Mooners and Shakers: Bitcoin gets a small Nvidia tech-rally push, but still hangs in the balance

Getty Images

Bitcoin and other crypto assets have had the smallest of bumps back up from where they were languishing overnight and threatening to dump lower.

Maybe the Nividia AI chip-making tech-stock narrative has helped throw a little bit of interest the way of the crypto market.

Nvidia is poised for one of the biggest one-day pops in US history, with the promise of AI (and other factors) propelling its market capitalization to levels that rival Amazon. https://t.co/TmHBeD87an pic.twitter.com/FHWmBhO0wH

— Lisa Abramowicz (@lisaabramowicz1) May 25, 2023

As Eddy Sunarto reports in his Market Highlights update this morning:

“Overnight, Wall Street rebounded as chipmaker Nvidia ignited a rush for AI and tech stocks. At the close, Nasdaq was +1.7% higher, and the S&P 500 rose +0.88%.”

The fact that Wall Street stonks have bounced as a whole, though, might merely be having the usual knock-on positive effect for the crypto market.

Per a CoinDesk article this morning meanwhile, the Nividia surge might well prove to be a reminder to Bitcoin mining firms that AI tech should not be overlooked as a potentially extremely powerful integration into to their computational mining operations.

“The overwhelmingly positive market reaction” to Nvidia’s news “will incentivize more mining companies to follow suit making announcements of their own and allocating more of their power capacity to other forms of compute,” said Ethan Vera, chief operating officer at mining services firm Luxor Technologies told CoinDesk.

Meanwhile, still aping off Eddy’s morning update, this also caught Coinhead’s eye:

“Analysts believe that if the debt ceiling drama gets uglier, it could lead to some safe-haven flows for bullion.”

Bitcoin is widely regarded by the crypto industry as a store-of-value, safe-haven asset itself and Gold 2.0, remember. It’s also becoming, more and more, part of the political conversation – especially at a presidential-race level.

Top 10 overview

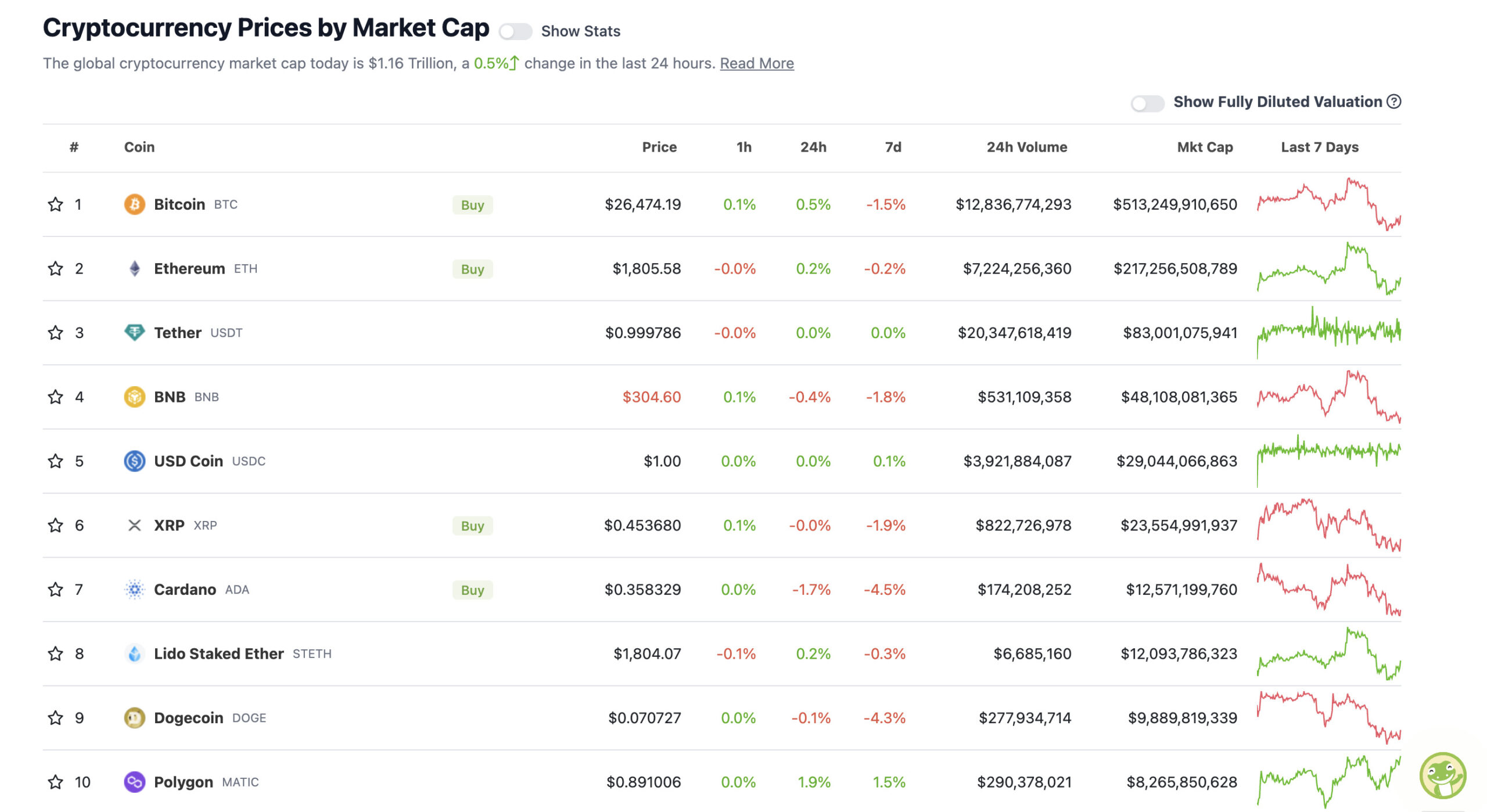

With the overall crypto market cap at US$1.16 trillion, up about 0.5% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Other than the fact Polygon’s MATIC has once again well and truly booted Ethereum competitor Solana (SOL) out of the top 10 cryptos by market cap, there’s not loads to talk about regarding the crypto majors today.

That said, BTC and Ethereum have both retained key levels for the minute – US$26.2k and US$1,800 respectively.

That BTC level is of key importance to many crypto technical analysts out there at the moment, as it happens to pretty much coincide with the 200-week moving average line of support, which Rekt Capital, for one certainly regards as imperative to hold and bounce from if a bullish thesis is to stand any chance whatsoever.

More than, that, however, he feels that bounce needs to move above US$26,800. Considering BTC was all the way back around US$25,800 as most Aussies were nodding off to sleep last night, this isn’t a bad bounce so far. That said, momentum on it seems to have faded a tad.

It's possible this #BTC rebound is happening right now

Fail to reclaim $26800 (blue) and the short-term bias will remain bearish for $BTC#Crypto #Bitcoin https://t.co/8Rg9KTkZ6d pic.twitter.com/eMRPrtB3Er

— Rekt Capital (@rektcapital) May 25, 2023

How’s Mr Low Volume doing? That’s be US trader/analyst Roman. Yep, he’s still eyeing a most positive short-term outcome for BTC than the likes of veteran trader Peter Brandt.

Low volume moves do not confirm breakdowns/breakouts and often lead to fakeouts.

Yesterday’s volume was lower than the average 60 days worth of volume.

As price continues to drop so is volume.

A long set up is coming.#bitcoin #cryptocurrency #cryptotrading

— Roman (@Roman_Trading) May 25, 2023

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Render (RNDR), (market cap: US$987 million) +4%

• Axie Infinity (AXS), (market cap: US$799 million) +4%

• Decentraland (MANA), (market cap: US$851 million) +3%

• ImmutableX (IMX), (market cap: US$734 million) +3%

• The Sandbox (SAND), (market cap: US$935 million) +3%

PUMPERS (lower, lower caps)

• Akash Network (AKT), (market cap: US$92 million) +25%

• Velas (VLT), (market cap: US$36 million) +23%

• Optimus AI (OPTI), (market cap: US$19 million) +20%

• Waltonchain (WTC), (market cap: US$15 million) +6%

SLUMPERS

• NEO (NEO), (market cap: US$695 million) -6%

• Kava (KAVA), (mc: US$582 million) -5%

• Radix (XRD), (mc: US$702 million) -4%

• Synthetix (SNX), (mc: US$735 million) -3%

• ApeCoin (APE), (mc: US$1.19 billion) -3%

SLUMPERS (lower, lower caps)

• Samoyedcoin (SAMO), (market cap: US$23 million) -55%

• Multichain (MULTI), (market cap: US$83 million) -19%

• UTrust (UTK), (market cap: US$45 million) -19%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Entire #altcoin market is 560 billion.

NVIDIA added 220 billion in 16 hours.

But “where will the money come from”?

— TechDev (@TechDev_52) May 25, 2023

News:

GDP comes in at 1.3%, while 1.1% forecasted.

Unemployment claims are also coming in more positive than expected at 229K, while 249K forecasted.Economy is still 'strong'.

— Michaël van de Poppe (@CryptoMichNL) May 25, 2023

🇲🇽 Mexican Senator: Let's not wait for "prince charming" to bring #Bitcoin adoption to Mexico. 👏

"If we are going to wait for the government to do it, then that is not going to happen." pic.twitter.com/EdHgNw6GMc

— Bitcoin Magazine (@BitcoinMagazine) May 25, 2023

Important reminder that even if #BTC may potentially have a short-term bearish bias…

Mid- to long-term bias is very bullish for $BTC#Crypto #Bitcoin pic.twitter.com/D91aDi3ycq

— Rekt Capital (@rektcapital) May 25, 2023

#Bitcoin pic.twitter.com/VBUEnj2i9c

— naiive (@naiivememe) May 22, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.