Mooners and Shakers: Bitcoin squeezes in tight ahead of potential breakout

Pic via Getty Images

Bitcoin, Ethereum and most other notable cryptos appear to be in a comfortable, if kinda meh, ‘chop-solidation’ (chopping sideways) period for the moment. But some observers are predicting a breakout move soon.

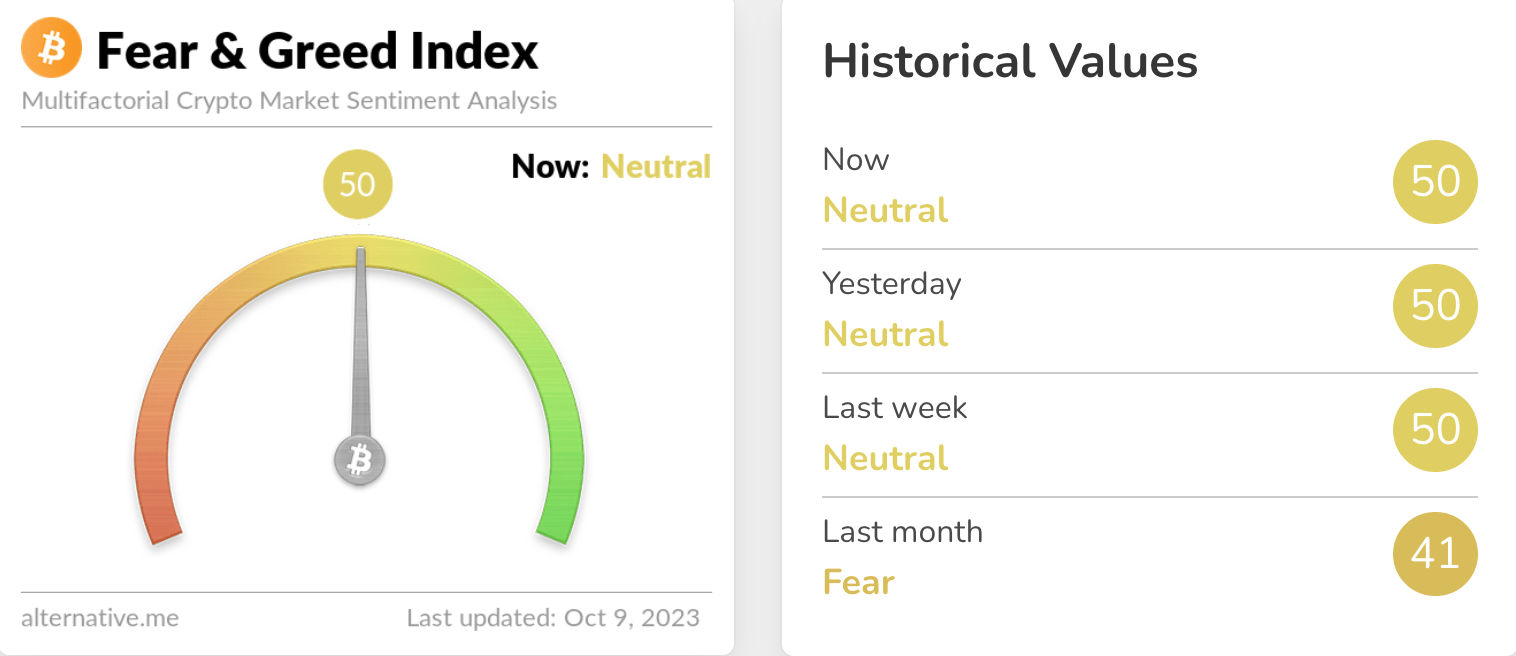

The crypto market mover in chief, Bitcoin (BTC), is hovering just below US$28k, and has been trading pretty flat over the past seven days. This is reflected, too, in the popular sentiment tracker the Crypto Fear & Greed Index, which has been coasting in Neutral for the past several days, too.

Apparently, the technical data supports this, too, with BTC’s price movement heading along sideways in an increasingly tight band – see the squeezing Bollinger bands in this “Titan of Crypto” post below – a technical analysis tool we were banging on about recently.

#Bitcoin 4 Steps Sequence 🔢📈

No need to overcomplicate things.

To see more clearly what is happening now with Bitcoin in the larger scale all you need is to set the Bollinger bands (BBs) on a monthly chart.

The sequence breaks down into 4 steps:

1⃣ BTC price exceeds the… pic.twitter.com/T8uMj3pXpT

— Titan of Crypto (@Washigorira) October 3, 2023

Let’s grab a bit more analytical nouse and opinion.

Here are the data analytics gurus Santiment, with a reminder that a LOT of BTC has been moving off exchanges lately, which can potentially/likely mean they’re ending up in cold storage for HODling. A good thing for the sentiment surrounding a price-strengthening narrative…

📊 #Bitcoin had its most coins (over 10K $BTC) moving off exchanges since September 7th, and #crypto's top market cap asset is making a 2nd run at crossing a $28K market value. Utility will be important here, as unique addresses have fallen to 6-week lows. https://t.co/JoJv9YYJsA pic.twitter.com/3JELGuzJRG

— Santiment (@santimentfeed) October 8, 2023

Meanwhile ‘TechDev’, he of 418k followers on Twitter/X, notes this:

What #bitcoin has looked like before heading north… pic.twitter.com/aDCCAKSDli

— TechDev (@TechDev_52) October 6, 2023

… in which he also references the tightening Bollinger bands as they relate to the 200-month moving average – the upshot making this formation a potential precursor to a breakout move to the upside.

Then there’s ‘DonAlt’ (508k followers), who has something of a reputation for calling the bottom of the last bear market, last year. Recently he hasn’t been the most bullish on Bitcoin, we’ve noticed, but he appears to be open to flipping that script. On Bitcoin at least.

I'm getting more and more bullish by the minute

Not sure if top signal or signs of what's to come

We'll see

— DonAlt (@CryptoDonAlt) October 6, 2023

If Bitcoin can break the US$28k resistance it appears to currently be facing, DonAlt believes the bull goose crypto could rally to +$40k before too long.

If this breaks up we'll get a huge move

If it breaks down we'll probably go towards 23-20kImagine getting liq'd on a 1% move instead of just taking reasonably sized bets and winning big if you're right regardless

Trying to get rich fast will only make you go poor quick

— DonAlt (@CryptoDonAlt) October 6, 2023

35 if you ask me on twitter

42 if you ask me privately

0 if this setup fails— DonAlt (@CryptoDonAlt) October 5, 2023

Top 10 overview

With the overall crypto market cap at US$1.13 trillion, down a fraction since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Meanwhile, here’s a very quick take (from US-based economist/analyst Sven Henrich) on what the fresh, developing, shocking geopolitical turmoil in the world might mean for US Federal Reserve rate hiking, if anything…

Hard to see the Fed risking another rate hike with a new geopolitical risk event unfolding especially knowing the lessons of 1973.

— Sven Henrich (@NorthmanTrader) October 8, 2023

And here’s another US-based chart watcher, Roman, who is keeping an eye on the S&P 500 and its potential move upwards against a potentially resistance-hitting US dollar. Hmm, we shall see.

With $SPX holding its macro uptrend last week, $DXY is seeming to deviate right above 106 resistance.

Still sticking to my macro bullish thesis and hopeful that stocks put new ATHs in by the end of the year.

Risk assets should fly given the above.#bitcoin #cryptocurrency pic.twitter.com/ruFPo9lKBy

— Roman (@Roman_Trading) October 8, 2023

FTX founder Sam Bankman-Fried is in the frying pan right now, staring down the barrel of a possible 115-year prison sentence for financial fraud crimes.

Tomorrow, Sam Bankman-Fried will stand trial for one of the biggest frauds in US history.

SBF is facing up to 115 years in prison. pic.twitter.com/jPM8zMf7sj

— Watcher.Guru (@WatcherGuru) October 3, 2023

We’ll look to give you a few updates on that this week as things progress. But in the meantime, this was interesting. SBF was toying with the idea of paying Donald Trump not to run for president? For a US$5 billion fee?

That’s according to a US 60 Minutes interview with Michael “The Big Short Author” Lewis, that is…

BREAKING: TRUMP OFFERED $5 BILLION BY FTX'S SBF TO NOT RUN FOR PRESIDENT

Sam Bankman-Fried apparently toyed with the idea of offering Donald Trump $5 billion to abstain from the 2024 presidential race, according to insights by Michael Lewis, author of "The Big Short."

In a "60… pic.twitter.com/Z9mq0HmJIk

— Mario Nawfal (@MarioNawfal) October 2, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.