Mooners and Shakers: Bitcoin passes $28k. Can it hit… $1 MILLION in 90 days? Former Coinbase CTO bets it will

A former Coinbase CTO has made an outlandish Bitcoin bet. (Getty Images)

Bitcoin was already performing pretty well without too many new wild price predictions. But the wildest one yet from someone of prominent industry standing dropped over the weekend.

If you’re right across Crypto Twitter you’ll have heard this by now. But if not, get a load of it…

Two bonkers $1 million Bitcoin bets

Former Coinbase CTO Balaji Srinivasan has made the outlandish prediction that Bitcoin (BTC) will hit US$1 million per coin within just 90 days, based on US banking concerns and hyperinflation taking hold of America.

And he’s put his magic internet money where his mouth is, accepting a seemingly insane bet with two people that BTC will reach his target by June 17.

The crazy wager began with this March 17 tweet from the pseudonymous Twitter account “James Medlock”:

I'll bet anyone $1 million dollars that the US does not enter hyperinflation

— James Medlock (@jdcmedlock) March 16, 2023

The former Coinbase exec swiftly accepted the deal, which will see Medlock winning US$1 million of the US dollar-pegged stablecoin USDC if BTC fails to reach US$1 million by June 17.

And in the extremely unlikely event that Srinivasan wins the bet then he’ll keep the 1 BTC he’s asked Medlock to stump up.

I will take that bet.

You buy 1 BTC.

I will send $1M USD.

This is ~40:1 odds as 1 BTC is worth ~$26k.

The term is 90 days.

All we need is a mutually agreed custodian who will still be there to settle this in the event of digital dollar devaluation.

If someone knows how to do this… https://t.co/hhPr522PQu pic.twitter.com/6Aav9KeJpe— Balaji (@balajis) March 17, 2023

In fact, it turns out Srinivasan is so convinced he’s going to win, he’s made the same bet with “one other person, sufficient to prove the point”. So that’s $2 million the obviously loaded Srinivasan stands to lose in a few months, then.

Why is he so convinced, though? And if hyperinflation takes hold, isn’t that pretty much the end of days and time to load up again on toilet paper, rifles, crossbows, baked beans and more toilet paper?

Quick update: we are moving forward with the bet. Just working out escrow logistics.

But hyperbitcoinization may come at you fast, so don't wait on us to get Bitcoin. When the printing starts in earnest, currency collapse can happen in days.https://t.co/FESPFu4MSH pic.twitter.com/WDZpxeUKVf

— Balaji (@balajis) March 19, 2023

Srinivasan’s idea of “hyperbitcoinization” (see his tweets above) isn’t a new thought, but he’s certainly pushing the concept hard and fast based on fears in the US banking system post Silvergate, Silicon Valley Bank, Signature woes and more – with more than 180 American banks said to potentially be staring down the bank-run barrel.

Not to mention global-banking contagion risk. News just in on that, actually – multinational investment bank UBS is reportedly acquiring Credit Suisse for $3 billion Swiss francs (US$3.24 billion) in a bid to rescue the ailing financial institution. And it’s a move backed by the Swiss government.

Swiss authorities are planning to literally change the country's laws to push through the merger. No UBS shareholder votes. No parliamentary votes. Nothing.

A decision by fiat to save the fiat money system. 🤯

— Coin Bureau (@coinbureau) March 19, 2023

Meanwhile, Srinivasan predicts that the global economy is about to undergo a massive shift, with the global reserve currency – the US dollar – entering hyperinflation. He believes that the global economy will “redenominate on Bitcoin as digital gold”.

Several crypto-market commentators have been quick to critique and largely dismiss Srinivasan’s thesis, though. Venture capitalist Adam Cochran, for instance, certainly seems to think it’s highly unrealistic to expect a 3,600% BTC gain over the next few months, considering the token’s previous two monster rallies topped out with around 547% and 1,105% gains.

3/25

The bet here, is that within 90 days, Bitcoin will reach a price of $1M USD.

Or around a 3600% gain within the next 90 days.

To put that in perspective, the rally from 2020 – 2022 was only 547% and the 2017 rally at far lower prices was only 1105% gain. pic.twitter.com/7OZZHXNgYX

— Adam Cochran (adamscochran.eth) (@adamscochran) March 18, 2023

Right then, time to come back down to earth with a look at the current crypto price action…

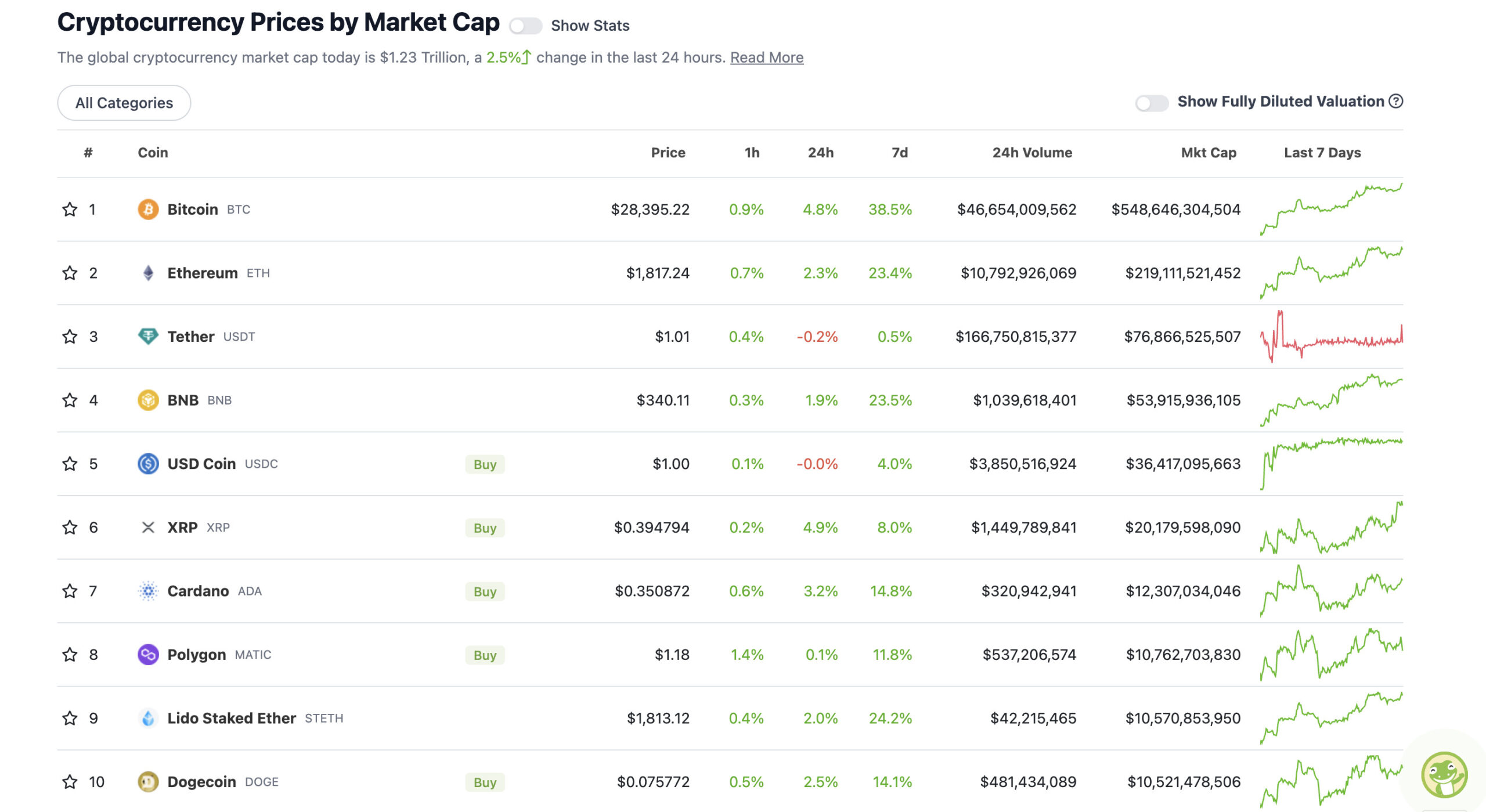

Top 10 overview

With the overall crypto market cap at US$1.23 trillion, up about 2.5% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

The market has managed to find another US$70 billion since late Friday afternoon AEDT, with leading cryptos Bitcoin and Ethereum both posting impressive gains.

Even XRP, which is under the ongoing SEC lawsuit cloud regarding its original status as a sold security or otherwise, has had a reasonably strong weekend. The XRP “what if” moonboys are hitting Twitter hard right now.

What If Price Of #XRP Shoots Upto 10,000$ Per #XRP & Become A Stable Coin Like #USDT At The Price Of 10K$.

All Central Banks Are Using Private #XRPL For Testing The System Before They Go Live Once They Are Ready ( FLIP THE SWITCH ) This Is The Reason Why #XRP Have Price Glitch… pic.twitter.com/TG5zulrd0K

— XRP CAPTAIN (@UniverseTwenty) March 19, 2023

Uppers and downers: 11–100

Sweeping a market-cap range of about US$8.5 billion to about US$447 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS

• Conflux (CFX), (market cap: US$982 million) +22%

• NEO (NEO), (mc: US$938 million) +12%

• 1inch (1INCH), (mc: US$465 million) +7%

• Filecoin (FIL), (mc: US$2.6 billion) +7%

• VeChain (VET), (mc: US$1.78 billion) +6%

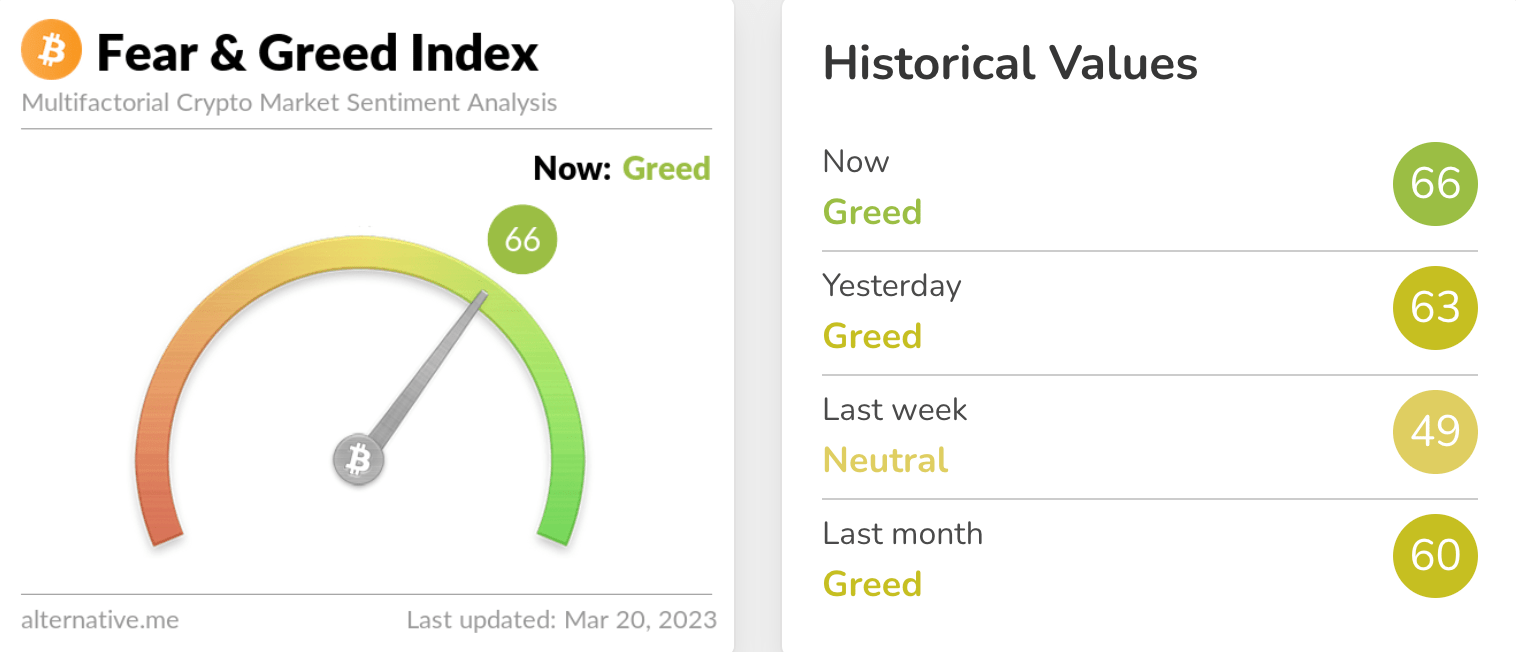

Fear and Greed

The crypto market’s leading sentiment tracker, the Fear & Greed Index has gone up a gear moving into Greedy territory again after slipping into Neutral from an off-road wobble last week.

Where will it sit leading into and post the US Fed’s next FOMC meeting (Mar 22)? That’s one question.

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Reflecting some of that market sentiment greed then, we’re seeing statements like this: “the bear market is officially over”…

The bear market is officially over. $BTC made it's first higher high ($25,212) since the all time high . That confirms a new bullish trend. Price can still go down, but that would be a new trend, not a continuation of the previous bear market. Congrats everyone. pic.twitter.com/Y4Mzl906s5

— The Wolf Of All Streets (@scottmelker) March 19, 2023

And these ones, from “PlanB”…

#Bitcoin RSI > 50 .. bull market confirmed🚀 pic.twitter.com/3L1y5PBsoQ

— PlanB (@100trillionUSD) March 19, 2023

A key bear argument is gone!

❌"this time is different, because bitcoin has only seen QE (in 2009-2022), and central banks have now stopped QE and started tapering (QT)"

Well, QE is back .. and here to stay. pic.twitter.com/hf0QkaM9AW

— PlanB (@100trillionUSD) March 19, 2023

$26,800 held for #Bitcoin, so continuation of the push.

I´ve mentioned this before, but I´m expecting a push towards $28,500-29,200 and then pullback towards $25K, before we´ll continue the rally to $40K. pic.twitter.com/ntW6jASZIC

— Michaël van de Poppe (@CryptoMichNL) March 19, 2023

"$1M per Bitcoin in 90 days" – @balajis

Insane or possible? 😂

👇

— Dan Held (@danheld) March 18, 2023

I’d be ok with him being half wrong. 🥲

— 🇦🇺Tomás Dún Beag ™️ (@tomdoonbeg) March 19, 2023

A forced wind-down of Credit Suisse, a run on US regional banks, the arrest of a former US President, the launch of GPT-4 … I was in the trenches in 2008, and I never felt like system-shattering events were advancing so quickly and (w/exception of GPT-4) on so little substance.

— Ben Hunt (@EpsilonTheory) March 18, 2023

When banks fail and the world goes to Mad Max mode, we're building these and having new chariot races in them for entertainment. https://t.co/QAVRikkClq

— Adam Cochran (adamscochran.eth) (@adamscochran) March 19, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.