Mooners and Shakers: A 75pc chance of a US Bitcoin ETF this year, ‘done deal’ for 2024, say experts

Pic via Getty Images

Yesterday’s Grayscale win over the SEC in its quest to turn its GBTC product into a spot Bitcoin ETF has many a crypto-interested observer and analyst excited. Not to mention regular-schmo punters.

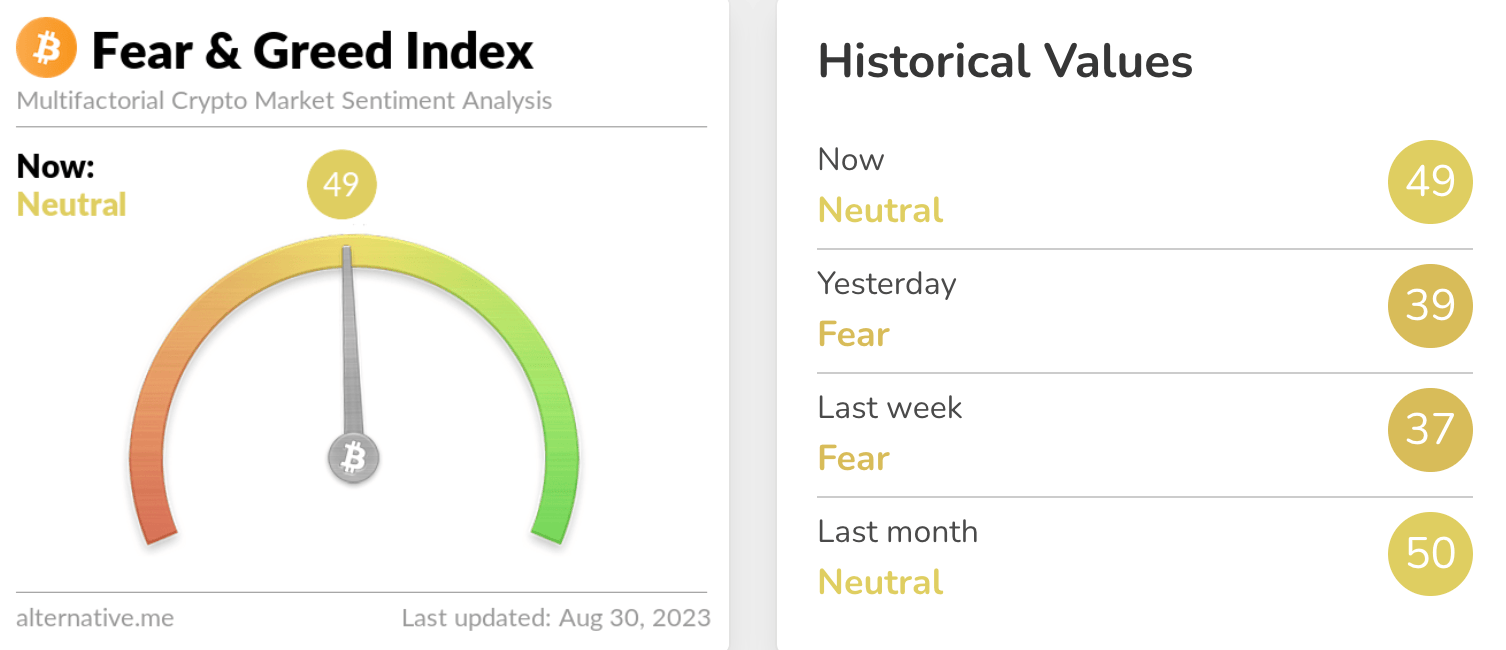

And look, the sentiment dial just went up a notch or 10, slipping back into Neutral from where it was quietly touching cloth and in danger of completely soiling its pants. That’s not to say a frantic dash back to the smallest room in the crypto house won’t be on the cards again soon, mind.

After yesterday’s Grayscale news, Bloomberg’s ETF-analysis experts Eric Balchunas and James Seyffart have made a couple of fresh predictions about the approval of spot Bitcoin exchange-traded funds in the US.

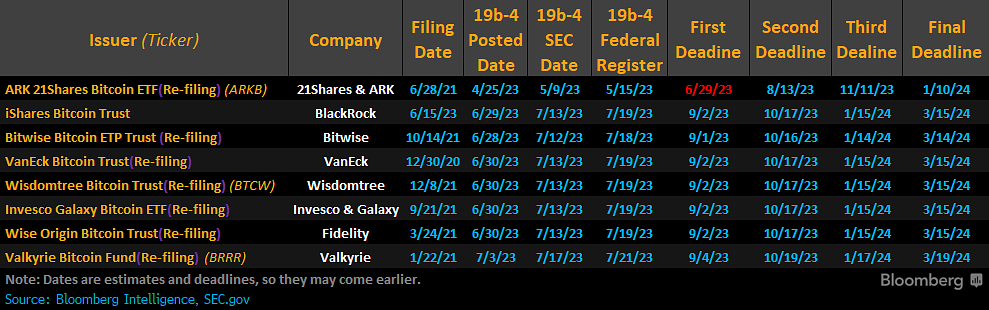

Most observers, including these two, think if one (for example BlackRock’s) gets across the line, then a whole flurry of them will at pretty much the same time.

And Bloomberg’s analysts have upped their odds to a 75% chance of the ETFs being approved before the end of this year, while they give a 95% chance that they’ll launch by the end of 2024.

Seyffart added he thinks it’s almost “done deal” for next year, while Balchunas believes the legal and PR loss for the SEC makes the denial of a spot Bitcoin ETF “politically untenable”.

Lot of people were asking yesterday. Eric and I have moved to 75% for 2023 launch of a spot #Bitcoin ETF and we think it’s almost a done deal that we will have one launched by the end of 2024. https://t.co/nO1gtSQzH1

— James Seyffart (@JSeyff) August 30, 2023

What’s the big deal about getting these Bitcoin ETFs approved in the US? It’s an institutional-money floodgates narrative.

A spot BTC ETF is seen as the holy grail for institutional investment into Bitcoin (and subsequently likely other cryptos) in the United States, and huge players, including BlackRock, VanEck, Fidelity, Invesco/Galaxy and ARK Invest, among others, are all gunning to get their applications approved.

So, then who else is excited?

Republican Presidential candidate Vivek Ramaswamy, who says yesterday’s court decision in favour of crypto asset manager Grayscale “clears a path to keep Bitcoin and blockchain innovation in the US”.

He also suggests that Gary Gensler’s SEC is way out of line in what seems a clear quest by the financial regulator to kill off crypto innovation in the States:

“The shadow government in D.C. is out of control & the federal courts are our only remaining line of defense against the unlawful rogue behaviors of 3-letter government agencies.”

The shadow government in D.C. is out of control & the federal courts are our *only* remaining line of defense against the unlawful rogue behaviors of 3-letter government agencies. This decision is strong and clears a path to keep Bitcoin & blockchain innovation in the U.S.… https://t.co/FsykKyQEVG

— Vivek Ramaswamy (@VivekGRamaswamy) August 30, 2023

Meanwhile, US broker Berstein agrees that the Grayscale decision paves the way forward, noting in a research report yesterday that the ruling “likely clears the path for a spot bitcoin ETF,” and increases chances the SEC might approve all the current applications together.

The court’s ruling doesn’t allow for the GBTC product to be converted into an ETF right away, “but gives a fair basis for Grayscale to be treated in line with other Bitcoin ETF applicants,” the report said.

Bernstein has noted in the past that it sees a US$5 trillion opportunity in the blockchain space and that a spot Bitcoin ETF market will likely be sizable, reaching 10% of Bitcoin’s market cap in two to three years.

Balancing in the bears

Let’s hear the party-pooping out, because there are some notable poopers of crypto partying making themselves heard this year. Here’s two.

Brainiac crypto analyst Benjamin “Into the Cryptoverse” Cowen, a former NASA researcher, is regarded as one of the space’s more astute self-made analysts.

Here, he tells his more-than 763k followers on X that there’s a “good chance we see $23k BTC in September”.

Why, Ben, why?

It’s partly based on the performance of Septembers past, innit – historically the crappiest month of the year for Bitcoin and crypto.

September average return for #BTC is -7.0%.

In 2019 (last pre-halving year), #BTC dropped 13.91%. pic.twitter.com/wlcInXqcNB

— Benjamin Cowen (@intocryptoverse) August 29, 2023

That Bitcoin Monthly Returns chart he shares above shows that the average return for the bull goose crypto asset in all previous Septembers its been in existence, is a disappointing -7%.

And he compares where Bitcoin is currently at in its pre-halving year cycle with a similar stage in 2019 noting that, back then, BTC dipped 13.91% in September.

Look, past performance is no guaranteed indicator of future results and all that, so maybe September 2023 can pull off another September 2016 0r 2015 instead, eh?

When are those next Bitcoin ETF application deadlines again? (Reaches for hopium pipe…) Ah yes, here they are, and seven of them are extremely imminent. Like, in the next few days imminent.

Then again, it’s likely to be another SEC delay nuthinburger, right?

And here’s another well-watched analyst in the space – Nicholas “Datadash” Merten, who’s of the opinion the crypto-market bulls are over-hyping Grayscale’s court victory over the SEC.

Wait…Grayscale supposedly wins its case against the SEC, yet #bitcoin is up only…4.75%?!

This smells like another “victory against the SEC!” that will be eventually faded because there’s either some catch or simply no desire for an ETF.

Bulls better pray it isn’t the second…

— Nicholas Merten (@Nicholas_Merten) August 29, 2023

Ah well, being bullish on the next cycle (meaning Bitcoin halving cycle), like both these gents have expressed elsewhere that they ultimately are, doesn’t mean things move up in a straight line from here, of course. A significant dip or two may very well come first.

Top 10 overview

With the overall crypto market cap at US$1.13 trillion, down almost 1% since about this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

The Grayscale-induced pump is over for now, which will please those “I’ve been bearish pretty much all year and I’m sticking to my thesis come what may” analysts above.

It’s definitely over for layer 1 blockchain Solana (SOL) for the moment, which is the worst of the crypto major daily performers with a -4.6% bleed.

If you FOMO on a green day…

You won't have enough ammo to FOMO on a red day

If you must FOMO – choose a red day#BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) August 30, 2023

One big reason why I'm looking for longs on $BTC:

Ever since the 15.5k bottom, $BTC & $BTC.D have been in an uptrend. $BTC.D just showed a bullish breakout & retest while $BTC is still up 100% on the year.

What this tells me is $BTC & $BTC.D are moving in positive correlation.… pic.twitter.com/45ytRABjoJ

— Roman (@Roman_Trading) August 30, 2023

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Tokenize Xchange (TKX), (market cap: US$422 million) +2%

• Mantle (MNT), (market cap: US$1.46 billion) +2%

• Toncoin (TON), (market cap: US$5.84 billion) +1%

SLUMPERS

• Rollbit Coin (RLB), (market cap: US$596 million) -11%

• XDC Network (XDC), (market cap: US$825 million) -5%

• KuCoin (KCS), (market cap: US$415 million) -5%

• Synthetix (SNX), (market cap: US$630 million) -5%

• Hedera (HBAR), (market cap: US$1.76 billion) -3%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

JUST IN: The Court ruled against the SEC's rejection of a Bitcoin ETF, saying: "The denial of Grayscale's proposal was arbitrary and capricious…because the commission failed to explain its different treatment for similar products." pic.twitter.com/rQIMMstlyu

— Bitcoin Archive (@BTC_Archive) August 29, 2023

Big players on Wall Street don't want to telegraph their intent.

But to get an ETF approved, you have to formally signal your plans months in advance.

That's what BlackRock has done.

You have an opportunity to front run them.

Wake up. This is your #Bitcoin opportunity

— Jesse Myers (Croesus 🔴) (@Croesus_BTC) August 30, 2023

JUST IN – CNBC Senior Markets Correspondant on spot #Bitcoin ETFs: "My bet would be eventually sometime in the fall, they approve them. All of them." pic.twitter.com/28m4scA5sv

— Bitcoin Magazine (@BitcoinMagazine) August 30, 2023

We’re officially in the longest bear market.

490 days.

Hold in there. pic.twitter.com/aqtziRd8cM

— Ben Simpson (@bensimpsonau) August 31, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.