Mooners and Shakers: Bitcoin fights hard to hold $30k; big investors buy dip; Fed plans to use its tools

One of the Fed's tools… possibly. (Getty Images)

It’s a two-pronged defensive effort at the top of the crypto league table. Can Bitcoin and Ethereum hang on to US$30k and US$2k respectively? What we do know, is the Fed has just spoken again.

A flurry of US Federal Reserve speeches and interviews occurred today but the main focus, as per, was on Fed Chair Jerome Powell, who spoke at The Wall Street Journal’s Future of Everything Festival.

So did we get any clues on the world’s most influential central bank’s next move to address the worst inflation problem in the US since the early 1980s? Kinda.

“What we need to see is inflation coming down in a clear and convincing way, and we’re going to keep pushing until we see that,” said Powell.

And he spoke about using tools. Not “precision tools”, mind, but tools nonetheless…

Jerome Powell has the tools to fix inflation. pic.twitter.com/GqCq4T89U2

— Julian Figueroa (@kinetic_finance) May 17, 2022

Powell also noted that the Fed “won’t hesitate at all” to raise rates above neutral if warranted. That level represents a target of about a 2-3% federal funds rate, which pundits have been expecting will be hit by the end of the year. That’s as long as the Fed maintains its course of at least 50 basis points interest-rate hiking for the next few months.

We’ve seen one of those 50bps rate hikes so far this year, and the markets didn’t enjoy it. According to the Financial Times, another two or three at that level is likely in coming months, before it’s perhaps then dialled back beyond September.

The upshot of all this? It was some expected tough talking from the Fed boss. But how has it affected crypto?

Actually, possibly a little unexpectedly, it hasn’t seemed to have had much affect at all so far. Hmm… perhaps we’ve already focused on it too much in this article, then.

That said, still think it’s important to keep the Fed in view, as it sounds like it’s nowhere near done controlling the year’s markets-suppressing narrative yet.

Top 10 overview

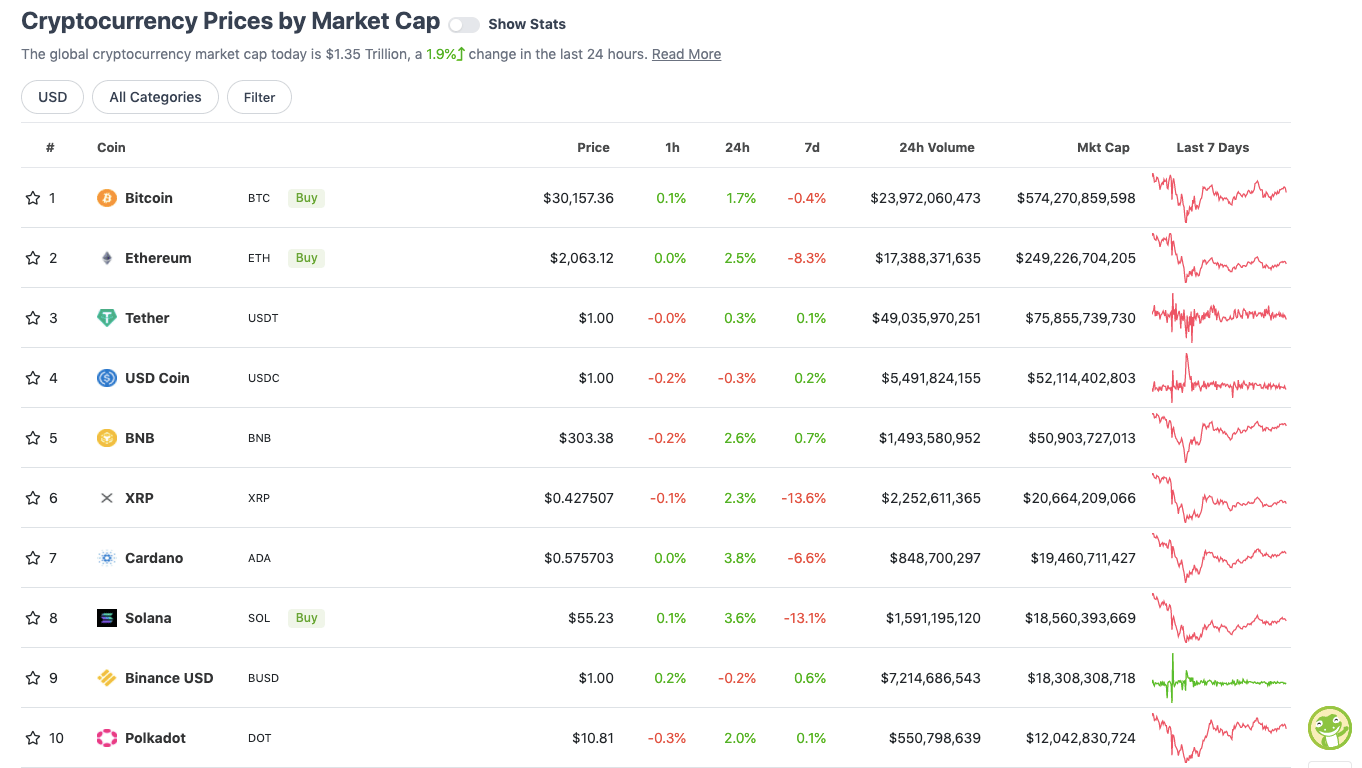

With the overall crypto market cap at roughly US$1.35 trillion, up 1.9% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

After this column noted yesterday that it wasn’t the most solid of weekly openings for Bitcoin, the OG digital asset has actually weathered a bit of a bouncer barrage half decently ever since, pulling back above US$30k again and managing to hang on around there for the past few sessions (actually about 12 hours or so at the time of writing).

And the same goes for Ethereum (ETH), which has been offering good support, holding up the other end, just above US$2k.

Institutional investors pour into Bitcoin ETFs

We’ve been noticing a few Crypto Twitter commentators pumping up the market’s tyres this week. There’s a widely held opinion that Bitcoin and some of the majors have been holding up pretty well despite the Terra/UST fiasco.

After a rapid dump of 3 billion dollars worth of #Bitcoin onto the market, its price stands at $30,000.

This, friends, is what the path to hyperbitcoinization looks like.

Not even gold would show this kind of resilience.

— Vijay Boyapati (@real_vijay) May 16, 2022

The Luna Foundation Guard (LFG) – the organisation responsible for handling the Terra project’s previously vast, US$3b Bitcoin reserve – this week revealed it sold almost all of its BTC in a failed attempt to restore the UST stablecoin dollar peg. Its reserve held roughly about 80k BTC, now reportedly reduced to about 313.

Anyway, during all that LFG BTC depletion, it appears that North American institutional investors poured more than US$300 million into Bitcoin ETFs last week, in a dip-buying spree. And that’s according to a report released by digital asset investment firm CoinShares.

NEW: Institutions poured $300 million into #Bitcoin funds during $UST crash — CoinShares 🚀

— Bitcoin Magazine (@BitcoinMagazine) May 17, 2022

Commenting on the big-player dip buying amid increased market volatility, CoinShares’ head of research, James Butterfill noted: “It’s the highest weekly total [of crypto-asset inflows] since October 2021, and the 19th highest since records began in 2015.”

Uppers and downers: 11–100

Sweeping a market-cap range of about US$12 billion to about US$589 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Kusama (KSM), (market cap: US$752 million) 11%

• Convex Finance (CVX), (market cap: US$753 million) 10%

• ZCash (ZEC), (market cap: US$1.4 billion) 10%

• Klaytn (KLAY), (market cap: US$1.23 billion) 9%

• Axie Infinity (AXS), (market cap: US$1.68 billion) 7%

DAILY SLUMPERS

• Chain (XCN), (mc: US$1.56 billion) -12%

• Terra (LUNA), (mc: US$1.23 billion) -8%

• NEAR Protocol (NEAR), (mc: US$4.5 billion) -3%

• Arweave (AR), (mc: US$780 million) -2%

• TerraUSD (UST), (mc: US$1 billion) -2%

Uppers and downers: lower caps

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• IDEX (IDEX), (market cap: US$62 million) +86%

• UniLend Finance (UFT), (mc: US$19m) +69%

• Goldfinch (GFI), (mc: US$15m) +44%

• Uquid Coin (UQC), (mc: US$84m) +35%

• Songbird (SGB), (mc: US$271m) +30%

DAILY SLUMPERS

• DEI (DEI), (mc: US$38m) -1o%

• SuperRare (RARE), (mc: US$35m) -9%

• X2Y2 (X2Y2), (mc: US$30m) -9%

• Synapse (SYN), (mc: US$255m) -8%

• Orchid Protocol (OXT), (mc: US$85m) -7%

Around the blocks

This conference is amazing.

Guessing there are some places like IMF, World Bank and BIS people are having meltdowns.

— BitcoinT.I.N.A.– There Is No Alternative (@BitcoinTina) May 17, 2022

The number of bitcoin wallet addresses with at least $300 of bitcoin has hit an all-time high of more than 10 million wallets.

Individuals continue to stack sats aggressively. pic.twitter.com/PL5YPRESYw

— Anthony Pompliano 🌪 (@APompliano) May 17, 2022

There goes my plans for a sunny retirement ☹️ pic.twitter.com/jK3EbaXbW4

— Coin Bureau (@coinbureau) May 17, 2022

https://twitter.com/ChloeWhiteAus/status/1526384410219540480

Billionaire crypto investor Mike Novogratz hasn’t tweeted since Luna and Terra imploded https://t.co/uIhZoa7qku

— Bloomberg Wealth (@wealth) May 16, 2022

We have redeemed 7B in 48h, without the blink of an eye. How many institutions can do the same?

We can keep going if the market wants, we have all the liquidity to handle big redemptions and pay all 1-to-1.

Yes, Tether is fully backed.— Paolo Ardoino 🤖🍐 (@paoloardoino) May 17, 2022

BREAKING: Vitalik believes each bored ape is worth at least $3M https://t.co/MQ4WUfhSbH

— fndati0n (@fndati0n) May 17, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.