Mooners and Shakers: Bitcoin resilient, Citigroup goes the private blockchain route, Toncoin surges

Pic via Getty Images

Bitcoin continues to show some resilience for now, trading near US$26,800. A new report, however, shows that institutional investment into the space has recently been pretty weak.

We’ll get to that momentarily, but first, here’s a blockchain adoption vibration for you – whether it’s a good, bad or meh vibration… is open for debate.

Citigroup makes a private blockchain move

Banking giant Citigroup is launching a unique blockchain for its moneybags clients, according to a new Bloomberg report.

The Wall Street financial services gun has revealed a new platform – Citi Token Services – which aims to tokenise client deposits, including bank guarantees and letters of credit.

Citigroup has reportedly successfully tested the new system with the Federal Reserve Bank of New York and it apparently enables banks to generate digital money for their customers, which can then be cleared using central bank reserves.

Citigroup debuted a token service that’s part of a broader push to offer digital assets to institutional clients https://t.co/iPoBAZ6Cqu

— Bloomberg Crypto (@crypto) September 18, 2023

The reaction to this so far hasn’t been strong from the cryptoverse, and that’s partly because Citigroup’s blockchain is a private one, rather than utilising a public blockchain such as Ethereum or Bitcoin.

I think it's super cute @Citibank can LEGALLY use their own PRIVATE BLOCKCHAIN while all of crypto is under attack by the SEC in America for being transparent and public https://t.co/uNQNoi6pDO

— Wendy O (@CryptoWendyO) September 18, 2023

The looming prospect of global CBDCs is extremely unpopular among those who espouse blockchain and crypto decentralisation – which is much, if not most of the crypto industry worldwide. And that’s for obvious reasons based around fears of more powerful centralised financial control than ever.

Speaking of public and private blockchains and tokenised assets, however, here’s a tweet that caught our eyes, especially as it positively involves the ANZ bank and crypto oracle Chainlink (LINK) technology.

Shared today at #Sibos by @SergeyNazarov, this slide showcases how ANZ is using CCIP to enable cross-currency, cross-chain settlement of tokenized assets

The implications of this cannot be understated

Enabling the buyers and sellers of tokenized assets… pic.twitter.com/M6UjBW4j3H

— Zach Rynes | CLG (@ChainLinkGod) September 18, 2023

Weak institutional investment last week

Regarding the subhead there, that information comes from CoinShares, which releases its Digital Asset Fund Flows Weekly Report into the wild, as the name suggests, each week.

The analysts’ latest findings seem to reveal that global institutional investors have cooled somewhat on the space over the past several weeks, with digital asset investment products seeing “outflows totalling US$54m last week, marking the fifth consecutive week”.

In fact, further to that, the analysis notes that there have been outflows for eight of the past nine weeks totalling more than US$450 million, while year-to-date inflows total just US$51 million.

The digital asset investment products referenced by CoinShares, by the way, do not, for the US at least, include spot ETFs – which are still, of course, for the moment a fantasy hot ticket yet to be realised. We’ll certainly know about it when that eventually happens.

As CoinShares’ James Butterfill notes, Bitcoin (BTC) has lately been the most sold digital asset by a wide margin, accounting for 85% of all institutional activity, and marking $45 million worth of outflows over the past week.

The wider picture is less bleak, though, because Butterfill also calls BTC the most-loved investment product, with it drawing inflows worth US$12 million over the past month, according to CoinShares.

⏰ What are the latest trading dynamics in #Bitcoin and #Ethereum? Could the US political instability benefit $BTC? What is the reason for $ETH net inflation?

Let's find out in our CryptoMonday with @jbutterfill. pic.twitter.com/DKKFQwiWFb

— CoinShares (@CoinSharesCo) September 18, 2023

Interestingly, the brightest part of CoinShares’ report shines on three trend-bucking altcoins: with Solana (SOL), Cardano (ADA) and XRP all seeing inflows of US$0.7m, US$0.43m and US$0.13m respectively.

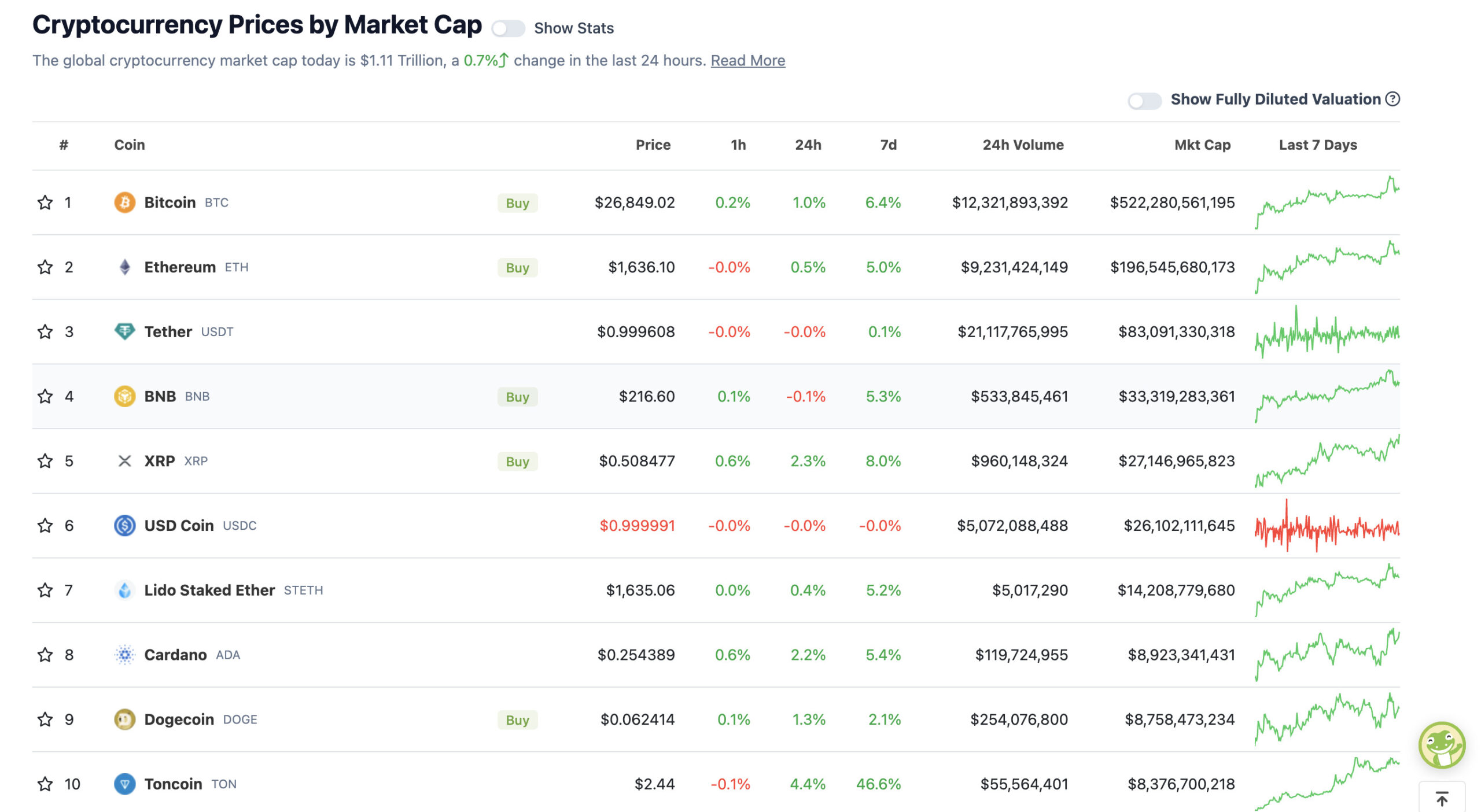

Top 10 overview

With the overall crypto market cap at US$1.1 trillion, up a fraction of a fraction since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Toncoin (TON) has surged into the top 10 crypto majors, jostling Solana down the order to no.11.

What is Toncoin again? It’s a layer 1 blockchain originally conceived in a whitepaper by the creators of the Telegram messaging platform.

TON stands for The Open Network and in 2018 the project became one of the biggest ICO launches in crypto’s history at that frothy time in the market, raising US$1.7bn in a token sale.

That was before the SEC effectively scared off Telegram, with the latter’s founders distancing themselves from the project and issuing refunds to investors. Toncoin was effectively then taken over by community members, aka the TON Foundation.

Remarkably, the project has survived, albeit with a different token – TON (the original was called GRAM). And this latest surge can be put down to a toe dip back in by Telegram.

As reported by The Block, the TON Foundation and Telegram jointly announced a new self-custodial crypto wallet called TON Space at the Token 2049 conference in Singapore late last week.

Toncoin leads bitcoin in crypto market rally after Telegram endorsement https://t.co/cA4rwTUk9K

— The Block (Meet Us at Emergence) (@TheBlock__) September 18, 2023

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• eCash (XEC), (market cap: US$516 million) +14%

• Stacks (STX), (market cap: US$679 million) +7%

• Chainlink (LINK), (market cap: US$3.62 billion) +5%

• Injective (INJ), (market cap: US$620 million) +4%

• Kaspa (KAS), (market cap: US$1.03 billion) +2%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

To be clear, I still stand by my January 12 prediction:

✅ Nov 2022 $15.5k was the bottom

✅ Bitcoin will rise towards 2024 halving. BTC already rose from $18k to $27k since Jan 12.

❓ 2024 halving will be >$32k ($32k-$66k IMO)

❓ 2025 bull market >$100k ($100k-$1m IMO) https://t.co/V74Y8VYCVo pic.twitter.com/VBjsHObMMl— PlanB (@100trillionUSD) September 18, 2023

"New York crypto regulator removes $DOGE and $XRP from token ‘greenlist’ in latest update"

if you people do not see what is going on with this current administration and their predatory actions of injustice

I do not know what to tell you https://t.co/1LSPFuIAlf

— Wendy O (@CryptoWendyO) September 18, 2023

Meanwhile, there’s a hunt for Bitcoin going on right now, courtesy of CoinSpot… maybe keep your eyes peeled for a rocket if you’re in the Adelaide area…

POV: You just won a Bitcoin ($40k) 🤯

The next rocket will be hidden in Adelaide at 3:30pm, will you find it?

*Re-enactment of the Melbourne Rocket already found. pic.twitter.com/uVI9Nt3Xga

— CoinSpot (@coinspotau) September 19, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.