Mooners and Shakers: Bitcoin steady around $28k; Arbitrum dips amid governance drama

Getty Images

Morning Coinheads. Another week, another bunch of Satoshis? If you’re stacking and HODLing Bitcoin, then yes. How’s it tracking? It seems to have turned US$28k into some sort of support for now.

As for the recently (partially) airdropped Arbitrum token (ARB), however, it’s one of the biggest dippers. And that’s due to some grave concerns, and poor miscommunication, around the layer 2 Ethereum scaling project’s very first DAO (decentralised autonomous organisation) governance proposal.

Why’s that been a drama? Because it involves the allocation and usage of about US$1 billion worth of ARB – that is, 750 million of the tokens.

ARB is a governance token that is designed to allow holders/community members of the DAO to vote on proposals, such as AIP-1, which deal with structural changes to the DAO and the project’s Foundation.

Long story short, the Arbitrum Foundation has been heavily criticised by many members of the Arbitrum DAO who believed their input regarding the proposed allocation of the 750 million ARB tokens was being ignored.

Here’s one take on that…

Vote is underway for @arbitrum to steal 750m $ARB from treasury for its “Foundation” to hand out “Special Grants”.

No votes on these grants.

No mention of security or oversight.

3 ppl control the Foundation.

This is a SLUSH FUND for Arbitrum VCs.

Total embarrassment. pic.twitter.com/hnabrJafbi

— CS Bastiat ⚖️ (@CSBastiat) April 1, 2023

The vote for the AIP-1 (Arbitrum Improvement Proposal) had swung to a majority signalling non-approval (it’s currently 82% against). And yet, what seemed a red flag for many transpired when it became clear the Foundation had already used/diverted more than 50 million ARB tokens regardless of any DAO vote.

Arbitrum foundation made a proposal (AIP-1) to allocate 750M ARB tokens for admin and op costs, but $ARB holders voted against it

Now they said the vote was just a formality, and they have already spent 50.5M (6.7%) of the proposed 750M $ARB

Your vote is not vote pic.twitter.com/lvhBbBesum

— Eden Au (@0xedenau) April 2, 2023

The Arbitrum Foundation has since released a statement addressing the concerns and admitting it could have communicated plans better. It also explained that some decisions needed to be made before the public launch of Arbitrum and that 40 million of the tokens were “allocated as a loan to a sophisticated actor in the financial markets space” with the remaining 10 million converted to fiat for operational costs.

According to the Arbitrum Foundation, AIP-1 was intended to be “a ratification of the initial setup of both the Arbitrum DAO and the Foundation created to serve the DAO”. Confusing, huh? Poor communication? 100%.

6/ Regarding the on-chain transfers of 50M $ARB tokens, 40M $ARB tokens have been allocated as a loan to a sophisticated actor in the financial markets space. The remaining 10 million has been converted to fiat and dedicated towards operational costs.

— Arbitrum (💙,🧡) (@arbitrum) April 2, 2023

This seems to have satisfied some, but certainly not all members of the Arbitrum DAO community.

https://twitter.com/Cringe/status/1642654706953768961

At the time of writing, the ARB token is down about 8% over the past 24 hours and is trading for US$1.19.

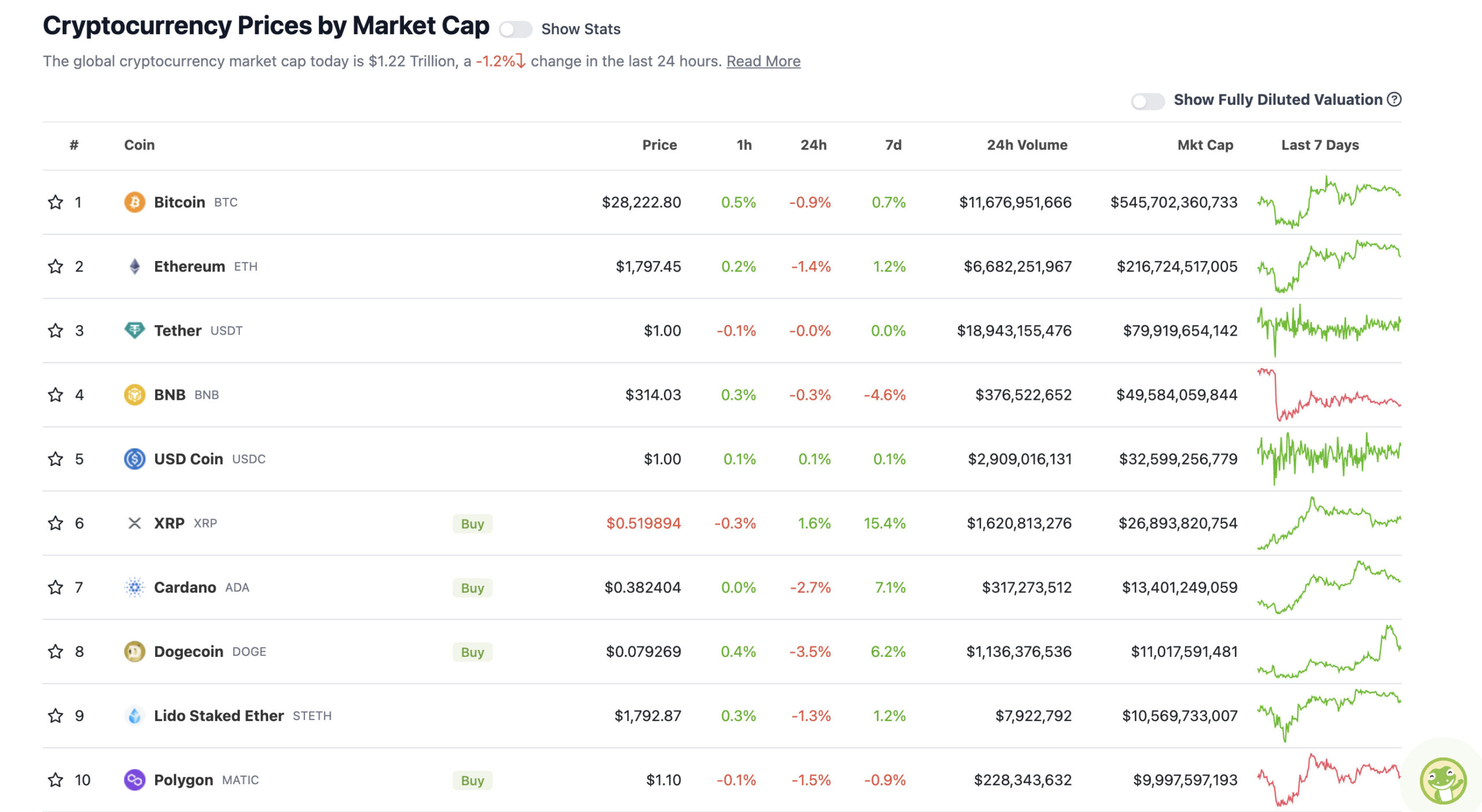

Top 10 overview

With the overall crypto market cap at US$1.22 trillion, down about 1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

It was a pretty quiet weekend for crypto all (well, some) things considered. And that’s despite the growing fears that influential US politicians really have it in for Bitcoin and cryptocurrencies – and therefore monetary freedom from a system of overreach and control, in general.

Here’s US Senator Elizabeth Warren (below) explaining the superiority of fiat currencies, such as the US dollar, due to them being backed by something tangible – you know, like 100% competent governments and banks.

Side note, at the time of writing, the US dollar is backed by… US$31.6 trillion of debt that costs about US$307 billion to maintain. It’s increased every year over the past 10 years.

The #Bitcoin Marketing Team is working hard out there.

„Fiat currencies are backed by the government and banks. #Bitcoin is different.“

Venezuelans | Zimbabweans like, damn pls I don’t want any government backing anymore. pic.twitter.com/5isSgVlnmd

— Carl ₿ MENGER ⚡️🇸🇻 (@CarlBMenger) April 2, 2023

Hey-ho. Bitcoin is still looking pretty steady in the face of Warren’s warpath right now, but let’s see what fresh attacks from her “Anti-Crypto Army” transpire this week.

In the meantime, though, Crypto Twittering analyst Rekt Capital is satisfied that BTC has “broken the Macro Downtrend”, which is a trendline that’s kept Bitcoin in bearish territory ever since it peaked in November 2022.

He caveats, though, that a dip below US$25k before pushing higher, isn’t out of the question, looking at 2015’s price action as a historical example.

Historically, when #BTC has broken the Macro Downtrend, a macro uptrend followed

In 2015 however, there was first a $BTC retest of the Downtrend before upside

If a dip occurs this April or May, it could be one of the last visits below ~$25K for several months#Crypto #Bitcoin pic.twitter.com/bnKh7wUNJv

— Rekt Capital (@rektcapital) April 2, 2023

Fellow chart watcher Roman Trading, is also spotting the possibility of a short-term pullback, due to a DT (double top) formation for Bitcoin potentially playing out right now.

$BTC H4

As it stands we have a potential DT that confirms at 27.7. That will most likely take us down to daily support at 25.2.

Unless we lose that area, the 1D TF still looks like consolidation for more upside.

We are trading between S/R.#bitcoin #cryptocurrency pic.twitter.com/lb76YluuBQ

— Roman (@Roman_Trading) April 2, 2023

That said, as noted further above, Bitcoin is still holding its +$28k position at the time of writing.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$7.9 billion to about US$433 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS

• Kaspa (KAS), (market cap: US$694 million) +10%

• Aptos (APT), (mc: US$2.17 billion) +7%

• EOS (EOS), (mc: US$1.35 billion) +3%

• Decentraland (MANA), (mc: US$1.1 billion) +2%

• Quant (QNT), (mc: US$1.86 billion) +2%

SLUMPERS

• Arbitrum (ARB), (market cap: US$1.19 billion) -8%

• Conflux (CFX), (mc: US$773 million) -8%

• Render (RNDR), (mc: US$460 million) -6%

• ImmutableX (IMX), (mc: US$964 million) -6%

• Mask Network (MASK), (mc: US$437 million) -5%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Giant #Bitcoin logo projected onto Germany's tallest tower 🇩🇪

— Bitcoin Magazine (@BitcoinMagazine) April 2, 2023

Leaked video of Elizabeth Warren’s anti crypto army pic.twitter.com/9YrVst7V13

— WF (@WhaleFUD) April 1, 2023

Crypto bros pic.twitter.com/pyocgy46ZE

— Wifey (@WifeyAlpha) April 2, 2023

https://twitter.com/tedtalksmacro/status/1642663884552298496

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.