Mooners and Shakers: Bitcoin and crypto market get a Sunday bounce; G20 proposes global crypto regs framework

Getty Images

Welcome to a new week in obsessive crypto price watching, Coinheads. And right now, it seems Bitcoin and pals are making a last-ditch effort to hit what’s supposedly an important “weekly close” level.

The end of the week may be done and dusted Down Under, but we’re not quite there yet on the crypto timeframe, because apparently things only matter when they happen in the United States of America.

Bitcoin and stocks took a hit late last week and into the first half of the weekend, as the latest PCE (personal consumption expenditures) data came in a little hotter than expected, giving cause for concern that the Fed may look to go harder on its inflation combatting for longer than some/many market participants have been hoping.

G20 and regulatory fun

And add to that the fact that a largely crypto-negative India is running the show over at the G20 Finance Ministers and Central Bank Governors (FMCBG) meeting in Bengaluru, plus all the negative regulatory pushing from Gary Gensler’s SEC in the States, and it might seem time for a few squeaky bottoms across the macro-watching Cryptoverse.

Nevertheless, the price of BTC is holding up okay today. For now.

Now, the G20 ruminations aren’t necessarily a bad thing – not much can be gathered from that just yet, other than a call from India’s Finance Minister, Nirmala Sitharaman to create a united regulatory front when it comes to crypto, which has been met with approving nods from serious-looking financial reps of various global governing bodies.

Of course, some hard-liners among the throng over there, such as the International Monetary Fund (IMF) MD Kristalina Georgieva, just had to chime in with this sort of threatening rhetoric: “We should not take off the table banning those assets,” if regulation fails or is too slow to implement.

At least US Treasury Secretary Janet “From the Rooftops” Yellen noted that America, while in favour of a “strong regulatory framework” is not pushing for an outright banning of crypto activities.

And how do some sections view that little Yellen tidbit? Like this:

Bullish

On the sidelines of the G20 meeting, U.S. Treasury Secretary Janet Yellen said the country is not pushing for an outright banning of crypto activities.$Bitcoin $BTC $SHIB #BITCOIN #BTC #SHIB 🚀$HOGE $SAITAMA $BNB $DOGE $ETH https://t.co/dEiiRvsxIV

— SHIB Bezos (@BezosCrypto) February 26, 2023

“So you’re telling us there’s a chance… Yeeaaaahhh.”

Meanwhile, Gary “Rio Bravo” Gensler is waving his sheriff’s badge at anyone who’ll take notice. Which, I guess is most of the Cryptoverse, unfortunately. He’s, again, calling for “EVERYTHING other than Bitcoin” to be labelled a security.

Guess that includes the hard wallet full of speculative Chinese/AI/DeFi/gaming altcoins and NFTs at the back of your sock drawer. Probably the socks and the drawer, too.

https://twitter.com/BTC_Archive/status/1629823934492188672

Chair Gensler may have prejudged that every digital asset aside from bitcoin is a security, but his opinion is not the law. The SEC lacks authority to regulate any of them until and unless it proves its case in court. For each asset, every single one, individually, one at a time.

— Jake Chervinsky (@jchervinsky) February 26, 2023

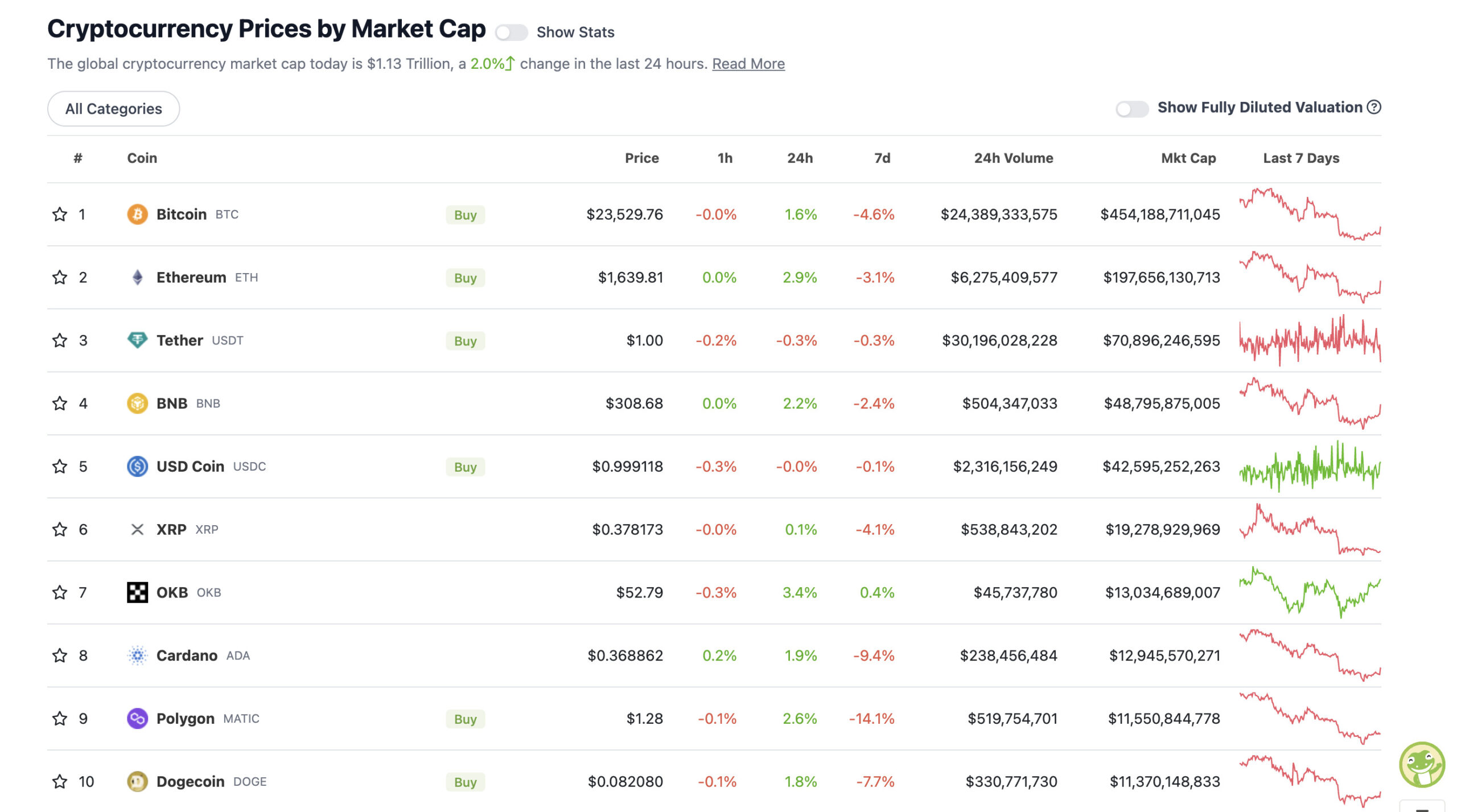

Top 10 overview

With the overall crypto market cap at US$1.13 trillion, up about 2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Hmm, Dogecoin has nosed its way back into the top 10. In fact, it was there on Friday, too. What’s been nudged out? Just the BUSD stablecoin. Nothing to see there, really, although that thing’s been slipping ever since Gensler and the SEC decided to have a bit of a chat with the stablecoin’s former issuer Paxos.

Other than that, though, things are largely green on the daily timeframe here, thanks to a late weekend surge. Let’s not get ahead of ourselves, though – it’s hard to trust weekend trading activity in a market that’s still so heavily correlated to US stocks action, despite some saying we’re starting to see a shift there.

As for that weekly close target. The likes of serial chart watchers such as Rekt Capital seem to think the US$23,400 level is important for both the weekly close (in a few hours at the time of writing) and the monthly close, lest Bitcoin sees a technically-influenced based dip of some potential significance.

At the moment, things are on target for some positive movement. But both bulls and bears are right in play here. As usual.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$10.9 billion to about US$472 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Defigram (DFG), (market cap: US$501 million) +1175%

• Klaytn (KLAY), (mc: US$955 million) +12%

• Maker (MKR), (mc: US$699 million) +10%

• NEO (NEO), (mc: US$887 million) +10%

• Optimism (OP), (mc: US$648 million) +10%

Okay… so let’s briefly talk about Defigram (DFG), which we’re reluctant to do, because we’re wary. That is an absolutely insane pump out of total flatline territory. And, frankly, there’s not a lot of news to support it, which makes us nervy about potential behind-the-scenes pump-and-dump action going on there.

What even is it? According to its Twitter account, it’s: “a new social platform integrating decentralized wallet and Telegram communication, dedicated to building a most efficient & valuable social network.”

Steering. Clear. Until we learn more.

DAILY SLUMPERS

• IOTA (MIOTA), (market cap: US$699 million) -3%

• OKC (OKT), (mc: US$569 million) -2%

• Frax (FRAX), (mc: US$1 billion) -1%

• Quant (QNT), (mc: US$1.9 billion) -1%

Around the blocks

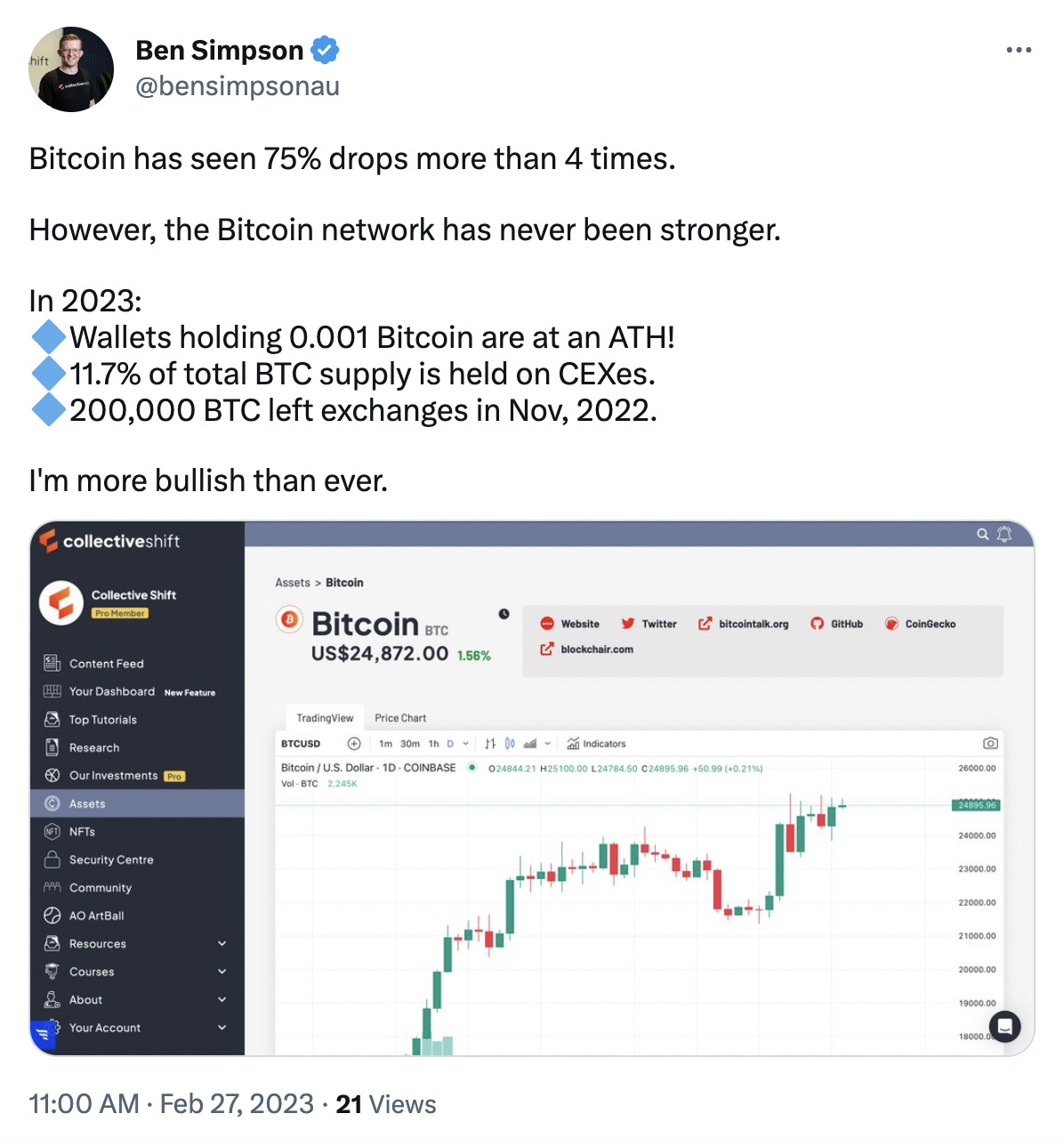

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.