Mooners and Shakers: Bitcoin stumbles lower; Solana loses shine; Russia likely to legalise

Pic: Getty

The movable feast that is the crypto market and industry continues on its frenetic, somewhat unpredictable journey like a yum-cha trolley with a wonky wheel.

Some major countries and companies have been flip-flopping this way and that just lately. India, for instance, now seems to be on a cautious path to crypto legalisation. Probably. Maybe. Okay, that’s still 50/50… but they want their tax cut.

And Russia’s Ministry of Finance is reportedly urging Putin and pals to regulate cryptocurrencies and even enable the country’s banks to sell them. This comes after the Bank of Russia recently called for bans on the asset class altogether. The rumours are, though, that the Russian government is leaning towards legalising and taxing crypto.

Of course, there’s a bit more going on in Russia, and the Ukraine, right now than crypto-related considerations. Seriously escalating border conflict may yet have a major bearing on US and world economies. It’s a potential geopolitical time bomb that has all markets on edge and may end up dominating and shaping the first quarter or first half of 2022 in a global macroeconomic sense.

But for the sake of all, particularly those potentially caught up in conflict… let’s very much hope that fizzles out so the tinfoil-hat brigade can conclude it was just another way to distract us all from alien visitations.

Russia estimates $2 BILLION annual earnings from regulating #Bitcoin and crypto. Should the U.S. start regulating? pic.twitter.com/AMHumFlw2s

— #1 Crypto Newsletter (@macrobits007) February 3, 2022

Top 10 overview

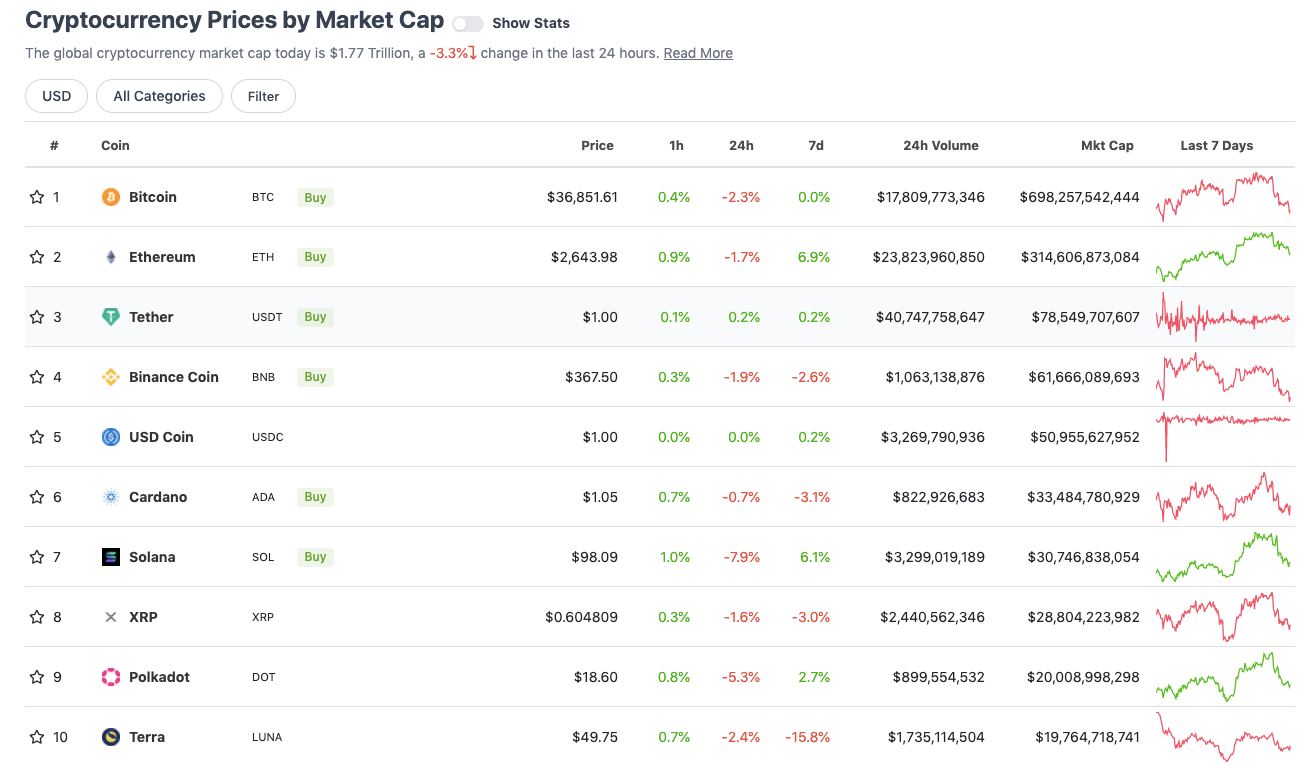

With the overall crypto market cap down about 3.3% over the past 24 hours, here’s the state of play in the top 10 by market cap at the time of writing – according to CoinGecko data.

The standout story in the top-10 chart today is Solana (SOL), which is currently down about 8% on the 24-hour timeframe (although still up 6% on the weekly).

The Ethereum rival has been roller coasting more than most just lately, having moved past some FUD (fear, uncertainty and doubt) regarding network issues with a spate of positive news – including Coinbase listings for its ecosystem tokens.

But it’s dipping again today on the back of an absolutely horrendous US$325 million exploit to one of its major decentralised apps – the cross-chain bridge known as Wormhole. You can read more about that on Stockhead here.

Meanwhile, there’s yet another piece of macroeconomic news that could be having a say on global markets today, from which Bitcoin and friends, and the likes of gold and silver, certainly won’t be immune.

We’ll let the gold-loving, BTC-dissing Peter Schiff take the mic for a moment…

Gold is selling off due to "Hawkish" comments made by ECB President @Lagarde. But nothing she said about #inflation is hawkish. Inflation will be a big problem in Europe for years to come, just not as huge a problem as it will be in the U.S. Lagarde is a dove and #gold is a buy!

— Peter Schiff (@PeterSchiff) February 3, 2022

The European Central Bank’s president Christine Lagarde today added some fuel to a theoretical fire that the influential financial institution could look to make faster monetary policy tightening in the first half of this year. If so, it would mimic similar, well-documented moves being touted, although still yet-to-be-clarified, by the US Federal Reserve.

Lagarde reportedly acknowledged that inflation is hitting higher levels than the ECB expected, but did forecast it would ease through this year.

In other words, perhaps Schiff is right – it could just be a case of something and nothing on that front.

As for Bitcoin technicals, the failure to properly break $39k the other day has pushed the OG crypto into “lower low” territory. Maybe anything less than an emphatic move above that level, with a solid retest of Rekt Capital’s $38.6k (below), is just a sucker’s rally for now.

Indeed, #BTC produced an upside wick into resistance on its latest recovery

For the time being, this ~$38600 area continues to figure as resistance$BTC #Crypto #Bitcoin https://t.co/Pv6obZz87x pic.twitter.com/fM0USi9Zd8

— Rekt Capital (@rektcapital) February 3, 2022

Oh, and here are some further technical thoughts to bear in mind, too…

https://twitter.com/jomaoppa/status/1487453189829967875

Winners and losers: 11–100

Sweeping a market-cap range of about US$18.3 billion to about US$887 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Immutable X (IMX), (market cap: US$887b) +39%

• Quant (QNT), (mc: US$4.35b) +20%

• Hedera (HBAR), (mc: US$4.6b) +10.5%

• Tezos (XTZ), (mc: US$3.4b) +8%

• Maker (MKR), (mc: US$2.1b) +7.5%

DAILY SLUMPERS

• Synthetix (SNX), (market cap: US$1.05b) -11%

• Flow (FLOW), (mc: US$1.9b) -7%

• Arweave (AR), (mc: US$1.75m) -6.5%

• Convex Finance (CX), (mc: US$1.2b) -6%

• Loopring (LRC), (mc: US$1b) -6%

Lower-cap winners and losers

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Ampleforth (FORTH), (market cap: US$96m) +95%

• Ooki (OOKI), (mc: US$64m) +39%

• Dero (DERO), (mc: US$105m) +36%

• Quantstamp (QSP), (mc: US$60m) +35%

• Lisk (LSK), (mc: US$297m) +28%

DAILY SLUMPERS

• Rome (ROME), (market cap: US$54m) -20%

• NFTX (NFTX), (mc: US$46.5m) -19%

• Offshift (XFT), (mc: US$42.5m) -18%

• Universe.XYZ (XYZ), (mc: US$78m) -15%

• Altura (ALU), (mc: US$40m) -14%

Final words

Microsoft’s Blockchain Director on Ethereum’s future pic.twitter.com/bb1tohCss2

— Blockworks (@Blockworks_) February 3, 2022

all that effort and it's not even tungsten. https://t.co/0W0tKMPXUx

— Tim Copeland (@Timccopeland) February 3, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.