Mooners and Shakers: Bitcoin and Ethereum sink lower as Wall Street stocks dive deepens

Getty Images

Crypto is trending lower again today. Unsurprised? Fair enough. Going out on a limb here… it’s probably to do with a malaise taking hold in the aftermath of the LUNA death spiral. Plus, you know… the Fed and inflation ‘n’ that.

It’s also not unlikely that Machiavellian whale investors are throwing their weight around beneath the surface, sending the markets this way and that for a bit of fun on a Wednesday arvo.

Meanwhile, certain YouTubing, told-you-so, Bitcoin-halving-cycle fanboys are beating their chests for their Kool-Aid-supping followers. It’s all going down exaaaactly as they predicted.

Let’s nervously wade into the price action…

Top 10 overview

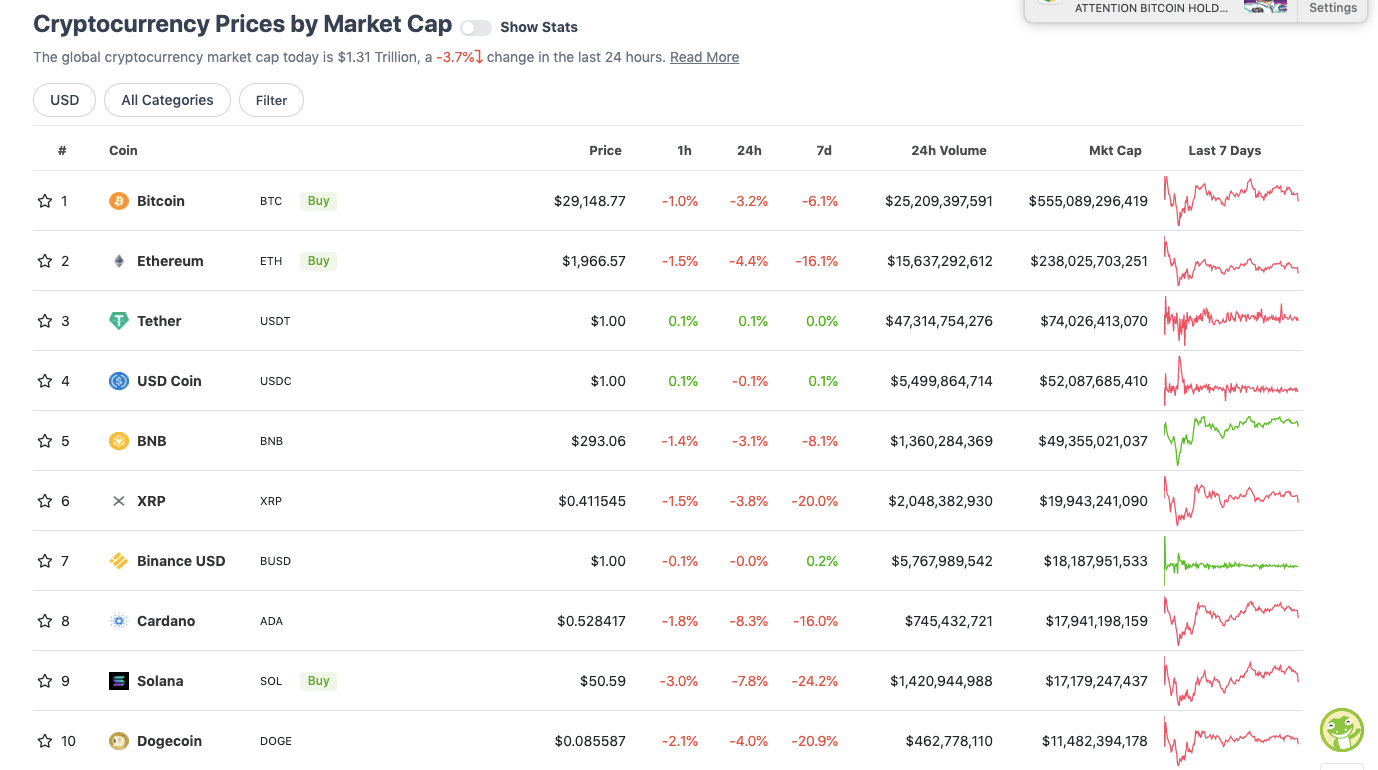

With the overall crypto market cap at roughly US$1.31 trillion, down 3.7% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Yup… things are heading south as this is typed. There’s not much point talking about the biggest top-10-coin gainers here right now. But you know things aren’t in terrific shape when the leading percentage pumper is the stablecoin Tether (USDT). Still, it’s doing what it’s meant to – maintaining its peg. So cop that, haters.

The biggest daily losers in the majors, though, are being led by the layer 1 protocols Cardano (ADA), -8.3%, and Solana (SOL), -7.8%.

Just beyond this chart, it’s actually a similar story for most of Ethereum‘s main layer 1 competitors, with Polkadot (DOT), Avalanche (AVAX), NEAR Protocol (NEAR), Algorand (ALGO), Elrond (EGLD), Tezos (XTZ), Fantom (FTM), Cosmos (ATOM) and others all currently bleeding to the tune of about 7-10% over the past 24 hours.

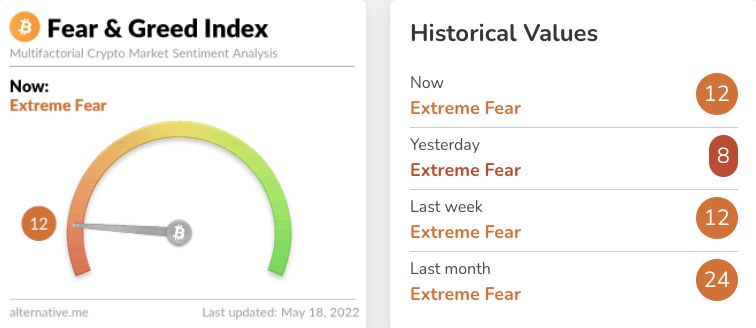

Time for a quick peek through fingers at the Crypto Fear & Greed Index? Still extremely fearful. Might be a single digit again this time tomorrow at this rate.

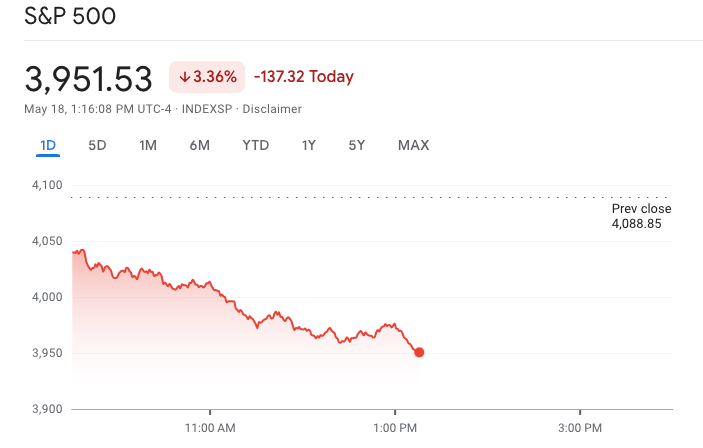

Meanwhile, here’s what’s occurring in the S&P 500 right now, to which Bitcoin is pretty much tied by the apron strings.…

(For more S&P 500 happenings, by the way, check out the Tesla-related tweets in ‘Around the Blocks’, further below. Spoiler: Elon ain’t happy.)

Analysing some Bitcoin Twitter analysis

This columnist follows a lot of Bitcoin/crypto analysts on Twitter – some really good ones and probably some that don’t quite fit that bill, too. Many have been relatively bullish in recent times, which admittedly does tend to offer a level of confirmation bias that’s inherently compelling if you have a longterm positive outlook on the space.

There’s one, however, who’s been pretty consistent in his neutral/bearish outlook for some time now – a US trader who goes by the handle @Roman_Trading. And, gotta say, he’s probably been the most consistently accurate chart watcher we’ve followed over the past few months – since well before the Terra drama. A bit spiky at times, sure, but have to hand it to him.

Here he is (below), having perfectly called the latest Bitcoin wall headbutt at about US$30.5k. He’s now spotting a classic “bear flag” pattern, which could be leading to a further breakdown.

But, as he notes, if the volume of activity isn’t showing up for this action, it might not play out…

$BTC H4

Bear flag breakdown. I’d like to see volume come in over the next few hours before the candle close for confirmation.

MACD flipping bearish & RSI bearish divergences.#bitcoin #cryptocurrency #cryptotrading #cryptonews https://t.co/F64p9C9wN7 pic.twitter.com/Sf3f9ryyxp

— Roman (@Roman_Trading) May 18, 2022

Dutch trader Michaël van de Poppe, meanwhile, also appears to have made a good call on the BTC drawdown, and he thinks there might be some support found down around US$28.4k. He also predicts it could bounce pretty nicely off that level.

And the focus on $28.4K seems right.

Markets turning south, so I'm looking at that one before we can go to $32.8K or potentially $34K for #Bitcoin. pic.twitter.com/LtlCDlGFON

— Michaël van de Poppe (@CryptoMichNL) May 18, 2022

Whichever way things turn in the short term… it might well be an idea to keep some powder dry in the hold for potential dollar-cost averaging into “blue chips” (e.g. BTC and ETH) over coming months.

You might be well versed in it already, but zooming out that way isn’t the worst way to go about things – even as a partial strategy while keeping an eye on the space more generally, or on certain sectors of interest such as DeFi or GameFi.

Bamboo’s Craig Jackson top-lined that kind of set-and-forget, micro-investing play for us earlier today, while also giving us his outlook and thoughts on the market in the LUNA aftermath.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$11 billion to about US$556 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• TerraUSD (UST), (market cap: US$1.18 billion) ($0.10) +17%

• Chain (XCN), (market cap: US$1.83 billion) +15%

• Chiliz (CHZ), (market cap: US$677 million) 8%

• LEO Token (LEO), (market cap: US$4.64 billion) 1%

DAILY SLUMPERS

• Kusama (KSM), (mc: US$664 million) -14%

• STEPN (GMT), (mc: US$841 million) -11%

• NEAR Protocol (NEAR), (mc: US$4.1 billion) -10%

• Gala (GALA), (mc: US$595 million) -10%

• Decentraland (MANA), (mc: US$1.61 billion) -9%

• The Sandbox (SAND), (mc: US$1.5 billion) -9%

Uppers and downers: lower caps

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Goldfinch (GFI), (market cap: US$20m) +70%

• Bridge Network (BRDG), (mc: US$5 million) +54%

• UniLend Finance (UFT), (mc: US$18m) +46%

• Shyft Network (SHFT), (mc: US$15m) +39%

• DEI (DEI), (mc: US$40m) ($0.60) +7%

DAILY SLUMPERS

• Astroport (ASTRO), (mc: US$11.5m) -5o%

• Crabada (CRA), (mc: US$12m) -37%

• Step App (FITFI), (mc: US$61m) -22%

• MAPS (MAPS), (mc: US$29m) -20%

• Kadena (KDA), (mc: US$454m) -18%

Around the blocks

BREAKING: UK inflation hits 40-year high at 9%

🇬🇧 needs #bitcoin

— Bitcoin Magazine (@BitcoinMagazine) May 18, 2022

Really liking the design of the new one dollar bills. I wonder what next year will bring? pic.twitter.com/GRmuLIfeKK

— Charles Hoskinson (@IOHK_Charles) May 18, 2022

Not strictly crypto related this, but some interesting Tesla news here…

Tesla has been kicked out of the S&P 500 ESG Index https://t.co/uAe6Hpztve via @business

— Eric Balchunas (@EricBalchunas) May 18, 2022

Exxon is rated top ten best in world for environment, social & governance (ESG) by S&P 500, while Tesla didn’t make the list!

ESG is a scam. It has been weaponized by phony social justice warriors.

— Elon Musk (@elonmusk) May 18, 2022

Back to crypto… it seems former Facebook/Meta man David Marcus has been orange-pilled and is now heading up a Bitcoin Lightning Network payments startup called Lightspark. Whether this will have any connection with Meta is unclear, but possibly not, even though he’s taken some other former Meta staffers with him to develop the project.

Here he is, talking like a true crypto veteran…

— Mt.Gox’ed📉 (@RealWillyBot) May 17, 2022

Downturns are good moments to focus on building and creating value with mission-aligned people. We’re excited to dive into Lightning, learn more, and work alongside the community. We’ll share more about our work as we make progress! (3/3)

— David Marcus (@davidmarcus) May 12, 2022

I have no idea if ETH will be at $10k or $100 in the next 3 years.

But I DO know there will be 100s high quality NFT integrated games, virtual worlds, apps, projects, industries, etc.

That’s what I’m here for tbh.

— MattyVerse (@DCLBlogger) May 18, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.