Mooners and Shakers: Bitcoin goes NUCLEAR (but not in price); Kraken set to launch its own bank

Coinhead

Coinhead

Bitcoin is tentatively tiptoeing through the tulips (okay, bad analogy) in terms of price action so far this week. But at least it’s powering up in one sense, with the launch of the first-ever nuclear-powered BTC mining farm.

TeraWulf (NASDAQ:WULF) has announced it’s switched a button to “ON” at its Nautilus Cryptomine facility, which is the first nuclear-powered Bitcoin mining operation in America, and quite probably in existence globally, too.

Located, nowhere near Springfield, the facility, which is a joint venture with Cumulus Coin LLC, powers about 8,000 BTC mining rigs, and gets its energy from the 2.5 GW Susquehanna nuclear generation station in Pennsylvania.

According to TerraWulf, the 8,000 rigs’ computing-power output is approximately 1 exahash per second (EH/s), which is apparently rather a lot. And its ouptut is set to significantly increase, too, when another 8,000 or so mining rigs are delivered soon.

In a recent article for Bitcoin Magazine, BTC mining consultant and cofounder of Citadel 256, Magdalena Gronowska, described how nuclear power could revolutionise Bitcoin mining:

“Nuclear is a carbon free, reliable and cheap energy source,” she told the magazine. No fossil fuels required for TerraWulf, then.

“It’s not perfect in that it emits nuclear waste,” Gronowska clarified, adding: “But every energy source has tradeoffs between environmental footprint, reliability and capital and operating costs… We need a diverse mix of energy generation, to serve both baseload and peak load, as we transition to a low carbon economy.”

US-headquartered crypto exchange Kraken, one of the biggest in the industry, has confirmed it’s on track to launch its own bank “very soon”.

Clearly the current regulatory crypto-crackdown climate in the US, led by the SEC’s Gary Gensler, isn’t deterring the exchange. In fact, perhaps the fact the crypto-connected bank Silvergate is on the brink of collapse (which is a hangover effect from the FTX implosion) opens the door for a new player in this space.

Hey Wayne,

Kraken Bank is not open yet but on its way! The offering will initially be available to existing Kraken clients in the USA with potential international expansion in the future.

You can subscribe to Kraken Bank updates here 👉https://t.co/m3yPoGpu2g

Kraken Support 🐙

— Kraken Support (@krakensupport) March 6, 2023

As well as responding to Wayne “A Hero Can Be Anyone” Sand the company’s chief legal officer Marco Santori noted on The Scoop podcast this week that Kraken would soon be launching its bank.

“Kraken Bank is very much on track to launch, very soon,” he stated. “We’re going to have those pens with the little ball chains. We’re going to order thousands of them and attach them to the desks of Wall Street banks everywhere. With our logo.”

In your face, Gensler! Popcorn at the ready, then… which you’ll consume and quickly move on when you realise the SEC’s probably not even interested in this and can’t do anything about it anyway. Hopefully.

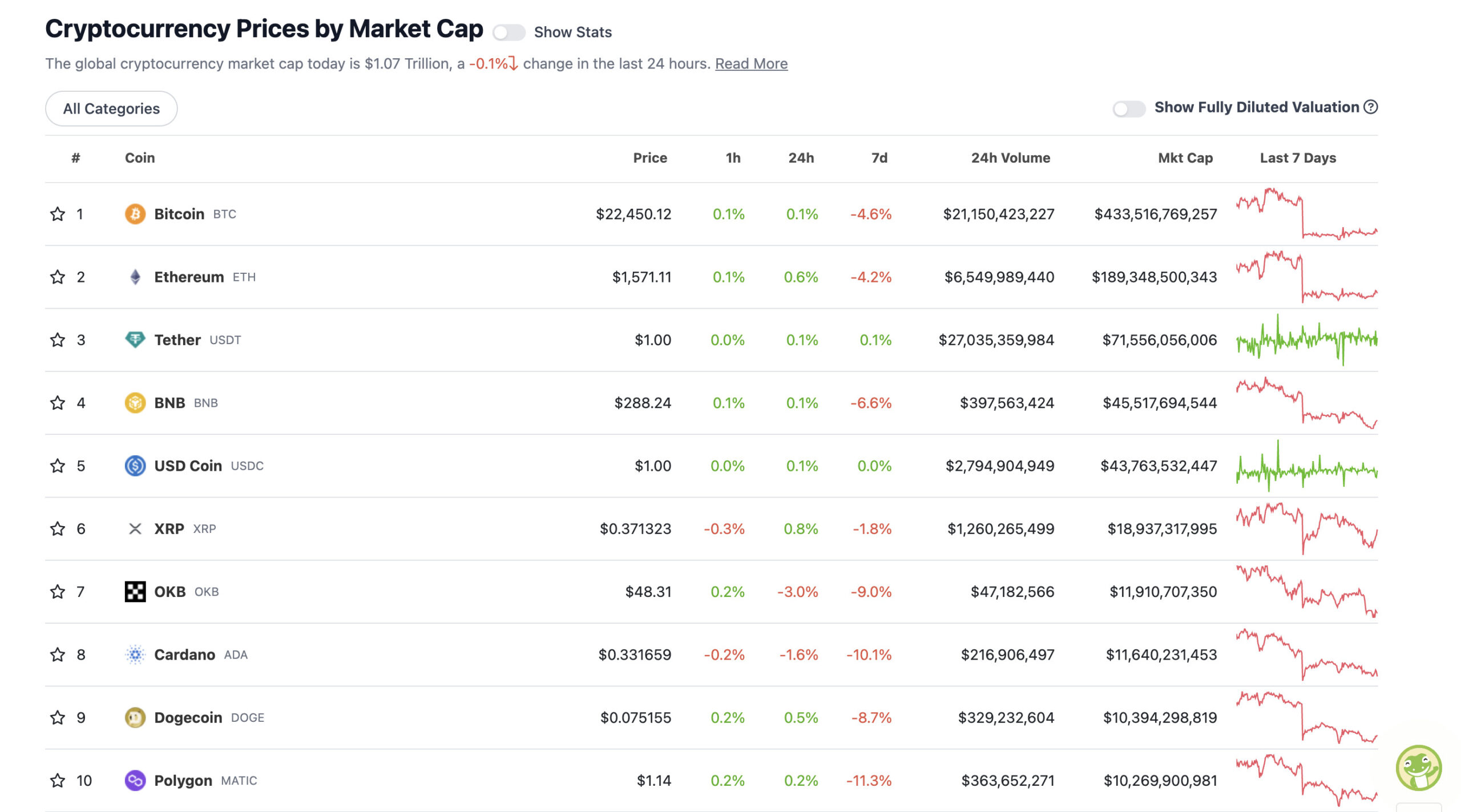

With the overall crypto market cap at US$1.07 trillion, with not much movement since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Well then, moving on to the 24-hour price action in the crypto majors, and things are looking flatter than a crêpe on the Eyre Highway.

US trader/analyst Justin Bennett thinks so, too.

Remember when markets used to move?

Those were the days!

— Justin Bennett (@JustinBennettFX) March 6, 2023

He’s still targeting the US$21,130-ish area as a level of extreme interest, though.

“Forget all the intraday levels, patterns, open interest etc,” he notes in a further tweet. “$23,130 is what matters for $BTC. That’s it. Above on the higher time fames = bullish. Below on the higher time frames = bearish.

“It’s pure gambling right now, though,” he added.

Grabbing some further analysis, Roman Trading, who, like Bennett, we included in our Crypto Twitter alpha article earlier this week, is seeing some potential upside in the short term, reflecting recent moves from the S&P 500.

$BTC 1D

Late night analysis for you all. Seeing some big bull divs along with bullish PA as price drops so does volume.

Now it’s looking like an upward channel to continue higher.

TA says up. $SPX also agrees for confluence.#bitcoin #cryptocurrency pic.twitter.com/HoHqPV6VYo

— Roman (@Roman_Trading) March 6, 2023

Meanwhile, Simon Peters, an analyst over at multi-asset investment company and trading platform eToro, has given the heads up on something that’s turned our head just slightly. And that’s the fact that Brazil has recorded a crypto market tax bounce.

Why is that interesting to note?

“Brazilian Tax Authorities give an interesting early insight into crypto market movements as it collects tax information regularly,” said Peters in an email that dropped in Coinhead‘s inbox this morning.

“For January the country’s tax collectors witnessed a bounce in crypto market transactions of over 10% compared to December 2022,” noted Peters.

“The total level of transactions has yet to reach 2022 highs in the country, however, but it gives some insight into regional investors returning to the market after a volatile H2 in 2022.”

Sweeping a market-cap range of about US$8.96 billion to about US$439 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Decentraland (MANA), (market cap: US$1.11 billion) +7%

• GMX (GMX), (mc: US$610 million) +6%

• Fantom (FTM), (mc: US$1.16 billion) +4%

• Optimism (OP), (mc: US$540 million) +3%

• The Sandbox (SAND), (mc: US$1.13 billion) +3%

DAILY SLUMPERS

• SingularityNET (AGIX), (market cap: US$530 million) -5%

• Maker (MKR), (mc: US$819 million) -4%

• Dash (DASH), (mc: US$698 million) -4%

• Trust Wallet (TWT), (mc: US$534 million) -3%

• Fetch.ai (FET), (mc: US$439 million) -2%

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Powell speaks tomorrow

— Benjamin Cowen (@intocryptoverse) March 6, 2023

Crypto quant analyst Ben Cowen is referring to the US Fed boss Jerome Powell’s scheduled speech/hearing in front of the US Senate Banking Committee tomorrow. Maybe markets will get some sort of clues as to the Fed’s next moves. Or maybe he’ll play his cards close to his chest. Maybe the next US jobs report, also due later this week, will end up being more telling.

According to Ripple, The Supreme Court ruling backs their case against SEC.

— Crypto Crib (@Crypto_Crib_) March 6, 2023

#Bitcoin https://t.co/G7lAZAeX9f

— naiive (@naiivememe) March 5, 2023

GAME ON 🚀: To celebrate the launch of Illuvitars we are going to play a FREE MINT game LIVE under this post!

We are giving away 20 Standard Disks!

• Must be following @illuviumio

• Pick a number between 1-1000 and comment belowIncrease your odds of winning below ⬇️ pic.twitter.com/Y5B1rPIw2x

— Brycent (@brycent_) March 6, 2023