Apollo’s Alpha: Missed Arbitrum’s ‘stimmy cheque’ ARB airdrop? More huge L2 opportunities are coming

Getty Images

David Angliss, an analyst with Australia’s leading cryptocurrency investment firm, Apollo Crypto, shares the fund’s regular take on what’s happening in the fast-changing and volatile cryptocurrency space.

The highly anticipated $ARB airdrop can now finally be claimed. It’s the token for Arbitrum – one of the leading layer 2 scaling solutions for Ethereum – and has been creating buzz in the crypto community for months.

If you managed to catch previous airdrop articles in Coinhead, hopefully you delved in and undertook each Arbitrum ecosystem step you needed to take in order to qualify. Congrats, if so. And, by the way, you can check your ARB airdrop status at the official Arbitrum Foundation site here.

It wasn’t an overly straightforward process for the casual crypto investor, however, so there’s every chance you may have missed out on a fairly lucrative payday if you didn’t take the time to follow procedures, part of which involved bridging assets over from the Ethereum chain to the Arbitrum network.

If so, you might want to keep in mind that there are some other, equally promising if not better, L2 airdrop opportunities still to come.

For the purposes of this article then, we asked David Angliss a little bit about those opportunities, as well as his expectations for the ARB token and where there might still be a good entry point for those who missed the drop.

Today The Arbitrum Foundation is extremely excited to announce the launch of DAO governance for the Arbitrum One and Arbitrum Nova networks, alongside the launch of $ARB. https://t.co/TB3wG0QK0v

— Arbitrum (💙,🧡) (@arbitrum) March 16, 2023

How much will the ARB token be worth?

That’s the question on many an airdrop hunter’s mind right now, considering many will be receiving around 3,000 tokens or more.

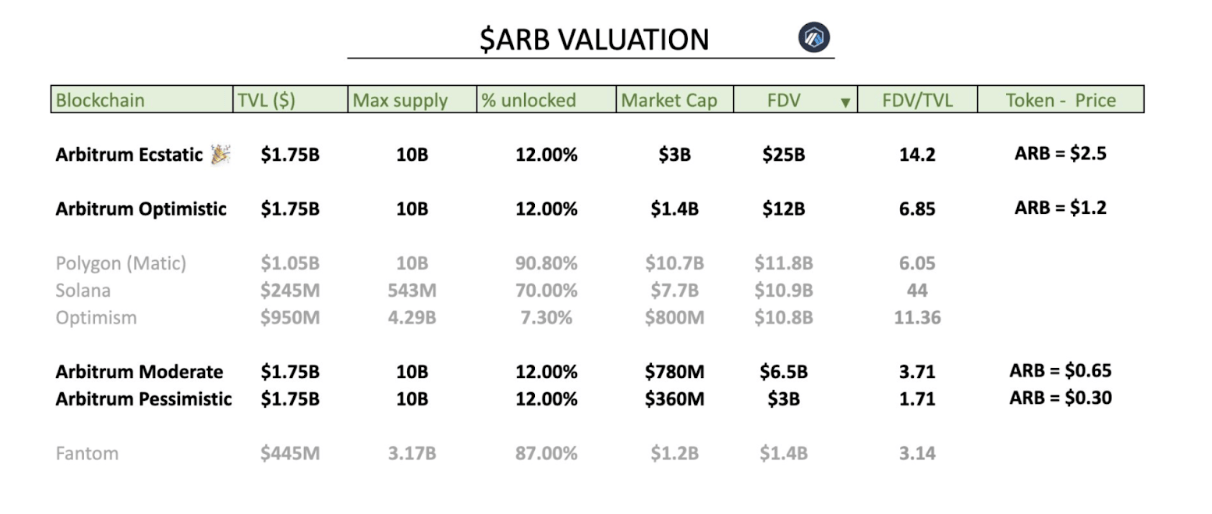

“The amount of ARB that’s being unlocked for this airdrop is almost 12% of the total supply of the project’s tokens, and the maximum supply is 10 billion,” noted Angliss.

“A moderate, fully diluted valuation of Arbitrum would be around the US$6.5 billion mark, while an optimistic fully diluted valuation would be around US$12 billion,” he added (see image below).

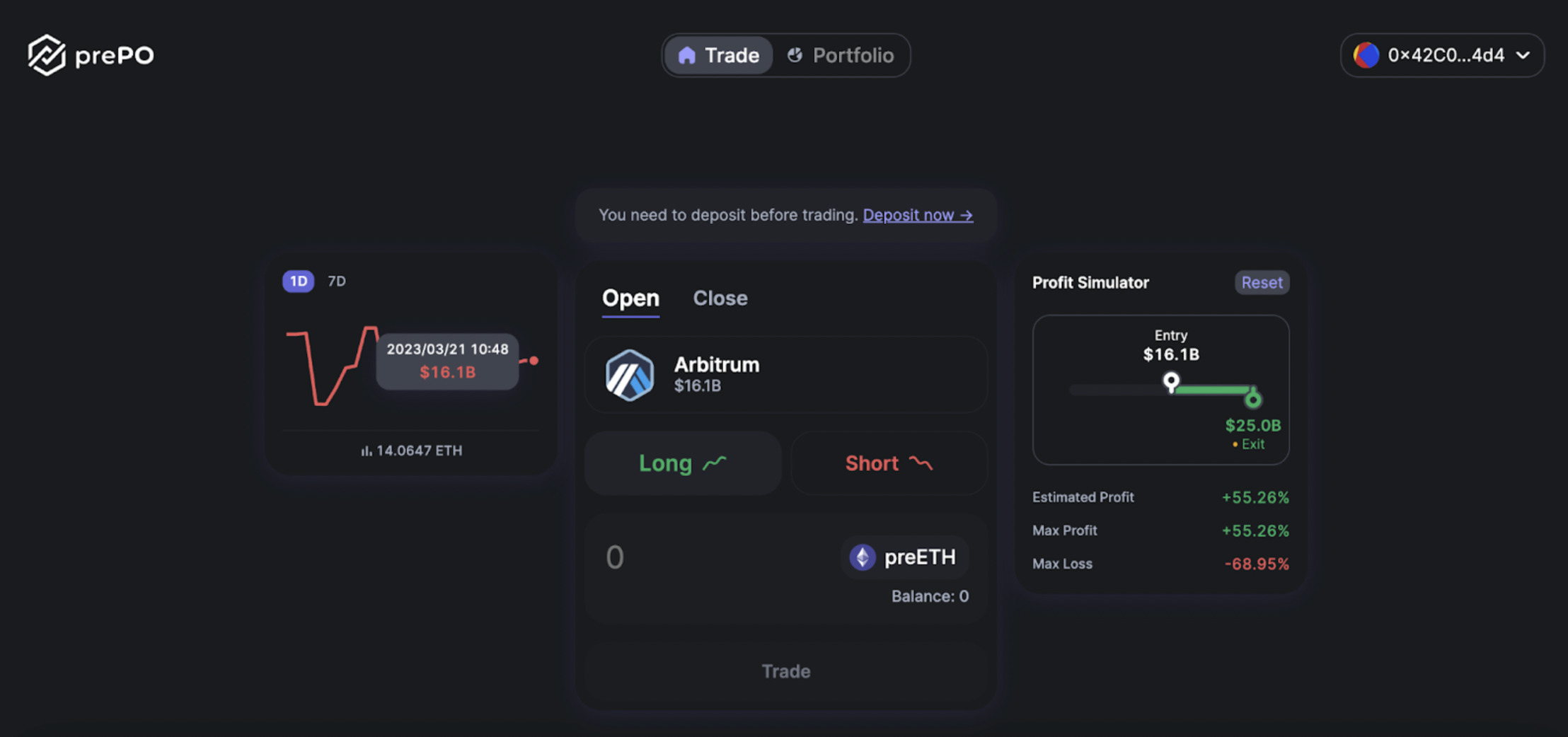

“Now what’s interesting is that prePO [a disruptive pre-public investing platform] have got their live market up and running, and it’s giving Arbitrum a fully diluted valuation of US$16 billion right now, which, would value the ARB token somewhere between the $1.25 to $2 bracket.”

Trading ARB, in fact any token, is about timing

Angliss emphasised that anyone looking to sell their airdropped tokens, or indeed anyone who missed out on the drop and looking to buy, needs to be very careful with their timing.

“You have to be very cautious with trading these tokens within the first week,” said the analyst. “Especially within the first 24 hours, because there’s going to be a lot of volatility.

“There will be a lot of people just cashing in all or most of their tokens. If ARB does get to above that $2 mark, I would be cautious buying at that point, as that’s at the ‘ecstatic’ price level.

“As for Apollo, we would probably only look to add to a position in ARB when it’s closer to or less than $1.”

Hodl or sell $ARB at TGE? Whatever you chose, knowing when to cash out is key.

To help you maximize profit from $ARB, let's take a look at how previous airdrops performed.

You won't want to miss the bonus at the end of this thread 👇🧵 pic.twitter.com/G3ie21ly2e

— Rekt Fencer (@rektfencer) March 22, 2023

▓▓▓▓▓░ 91%$ARB is coming TOMORROW 🔵 🦅

A quick guide on how to be prepared:

• how to claim faster

• how to LP

• how to buy/sell/snipe fasterDon't get front-run 🐵 👇

— olimpio (@OlimpioCrypto) March 22, 2023

Layer 2 season?

So, is Apollo is bullish on Arbitrum and/or its main optimistic rollup-based Ethereum scaling rival Optimism?

“Bullish on both,” said Angliss. “But I think it’s more a question of are both those layer 2 protocols going to be taking market share away from competing layer 1 chains such as Avalanche and Fantom and all the others.

“And I think the answer is very much yes. The L2s open up a broader user base for Ethereum utilising its extra security and decentralisation.

“L2 season is definitely coming into fruition. As long as Bitcoin and Ethereum keep performing well in the market, as they have done so far this year, then these sorts of altcoins should do well, too.”

What effect will the ARB airdrop have on the crypto market?

Angliss notes that it could be very positive.

“With 1.2 billion airdropped ARB tokens hitting wallets, what you’ll have, if the ARB price settles, say, around US$1.2 dollars is about US$1.44 billion being injected into the crypto ecosystem.

“So you you’re essentially stimulating the DeFi ecosystem, too. Some people are going to hold it, some people are going to sell it. Some people are going to go into stablecoins, and some people are going to buy Ethereum with it, or maybe other Arbitrum ecosystem tokens.

“So all in all, it’s like a second mini stimulus. Well, actually, quite a large one with the average ARB drop being around the 3,000 to 4,000 mark. Airdrop recipients have essentially got themselves a big stimmy cheque here.”

$ARB ecosystem gem hunt 101

You can go from $1k to $100k if you know how to follow the smart money in crypto.

Using on-chain data I have spotted 5 protocols on #arbitrum whales are consistently buying

find out 👇

— CyrilXBT (@cyrilXBT) March 21, 2023

Other airdrop opps

If you’re feeling bummed out or annoyed with yourself for missing out on the ARB drop, now’s the time to make sure you grab the next big opportunity. Because not only is it shaping as “L2 season” in crypto, it’s also clearly airdrop season, with some huge decentralised protocols yet to release tokens.

Of these, Angliss nominates the following as top priorities for those willing to jump in and become early adopters:

• zkSync

People make millions of dollars from airdrops, and you can do the same.$ZKS by @zksync has been confirmed and the potential airdrop is huge.

Maximize your chances of receiving the $ZKS airdrop with this zkSync Airdrop Strategy: 👇🧵 pic.twitter.com/9eVKSrNsJ7

— Rekt Fencer (@rektfencer) March 19, 2023

Arbitrum airdrop will be worth $10,000+ and many of you missed it

The next $30,000 airdrop will be ZkSync, and you don't have much time left to farm 👀

🧵 Here is how you can position yourself for $ZKS airdrop 👇

— Mingo (@MingoAirdrop) March 21, 2023

• Starknet

Testing, 1, 2, 3…$STRK is close

You will all know where to find me → olimpio.eth 🏛️ pic.twitter.com/e906mIyoFC

— olimpio (@OlimpioCrypto) March 15, 2023

Missed $ARB #airdrop? Don't worry.

There are other airdrop opportunities that can help you make your first $100k in crypto and Starknet one of them.

Here's your guide to getting $STARK airdrop 👇🧵: pic.twitter.com/jiY0tDDrOh

— ardizor 🧙♂️ (@ardizor) March 22, 2023

• Scroll ZKP

Reminder

A Step by Step Guide On How To Intreact On @Scroll_ZKP Pre-Alpha TestnetLike and RT & Let tag your #Airdrop fren 🪂

A complete thread 🧵⤵️ pic.twitter.com/6jK2zv9xRu

— Fortizo (@TKatugwa) December 2, 2022

• LayerZero

5/

3) To increase my chances of qualifying for the LayerZero airdrop,

I engaged in various activities on following protocols that use Layerzero technology;@StargateFinance @PontemNetwork @harmonyprotocol @AngleProtocol

I suggest you do the same. ⤵️

— Axel Bitblaze 🪓 (@Axel_bitblaze69) February 27, 2023

Does Angliss have a favourite among these opportunities?

“Yep, zkSync, hands down. I rate its zk-rollup tech highly. I believe zero-knowledge proof technology can process transactions a lot quicker than Optimistic rollup technology. Zk is very complicated technology, however, which is why it’s taking a longer time to develop and for zk protocols to get to market.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.