Mooners and Shakers: Bitcoin dips near $25k as FTX rears its ugly head and Solana struggles

FTX, if it was reincarnated as a… whatever the hell that is. (Pic via Getty Images)

Bitcoin took a dramatic dive down to US$25k earlier today before a just-as-sharp recovery saw it spike back up again just under US$26k. A reverse Bart Simpson. Huzzah for volatility, right?

What caused the dip, what caused the bounce back? Not everything can be explained by news and fundamentals, unfortunately. The dark arts of behind-the-scenes trading activity will definitely be at play here…

That said … here’s what we can quickly glean from the bearish and bullish sides of the analysis and news ledger today, and maybe a little from what lies in between, too…

FTX crypto sell-off worries remerge

There has been quite a bit of fear, uncertainty and doubt over the past handful of days surrounding the potential sale of old FTX crypto assets. And it might be this that’s weighing most heavily on the crypto market right at this moment.

Altcoins (basically every crypto token that isn’t Bitcoin and these days Ethereum) have been hammered on the back of this negative narrative. After recent strong performance, Solana (SOL) is leading the altcoin losses in the majors with a 7% dip over the past week.

Essentially the market is biting fingernails over the possibility of the FTX exchange (yes, it still exists as a bankrupt, liquidating firm) securing approval from the bankruptcy courts process to sell assets from its US$3.4bn worth of crypto holdings.

An updated FTX asset report was just released.🚨

On Wednesday, they will likely get approval to liquidate their $3.4b worth of crypto.

Here is a breakdown of the assets:$SOL: $1.16b$BTC: $560m$ETH: $192m$APT: $137m$XRP: $119m$BIT: $49m$STG: $46m pic.twitter.com/NSu7keqXrv

— Miles Deutscher (@milesdeutscher) September 11, 2023

Singapore-based digital asset services provider Matrixport wrote in a Monday market report that “an altcoin crash is coming” as FTX might start selling tokens as soon as this week.

And the reason Solana is under pressure, as CoinDesk notes, is because FTX still holds some US$1.16 billion worth of the token – nearly 16% of its outstanding supply. Yikes.

But…

Is this all just, to some degree, baseless “FUD”, though? Can FTX just dump on the market all at once?

Here’s a take from analyst Lark Davis, who reckons he’s debunked it, noting “these coins will not be market sold”, guessing that most of them will instead be traded OTC (over the counter) outside of exchanges and therefore not creating knock-on selling havoc on exchanges.

He also adds that “those that aren’t will be sold slowly via market markers, IMO.”

“And as for SOL – this is all locked with release of the coins happening over the next 4 years. When this is sold OTC, it will be someone buying FTX’s vesting contract,” he clarifies. “BTC & ETH – they have a good amount, but not billions. This is absorbable buy pressure…

“The FUD around this is worse than the actual event itself.”

FTX is going to crash the crypto market again. OMG!!!

Debunked.

FTX has according to this slide 3 billion in crypto ready to dump on the market and send us to goblin town.

But what is the truth?

First, these coins will not be market sold. I bet most will go OTC. Those that… pic.twitter.com/7Y9dxXzbKU

— Lark Davis (@TheCryptoLark) September 10, 2023

Altcoins due a turnaround?

Another popular analyst avoiding the doom and gloom at the moment is Dutch trader Michaël van de Poppe, who tells his 666,000+ followers on X that altcoins are in their “depression phase” right now. In other words, they’re pretty much at rock bottom and are “ready to start trending upwards”.

You can grab a visual bead on where he thinks the crypto market is at in his tweet below, in which he references the good ol’ Wall Street Cheat Sheet.

#Altcoins are in their depression phase and are ready to start trending upwards.

It might sound repetitive, but for most of the altcoins, the lows might be in or close to in.

The interest in crypto is on the same levels as 2020, while BTC pairs are slowly breaking out.👇

The… pic.twitter.com/IlOLK4rMKW

— Michaël van de Poppe (@CryptoMichNL) September 9, 2023

“The interest in crypto is at the same levels as in 2020, while BTC pairs are slowly breaking out,” writes the van that goes Poppe, adding:

“The interest in the markets isn’t there, while we’ve got some important indicators in the meantime:

– Bitcoin spot ETF around the corner.

– Ethereum spot ETF applications.

– Ethereum futures ETF around the corner.

“The institutions are jumping in.”

Top 10 overview

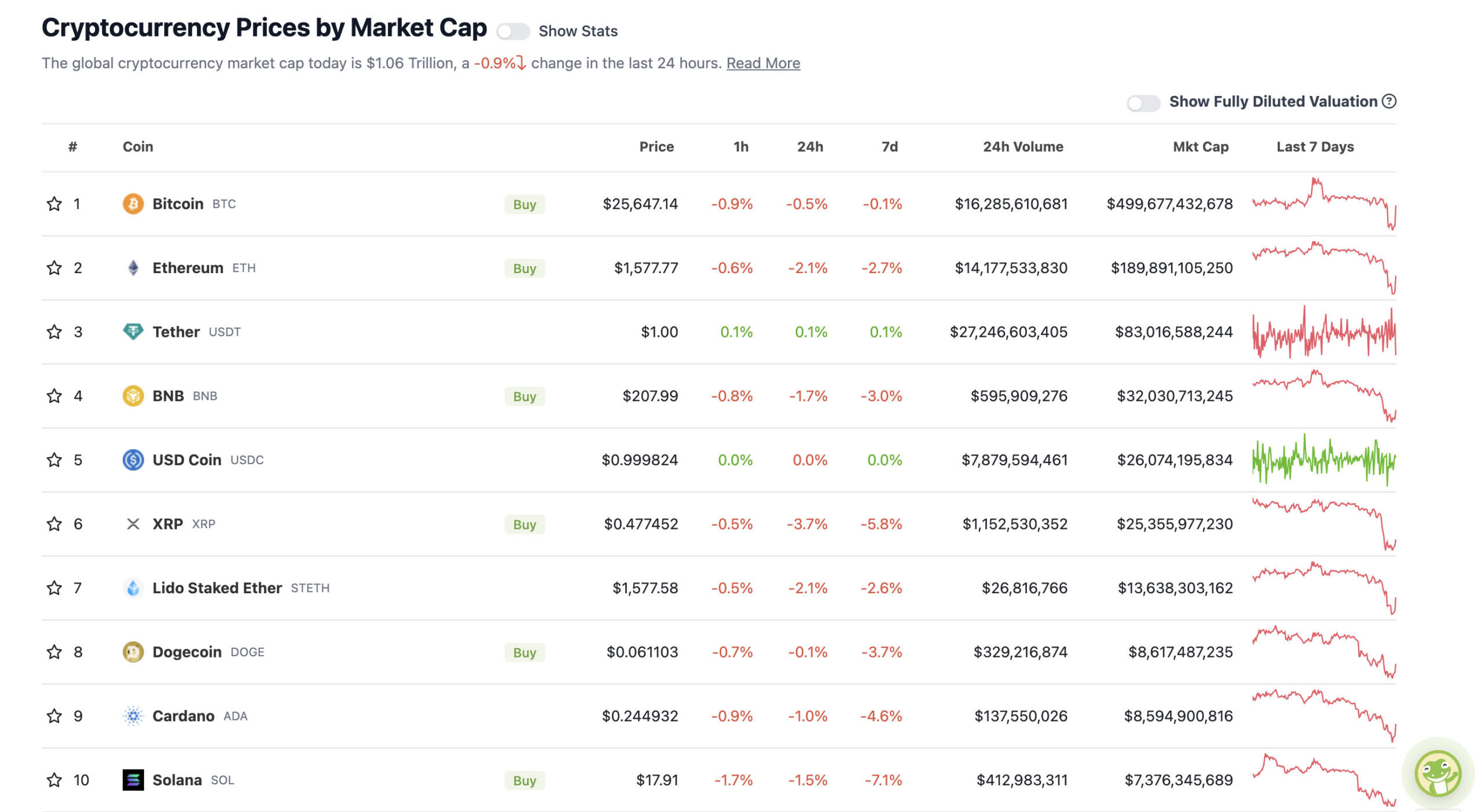

With the overall crypto market cap at US$1.06 trillion, down a fraction since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

$BTC 1D

Looking good for our potential long reversal setup between 24-25k as bull divs MACD/RSI, bull price action, & price being inside main support.

Need to see a bit more before we take longs but it’s looking solid right now.

All according to plan.#bitcoin #cryptocurrency pic.twitter.com/63RSh7Z9jL

— Roman (@Roman_Trading) September 11, 2023

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Trust Wallet (TWT), (market cap: US$336 million) +9%

• Optimism (OP), (market cap: US$1.05 billion) +5%

• Kaspa (KAS), (market cap: US$844 million) +2%

SLUMPERS

• Rollbit Coin (RLB), (market cap: US$413 million) -11%

• Arbitrum (ARB), (market cap: US$983 million) -8%

• Klaytn (KLAY), (market cap: US$394 million) -6%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

JUST IN: Former PayPal President: We're trying to turn #Bitcoin into a global payment network. We are still in the ‘fax era’ of payments. pic.twitter.com/VDjJ0u2Rgx

— Bitcoin Archive (@BTC_Archive) September 11, 2023

This is Bitcoin’s event horizon. The April 2024 Bitcoin Halving is the most important date in Bitcoin's 15 year history, second only to the Genesis block on 3 January 2009.

On this day Bitcoin becomes the hardest asset in the world. 2X harder than gold. pic.twitter.com/kcDUjR6Go0

— Charles Edwards (@caprioleio) September 11, 2023

NEW: 🇺🇸 SEC commissioner Hester Peirce says she doesn’t understand the SECs rationale for rejecting a Bitcoin ETF.

We don’t understand it either… 🤷🏻♂️

— Bitcoin Archive (@BTC_Archive) September 9, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.