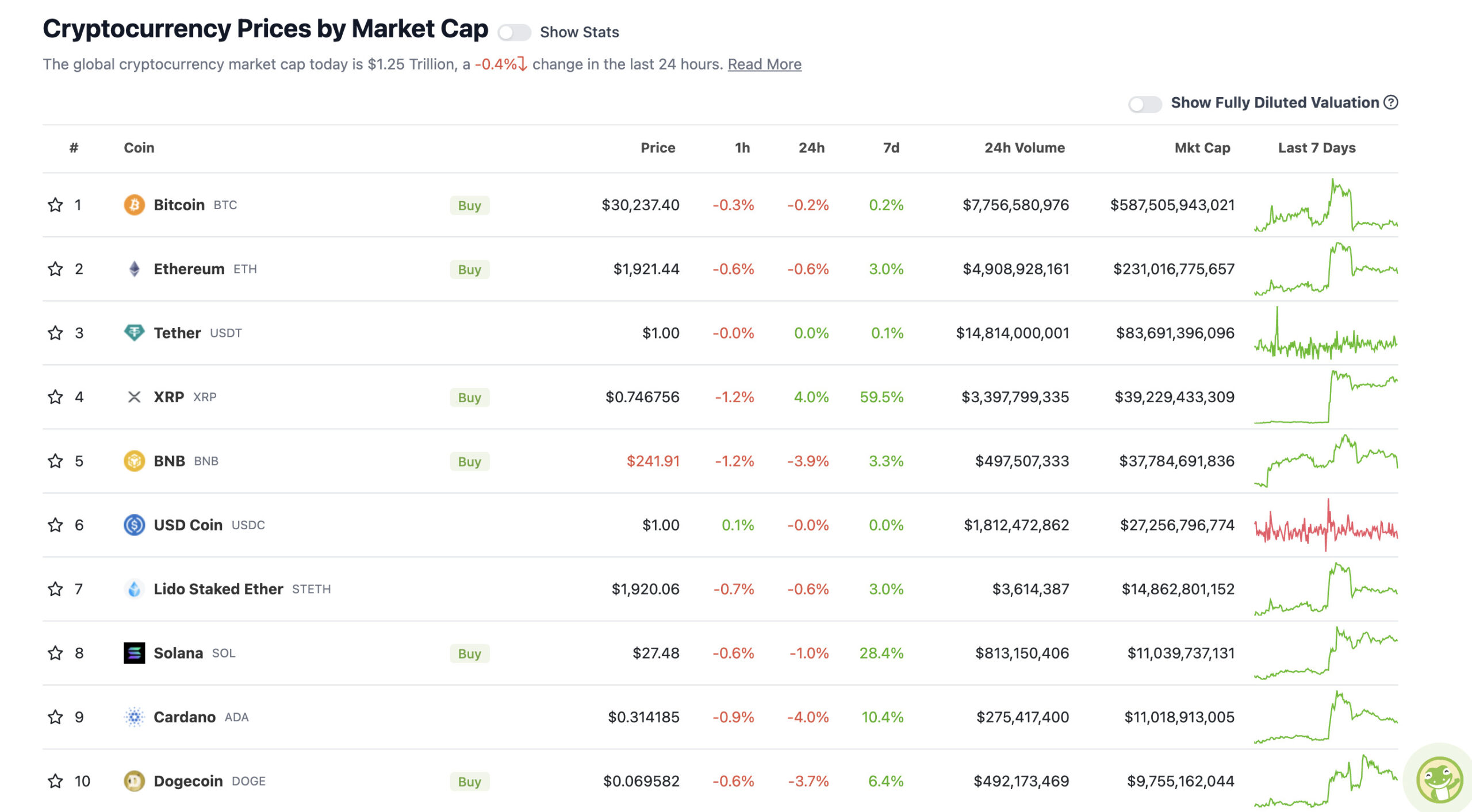

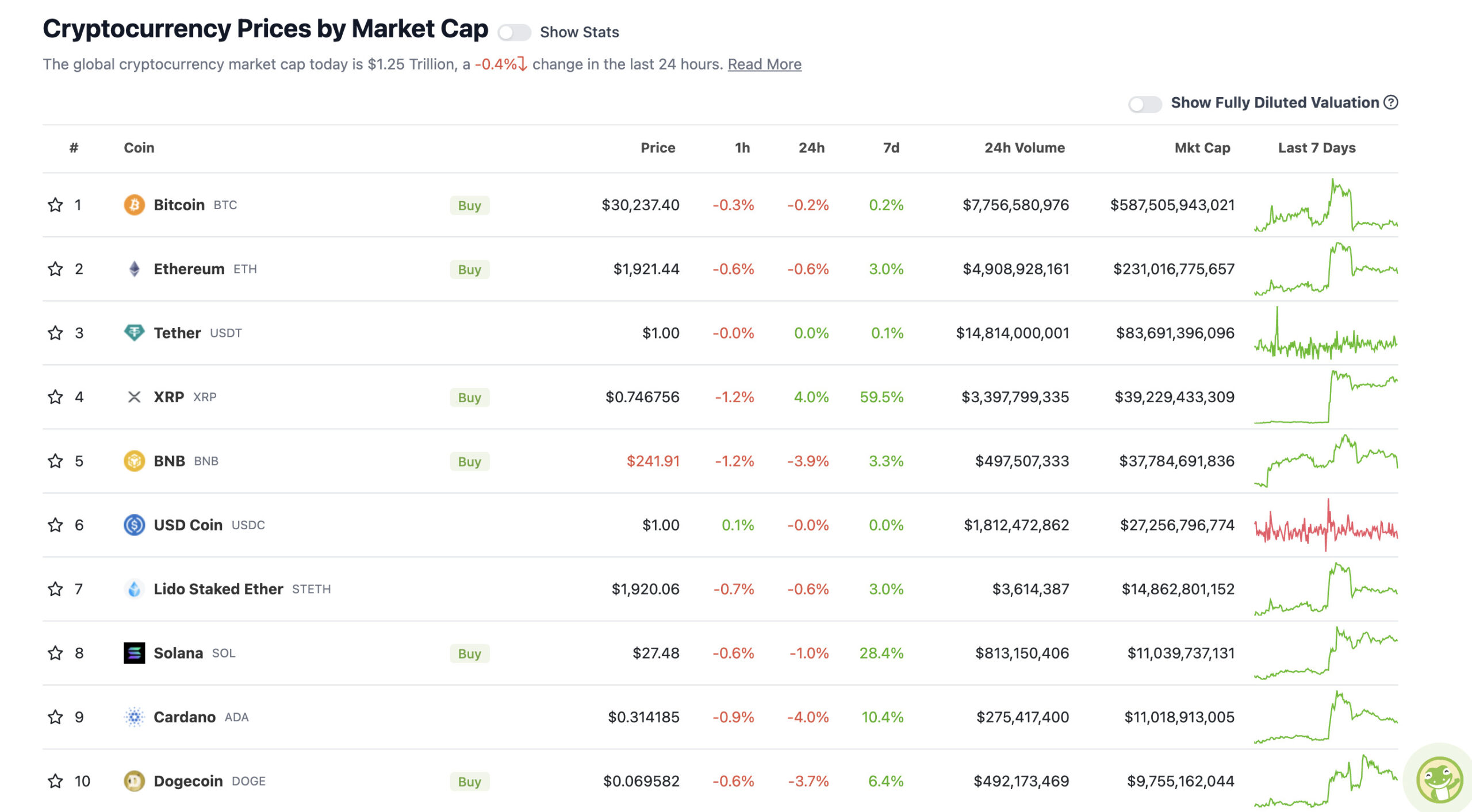

With the overall crypto market cap at US$1.25 trillion, down about 0.4% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

"Mummy, can I give this weird, levitating hobo some Bitcoin?" (Getty Images)

Morning Coinheads. Hope you’ve been enjoying Gregor “Thinly Veiled Contempt For Crypto” Stronach’s caretaker role on this column. He did an excellent job and didn’t manage to break anything.

Aside from your spirit, that is, if you’re unerringly bullish on everything to do with crypto. (Which you probably shouldn’t be. Aside from Bitcoin, of course, and perhaps a handful or so of others. No, it’s not advice.)

In any case, he will be relieved to be relieved of this duty for now, and you can check out his other informative daily (a)musings here.

Meanwhile, what’s doing in the cryptoverse? A bit of a refresh on happenings since late last Friday:

• Ripple (and its blockchain payments-rail asset XRP) scored a crucial victory over the US Securities and Exchange Commission and its dastardly overlord Darth Gensler. Gregor filled you in on that one on Friday.

Ripple CEO Brad Garlinghouse said that the “law of the land” right now is that XRP is "not a security."

He noted it could “take years” before the SEC has the opportunity to file an appeal against that decision. pic.twitter.com/70UxmxDjtj

— Crypto Crib (@Crypto_Crib_) July 16, 2023

• Speaking of overlords, BlackRock CEO Larry Fink (while unable to comment specifically about favoured asset Bitcoin due to its BTC ETF review with the SEC) has made some further eye-popping comments about crypto in general. Here’s some of what he told CNBC the other day, and an accompanying video to boot…

Fink said he expects crypto to “transcend” traditional currencies, including the US dollar. The BlackRock boss, who tarred the market as an “index of money laundering” a handful of years ago, now believes that crypto assets could “revolutionise finance“.

Fink added a couple of days ago: “It has a differentiating value versus other asset classes, but more importantly, because it’s so international it’s going to transcend any one currency.”

Blackrock CEO Larry Fink seems…bullish. pic.twitter.com/VJLqHjoHyP

— Anthony Pompliano 🌪 (@APompliano) July 14, 2023

• The SEC has formally accepted the BlackRock spot Bitcoin ETF application for review, and other major filings, too. Look, it’s nothing too get too foamy at the mouth just yet, as it’s merely a procedural move that indicates Gensler and co are shifting the filings from the in-tray to the “sigh, I suppose we’d actually better take a look at this” tray.

The BlackRock-instigated flurry of BTC ETF filings, and the formal acknowledgement from the SEC, does, however, represent the most closely watched, largely hyped Bitcoin-related proposals that the US financial agency has been forced to consider so far.

A spot Bitcoin ETF is considered the holy grail of institutional investment vehicles for the crypto space, because it would track the actual value of BTC (backed by actual Bitcoins), as opposed to a BTC futures ETF, and it would also be tradable on a traditional stock exchange.

The clock has been started officially. Altho none of this changes our odds as it is just procedural. That said it could be looked at as good news for ARK tho that these were ack in order of filing date vs ack all w the same date. https://t.co/zPVHSJDL5l

— Eric Balchunas (@EricBalchunas) July 14, 2023

Other than these quite massive developments, then, what else is going on? Price action, of course… Let’s take a quick squizz.

With the overall crypto market cap at US$1.25 trillion, down about 0.4% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Right then, the crypto market has certainly settled down a tad since Friday’s froth, with bull goose cryptos Bitcoin and Ethereum coming back to Earth somewhat. The former had busted above US$31k amid “the bull run is DEFINITELY here this time, honest!” chatter.

It wasn’t to last, and neither did XRP’s attempt to crack the fabled US$1 mark. That said, the Ripple asset is still up about 60% on the week.

Blockchain analytics gurus Santiment has noted a “second $XRP upswing” is possible once the “FOMO turns back to FUD”. We shall watch and see.

📉 #Crypto has been seeing a bit of a hangover after the major market-wide gains we saw Wednesday and Thursday. Keep an eye out for a second $XRP upswing once the #FOMO turns back to #FUD. $SNX is an outlier from the rest of the pack, jumping another +28%. https://t.co/S6XIfdid10 pic.twitter.com/vOS53RkfoN

— Santiment (@santimentfeed) July 14, 2023

Santiment also noted in some further XRP analysis that: “If key whale and shark addresses are increasing their supply going into this pump, then it is a get foreshadowing signal that the pump may just be getting started, and it’s a sign of good things to come.”

As for Bitcoin, here are a couple of hot takes before we look at who’s performing lower down the batting order.

This is the MOST important technical reason to be macro bullish.$DXY losing value = Equities / Crypto gaining value. Especially when we have a major breakdown.

Don’t miss out on the next bull run.#bitcoin #cryptocurrency #stocks pic.twitter.com/G268nCNyV7

— Roman (@Roman_Trading) July 16, 2023

Historically, #BTC pre-Halving prices have always been considerably lower compared to $BTC Post-Halving prices#Crypto #Bitcoin

— Rekt Capital (@rektcapital) July 16, 2023

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• 1INCH (1INCH), (market cap: US$411 million) +16%

• Kaspa (KASPA), (market cap: US$650 million) +19%

• Maker (MKR), (market cap: US$874 million) +9%

• Stellar (XLM), (market cap: US$3.59 billion) +5%

• Optimism (OP), (market cap: US$962 million) +5%

PUMPERS (lower, lower caps)

• Aleph.im (ALEPH), (market cap: US$19 million) +42%

• WazirX (WRX), (market cap: US$56 million) +14%

• GMM (GMM), (market cap: US$24 million) +8%

SLUMPERS

• Fantom (FTM), (market cap: US$726 million) -6%

• Lido DAO (LDO), (market cap: US$1.9 billion) -5%

• Synthetix (SNX), (market cap: US$847 million) -5%

• Injective (INJ), (market cap: US$711 million) -5%

• Chainlink (LINK), (market cap: US$3.4 billion) -4%

SLUMPERS (lower, lower caps)

• ARK (ARK), (market cap: US$54 million) -11%

• Gods Unchained (GODS), (market cap: US$40 billion) -10%

• Multichain (MULTI), (market cap: US$37 million) -8%

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Bitcoin ETF applications also acknowledged from:@vaneck_us@InvescoUS@GalaxyDigital@Fidelity@WisdomTreeFunds

LFG! 🔥🚀🔥

— Bitcoin Archive (@BTC_Archive) July 14, 2023

Milton Friedman predicting #Bitcoin back in 1999 🤯

— Bitcoin Magazine (@BitcoinMagazine) July 16, 2023

As an investor, % returns are missing the point in crypto’s early years. If you’re thinking in % returns, you’re taking too little risk and likely underperforming. Think in multiples, in X’s.

— Chris Burniske (@cburniske) July 16, 2023

https://twitter.com/naiivememe/status/1680547913431236611

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.