Mooners and Shakers: Break out the Bollinger (Bands)? BTC holds above $27k ahead of Fed decision

Pic via Getty Images

Trading above US$27k, Bitcoin appears to be showing some strength ahead of the US Fed’s FOMC meeting interest rates decision.

That’s very well due to the fact consensus (including a 99% prediction from the CME FedWatch Tool) appears to favour the Fed keeping rate levels as they stand for the moment.

And, while we know there are more technically analytical indicators than areas on your head you can scratch while going “huh?”, a famous one, known as the Bollinger Bands, might be cause for some optimism here for BTC.

Might being the operative word, of course.

Bollinger Bands are a set of trend lines plotted in and around the price flow of any tradable asset, and are partly used as a measure to indicate whether an asset looks overbought or oversold, as well as a means to project where the asset might move next based on previous trading.

Straight from the horse’s mouth, then, we have the indicator’s creator, renowned technical trader John Bollinger (no relation to Doug, probably), with the following, posted on X over the past couple of days:

And today we have the second, confirming, tag of the upper Bollinger Band.

— John Bollinger (@bbands) September 19, 2023

“And there is the first tag of the upper Bollinger Band after a new set of controlling bars was established at the lower band,” wrote the analyst.

“The question is now can we do a walk up the upper band? Too early to answer,” he tweeted on Monday, but today he reckons a “second, confirming tag” of the upper band has played out.

This suggests that the Bitcoin price could be moving into a position of strength here, especially considering that the narrowing of Bollinger bands, like we’re seeing here on Bitcoin, can tend to precede explosive moves.

That said, we’ve been here before, and in fact have refused to leave. Bitcoin has largely been trading in a pretty tight range between about US$25k to $30k for what seems like an eternity.

And reaching the mid US$27k range before hitting a wall of sell pressure sending BTC back down again has become a tiresomely familiar move.

Let’s see what the FOMC sentiment brings later tonight (AEST).

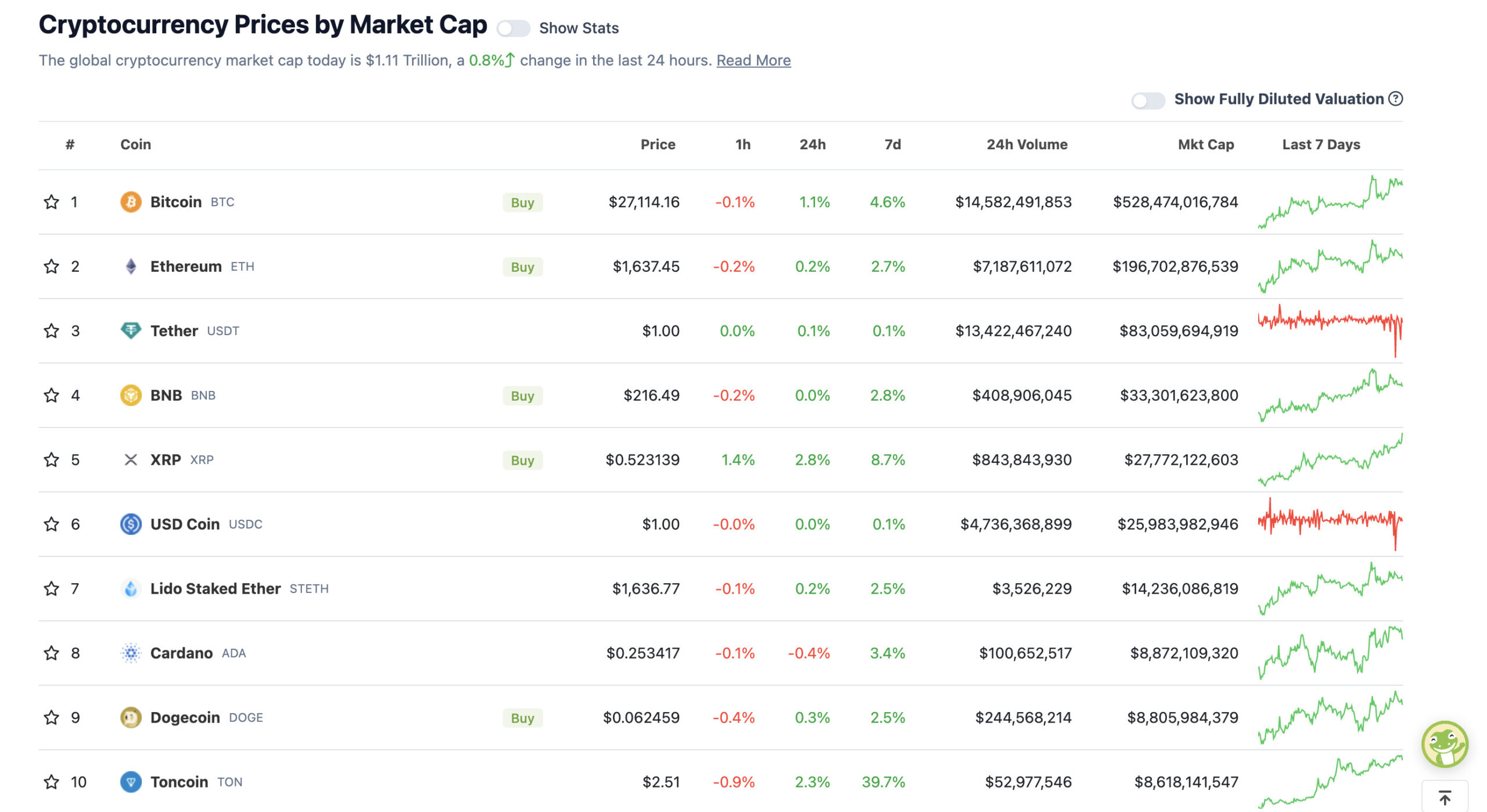

Top 10 overview

With the overall crypto market cap at US$1.1 trillion, up a fraction since about this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Here’s another positive tweet regarding Bitcoin, from young Aussie crypto content creator and analyst Miles Deutscher, citing Glassnode information that shows long-term Bitcoin holders continue to accumulate…

Long term #Bitcoin holders keep accumulating, with long-term holder supply at ATHs.

The % of $BTC held by long-term holders is also about to break its ATH.

Bear markets represent a shift of wealth from the weak to the strong hands. pic.twitter.com/GBJ8QEJM7x

— Miles Deutscher (@milesdeutscher) September 19, 2023

However, regarding the short term price action, for every bullish thought, it seems there’s a prominent bearish one.

As a counterpoint to Bollinger above, the popular American crypto analyst Ben Cowen references a different set of bands in one of his most recent YouTube posts – namely the bull market support band.

That’s a formation constructed by the 20-week simple moving average (SMA), currently at $27,888, and the 21-week exponential moving average (EMA) currently at $27,227, according to Cowen.

And that’s an area where he has expressed he expects continued huge resistance – a possible short-term break above to US$28k, but ultimate rejection and a significant price fade to lower levels.

“The battle… between the bears and the bulls.”

📺https://t.co/vQ5Q6eF1hP pic.twitter.com/3nLifspnD7— Into The Cryptoverse (@ITC_Crypto) September 18, 2023

“The bulls are giving it another chance,” noted the analyst.

“They’re giving it another go. And they’re going to find out whether they can break through it or not. If they cannot break through, if we spend a week or two and the bulls cannot break through, then what’s more likely to happen is this likely just fades back down and puts in a lower low and then eventually they’ll try again.”

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• XDC Network (XDC), (market cap: US$758 million) +5%

• KuCoin (KCS), (market cap: US$438 million) +5%

• Kaspa (KAS), (market cap: US$1.07 billion) +5%

• LEO Token (LEO), (market cap: US$3.48 billion) +3%

• Maker (MKR), (market cap: US$1.17 billion) +3%

SLUMPERS

• Rollbit Coin (RLB), (market cap: US$399 million) -5%

• eCash (XEC), (market cap: US$503 million) -4%

• Sui (SUI), (market cap: US$353 million) -3%

• Frax Share (FXS), (market cap: US$390 million) -2%

• Gala (GALA), (market cap: US$372 million) -1%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

NEW: $500 billion financial giant Nomura's digital asset subsidiary launches new #Bitcoin fund for institutions

Wall Street adoption continues 🚀 pic.twitter.com/UO7U2HG6zs

— Bitcoin Magazine (@BitcoinMagazine) September 19, 2023

SBF's father was unhappy with his salary at FTX US so he emailed SBF asking for more money, and then pulled the "I'm telling your mother" Dad move and looped SBF's mom into the email thread pic.twitter.com/jJaHFqpI7Z

— Conor (@jconorgrogan) September 19, 2023

Usually you'll get a correction on #Bitcoin deeper than $26,700.

The fact that we're back towards $27,400 is actually a strong signal.

Wouldn't count to much on it, but the odds of the bottom to be in has increased substantially.

— Michaël van de Poppe (@CryptoMichNL) September 19, 2023

$100,000 per #Bitcoin is great and all, but do you realize how small $2.1T is? That ain't the end of the line for this train

$100k is just another stop on the way to $1M… which is just another stop on the way to $10M.

— Jesse Myers (Croesus 🔴) (@Croesus_BTC) September 19, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.