Mooners and Shakers: Bitcoin jumps above $28k again; Arbitrum airdrop pushes Ethereum higher

Coinhead

Coinhead

Bitcoin jumped off the bench, grabbed the ball and made a typically energetic burst up the sideline in the wee hours last night, reaching as far as the US$28,800 mark. Ethereum followed suit, energised as well by increased network activity related to the Arbitrum airdrop.

There’s a lot going on in the Cryptoverse right now, and taken as a whole, it’s all a bit of a confusing mess for investors. Let’s quickly bullet point some of the major happenings (and not a lot of it is overly positive, despite the BTC and ETH surge) before moving on to the latest price action…

• Major US exchange Coinbase, as we mentioned yesterday, has been targeted (not for the first time) by the SEC, which is threatening to sue the firm over some of its products, including staking.

• The COIN stock has sold off, meanwhile – it’s currently down 14% over the past 24 hours. Cathie Wood’s ARK Invest, a huge buyer of the stock, recently sold about US$13 million of it about 12 hours before news broke of the SEC’s Coinbase crackdown. Interesting timing, to say the least.

So, heres a weird one. Cathie Wood purchased Coinbase stock incessantly for almost a year, non stop, BUT, actually sold 13 million worth last night, just 12 hours before coinbase got indicted by the SEC… how did she know to sell? pic.twitter.com/yj9h6QFqnr

— The Modern Investor (@ModernInvest) March 23, 2023

• Terraform Labs co-founder Do Kwon has apparently been arrested in Montenegro overnight as he tried to flee to Dubai, reports Stockhead‘s very own, non-fungible Eddy Sunarto in this morning’s Market Highlights.

🚨 Do Kwon has reportedly been arrested in Montenegro. pic.twitter.com/gtIVAXgJjs

— Crypto Crib (@Crypto_Crib_) March 23, 2023

• Eddy also notes that Block Inc (-14.8%) has crumbled after scathing report from Hindenburg Research. “Jack Dorsey’s NYSE listed Block Inc/ASX listed Block (ASX:SQ2) was at the centre of short seller Hindenburg Research’s report, which accused the company’s flagship Cash App of facilitating crime and lacking compliance controls.”

Dorsey is a huge proponent of Bitcoin and Block’s Cash App is a major user/enabler of the Bitcoin Lightning payments network.

• The Arbitrum $ARB token airdrop has landed and savvy airdrop hunters, who have been waiting for this day for many months, have potentially made anywhere between about US$600 to US$50k from it.

Stockhead spoke with Apollo Crypto analyst David Angliss about what it means for the crypto ecosystem, how to play it from here, and which potential airdrops you should try to target next.

Crypto Twitterer Miles Deutscher has some thoughts on that here, too…

Missed the $ARB airdrop?

People made $600-$50k+ today.

I've compiled a list of the best upcoming crypto airdrops that could be the next Arbitrum.

🧵: Here are 10 airdrops that I'm looking forward to.👇

— Miles Deutscher (@milesdeutscher) March 23, 2023

• $ARB is currently trading for US$1.39, having made a startling entry – reportedly up around US$10 in the small hours (AEDT) overnight. At that stage the Arbitrum Foundation site, where airdrop recipients claim their ARB tokens, was down – presumably due to congestion.

As Cointelegraph reports, “only one address successfully sold the token at $10.29 through the ARB/USDC pool on Uniswap, bagging $64,340 for 6,250 tokens. A few others were able to sell for $4.50, however, the price dropped quickly below $1.50 as more sellers arrived.”

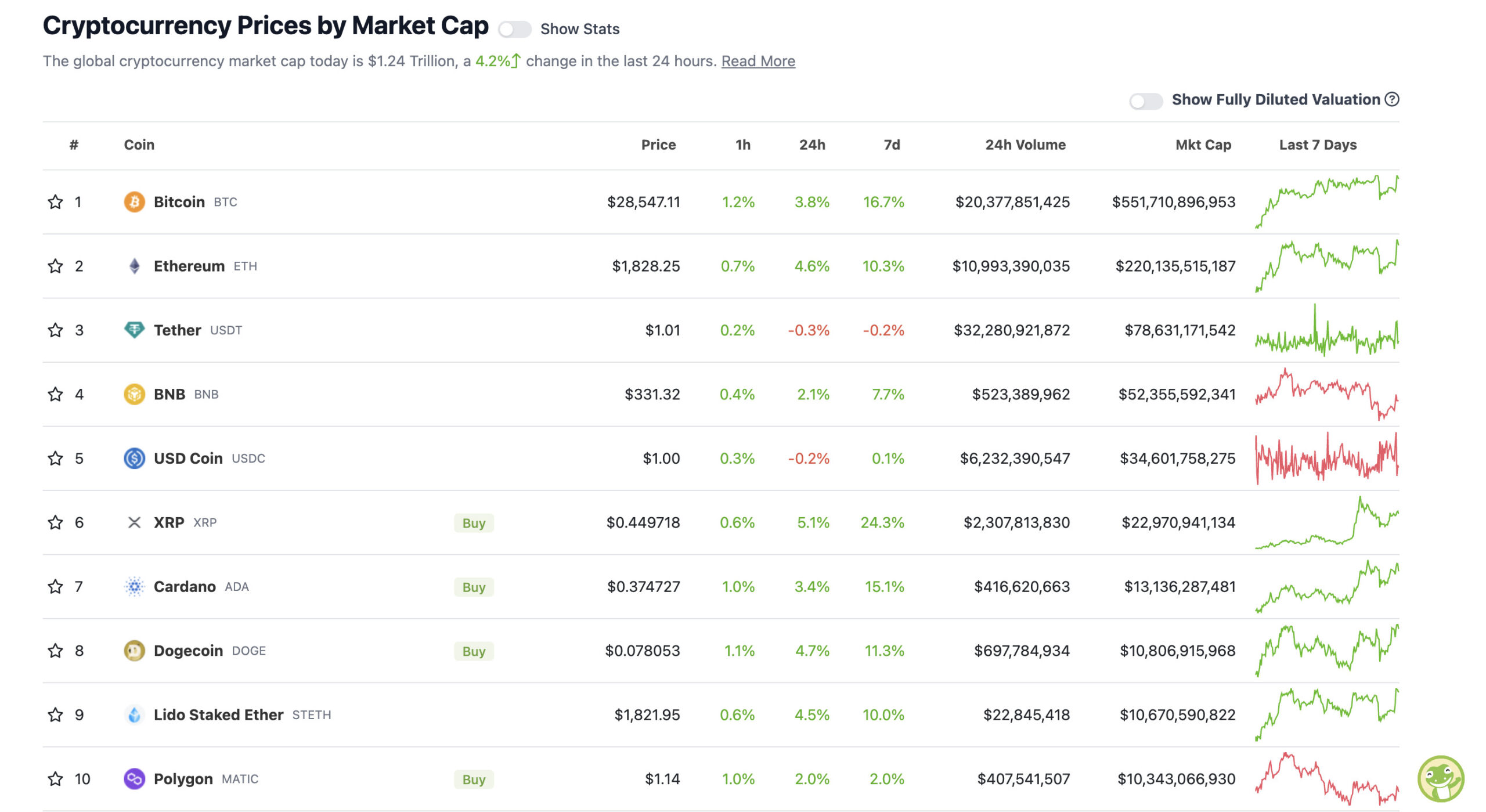

With the overall crypto market cap at US$1.24 trillion, up about 4.2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Bitcoin, Ethereum and pals have pumped a little harder since we began this article.

Our Market Highlights rounder-upperer Eddy must’ve been in a crypto-watching mood, because he also noted some interesting observations from Oanda analyst Edward Moya as well as potentially calling a breakout catalyst:

“Bitcoin is facing major resistance at the US$30,000 level. For the rally to continue, Bitcoin needs a fresh catalyst to break above the US$30,000 level,” said Moya.

Adding to this, Eddy noted: “Some US$1.2 billion worth of BTC options are set to expire today, March 24, where there is a 1.17 call-to-put ratio (1.17x times more calls than puts).”

ETH has seen a price breakout of its own this morning, on the back of a few things, but absolutely including increased gas fees due to the frenetic activity surrounding layer 2 Ethereum scaler Arbitrum’s airdropped entry into the market.

Fees for claiming the ARB airdrop on the Arbitrum network are paid for using ETH. So, as users have rushed to the Arbitrum Foundation site to claim their $ARB tokens, Ethereum gas costs have risen due to network congestion and users opting to pay higher gas fees to receive their tokens faster.

Increased gas fees and network congestion on Ethereum have, in the past, often correlated with the price of ETH moving higher.

Also, there’s this… part of the goal of Ethereum’s Merge to proof of stake was to make ETH a deflationary asset, which seems to be working, according to Blockworks among others, based on recent surges in network activity through the likes of Uniswap, Blur, Optimism and now Arbitrum.

#ethereum has been deflationary for over 2 months now! pic.twitter.com/7WnO9lJn1Q

— Lark Davis (@TheCryptoLark) March 22, 2023

Sweeping a market-cap range of about US$8.56 billion to about US$435 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS

• Mask Network (MASK), (market cap: US$468 million) +22%

• Radix (XRD), (mc: US$464 million) +15%

• Loopring (LRC), (mc: US$460 million) +10%

• Mina Protocol (MINA), (mc: US$769 million) +9%

• Dash (DASH), (mc: US$714 million) +8%

SLUMPERS

• Arbitrum (ARB), (market cap: US$1.7 billion) -73%

• Toncoin (TON), (mc: US$3.3 billion) -8%

• GMX (GMX), (mc: US$644 million) -4%

• Optimism (OP), (mc: US$783 million) -2%

• Lido DAO (LDO), (mc: US$2 billion) -2%

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Consensus is that #Bitcoin dominance rips through 50, however…

What if this time is no different to the others since 2021?

It could be time for rotation into ALTS!! pic.twitter.com/4Sgetmpat6

— ted (@tedtalksmacro) March 23, 2023

The SEC should actually provide clarity around crypto rather than just telling investors to be cautious.

The whole “may not comply” is absurd. How about they just tell the companies what they need to do so they can do them? https://t.co/rKycqVIi7v

— Benjamin Cowen (@intocryptoverse) March 23, 2023

The Fed fixing the economy pic.twitter.com/E8K3sHXBOb

— Not Jerome Powell (@alifarhat79) March 23, 2023

Fed March 22: WE WILL KEEP REDUCING THE BALANCE SHEET AS PLANNED.

Increases balance sheet by another $93B during the week for a total of almost 400B in 2 weeks. pic.twitter.com/zbrmWZLJXb

— Sven Henrich (@NorthmanTrader) March 23, 2023

On the ₿rink of Second ₿ailout for ₿anks. pic.twitter.com/muWmUFljiO

— Michael Saylor⚡️ (@saylor) March 23, 2023