Meanwhile, Coinbase…

… the largest crypto exchange in the US and certainly one of the biggest globally, has some news today, too. Of the more positive variety.

Pic via Getty Images

Another month, another US CPI report filed and announced. And where is Bitcoin and crypto at on the back of this latest market-moving news? Up a bit, surprisingly.

Bitcoin is currently trading back above the US$26k level again, which might leave the odd “we’re definitely going to break down hard from the double top” analyst or two scratching heads today.

That said, the fear across the market is still palpable right now. If it hits “Extreme Fear”, will it be time for crypto true believers to buy “aggressively” again? We’ll leave that question hanging out there in the headwinds.

As our very own non-fungible Eddy Sunarto reported in his Market Highlights column earlier today:

Inflation in the US surged to 3.7% on a yearly basis in August from 3.2% inJuly – bolstering the chances of another Fed rate hike next week.

The Core CPI, which excludes volatile items such as food and energy, was up 4.3% Y-o-Y in August down from a 4.7% growth in July.

“This latest US CPI data is unlikely to move the needle on the Fed’s highly anticipated move to hold rates steady at their meeting next week – which has already been priced-in by financial markets,” said Nigel Green of the deVere Group.

“But the uptick in inflation gives the US central bank extra reason to be hawkish moving forward. As such, we also expect the Fed will start to prepare the market for a rate increase at its November meeting.”

… has revealed it was responsible for a sickening fat-fingered BTC transaction, losing $510,000 worth of the asset in an instant.

The institutional crypto brokerage and custody firm Paxos, which PayPal uses to custody its hundreds of millions of dollars worth of crypto, has claimed the error, originally thought (by some observers across the cryptoverse) to be a PayPal screw-up.

UPDATE: A PayPal spokesperson says its infrastructure partner Paxos was responsible for the overpayment:

“Paxos overpaid the BTC network fee on Sept. 10, 2023. This only impacted Paxos corporate operations. Paxos clients and end users have not been affected and all customer…

— Bitcoin Magazine (@BitcoinMagazine) September 13, 2023

Thank you for your sacrifice https://t.co/zqaZ7mLggU

— Cory Klippsten 🦢 Swan.com (@coryklippsten) September 10, 2023

Labelling Bitcoin “the most important asset in crypto”, Coinbase CEO Btian Amstrong took to the X platform to announce that the exchange will add support for the Lightning Network, which is a layer-2 blockchain that dramatically helps speed up Bitcoin payments transactions, making them “lightning fast” and almost instantaneous.

The team did a great job digging into this, and we've made the decision to integrate Lightning. Bitcoin is the most important asset in crypto and we're excited to do our part to enable faster/cheaper Bitcoin transactions. Will take some time to integrate so please be patient. https://t.co/FneeXkLI25

— Brian Armstrong (@brian_armstrong) September 13, 2023

Bitcoin is the world’s digital monetary system, and Lightning is Bitcoin’s payments layer. Coinbase’s integration with Lightning will give its 100 million users an on-ramp to faster and cheaper bitcoin transactions. Hats off to Coinbase! https://t.co/zJ5HqHvyrz

— Cathie Wood (@CathieDWood) September 13, 2023

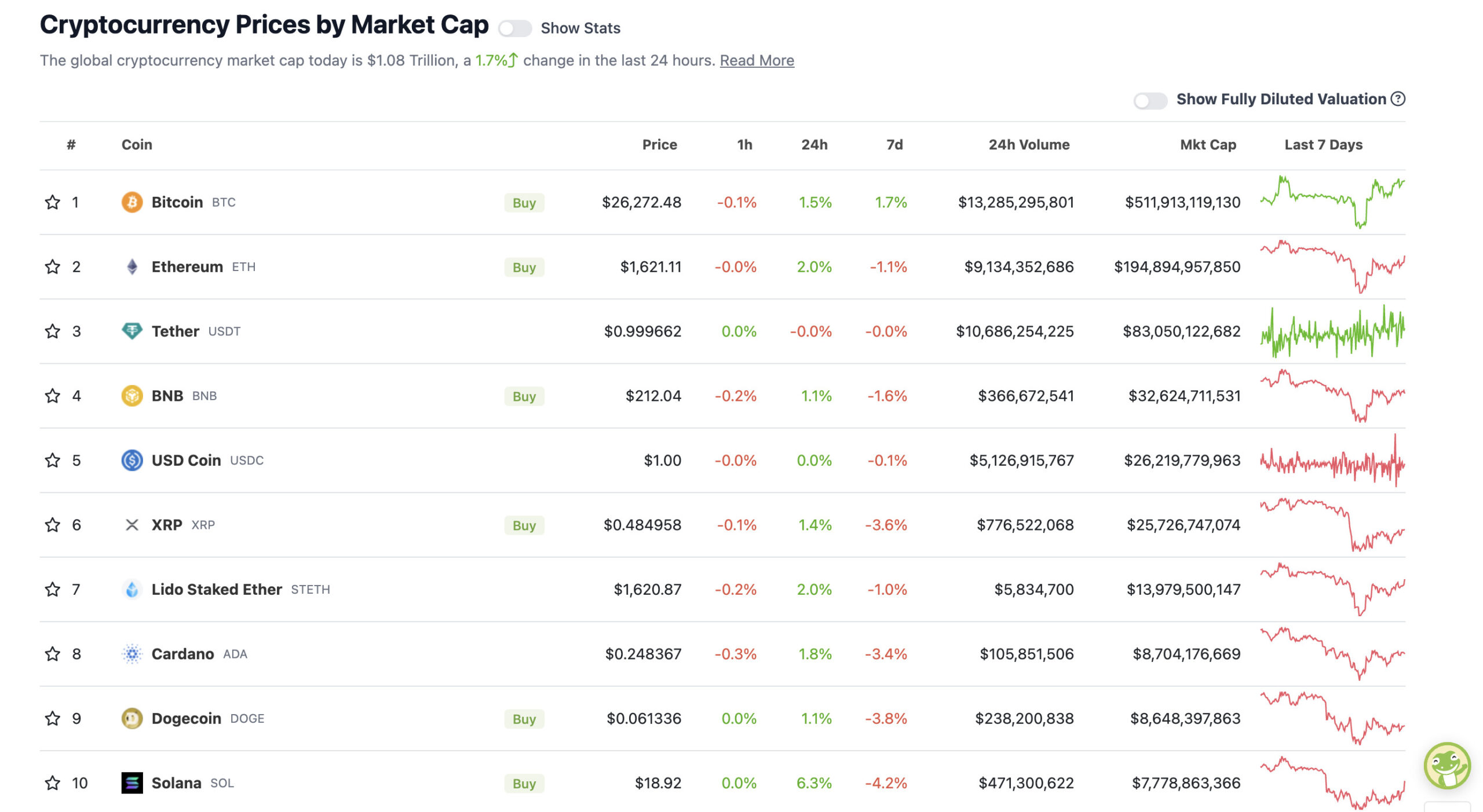

With the overall crypto market cap at US$1.08 trillion, up a fraction of a fraction since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Solana is the big daily winner in the majors today, neatly shrugging off some FUD based around the FTX exchange potentially selling its $1.2 billion worth of the SOL token.

In a major development overnight, FTX has now received judicial approval to liquidate its crypto assets to repay its creditors.

The SOL token is going okay on the news, though, as various crypto analysts (see Lark’s tweets from the other day and Chris Burinske’s and Michaël van de Poppe’s below) seek to debunk the idea that all of the liquidating exchange’s SOL tokens can be sold off quickly.

The fact is, they can’t. A lot of those coins are locked up with a slow-release mechanism over four years. The selling of the asset should, in effect, create minimal market impact.

FTX gets approval to sell $3.4B in #Crypto assets & CPI data comes in worse than expected

Markets aren't falling down that much, and not much should be happening from it.

The Solana, which corresponds to $1.2 billion of the assets of FTX, is mostly staked and can't be sold.👇… pic.twitter.com/uKG9XefCzy

— Michaël van de Poppe (@CryptoMichNL) September 13, 2023

Only ~13% of FTX’s $SOL holdings are liquid – nbd imo – keep a cool head, folks.

(h/t @fundstrat’s FS Insight) pic.twitter.com/TOhmTV0g2p

— Chris Burniske (@cburniske) September 13, 2023

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Kaspa (KAS), (market cap: US$983 million) +12%

• Hedera (HBAR), (market cap: US$1.74 billion) +11%

• THORChain (RUNE), (market cap: US$484 million) +9%

• Toncoin (TON), (market cap: US$6.48 billion) +7%

• Decentraland (MANA), (market cap: US$519 million) +5%

SLUMPERS

• Klaytn (KLAY), (market cap: US$378 million) -4%

• Radix (XRD), (market cap: US$572 million) -2%

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

📈 #Crypto is up after today's #CPI August report was released, with a +3.7% increase compared to the expected +3.6%. Core CPI also had a +4.3% rise. There isn't quite as much discussion compared to July & August, but this should be considered a positive. https://t.co/8ajy90ewh4 pic.twitter.com/6vtTVq8VDp

— Santiment (@santimentfeed) September 13, 2023

JUST IN: 🇺🇸 US Congressman says CBDC is a surveillance tool that can be weaponized to oppress the American way of life.

CBDC is slavery, #Bitcoin is freedom!

— Bitcoin Magazine (@BitcoinMagazine) September 13, 2023

This is what I’m referring to.

Everyone is so certain of where price is going.

Clearly none of you remember how certain everyone was 2 years ago that $BTC was “going to 100k & higher. It was all in the charts!”.

This mindset will be your downfall.#bitcoin #cryptocurrency https://t.co/TDUDuBe6kD

— Roman (@Roman_Trading) September 13, 2023

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.