Mooners and Shakers: Chainlink surges on staking news and fresh roadmap; Bitcoin clings to $30k

A hard-earned thirst deserves a big… staked crypto? (Getty Images)

Mooners and Shakers is sponsored by Dacxi, the world’s first purpose-built Crypto Wealth platform.

As Bitcoin meanders along (at time of writing) just north of US$30k, there’s plenty more action happening across the crypto market – including surges from Chainlink and Tezos.

We’ll dig into the market’s price action in a minute, but first a bit of a news roundup…

Crypto news: PayPal, Edge’s Bitcoin Mastercard, Salesforce, Jay-Z

• At long last, online-payments enabler PayPal is now letting users deposit and withdraw cryptocurrency to and from their personal wallets. This is a feature that’s been anticipated ever since PayPal introduced limited crypto trading in October 2020 and commercial crypto payments in March last year.

PayPal said in an announcement on June 7 that it will support “the native transfer of cryptocurrencies between PayPal and other wallets and exchanges”.

It noted that the feature is “consistently ranked by users as one of the most requested enhancements” to its crypto services.

Both Robinhood and PayPal eventually allowed deposit/withdrawal of crypto.

Customers don’t want siloed experiences 👏

This bodes well for the future of the space.

— Dan Held (@danheld) June 7, 2022

• San Diego-based startup Edge has reportedly released the first “Confidential” Bitcoin Mastercard. And that means it doesn’t require any KYC (know-your-customer) compliance.

“There is no name or address associated with your Edge Mastercard, making for completely private transactions when your card is used,” stated the company’s website.

Note: according to crypto media outlet Decrypt, Mastercard says it has no official involvement with the new offering. Instead, Edge is apparently issuing the card through a Mastercard template program with America’s Patriot Bank.

• US software firm Salesforce is taking the crypto plunge, specifically into the realm of non-fungible tokens (NFTS).

The company is launching a pilot platform called NFT Cloud, on which users can mint and trade digital assets. Salesforce views the enterprise as a way to connect to its customers and “make NFT selling more accessible,” according to TechCrunch coverage.

• Rapper Jay-Z, aka Shawn Corey Carter, aka @sc on Twitter, has teamed up with Block CEO Jack Dorsey to create a new project called the Bitcoin Academy.

The program is open to anyone from Brooklyn’s Marcy Houses public-housing complex, where the rapper grew up, and will teach financial literacy, run crypto camps for kids and more.

Mr @sc and I are funding The #Bitcoin Academy, a program for residents of Marcy Houses in Brooklyn New York where Jay grew up, designed in collaboration with @CryptoPlug3 and @BlkBTCBillions: https://t.co/hKfq1jqii7

— jack (@jack) June 9, 2022

• For a couple more significant crypto-related happenings from the past 24 hours or so, you can read about a fat-cat financial services crypto-trading supergroup here… and a huge new Aussie-based collab between Swyftx and Superhero.

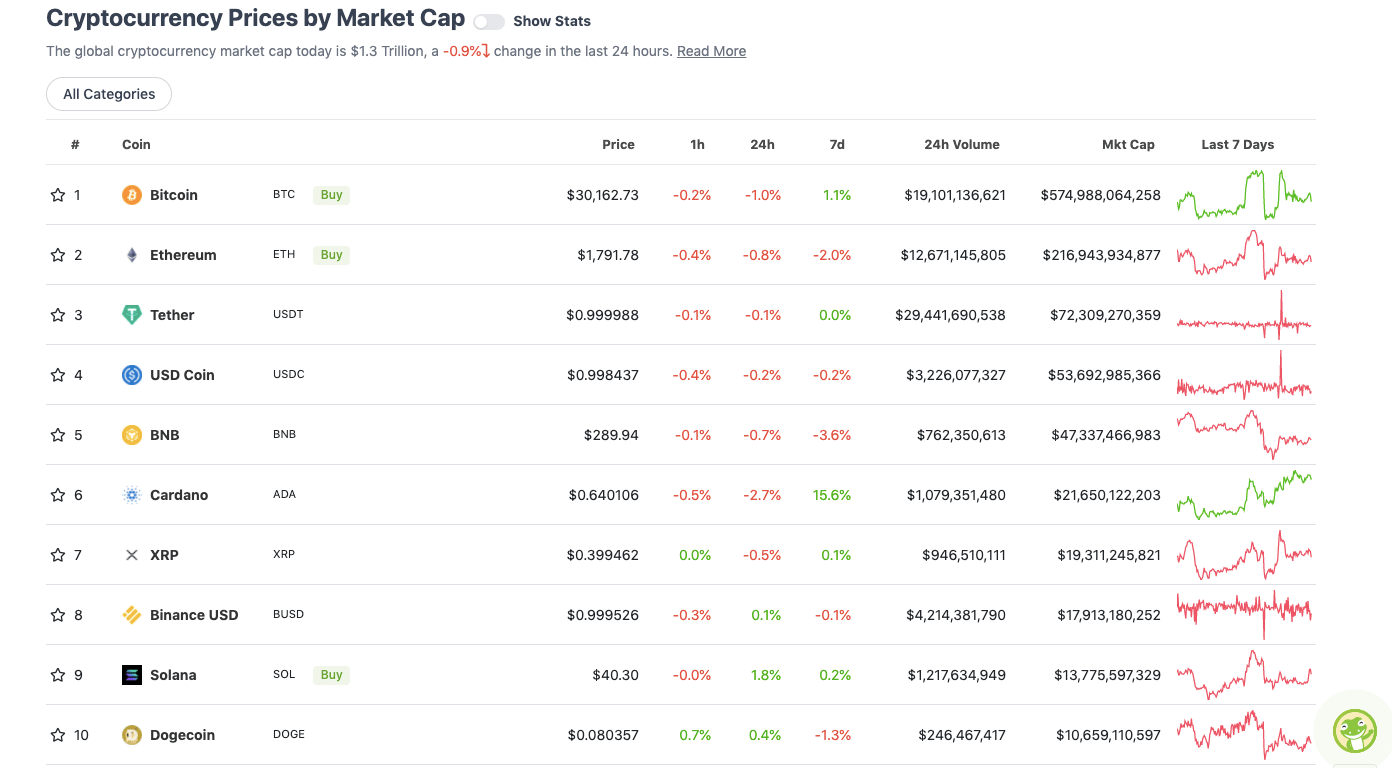

Top 10 overview

With the overall crypto market cap at roughly US$1.3 trillion, down about 0.9% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

There’s some Larry David-esque “meh” stuff going on in much of the top 10 cryptos over the past 24 hours… actually seven days, if you zoom out a bit.

Cardano (ADA) is the standout weekly exception with a 15.6% gain, although it’s the biggest daily loser in the majors today, down 2.7%. For now, though, it’s still largely holding on to the price progress that’s come on the back of its upcoming Vasil hardfork and blockchain upgrade.

Heads up: fresh US inflation data landing on Friday

For short-term market watchers, one thing to keep in mind for tomorrow is a fresh batch of US Consumer Price Index (CPI) inflation data – reflecting the latest annual inflation rate – up to the end of May.

This may or may not have a say on the charts to round out the end of the week.

Some financial gurus are predicting there won’t be much change, if any at all, from the 8.3% annual inflation level announced last month. In fact, according to USA Today, many American economists believe March’s 8.5% figure marked the US inflation-rate peak.

Good news for the markets? Maybe looking further ahead, but it seems unlikely the Fed will be taking its foot off the interest-rate-hiking pedal over the next month or so.

Meanwhile, the European Central Bank is widely expected to begin combatting rising inflation by raising interest rates next month – for the first time in 11 years.

Some, however, are noticing a slightly different narrative…

Inflation in the Netherlands is currently 8.8% in May, lower than the number of April 2022; 9.6%.

Meaning that the accelerated inflation is slowing down a little and is way too high.

Going into tomorrow; I think we'll see the same from the U.S. which can benefit relief.

— Michaël van de Poppe (@CryptoMichNL) June 9, 2022

Here in Australia, of course, the ASX 200 took a hit from the higher-than-expected 50bp rate hike announced earlier this week, but was rebounding somewhat as of yesterday.

Anyway, depending on how inclined you are to zoom in, the US figures are perhaps just something extra to keep half an eye on tomorrow while you enjoy a criminally expensive Friday tipple. Or not.

Central banks trying to get to neutral rates pic.twitter.com/RMcWz3oupn

— Sven Henrich (@NorthmanTrader) June 9, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$10.4 billion to about US$488 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Terra Luna Classic (LUNC), (market cap: US$806 million) +27%

• Chainlink (LINK), (mc: US$4.4 billion) +10%

• Tezos (XTZ), (mc: US$1.98 billion) 9%

• Helium (HNT), (mc: US$1.17 billion) 7%

• Theta Network (THETA), (mc: US$1.43 billion) 7%

Chainlink holders are having a great week – LINK is up 36% over the past seven days. This dramatic rise in relatively bearish conditions overall can be entirely put down to new announcements for the industry’s leading decentralised oracle.

The protocol’s developers have released a brand-new roadmap for Chainlink 2.0, which includes upcoming staking (passive income yield) for the LINK token. Cue rejoicing from the “LINK Marines” – the Chainlink faithful, who’ve been hoping for this feature for a good few years now.

Ladies & Gentlemen, #Chainlink Staking 🥩

Chainlink Staking: Goals, Roadmap, and Initial Implementation https://t.co/WfEgJyL0WD

— ⬡ LINK Collector ⬡ (@Crypto_BitC) June 8, 2022

Meanwhile layer 1 blockchain Tezos, a proof-of-stake competitor to the likes of Ethereum, Cardano and Solana, has hit a four-week high, currently changing hands for US$2.23, which is about 75% down from its all-time high of US$9.12.

XTZ is up nearly 15% on the week, and this price action comes after news announced earlier today that the stablecoin Tether (USDT) is launching on the Tezos blockchain. It’s good news for the potential growth of the blockchain’s DeFi ecosystem.

$USDT now available in #tezos blockchain

USDT current implementation:

Ethereum, Solana, Avalanche, Polygon, Algorand, Tron, Omni, EOS, Liquid Network, Kusama and Bitcoin Cash's Standard Ledger Protocol.https://t.co/jtarAYkN8s

— F | (@FepAguilar) June 9, 2022

As for that LUNC pump… what to make of that? After what happened with the original Terra ecosystem last month, founder Do Kwon is certainly trying hard to dispel the completely understandable Terra 2.0-based FUD (fear, uncertainty and doubt).

2/ There's a lot of misinformation and falsehood out there, and we promise to do our part in making sure as much of it is correct as possible.

A few tips to help us engage:

— Do Kwon 🌕 (@stablekwon) June 9, 2022

However, it’d be best to take any pump related to this project with a box of salt, as it seems the US Securities and Exchange Commission is right back on his case again…

Do Kwon when the SEC starts looking into $LUNA and $USThttps://t.co/0U2y9jrvtf

— LilMoonLambo (@LilMoonLambo) May 15, 2022

DAILY SLUMPERS

• Elrond (EGLD), (market cap: US$1.4 billion) -7%

• Arweave (AR), (mc: US$681 million) -6%

• Gala (GALA), (mc: US$.572 million) -5%

• eCash (XEC), (mc: US$990 million) -5%

• ApeCoin (APE), (mc: US$1.69 billion) -3%

Around the blocks

A selection of randomness that stuck with us on our daily journey through the Crypto Twitterverse…

As usual, Crypto Twitter is a seething hive of conflicting opinions on Bitcoin and crypto price-movement predictions.

Market slowly waking up.

Wouldn't be surprised to see $SOL and $AVAX run, but also $ETH and $BTC waking up for some relief.

— Michaël van de Poppe (@CryptoMichNL) June 9, 2022

Roman…please help explain who exactly is left to sell after holding this long? Who are the sellers that say hey….I’ve held on for this long, but yep I’m going to go ahead and cut my losses now. JPMorgan isn’t selling and you know it…

— Chris (@Devildogcrypto) June 9, 2022

Meanwhile, it appears Ethereum’s Merge testnet implementation has kicked off without a hitch…

First #ethereum testnet merge done, 2 more to go, and if everything goes smoothly then it pushes out to mainnet and a new era begins for ETH!!!

— Lark Davis (@TheCryptoLark) June 9, 2022

… while there are some concerns for Litecoin (LTC) as it appears to have been delisted by some Korean crypto exchanges after its “MimbleWimble” privacy upgrade…

I hope this isn't a trend that we will see replicated at other exchanges. The Litecoin community shouldn't have to choose between exchange support & privacy. $LTC pic.twitter.com/yFUdHRBT1M

— Coin Bureau (@coinbureau) June 9, 2022

Lastly – NFT news… sorta… the actor Anthony Hopkins has reached out to Snoop Dogg and others regarding some non-fungible recommendations. Snoop, aka “Cozomo de’ Medici“, has been well down the NFT rabbit hole for ages now – so not a bad shout there at all.

I’m astonished by all the great NFT artists. Jumping in to acquire my first piece, any recommendations? @SnoopDogg @JimmyFallon @ReeseW pic.twitter.com/pjeP8dVNfD

— Anthony Hopkins (@AnthonyHopkins) June 8, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.