Mooners and Shakers: Bitcoin hits a wall; Google CEO excited by blockchain and Web3

Pic: Getty

Babowww… Rejected. Again. Bitcoin has met a heavy wall of longterm resistance, failing to sustain a move past US$39k. (At the time of writing.)

Hopes were high among the more bullish market participants that this was finally it, the bust-out move that would prove several presently very bearish traders wrong once and for all.

And, of course, Bitcoin haters like Peter Schiff. The gold bug posted the following tweet about 56 seconds after BTC dumped from roughly US$38,500 to $37,500, citing PayPal’s price plunge and seemingly delighting in its connection as a crypto enabler.

It bodes ill for #Bitcoin that shares of $PYPL have plunged 25% so far today. #PayPal is deep in the #crypto ecosystem and one of the top picks among institutional investors looking for established stocks that are poised to ride the crypto wave. It looks like that wave has crash!

— Peter Schiff (@PeterSchiff) February 2, 2022

Still, where there’s some life, there’s hope(ium). As Dutch trader and analyst Michaël van de Poppe suggests, on purely technical levels, there’s still a reasonable chance of a bounce around the mid-$37k region. And failing that, round the $36k zone. And failing tha… well, you get the idea.

And that's not a breakthrough for #Bitcoin, so correction takes place.

Green zone first potential bounce possibility.

Overall remaining cautious. pic.twitter.com/cxkifC3y2i

— Michaël van de Poppe (@CryptoMichNL) February 2, 2022

Zooming out quite a bit further, we’re now rangebound between US$28k and $US68k, according to Rekt Capital. That’s, um, some pretty wide parameter setting, but hey, can’t argue with this chart so we’ll roll with it…

Macro-wise, #BTC is still consolidating inside its Re-Accumulation range ($28000-$68000; green-red)$BTC #Crypto #Bitcoin pic.twitter.com/VtPSUXnNhS

— Rekt Capital (@rektcapital) February 2, 2022

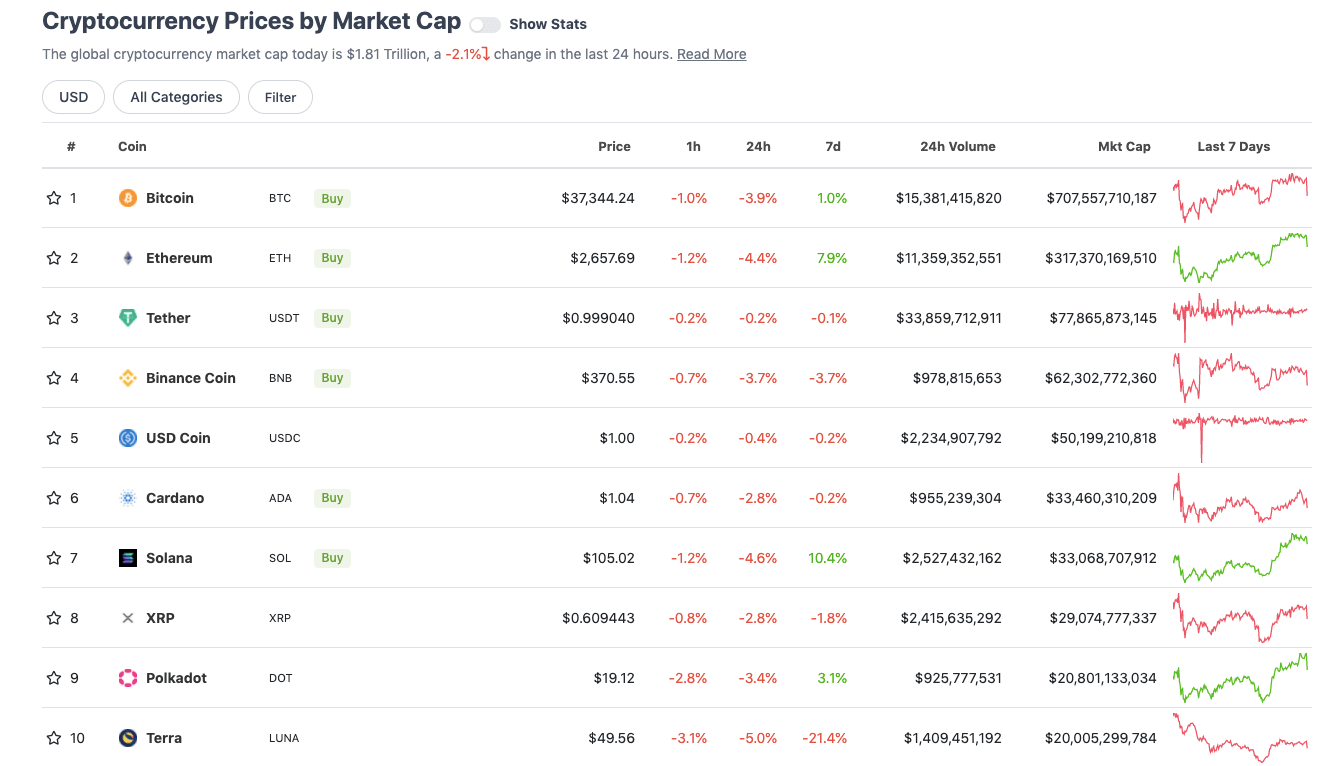

Top 10 overview

With the overall crypto market cap down about 2.1% over the past 24 hours, here’s the state of play in the top 10 by market cap at the time of writing – according to CoinGecko data.

Everything in the top 10 has been retracing at roughly the same pace over the past few hours, and attempting to arrest a deeper slide at the present moment.

Like yesterday, though, there are at least some encouraging news stories surfacing here and there. We’re not saying they’ll do much to alleviate short-term price pain, but let’s look at them anyway…

Two positive news bites

• Google’s CEO Sundar Pichai has revealed in a midweek conference call that the tech giant has very strong interest in blockchain and the crypto space, stating:

“On Web3, we are definitely looking at blockchain… [It’s] such an interesting and powerful technology with broad applications, so much broader again than any one application.”

• Recent US Congressional ruminations about crypto mining have had some advocates for positive regulation a little on edge, especially given the fact sections of the Biden administration haven’t exactly been too cheerful about crypto. (Downright staunchly negative in some cases…)

But… as Jerry Brito of US crypto think tank Coin Center highlights in the tweet below, it appears we shouldn’t expect big decisions one way or the other on crypto mining any time soon.

“It could be months but more likely years before there are any statutory moves”, said Democratic Congressman Darren Soto in a conversation with The Block website.

Wolves at bay for now, then? A sign that the US government might be looking to back off from any potentially harsh/crippling crypto legislation they might be cooking? Well, as ever… possibly.

https://twitter.com/jerrybrito/status/1488884325558984707

Winners and losers: 11–100

Sweeping a market-cap range of about US$18.6 billion to about US$879 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Quant (QNT), (market cap: US$1.5b) +12%

• Internet Computer (ICP), (mc: US$4.35b) +8.5%

• Synthetix (SNX), (mc: US$1.17b) +7%

• Leo Token (LEO), (mc: US$3.8b) +5%

• Neo (NEO), (mc: US$1.47b) +4.5%

DAILY SLUMPERS

• Arweave (AR), (market cap: US$1.88b) -8.5%

• Aave (AAVE), (mc: US$2b) -8%

• Kadena (KDA), (mc: US$957m) -7.5%

• Gala Games (GALA), (mc: US$1.43b) -7.5%

• Loopring (LRC), (mc: US$1.1b) -7%

Lower-cap winners and losers

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• IDEX (IDEX), (market cap: US$173m) +128%

• Strike (STRK), (mc: US$145m) +63%

• Augur (REP), (mc: US$121m) +32%

• Voxies (VOXEL), (mc: US$70m) +28%

• Adventure Gold (AGLD), (mc: US$117m) +27%

Strike, a Lightning Network-powered Bitcoin wallet, has partnered with New York Digital Investment Group (NYDIG) and the exchange Coinbase to enable employees of participating companies to be paid in Bitcoin.

.@NYDIG_BTC joins @ln_strike and @coinbase with a service allowing employees to get paid in #bitcoin. @SteveAlpher reportshttps://t.co/3CYVyOmSPc

— CoinDesk (@CoinDesk) February 1, 2022

As for the decentralised exchange IDEX, it’s made some upgrades. And seems to be sponsoring a rally car, too… in a kind of metaphorical transactional speed tie-in…

Fast car. Fast exchange. 💨 pic.twitter.com/kkfD9gQe4d

— IDEX 🐐 (@idexio) February 1, 2022

DAILY SLUMPERS

• Scream (SCREAM), (market cap: US$7.4m) -21%

• Crabada (CRA), (mc: US$95m) -20%

• Adax (ADAX), (mc: US$18m) -19%

• StarLink (STARL), (mc: US$227m) -18%

• Popsicle Finance (ICE), (mc: US$55m) -18%

Final words

At this point, at least no one should be surprised

— Benjamin Cowen (@intocryptoverse) February 2, 2022

Bitcoin is the most pro-liberty, anti-authoritarian, anti-censorship, pro-human rights movement to ever take place on a global level on the planet

— Darin Feinstein (@DarinFeinstein) February 1, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.