Mooners and Shakers: Bitcoin steady around $25k as Fed balance sheet swells; BNB pumps on Voyager news

Getty Images

Top of the morning to you, Coinheads. Bitcoin is plateauing around US$25k, waiting for its next big move in either direction. Altcoins are… all over the place, but BNB has surged. Meanwhile, how’s that economic tightening working out for you, The Fed?

The US Federal Reserve’s balance sheet, as several crypto and general market analysts have been quick to point out, has increased by about US$300 billion – making it larger than it was at the beginning of November 2021.

So much for QT, eh? Guess it was “transitory”?

Behold, the great tightening.

The Fed's balance sheet is now larger than it was on November 3rd, 2021. pic.twitter.com/RVUHNuwoIb— Sven Henrich (@NorthmanTrader) March 16, 2023

The "Fed Put" is back with assets on their balance sheet increasing $297 billion over the last week, the largest spike higher since March 2020. Thus nearly half of the Quantitative Tightening since last April was undone in a single week. pic.twitter.com/3Nk4J4Sxku

— Charlie Bilello (@charliebilello) March 16, 2023

Meanwhile, as a strangely Irish-sounding Eddy Sunarto notes over in Stockhead’s Market Highlights this morning, the Fed and US Treasury has applauded the likes of JPMorgan, Bank of America, Citigroup, and Wells Fargo for pumping in US$30 billion deposits into the struggling First Republic Bank.

Because, you know they’re all mates and have got each other’s backs, and it’s a show of the great strength and resilience of the US banking sector – or something like that.

Not that BlackRock CEO Larry Fink is having a bar of it. Per Market Highlights again, the Wall Street big shot has warned that the Fed’s rapid rate hiking has opened up the financial system’s cracks and is predicting more chaos to come with seizures and shutdowns.

Should we be worried about our own banks here Down Under? Christian Edwards, along with Marcel Thieliant from Capital Economics, allays those fears here.

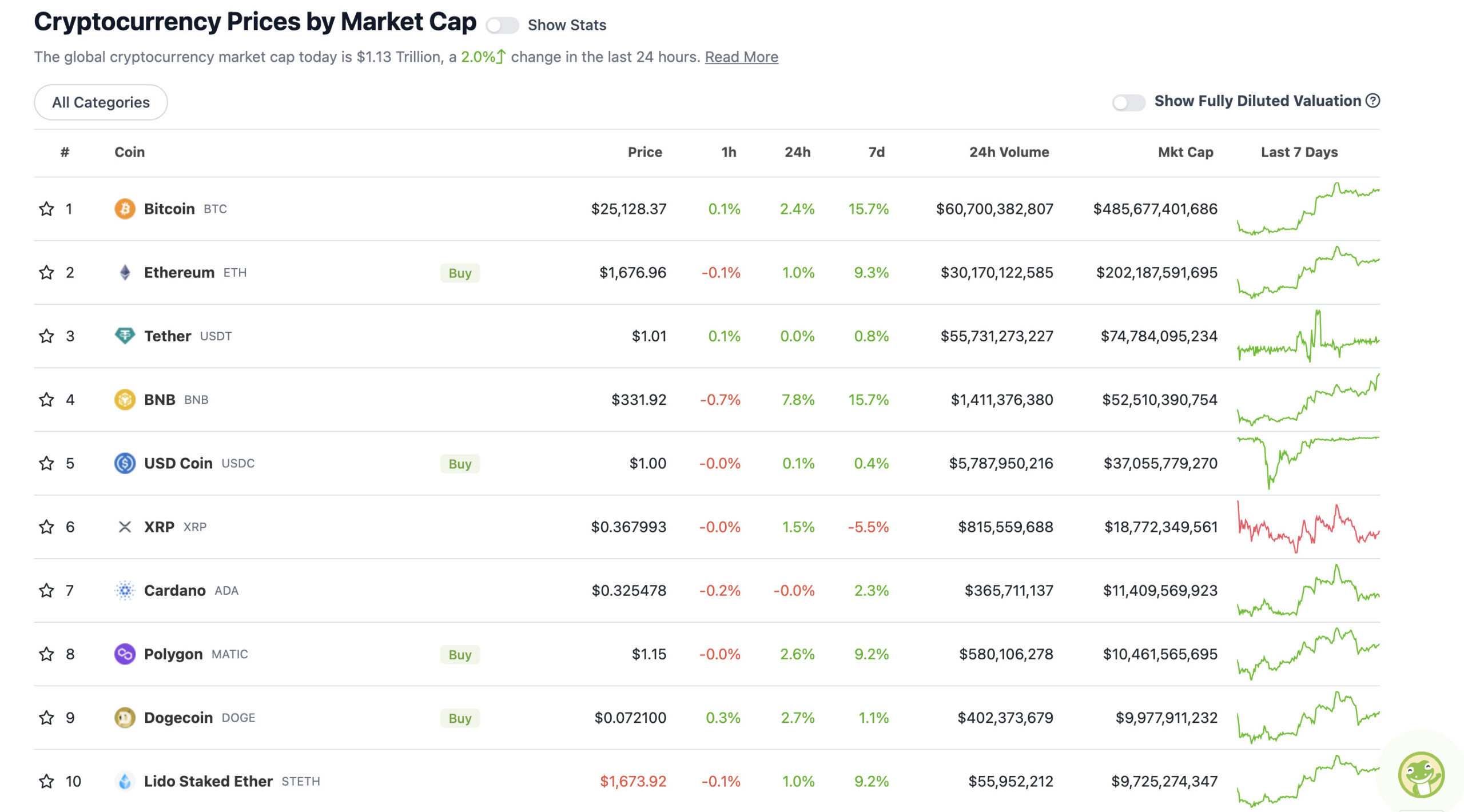

Top 10 overview

With the overall crypto market cap at US$1.13 trillion, up about 2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

It’s another green-tinged day in the crypto majors, although a flat Cardano (ADA) is letting the side down slightly.

Binance’s exchange token BNB is the standout. Why’s that, then? Could be something to do with the fact the US government’s request to halt the acquisition of bankrupt crypto lender Voyager by Binance.US has been rejected by a Southern District of New York judge.

Per a report from FXStreet, Binance.US will now be able to purchase the ailing crypto firm and its assets on March 20.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$8.3 billion to about US$412 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS

• Halo Coin (HALO), (market cap: US$448 million) +12%

• Arweave (AR), (mc: US$435 million) +10%

• The Graph (GRT), (mc: US$1.33 billion) +8%

• Rocket Pool (RPL), (mc: US$791 million) +7%

• Synthetix Network (SNX), (mc: US$900 million) +6%

SLUMPERS

• Kava (KAVA), (market cap: US$444 million) -9%

• GMX (GMX), (mc: US$644 million) -6%

• Maker (MKR), (mc: US$641 million) -5%

• PAX Gold (PAXG), (mc: US$475 million) -3%

• LEO Token (LEO), (mc: US$3.1 billion) -1%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

#Bitcoin momentum is turning bullish, despite banking woes. Blue is next, then red.🌊 pic.twitter.com/NrzYtolElP

— PlanB (@100trillionUSD) March 16, 2023

According to @ArkInvest, Bitcoin could reach $1.48 million by 2030.

In this thread, we look at the 8 Bitcoin use cases discussed in the report that could grow $BTC value to 1 million each🧵

1/ Digital Gold

Gold:

❌Expensive to store.

❌indivisible without losing value.…— Ben Simpson (@bensimpsonau) March 16, 2023

Given the number of elites that hold private bank accounts at Credit Suisse, you can bet your bottom franc they are getting a bailout.

— Coin Bureau (@coinbureau) March 15, 2023

When we finally have sound money in a #Bitcoin World…pic.twitter.com/pnt7UBUJtq

— Michael Saylor⚡️ (@saylor) March 16, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.