Mooners and Shakers: Solana rises; MicroStrategy buys another $25m of Bitcoin

Coinhead

It’s a strong day in the crypto market, with Solana shining brightest among top coins and enough positive news floating around to keep hopium alive. The bears are still roaming, however, with plenty still calling for lower prices.

Cue the Michael Saylor-led MicroStrategy company making another seemingly spur-of-moment Bitcoin (BTC) splurge…

MicroStrategy has purchased an additional 660 bitcoins for ~$25.0 million in cash at an average price of ~$37,865 per #bitcoin. As of 1/31/22 we #hodl ~125,051 bitcoins acquired for ~$3.78 billion at an average price of ~$30,200 per bitcoin. $MSTRhttps://t.co/bF6VImC0Qy

— Michael Saylor⚡️ (@saylor) February 1, 2022

The Bitcoin bull CEO was a recent guest on the popular UpOnly podcast and revealed the following insight about his BTC-buying strategy…

We finally get the full $BTC buying strategy from @saylor pic.twitter.com/7iwts6Y0yF

— Cointelegraph (@Cointelegraph) January 26, 2022

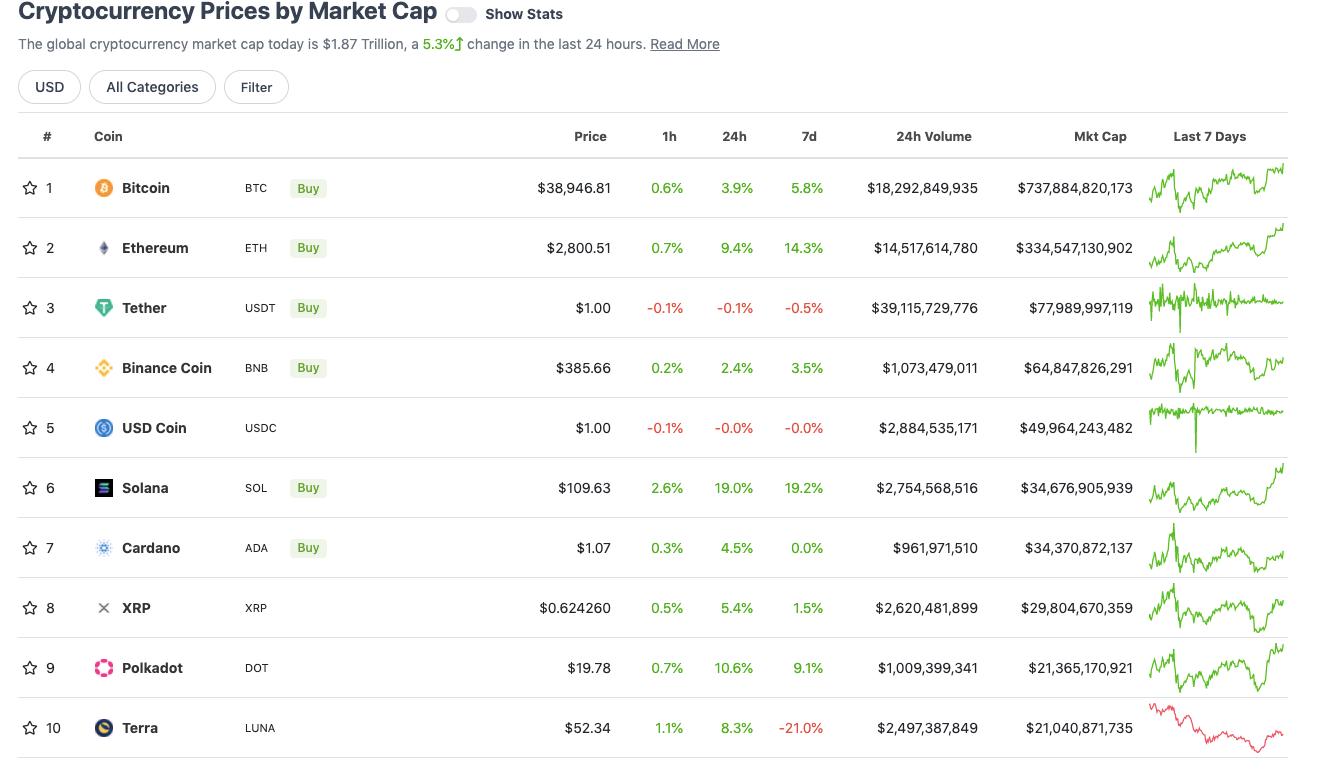

With the overall crypto market cap up about 5.3% over the past 24 hours, here’s the state of play in the top 10 by market cap at the time of writing – according to CoinGecko data.

Polkadot (DOT) is having a decent 24 hours, having flipped Terra (LUNA) and looking more and more likely to nab a shirt sponsorship deal with the famous FC Barcelona football club, according to the rumours.

However, it’s another prominent layer 1 platform, Solana (SOL), that’s really bursting through today, with a +19% daily gain at the time of writing, despite the project’s recent much-maligned network issues.

Solana has been surging on the back of a spate of good news this week. Firstly, the SOL-based wallet Phantom has raised US$109 million in a funding round led by the VC firm Paradigm, giving the company a US$1.2 billion valuation.

Then, there’s the launch of Solana’s “Pay” product, which aims to enable and boost stablecoin payments within the blockchain’s ecosystem, largely focused on USDC.

2/ Launching today, Solana Pay makes it easy for merchants worldwide to accept digital dollars like $USDC, and any other #Solana SPL Token, for a fraction of a penny and without any intermediaries

— Solana (@solana) February 1, 2022

But even more than these two things, the fuel that’s likely pumping SOL hardest right now is the fact crypto exchange behemoth Coinbase is now listing Solana-ecosystem tokens for the first time. Yup… the old Coinbase-listing-pumpage trick.

The new coins being supported include the decentralised exchanges Orca (ORCA) and Bonfida (FIDA).

Coinbase has started listing #solana tokens! https://t.co/DPRauDyqGC

— Lark Davis (@TheCryptoLark) February 1, 2022

And just to top things off, the SOL technicals are apparently looking pretty good, too, according to analyst Scott “The Wolf of All Streets” Melker…

Well in profit now, even though my first buys were "early" at $116.

Seeing this on a lot of alts… rounding bottom forming off of support, with some oversold bullish divergence.

Careful, Bitcoin can ruin the party fast.But cautiously optimistic, https://t.co/9tneUc7Fq5 pic.twitter.com/oqiPgsdYhY

— The Wolf Of All Streets (@scottmelker) February 1, 2022

But what about those bears we mentioned earlier? Yep, they’re still about, as usual making their presence strongly felt on hopium-filled days like this one. Shhh… look, here’s one now…

$BTC has tapped on the daily downtrend resistance line. We’ve seen this 2-3 times before. Each time with bearish price action (volume going down as price going up).

I doubt this time it’ll be different. #bitcoin #cryptocurrency #cryptotrading #cryptonews pic.twitter.com/YwWnOHxUjS

— Roman (@Roman_Trading) February 1, 2022

It’d be prudent to keep both bullish and bearish perspectives in mind, of course – especially in such a volatile market swinging this way and that at the whim of consistently inconsistent macroeconomic forces.

A lot of the market has come into areas we discussed for being a potential strong resistance like on $eth / $btc

I’ll say this again. Profits there today. May not be tomorrow. Be alert 🚨 and cautious ⚠️

Still need TL break on btc + flip of 39-40.7k which also has 4hr MA’s

— Pentoshi 🟠🐧 Goblinomics Professor (@Pentosh1) February 1, 2022

Sweeping a market-cap range of about US$18.9 billion to about US$906 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• LooksRare (LOOKS), (market cap: US$1.05b) +14.5%

• Mina (MINA), (mc: US$946m) +12%

• Leo Token (LEO), (mc: US$3.6b) +10%

• Elrond (EGLD), (mc: US$3.16b) +8.5%

• Aave (AAVE), (mc: US$2.2b) +8%

DAILY SLUMPERS

• Uniswap (UNI), (market cap: US$5.1b) -4%

• Arweave (AR), (mc: US$1.95b) -3%

• Loopring (LRC), (mc: US$1.3b) -2.5%

• Chainlink (LINK), (mc: US$8b) -2.3%

• Synthetix (SNX), (mc: US$1.1b) -2.2%

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• World of DeFish (WOD), (market cap: US$445m) +65%

• Bezoge Earth (BEZOGE), (mc: US$199m) +53%

• Adventure Gold (AGLD), (mc: US$90m) +43%

• UFO Gaming (UFO), (mc: US$308m) +33%

• Fancy Games (FNC), (mc: US$15m) +32%

We are giving out whitelist spots daily in discord!

Be sure to join and secure a spot for our mint and launch starting February 10th ! 🚀

> https://t.co/s5pNtP2aCX #p2e #PlayToEarn #NFTCommunity pic.twitter.com/w5uHW5rT6V

— Fancy Birds | Play2Earn (@Fancybirdsio) February 1, 2022

DAILY SLUMPERS

• BNS Token (BNS), (market cap: US$35.5m) -34%

• ADAX (ADAX), (mc: US$22.5m) -24%

• Inverse Finance (INV), (mc: US$40m) -15.5%

• Wonderland (TIME), (mc: US$305m) -12%

• OpenDAO (SOS), (mc: US$155m) -11%

The investment-management giant Fidelity, which is one of the largest financial services institutions in the world, has released a paper titled Bitcoin First, in which it describes the OG crypto as “a superior form of money”.

BREAKING – $11.1 trillion Fidelity believes "#bitcoin has the potential to be the primary monetary good." 🙌 pic.twitter.com/xGcHsWTHE4

— Bitcoin Magazine (@BitcoinMagazine) February 1, 2022