic.twitter.com/H9Yu8D2fUY

— Bleeding Crypto (@Bleeding_Crypto) November 21, 2022

Excited to be running a session about NFT investing w/ @NicholasScib on Wednesday 🦄

We're driven to help more new investors understand this topic.

Too many are getting rekt learning from people with misaligned incentives (e.g. paid influencers, some project founders). pic.twitter.com/AXJluqqcrC

— Matt Willemsen (@matt_willemsen) November 21, 2022

Looking forward to NFT Fest Melbourne next week. Always stoked to chat about music and Web3 on the big stage. 🤙

Come for the blockchain chat – stay for the music. 🔥 pic.twitter.com/okakdTeyTs

— SRGC (@srgcollectooor) November 21, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.