Mooners and Shakers: Bitcoin bounces back; Kim Kardashian fined $1.26m by SEC for ‘unlawful’ EMAX promotion

Putting it all behind her. Socialite Kim Kardashian. (Getty Images)

After yesterday’s little dip to open the week, Bitcoin and crypto is looking in better shape today, mirroring a bounce in the US stock markets. Meanwhile, Kim Kardashian is dealing with some EMAX pain.

Markets seemed pretty spooked yesterday by rumours regarding big banks Credit Suisse and Deutsche Bank being potentially on the brink of collapse. Those fears might just be pushed under the rug for the moment, as we’ve seen a little rebound that might be giving “Uptober” forecasters some hope.

Robert “Rich Dad Poor Dad” Kiyosaki certainly seems to think Bitcoin’s a buy right now…

BUYING OPPORTUNITY: if FED continues raising interest rates US $ will get stronger causing gold, silver & Bitcoin prices to go lower. BUY more. When FED pivots and drops interest rates as England just did you will smile while others cry. Take care

— Robert Kiyosaki (@theRealKiyosaki) October 2, 2022

And here’s another stupendously wealthy investor, billionaire Chamath Palihapitiya, who’s made the call (see tweet and podcast clip below) that we’re pretty much at the crypto market bottom, based on the premise that “the markets are now starting to stabilise”.

He added that he’s seeing “irrational behaviour starting to exit the system” and that he’s becoming bullish on the space again, while caveating that we could still be “three to five per cent from the lows”.

“The investments that one makes in this period will probably be the best for many many years to come because they’ll have the most asymmetric upside,” believes Palihapitiya.

Billionaires are Buying assets again 👁 #crypto #stocks #recession pic.twitter.com/YL2lf6GbIp

— Joshua Jake (@itzjoshuajake) October 3, 2022

Meanwhile here’s some further positive sentiment from noted “Bitcoin maxi” Samson Mow and CEO of Bitcoin startup JAN3.

#Bitcoin price is already pushed down to the limit, well below 200 WMA. We’ve had contagion from UST/3AC and leverage flushed already. BTC is massively shorted as a hedge.

Even if Credit Suisse / Deutsche Bank collapse & trigger a financial crisis, can’t see us going much lower.

— Samson Mow (@Excellion) October 3, 2022

Kim Kardashian fined $1.26m for unlawful EMAX ‘touting’

It’s been reported that Kim “Famous For Being Famous” Kardashian has agreed to settle charges made against her by the US Securities and Exchange Commission (SEC) for unlawfully promoting a dodgy crypto known as EthereumMAX (EMAX).

Kardashian will pay the SEC US$1.26 million in penalties, and reportedly plans to cooperate with the financial regulator’s ongoing investigation into the matter.

We’ve covered the EthereumMAX debacle before in Stockhead – former world champion boxer Floyd Mayweather has also been sharing the hot water with the socialite regarding it. However, at this stage, it’s Kardashian copping the financial rap.

Breaking News: Kim Kardashian will pay $1.26 million to settle with the S.E.C. for not disclosing she’d been paid to promote a crypto token.https://t.co/p2lPVW5b18

— The New York Times (@nytimes) October 3, 2022

What the hell is EthereumMAX? Here’s how Stockhead‘s Gregor Stronach described it in August, following the news EthereumMAX investors were looking to sue Kardashian and Mayweather for the famous duo’s alleged involvement in what appeared to be a classic crypto pump-and-dump. That lawsuit stemmed around the allegation that Kardashian and Mayweather misled investors in their promotion of the coin.

“EthereumMAX was launched [in June 2021] as a means for punters to buy tickets to a boxing match between a former World Champion and a Youtuber,” explained Gregor. “And its creators got a bunch of other famous people (including the aforementioned Kardashian) to go on Instagram to spruik it but once the boxing match was over the value of the coin plummeted and a bunch of idio… sorry, investors lost their money so now they’re suing the rich people who told them to buy what was clearly a s..tcoin from day one.”

Anyway, it’s the SEC and not a bunch of pissed-off investors that’s actually delivered some form of comeuppance. Here’s SEC boss Mr Burns, aka Gary Gensler…

Today @SECGov, we charged Kim Kardashian for unlawfully touting a crypto security.

This case is a reminder that, when celebrities / influencers endorse investment opps, including crypto asset securities, it doesn’t mean those investment products are right for all investors.

— Gary Gensler (@GaryGensler) October 3, 2022

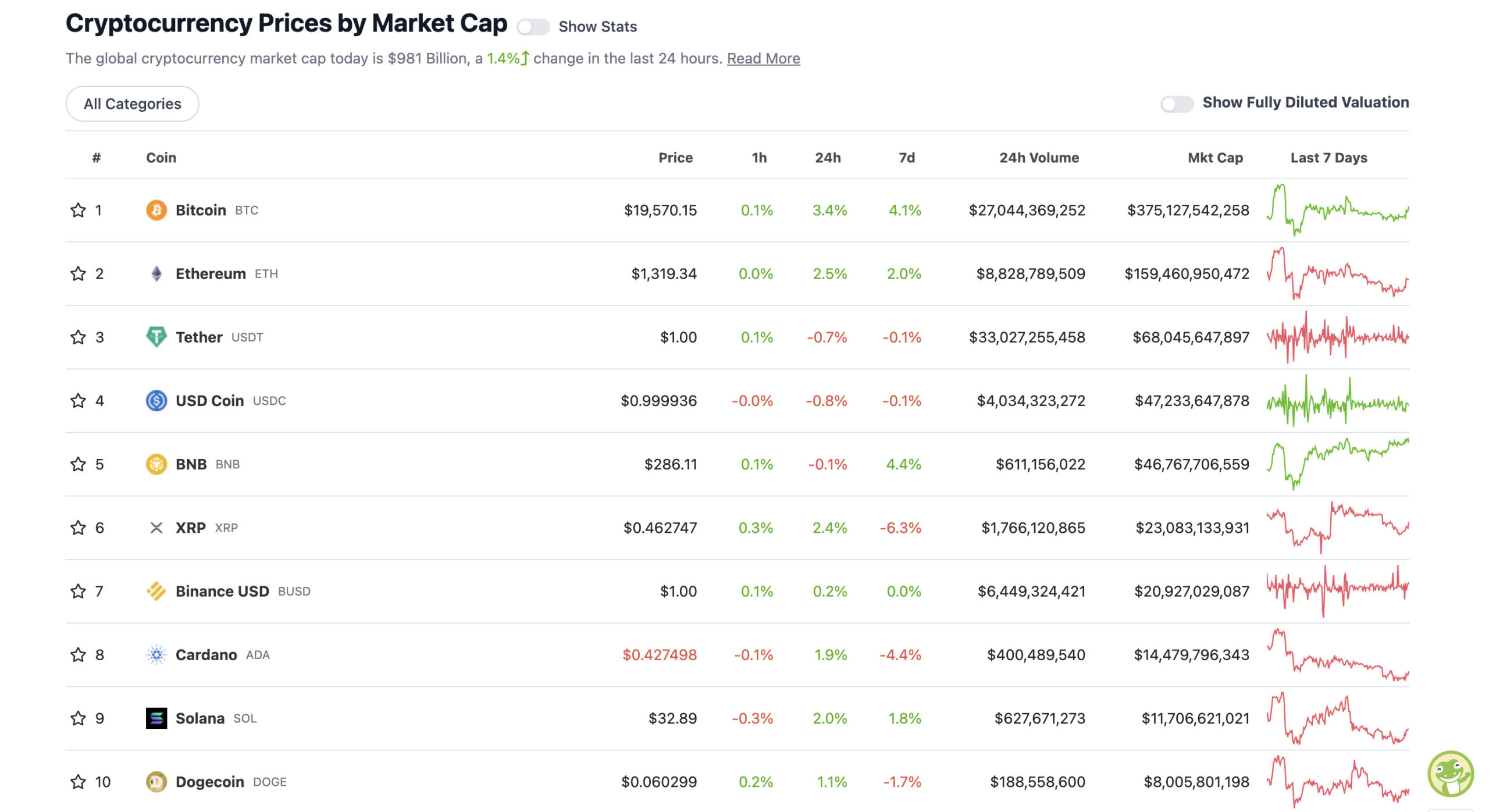

Onto some daily crypto price action.

Top 10 overview

With the overall crypto market cap at US$981 billion and up about 1.4% since yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

We’re not done with feeding you positive Bitcoin vibes from Crypto Twitter. Analyst Joe Burnett has some interesting data that shows the majority of BTC holders are HODLers. About 62% of the asset has not been transferred anywhere at all in more than a year. Which seems remarkable considering the year markets have endured so far.

BREAKING: NEW ALL TIME HIGH

~ 61.9% OF BTC HAS NOT MOVED IN OVER 1 YEAR

Name another asset where holders refuse to sell after a 72.3% drawdown. pic.twitter.com/ziku1cLZMl

— Joe Burnett, MSBA (🔑)³ (@IIICapital) October 3, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$7.4 billion to about US$399 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Maker (MKR), (market cap: US$734 million) +8%

• Ethereum Name Service (ENS), (mc: US$399 million) +8%

• Elrond (EGLD), (mc: US$1.23 billion) +8%

• Quant (QNT), (mc: US$1.87 billion) +8%

• Lido DAO (LDO), (mc: US$1 billion) +7%

• Uniswap (UNI), (mc: US$5 billion) +5%

DAILY SLUMPERS

• Terra Luna Classic (LUNC), (market cap: US$2.16 billion) -9%

• Huobi (HT), (mc: US$525 million) -3%

• Terra (LUNA), (mc: US$406 million) -2%

• Stellar (XLM), (mc: US$2.98 billion) -2%

• XDC Network (XDC), (mc: US$424 million) -2%

Around the blocks

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

https://twitter.com/MalwareTechBlog/status/1576908025297674240?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1576913284581638144%7Ctwgr%5Ed1663d9328c6dc2767cc458c450e8725f5fd3712%7Ctwcon%5Es2_&ref_url=https%3A%2F%2Fcryptobreaking.com%2Fhow-crypto-twitter-reacted-to-kim-kardashians-1-26m-sec-fine%2F

They went after Kim Kardashian because she makes a good headline and it shows the public that the SEC is "doing something" about crypto scams

In reality, the fine she paid is dust to her, the creators of Ethereum Max haven't been fined (yet?), and the victims are all still rekt

— sassal.eth/acc 🦇🔊 (@sassal0x) October 3, 2022

BREAKING!👉NYDIG just raised $720 million from institutions to buy Bitcoin!

— Bitcoin Archive (@BTC_Archive) October 3, 2022

Arbitrum Airdrop Guide

– Fastest guide to get the Airdrop

– High chance to get $ARBI

– 6 easy stepsI collected all info on the Arbitrum Airdrop and boiled it down for you

Let’s dive in👇🧵 pic.twitter.com/vbB0x9dr6K

— Corleone (@corleonescrypto) October 3, 2022

Fed officials bringing inflation down. pic.twitter.com/qu4dUtdRDc

— Sven Henrich (@NorthmanTrader) October 3, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.