Mooners and Shakers: Bitcoin and crypto slump again as SEC delays all spot BTC ETFs

Crypto is in danger of suffering terminal boredom with BTC at US$26k again. (Pic: Getty Images)

If you’ve been in a coma for the past week and woke up this morning (to immediately not greet loved ones and instead check your crypto portfolio) you’d be forgiven for thinking that yep, a US$26k Bitcoin seems about right.

Because that figure, where Bitcoin sat for, like, 10,000 lifetimes before this week, is about where the land lies again as this is typed.

And the reason for the sharp dip overnight (AEST), from the mid US$27k area? US Securities and Exchange Commission boss Gary Gensler knows the answer.

The SEC has, as you might know by now, shifted ALL spot Bitcoin ETF applications to the bottom of its in-tray to go with the ARK Invest one that was already there. And yep, that includes the big guns gunning for approval – BlackRock and Fidelity.

“Time to touch some grass,” reckons Bloomberg’s ETF expert Eric Balchunas.

BLACKROCK DELAYED. They all delayed. Time to touch some grass. https://t.co/2cyILzG1xG

— Eric Balchunas (@EricBalchunas) August 31, 2023

The ETF delay was highly anticipated, the SEC will try save face by delaying for 1 or 2 more deadlines before the inevitable approval.

— Charles Edwards (@caprioleio) August 31, 2023

Meanwhile, Uniswap dodges a legal bullet

Leading DEX (decentralised exchange) Uniswap (UNI) has dodged a class-action lawsuit, reports Cointelegraph, after a Southern District of New York judge dismissed claims of fraud brought forward by six plaintiffs.

This group, extremely broadly described as “a nationwide class of users” claimed in an April 2022 filing that Uniswap Labs controlled liquidity pools, including those created by scammers who launched fake tokens on the DEX.

The judge, however, dismissed the lawsuit due to the decentralised nature of Uniswap and the fact that, although yes, Uniswap created the technology, it clearly has no idea who the scammers are using the DEX.

“Instead of suing the scammers, the plaintiffs were suing the defendants over statements made on social media,” reported Cointelegraph.

Big Lesson for crypto policymakers and financial regulators (and the administrative state at large):

If you choose to avoid the legal process, if you do not want to engage in good faith rulemaking, the courts will not bail you out. https://t.co/r5RATmiwwq

— Mike Wawszczak 🇺🇸 (@mikewawszczak) August 30, 2023

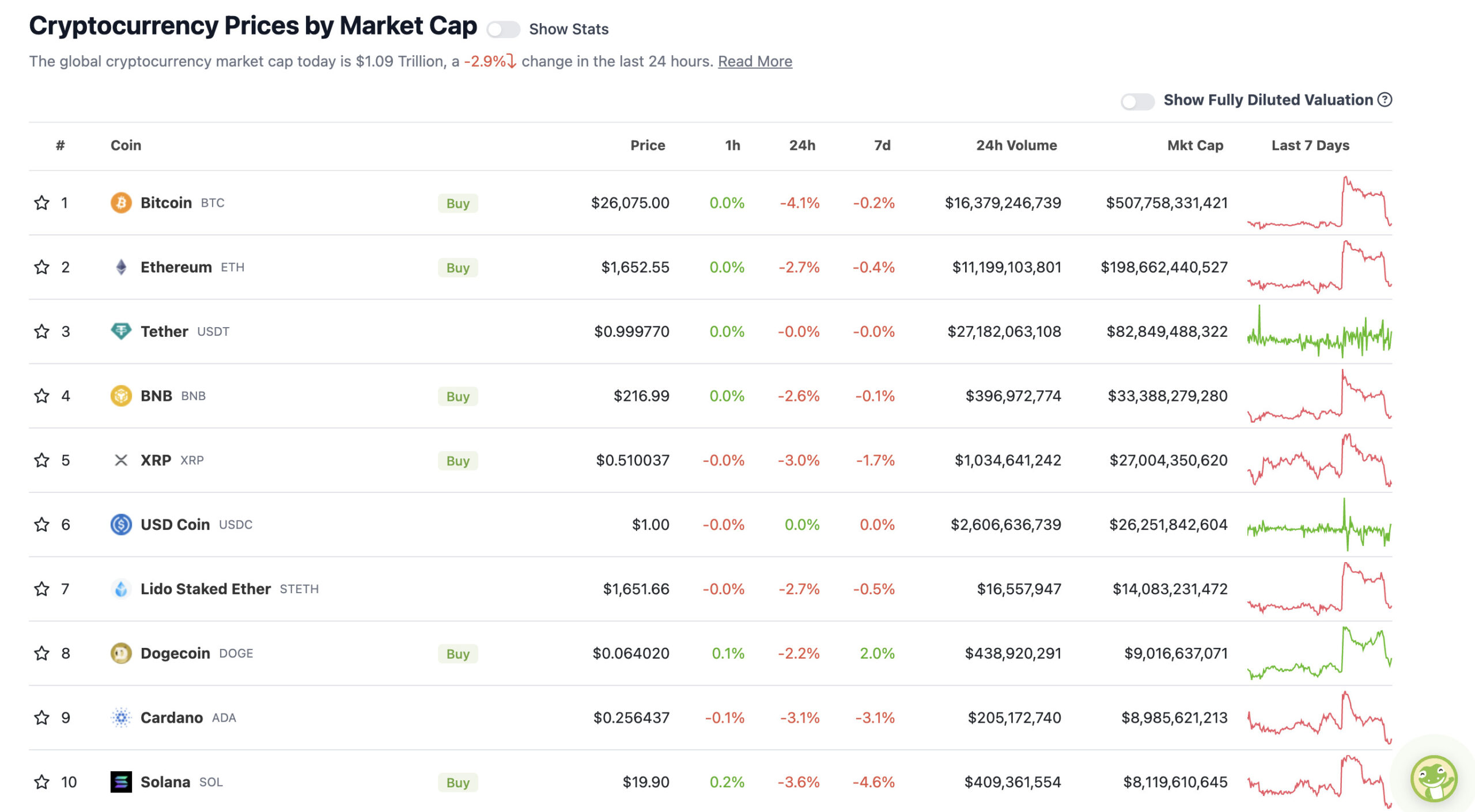

Top 10 overview

With the overall crypto market cap at US$1.09 trillion, down almost 3% since about this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Maker (MKR), (market cap: US$1.05 billion) +13%

• dYdX (DYDX), (market cap: US$393 million) +6%

• Toncoin (TON), (market cap: US$6 billion) +3%

SLUMPERS

• Stacks (STX), (market cap: US$693 million) -7%

• Optimism (OP), (market cap: US$1.1 billion) -5%

• Rocket Pool (RPL), (market cap: US$442 million) -5%

• Filecoin (FIL), (market cap: US$1.43 billion) -5%

• EOS (EOS), (market cap: US$661 million) -5%

• GALA (GALA), (market cap: US$485 million) -5%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

We’ve now fully retraced back to pre SEC Grayscale Lawsuit Bitcoin price.

Pretty much sums up where the markets at right now. pic.twitter.com/PS4T12uHFh

— Ben Simpson (@bensimpsonau) August 31, 2023

My long term view on #bitcoin. Plenty of time to accumulate over the next several months.

Short term bearish.

Long term bullish. pic.twitter.com/HGTwswPs2T

— Roman (@Roman_Trading) August 31, 2023

🤑 BlackRock supports #Bitcoin

⚖️ Grayscale defeats obstinate SEC

🇺🇸 Presidential candidates touting Bitcoin

It’s building… pic.twitter.com/jXi7F9JxJp

— Bitcoin Archive (@BTC_Archive) August 31, 2023

#Bitcoin normal day in crypto https://t.co/GfvQSWHvJx

— naiive (@naiivememe) August 31, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.