Mooners and Shakers: Coinbase launches Base network; OP token pumps; Bitcoin still near $24k

Some Coinbase staff, yesterday. (Getty Images)

A fair bit happened in the crypto industry overnight, as per. And, as per, we’ll try to give you the gist. Basically, Bitcoin and the market is flat, Coinbase launched something and some tokens are up, some are down.

There you go, you’re welcome. A bit more info? We’ll start with America’s biggest crypto exchange.

Coinbase launches Base network

Coinbase has, overnight, announced the launch of Base – a new “layer 2” network (a blockchain built on top of another to scale or provide extra capabilities) with the aim of attracting millions of crypto users in coming years.

2/ Base is a platform for developers to build the next generation of decentralized apps in the cryptoeconomy.

It is designed as a secure, low-cost, developer-friendly platform that enables anyone, anywhere, to build.

— Brian Armstrong (@brian_armstrong) February 23, 2023

Built on the existing Ethereum L2 tech stack Optimism, the aim, explained Coinbase developer Jesse Pollak, is to “onboard one billion users into the crypto economy”.

“In pursuit of this goal, he said, “Base will serve as both a home for Coinbase’s on-chain products and an open ecosystem where anyone can build.”

And by building, he means decentralised apps (dApps), as, according to Will “Lost in Space” Robinson – the VP of engineering at Coinbase – the Base network intends to incubate new projects within the Coinbase company structure at first, with the aim to “progressively decentralise the chain over time”.

Cool, so where’s our free, airdropped token? Nope… unlike other Layer 2s in this increasingly crowded niche of crypto, there won’t be a token.

“But our thesis is that tokens are not the only way to drive activity,” he told US crypto media outlet Decrypt. “Building great products is a great way of driving activity by making things actually useful.”

Nevertheless, the collaborating Layer 2 in this venture, Optimism does have a token economy, and its OP token pumped overnight. The token moved from US$2.36 to $3.01 on the news – a 20% increase. It’s currently pulled back a tad since then, however – see further below.

Top 10 overview

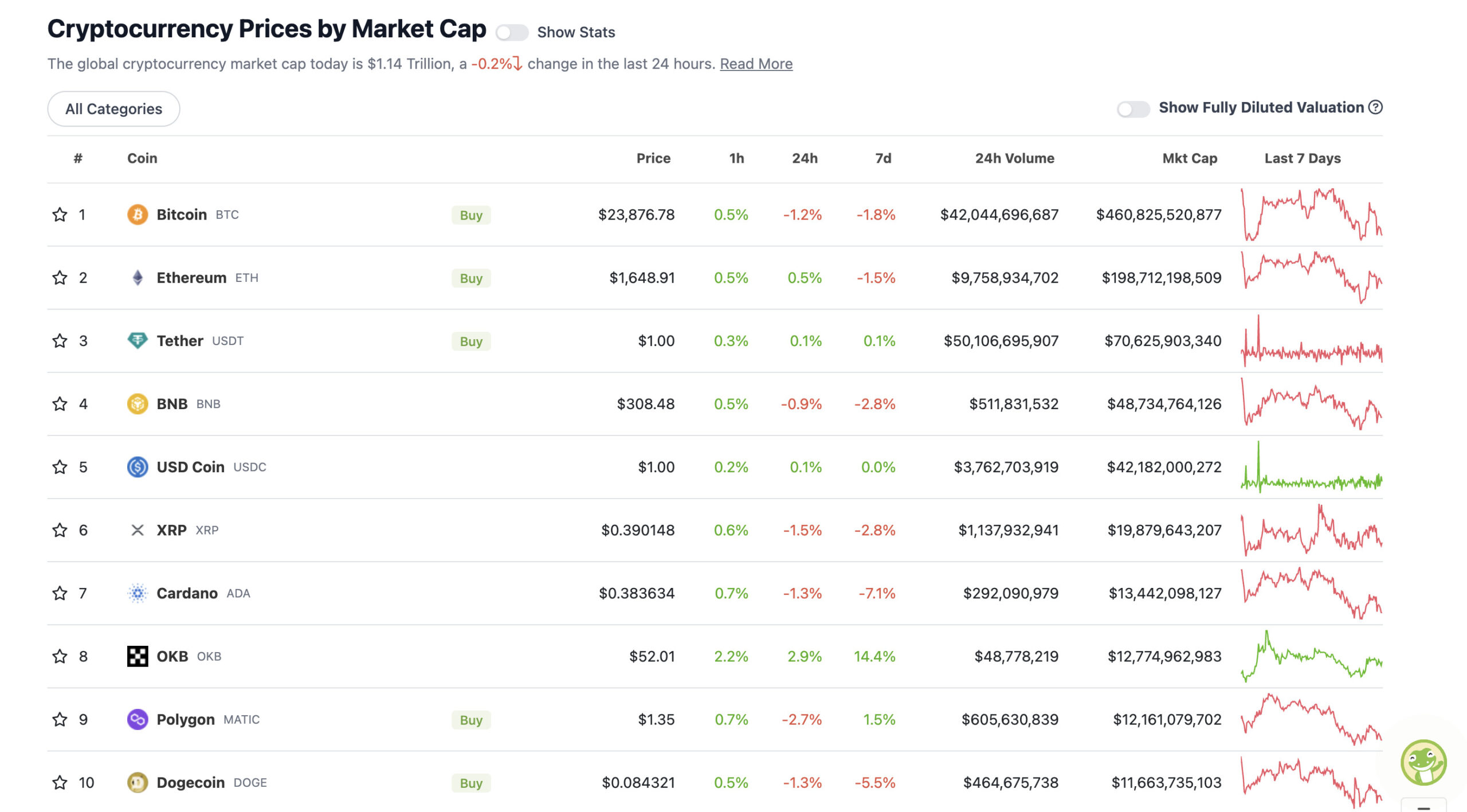

With the overall crypto market cap at US$1.14 trillion, pretty flat since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Bitcoin (BTC) continues its fairly unenthusiastic politician/dad dance around the US$24k mark for now, then. And Crypto Twitter analysis (which admittedly can be a hell of a lot of confusing white noise) seems to be increasingly all over the shop. A shop filled with bears and bulls blabbing predictions based on lines on charts, fears of rate hikes and recession, and the power of FOMO.

We’ve heard US$30k and $40k BTC predictions for this first quarter or half of the year, and we’ve also heard traders calling for fresh local lows below US$15k.

But here’s a fairly measured response from US analyst Justin Bennett who is watching the US dollar for stocks and crypto directional cues and clues at the moment.

Keep a close eye on this $DXY 105 area.

It's been a pivot since last May, so watch for a rejection or reclaim in the coming days.

Extends as high as 105.60.#stocks #crypto pic.twitter.com/bnKQOXiMMl

— Justin Bennett (@JustinBennettFX) February 23, 2023

He also notes in a separate tweet regarding the currency markers, “this is not about being bullish or bearish right now. Rising and falling wedges aren’t inherently bearish or bullish, respectively. It’s just a pattern and only offers directional cues with confirmation.” Fair enough.

Meanwhile, as for Ethereum, Ryan Sean Adams from the Bankless crypto podcast and video shows believes the Coinbase Base L2 announcement is bullish for ETH.

Coinbase is launching a Layer 2.

Coinbase has 110 million users.

They're going to onboard them all to Ethereum.

This is a massive day for Ethereum.

This is how the world goes bankless.

— RYAN SΞAN ADAMS – rsa.eth 🦄 (@RyanSAdams) February 23, 2023

Uppers and downers: 11–100: Enjin, Stacks and OP pump

Sweeping a market-cap range of about US$11.6 billion to about US$484 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Enjin (ENJ), (market cap: US$539 million) +13%

• Stacks (STX), (mc: US$1.12 billion) +12%

• Optimism (OP), (mc: US$627 million) +7%

• Synthetix (SNX), (mc: US$825 million) +5%

• Conflux (CFX), (mc: US$617 million) +4%

Some reasoning behind some of these pumps, then. As discussed, Optimism is the base layer for, er Coinbase’s Base network and that’s why its OP token has been surging overnight. Some real… “based” info there, right?

Extremely based for @Coinbase to fee share with the @Optimism collective and commit to core development of the OP stack

Congrats to everyone involved, incredibly excited about this vision for the future 🚀 https://t.co/u7FXKk26TG

— Hayden Adams 🦄 (@haydenzadams) February 23, 2023

As for Enjin, which is one of the leading GameFi, NFT and metaverse-focused crypto ecosystems, it’s a little harder to ascertain what that uptick in price and activity for the ENJ token is about.

The Efinity NFT project and token (EFI), which is built on the Enjin tech stack, was approved by regulators to operate in Japan a week or so ago. That makes it, along with Enjin, one of a small amount of metaverse/gaming-focused approved and regulated projects operating in that region. Maybe it has something to do with that, but we’re reaching.

And regarding Stacks (STX) – the Bitcoin layer 2 network is seeing a surge of activity on the back of the Ordinals non-fungible assets buzz.

DAILY SLUMPERS

• NEO (NEO), (market cap: US$904 million) -5%

• Tezos (XTZ), (mc: US$1.24 billion) -5%

• Monero (XMR), (mc: US$2.7 billion) -4%

• 1inch (1INCH), (mc: US$490 million) -4%

• Fantom (FTM), (mc: US$1.38 billion) -3%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Very clear that Wall Street has no idea how to price an L2 with Coinbase still trading at prices of less than last week despite this announcement 🤣

Their loss, my gain.$COIN's earnings next cycle will be a game changer.

— Adam Cochran (adamscochran.eth) (@adamscochran) February 23, 2023

-L2's make $100M+/year on sequencer fees even in a bear market, with <500k users.

-Coinbase has 110M users.

-Account abstracted chain means ability to use Coinbase KYC to add RWAs

-Fast, scalable, cheap L2 plugged directly into the app makes it easy for retail to use defi.— Adam Cochran (adamscochran.eth) (@adamscochran) February 23, 2023

Hmm, here’s an interesting rumour spread from “Australia’s crypto queen” Eunice Wong, regarding the developing Web3 music platform Audius…

Some birdy tells me $AUDIO announcing Sony partnership and integration with TikTok 👀 pic.twitter.com/ygouXZY1Us

— Eunice D Wong 🦄 (@Eunicedwong) February 23, 2023

JUST IN: 🇩🇪 Germany's 2nd largest bank DZ to offer #Bitcoin and crypto to institutional clients 🙌

— Bitcoin Magazine (@BitcoinMagazine) February 23, 2023

https://twitter.com/naiivememe/status/1628768835888361472

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.