Mooners and Shakers: Bitcoin still ranging, but is a short squeeze coming?

Getty Images

Welcome to another week trying to make some sense of the unpredictable world of magic internet money. Bitcoin has been struggling to reclaim US$27k all weekend, but… could the crypto bears be in for a shock?

According to at least one reasonably popular crypto-charting, technical analyst, @Roman_Trading, yes, as he believes a short squeeze might be on its way.

Mind you, he’s one of the few we’re seeing on our crypto Twitter-focused feed who isn’t short-term Bitcoin bearish right now.

But the US crypto trader is pointing to weak volume on the recent breakdowns, indicating a lack of validation at this stage for strength in a push lower. He also refutes that the Bitcoin chart is showing a “head and shoulders” pattern, which is a classic bullish-to-bearish trend reversal sign in the mystical, dark arts world of financial technical analysis.

You probably very well know this if you’re digging around in Stockhead, but a short squeeze, meanwhile, can occur when a sudden, sharp rise in an asset forces all the shorting traders to let out a collective, “Oh, sh*t!” and scramble to close out their bearish trading positions – shorts. A frisson in buying pressure then squeezes the short-sellers out like a memecoin millionaire squeezing a zit. The price of the asset can consequently shoot up in response.

Investopedia has a good, more detailed and less graphic breakdown.

FYI, that is not a head and shoulders nor looks anything like an HS.

Volume also doesn’t validate a breakdown if it was.

These are trading 101 ideas many are failing to recognize.

— Roman (@Roman_Trading) May 14, 2023

The “head and shoulders crowd”, as Aussie analyst @tedtalksmacro calls them, have been calling for Bitcoin breakdowns based on the apparent pattern Roman’s dubious about – to levels around US$25k or US$24k or much further below, around US$20k.

However, for now, Bitcoin is hanging in there just below US$27k. It does seem to be having a great deal of difficulty reclaiming the level as support for now, however.

https://twitter.com/tedtalksmacro/status/1656918144382824449

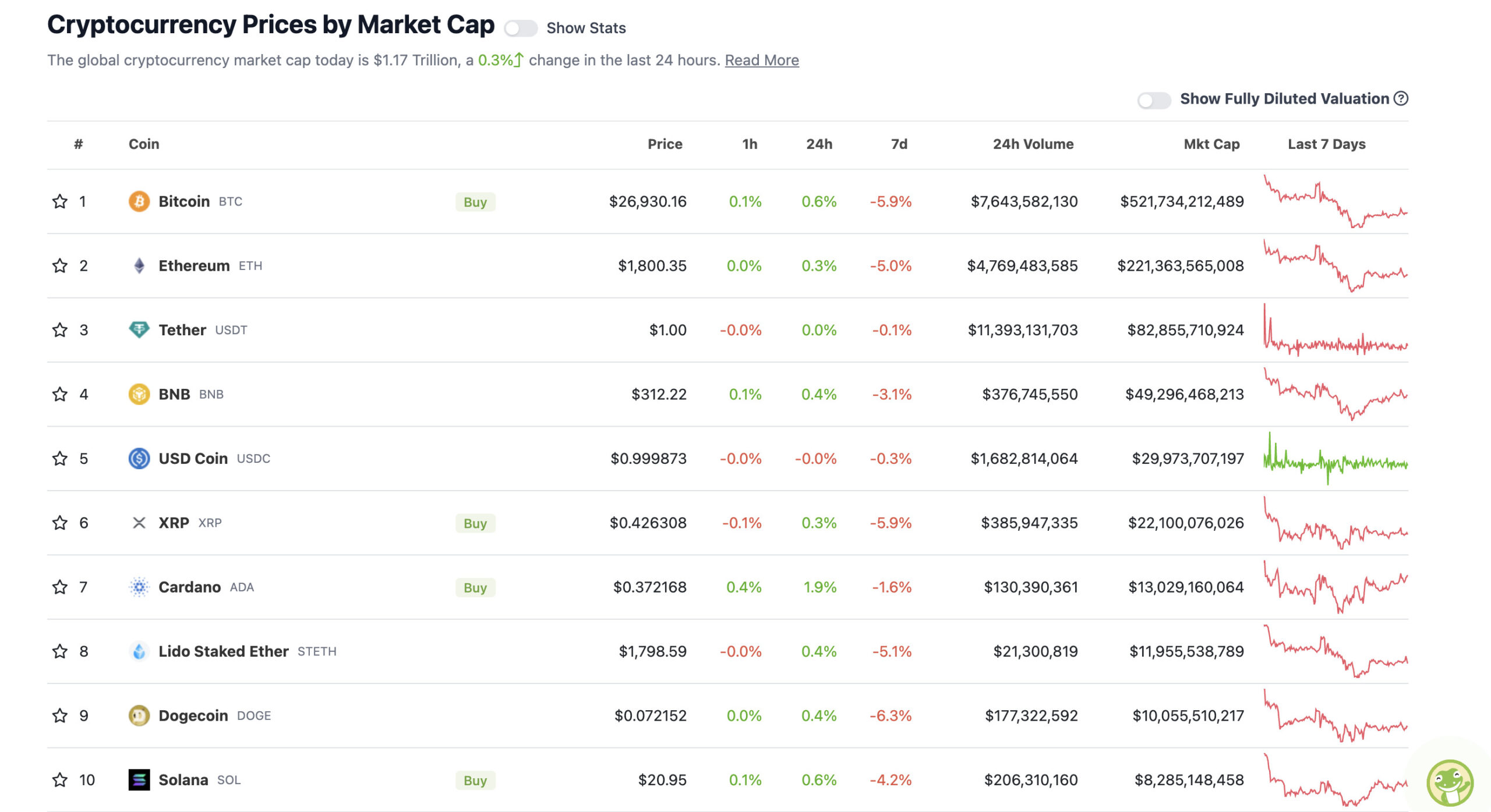

Top 10 overview

With the overall crypto market cap at US$1.17 trillion, up about 0.3% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

In the small hours last night (AEST), Bitcoin (BTC) did briefly move above the $US27k mark that short-midterm-focused traders have been eyeing as important. But that didn’t last long, unfortunately.

For good measure, we’ll grab a hold of another popular chartist’s analysis as something of a counterbalance to Roman’s above.

With the weekly close on Bitcoin closing in, “Rekt Capital” needs BTC to make a strong and sudden spurt back up over US$27,500 for him to not join the heavily creaking bandwagon of BTC bears right now.

#BTC Weekly Close below $27550 (black) would likely spell more downside for price after failing to reclaim $28800 as support (orange)$BTC #Crypto #Bitcoin https://t.co/92vs2C3kJy pic.twitter.com/lu6atoICAw

— Rekt Capital (@rektcapital) May 14, 2023

We shall see where the BTC price lands in a few hours, then. Meanwhile, we’re sure hoping the notoriously incorrect CNBC financial analyst Jim Cramer is right for once. Because blistering barnacles, thundering typhoons and twittering tarnations, we’re not so sure we’re happy we saw this…

Jim Cramer says an "economic wave is about to hit that will be fantastic for investors."

Do you believe him? 👀 pic.twitter.com/pg3GZ5GMMm

— Crypto Crib (@Crypto_Crib_) May 14, 2023

It’s over pic.twitter.com/tUf5V5Hjd1

— Inverse Cramer (@CramerTracker) May 14, 2023

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Conflux (CFX), (market cap: US$589 million) +11%

• Kava (KAVA), (market cap: US$523 million) +9%

• Kaspa (KAS), (market cap: US$402 million) +9%

• Sui (SUI), (market cap: US$613 million) +5%

• Litecoin (LTC), (market cap: US$6.1 billion) +4%

PUMPERS (lower, lower caps)

• Milady Meme Coin (LADYS), (market cap: US$114 million) +58%

• ORDI (ORDI), (market cap: US$317 million) +37%

• Bob Token (BOB), (market cap: US$48 million) +37%

SLUMPERS

• Klaytn (KLAY), (market cap: US$541 million) -7%

• Pepe (PEPE), (mc: US$752 million) -4%

• Bitcoin SV (BSV), (mc: US$699 million) -3%

• Theta Network (THETA), (mc: US$892 million) -2%

• Radix (XRD), (mc: US$740 million) -2%

SLUMPERS (lower, lower caps)

• ArbDoge AI (AIDOGE), (market cap: US$62 million) -15%

• Xen Crypto (XEN), (market cap: US$25 million) -11%

• Dejitaru Tsuka (TSUKA), (market cap: US$35 million) -5%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Hang on, here’s another reasonably prominent crypto analyst bucking the bearish hive mind…

https://twitter.com/VailshireCap/status/1657846156683034624

Whenever someone tells you that #Bitcoin has no use case, send them this meme pic.twitter.com/eR7yTkJHkr

— Coin Bureau (@coinbureau) May 14, 2023

https://twitter.com/CryptoEntj/status/1657720625828339713

— Out of Context Human Race (@NoContextHumans) May 14, 2023

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.