Unable to locate his mouth, it was clear Tony had a fundamental drinking problem. (Getty Images)

Bitcoin was flirting with US$30k at the Bar of Resistance all weekend, itching to inch its way into a comfortable position. It’s not quite there yet, according to some observers. Meanwhile, Chainlink is showing a bit of leg, looking good.

As usual then, analysts of varying degrees of professionalism and experience are watching the bull goose crypto asset closely. Some, for example popular (703k followers) trader Pentoshi, are suggesting about US$28.9k is the area to defend for the bulls.

https://twitter.com/Pentosh1/status/1715353518138077677?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1715353518138077677%7Ctwgr%5E10112c6a1ef2f9eaef4764f93a80f9d9e39287fb%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fcointelegraph.com%2Fnews%2Fbtc-price-2-month-high-bitcoin-break-32k

[Note: When we started this article, before being diverted elsewhere in the Stockhead universe, Bitcoin was sitting about US$1,000 above that supposedly critical area. Take a look at where it’s just surged, though, further below in the “Top 10 overview” price action section…]

Regarding further analytical takes, however, swing trader Roman Trading notes a bearish potential “head and shoulders” technical pattern that might be playing out. Something he notes that could see BTC take a dip back down in the near term, confirming on a break down to US$25k and invalidating if Bitcoin can break above US$31.8k.

These are not, one would think, arbitrary figures. He’s worked it out, using lines, triangles, moving averages and RSIs and those sorts of things.

“Titan of Crypto”, meanwhile isn’t so sure about that head and shoulders. Perhaps he has a non-flakey scalp. But I guess these things are there to be eternally debated in the Wheel of Time that is the dark arts of technical analysis.

Having some sense of very basic, surface-level understanding of such technical matters, but with time on hands short, we won’t linger on this. Oh, go on then, one more…

Here’s Stockmoney Lizards, who sees beauty in Bitcoin’s charts at present…

The trading group is very much of the belief that a fresh bull market for Bitcoin/crypto has just begun, based on the patterns of past Bitcoin “halvings”. The next halving, is due to hit next year, in April.

The halving event is essentially code written into the Bitcoin mining algorithm that cuts the asset’s supply issuance (which manifest as Bitcoin mining rewards) in half and occurs once every four years.

The past three halvings have all coincided with (or preceded) the price of Bitcoin, and the rest of the crypto market, surging into bull runs of epic proportions.

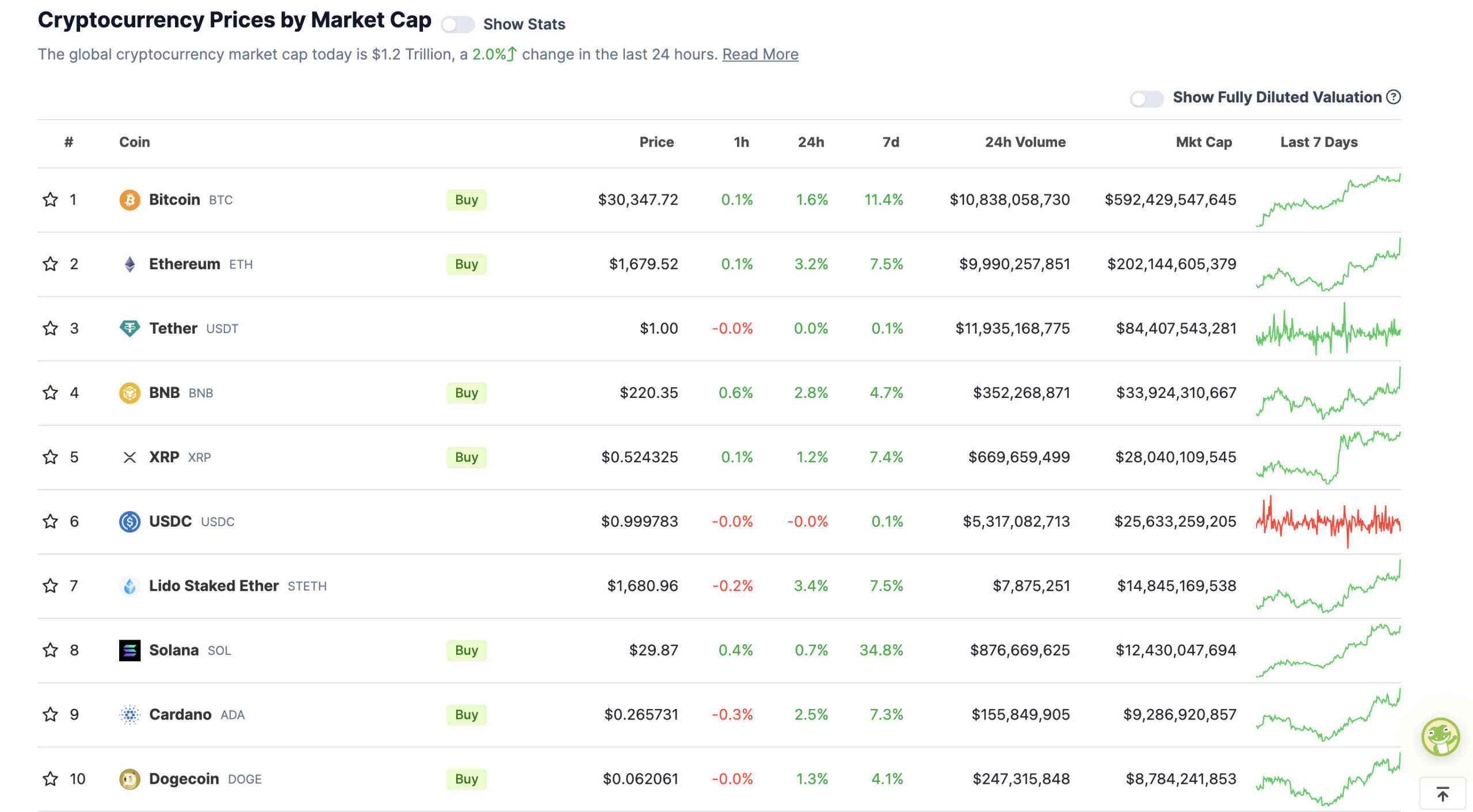

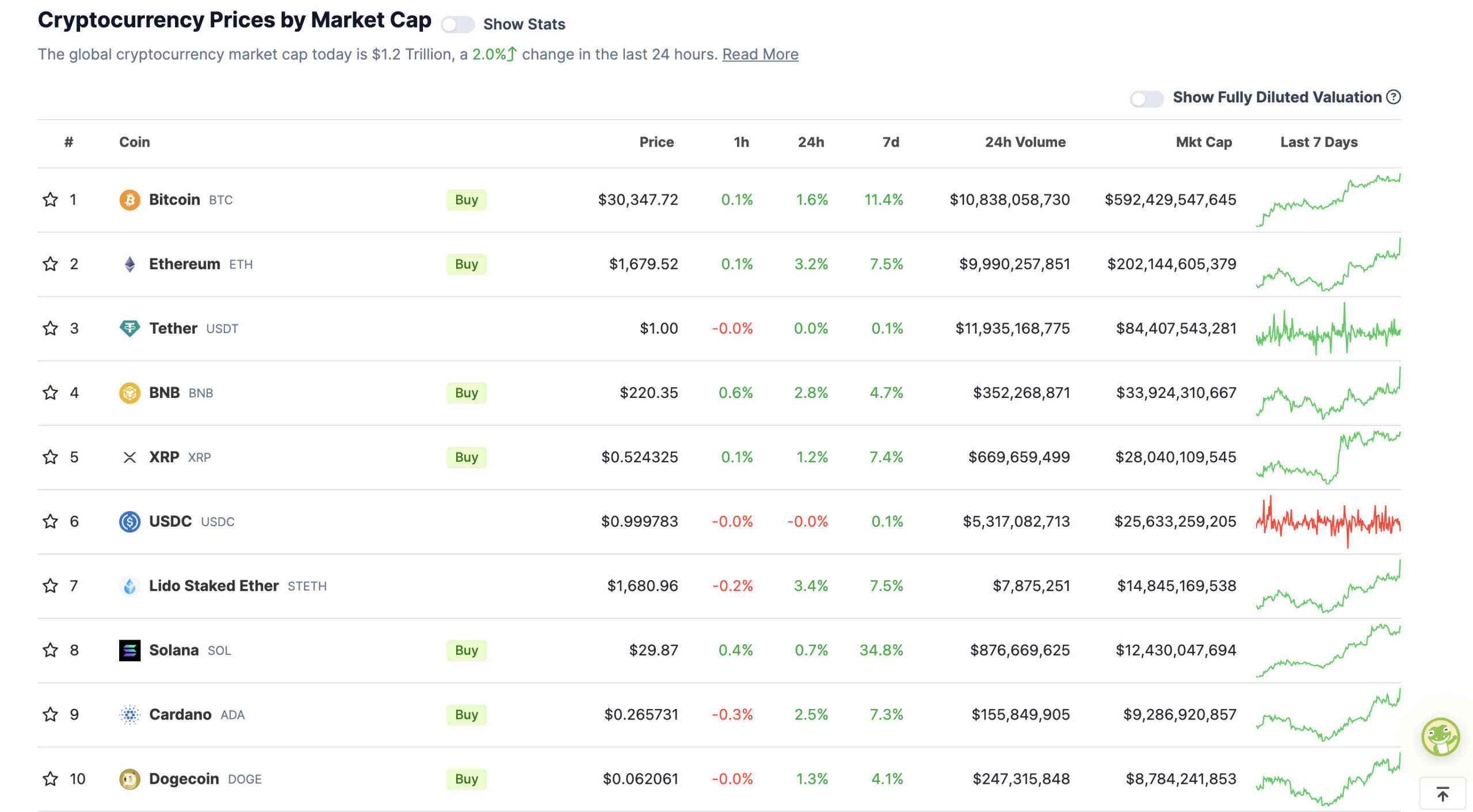

With the overall crypto market cap at US$1.2 trillion, up 2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Right then, BTC has surged back over US$30k since we began this article. It seems to be getting somewhere with its previously implied flirtations with the number.

This uptick happens amid a selloff on Wall Street overnight, by the way, which is interesting to note as so often over the past few years, Bitcoin and crypto has been deeply tied to the fickle movements of US equities and the macro environment at large.

Could, as BlackRock’s CEO suggested recently, a “flight to quality” be occurring for the OG crypto asset?

And sentiment around the possible approval of spot Bitcoin ETFs in the United States has certainly increased lately. Investment giant JP Morgan looks to be in that positive camp now, too, recently suggesting the SEC is likely to approve multiple BTC ETFs within a few months.

Uppers and downers: Chainlink surges

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Chainlink (LINK), (market cap: US$5.98 billion) +19%

• Aave (AAVE), (market cap: US$1.16 billion) +13%

• Aptos (APT), (market cap: US$1.53 billion) +11%

• Fantom (FTM), (market cap: US$611 million) +9%

• Polygon (MATIC), (market cap: US$5.78 billion) +9%

Chainlink (LINK), one of the most widely used protocols across the cryptoverse, is on a tear at the moment. It’s been getting a fair bit more cross-chain pick-up lately, thanks to its recent CCIP tech-stack upgrade, which, as Lee Ross from ANZ (yep, that ANZ) notes here “abstracts away blockchain complexity of moving tokenised assets across different [block]chains”.

SLUMPERS

• Rollbit Coin (RLB), (market cap: US$466 million) -16%

• Bitcoin SV (BSV), (market cap: US$1.02 billion) -5%

• XDC Network (XDC), (market cap: US$638 million) -2%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Maybe this chart, posted by MicroStrategy’s Bitcoin bull Michael Saylor, speaks for itself?