Mooners and Shakers: Bitcoin pump underwhelms; US stocks and dollar down, confusion up

A weak Bitcoin metaphor pumps, yesterday. (Getty Images)

Mooners and Shakers is sponsored by Dacxi, the world’s first purpose-built Crypto Wealth platform.

Bitcoin and crypto staged an underwhelming rally earlier, on the back of the Fed’s highest rate hike in nearly 30 years. It seems to have tapped out now, though… or has it?

BTC’s mild enthusiasm was curbed just under US$23k, with the no.1 crypto since steadily skulking back to its present, vaguely supported position around US$21k. Meh.

Other recent interest-rate-jacking moves from the Fed have seen the crypto market plummet, though… and maybe more of that fun’s in store yet. The tech-heavy Nasdaq 100 (-4%) and S&P 500 (-3.25%) are both well down at the time of writing, and Bitcoin has been closely tied to their fortunes of late.

But then again, the US Dollar Index (-1.4%) ain’t exactly in top form today, either. Crypto has certainly been know to favour that scenario, so it’s a somewhat confusing day for correlation and inverse-correlation narratives.

“Veteran US trader” Peter Brandt (as we often see him described) thinks Bitcoin could stage a decent relief rally, though…

A retest of $20,000 and 2017 high could provide relief rally in $btc. But remember — relief rally only pic.twitter.com/rQ3O8Is7Bt

— Peter Brandt (@PeterLBrandt) June 16, 2022

… with the heavily implied caveat that he doesn’t see a genuine BTC recovery any time soon.

Still, some chart watchers, such as Bloomberg’s Mike McGlone, seem to think it’s not unreasonable to find meaningful bottoming-out support around US$20k.

Others want lower, of course…

#DXY – Update

Coming up to a big resistance zone on the dollar, which if we can reject from here and dump. The #Bitcoin bottom may be in soon ..

However i am looking for another tap up before the drop, which coincides with another leg down on $BTC so keep an eye on this pic.twitter.com/Df3MVVeUgi

— Crypto Tony (@CryptoTony__) June 16, 2022

They are trying to defend the $20k level but demand is getting weaker and weaker. It won't hold for long. How low we go when it breaks? $16k-18k is a good support zone. The supports for altcoins are much clearer, so my bids will be mostly there, and a small % for BTC and ETH.

— il Capo Of Crypto (@CryptoCapo_) June 16, 2022

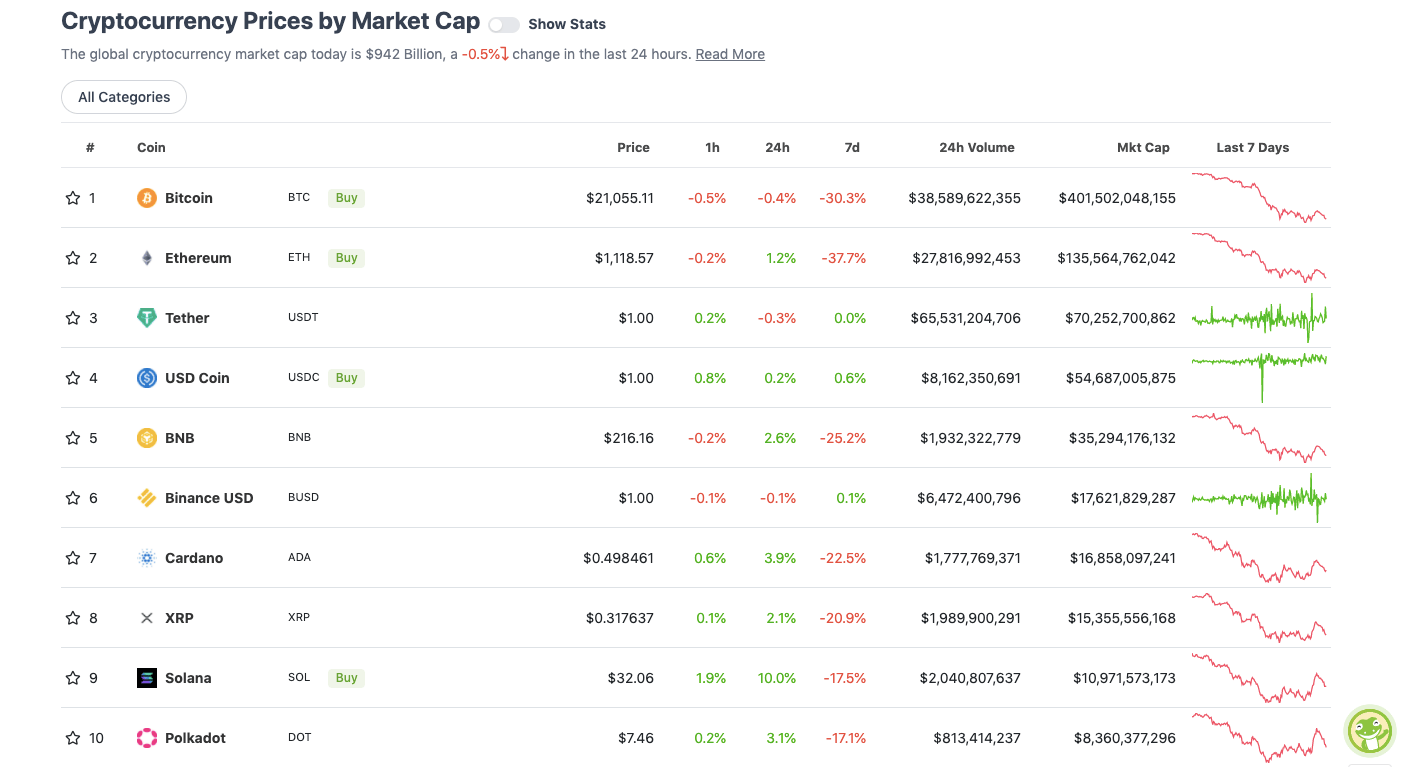

Top 10 overview

With the overall crypto market cap at roughly US$942 billion, down 0.5% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Perhaps some of those crypto-chart-gazing experts mentioned further above will get their sub-$20k Bitcoin levels. The fact probably is, there’s really not a big case for being much of a crypto bull in the short-mid term – not when global macro factors are so heavy and look like remaining that way for the foreseeable.

THERE IS NO SIGN OF A BROADER SLOWDOWN IN THE ECONOMY pic.twitter.com/EntNLdvdZ3

— Sven Henrich (@NorthmanTrader) June 16, 2022

However, while US$21k BTC and US$1,100 ETH might not be the very best deals you’ll get in the next few months, do you believe these prices will look ridiculously cheap, say, two years from now? In it for the short-term-trading drama or the long haul?

Current #BTC sell-side volume is very close to reaching 2018 Bear Market seller volume levels at the 200-week MA$BTC #Crypto #Bitcoin pic.twitter.com/EN2yFvrggQ

— Rekt Capital (@rektcapital) June 16, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$7.6 billion to about US$364 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Elrond (EGLD), (market cap: US$1.18 billion) +19%

• Helium (HNT), (mc: US$1 billion) +15%

• Theta Network (THETA), (mc: US$1.22 billion) +13%

• Arweave (AR), (mc: US$454 million) +12%

• TRON (TRX), (mc: US$5.6 billion) +11%

DAILY SLUMPERS

• Chain (XCN), (mc: US$1.86 billion) -6%

• Gate (GT), (market cap: US$594 million) -3%

• DeFiChain (DFI), (mc: US$587 million) -2%

• Bitcoin Cash (BCH), (mc: US$2.1 billion) -2%

• Monero (XMR), (mc: US$1.98 million) -1%

Around the blocks

To finish, a selection of randomness that stuck with us on our daily journey through the Crypto Twitterverse…

https://twitter.com/NorthmanTrader/status/1537478179488661504

This has called every single local and macro bottom in bitcoins history. Anything sub 10 has historically been a great buying opportunity but not always the 'best' buying opportunity.

— Scoriox $LIZ 🌿🔥 ♊️ (@kingscoriox) June 16, 2022

hehe that's a thing of beauty alright. interstellar @saylor on a bitcoin is the only crypto asset, no second best emotive explainer!

— Adam Back (@adam3us) June 15, 2022

https://twitter.com/naiivememe/status/1537386495652536320

Best way to stop yourself from looking at your portfolio. pic.twitter.com/nPlM2t97XK

— Ash Crypto (@Ashcryptoreal) June 16, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.