Mooners and Shakers: Bitcoin adopted as legal tender by Central African Republic; market flat as DXY surges

Getty Images

While the US dollar parties on for now, patience is the order of the day, week, month and year for crypto investors. Meanwhile, the Central African Republic is doing its best El Salvador impression with Bitcoin adoption.

The landlocked African nation (population: 4.83 million) has now passed legislation to recognise Bitcoin as a legal tender, which makes it the second country to do so. El Salvador was famously the first, last September.

Looks like #Bitcoin is really the official currency of the Central African Republic. There are laws that will govern "crypto" but only Bitcoin is mentioned as being currency. Nice! https://t.co/vQvbOnxjyc

— Samson Mow (@Excellion) April 27, 2022

Other territories have also “swallowed the orange pill” in recent months, making moves to adopt BTC. These were announced recently at the Bitcoin 2022 conference in Miami and include: Prospera, a jurisdiction on the island off the northern coast of Honduras, and Madeira, an autonomous region in Portugal.

The African news is bigger than those two, but as yet none of this has done much to move the price of Bitcoin back in a positive direction, which is strong indication of the cautiousness in the market right now. And that’s largely related to global/macroeconomic factors including inflation, and recession speculation.

Central African Republic in the Heart of Africa #Bitcoin pic.twitter.com/Br0NCn7CnF

— Conquer (@Bitcoinwojak) April 27, 2022

Still, the news is welcome for crypto hodlers and speculators after a market-deflating couple of days, which you can gain a sentiment visual on through the Crypto Fear & Greed Index right now…

Also making crypto news: Dragonfly and 21Shares

• US and Asian VC firm Dragonfly Capital has raised a whopping US$650 million for its third venture fund, focused on “new digital economies”, bringing the company’s assets under managment to around US$3 billion.

The crypto and blockchain championing fundraise was oversubscribed and led by investment giants Tiger Global, KKR and Sequoia China, among others.

(Wait, China? Crypto-fudding China? Hmm… they’re into blockchain tech, but how long will it be before the CCP reverses its stance on crypto more broadly? Market-moving hopium for another day, perhaps.)

• Swiss firm 21Shares, the world’s largest issuer of crypto exchange-traded products, has teamed up with UK-based ByteTree to launch an ETP that combines Bitcoin and gold. It’s called the… wait for it… BOLD ETP. See what they did there? Guess Gitcoin was already taken. Now, where’s a comment on this from Peter Schiff when you need it?

Top 10 overview

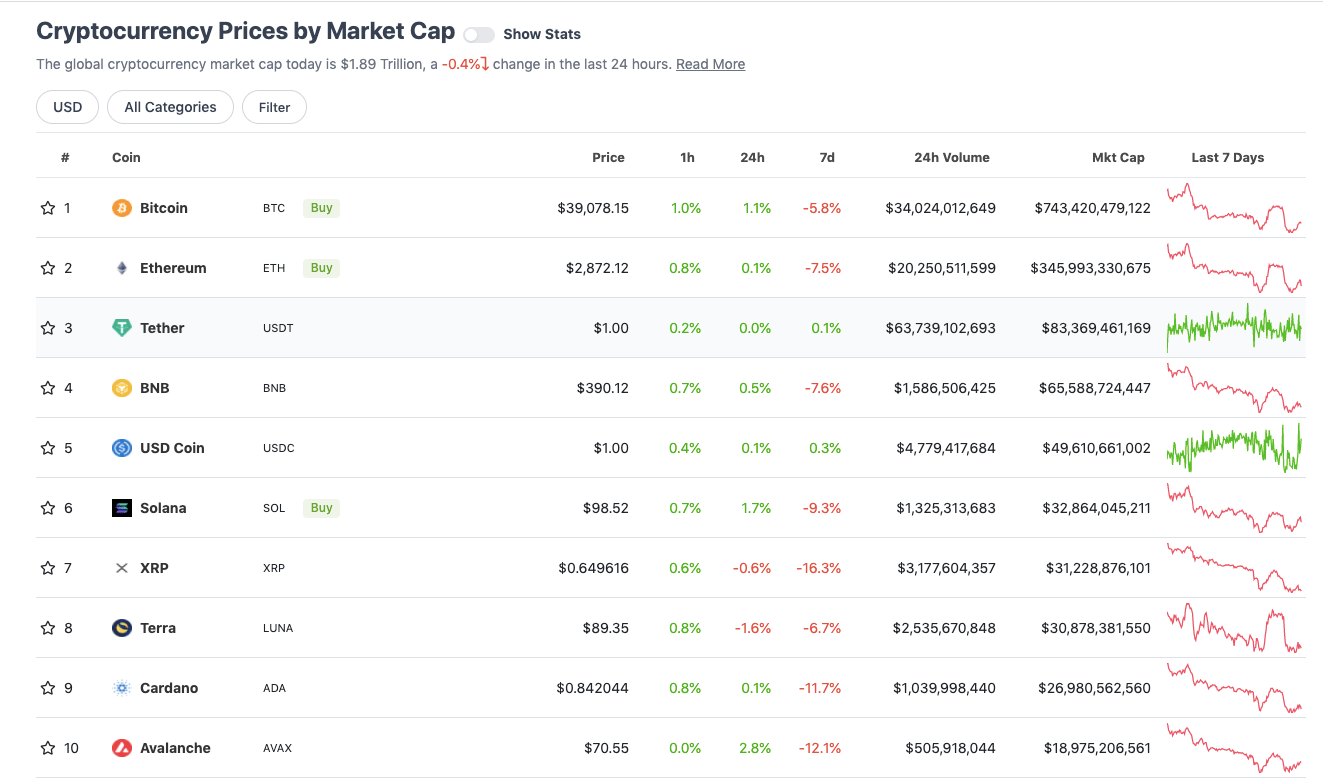

With the overall crypto market cap at roughly US$1.89 trillion, down a fraction since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Yesterday, we reported in this column that Dogecoin (DOGE) was pumping on the back of Elon Musk’s Twitter purchase. And it was, until about 10 minutes after we hit publish it seems.

Timing this stuff is difficult, as crypto moves faster than we can type and even think sometimes. We’ve called the crypto market flat in the headline… now it’ll probably either pump or dump by 20 per cent once we put this one to bed…

Anyway, DOGE has slumped off to its kennel again, outside the warmth of the top 10. Layer 1 protocol Avalanche (AVAX) reclaims a seat at the table with the majors. Polkadot (DOT), meanwhile, is standing just outside at #11, throwing a ball round with the canine meme.

As for the big dog, after losing US$40k and tumbling down under $38k yesterday, Bitcoin (BTC) is currently holding up better than some bears were predicting, bouncing off some support around US$38k.

Here’s what fulltime traders and Twitter-dwelling Bitcoin analysts Rekt Capital and Michaël van de Poppe are seeing this afternoon…

#BTC is forming a spinning-top candle at the Higher Low

Spinning top candlesticks signal uncertainty in the market but also tend to precede trend reversals

Candle could change until the Weekly Close but worth paying attention to the developing psychology$BTC #Crypto #Bitcoin pic.twitter.com/vYaeNv8mWR

— Rekt Capital (@rektcapital) April 27, 2022

When it comes to a potential #Bitcoin reversal or break-out of this structure, we need a 'weak' Dollar to act.

In that case, the $DXY is approaching key levels with those previous highs.

I think it's sweeping the highs there for liquidity and reverse -> equities & #Bitcoin up. pic.twitter.com/TVFhRyv2a1

— Michaël van de Poppe (@CryptoMichNL) April 27, 2022

As for the US Dollar Index (DXY)… yep, it’s still heading up right now: +0.66% in the past 24 hours. What goes up, must come down? Yeah, eventually, but short to midterm, the ball’s largely in the interest-rate-hiking US Federal Reserve’s court.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$18.8 billion to about US$974 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Convex Finance (CVX), (mc: US$1.6 billion) +10%

• STEPN (GMT), (market cap: US$2.14 billion) 8%

• Arweave (AR), (mc: US$1.4 billion) +8%

• ApeCoin (APE), (mc: US$5.5 billion) +7%

• Amp (AMP), (mc: US$1 billion) +5%

DAILY SLUMPERS

• Synthetix (SNX), (mc: US$1.27 billion) -11%

• The Graph (GRT), (mc: US$2.45 billion) -9%

• Monero (XMR), (mc: US$4.1 billion) -6%

• Chain (XCN), (mc: US$1.46 billion) -5%

• NEAR Protocol (NEAR), (mc: US$8.8 billion) -5%

Uppers and downers: lower caps

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Raiden Network Token (RDN), (mc: US$13m) +57%

• STEEM (STEEM), (market cap: US$217 million) +30%

• Step App (FITFI), (mc: US$57m) +25%

• XCAD Network (XCAD), (mc: US$118m) +24%

• Ethereum Name Service (ENS), (mc: US$417m) +21%

DAILY SLUMPERS

• Redacted Cartel (BTRFLY), (mc: US$94m) -25%

• Netvrk (NTVRK), (mc: US$36m) -15%

• Velas (VLX), (mc: US$298m) -14%

• Savanna (SVN), (mc: US$117m) -13%

• Balancer (BAL), (mc: US$157m) -12%

Around the blocks: Optimism goes OP with token airdrop

The rumours are true… Ethereum layer 2 scaler Optimism has announced a governance token (OP) which is being launched with an airdrop.

Today, @optimismPBC is introducing the Optimism Collective and its token $OP 🔴_🔴

This is the most thoughtful airdrop crypto has ever seen.

A two-house system, culture of experimentation, and 250k drop recipients. Let's break it down:

1. ECONOMICS

2. GOVERNANCE

3. AIRDROP #1— b0bby (@b0bby) April 26, 2022

Do you qualify as one of the 250k-plus addresses eligible for the drop? Depends how you’ve interacted with the protocol and on Ethereum more broadly…

Over 250k addresses are eligible via a carefully thought out set of criteria, proportionally rewarding addresses for healthy use of the ecosystem.

There is an overlap bonus for hitting 4 or more criteria.

You can check eligibility for Airdrop #1 here: https://t.co/LOyiLEqnVz pic.twitter.com/D9eHDkdAEW

— Optimism (@Optimism) April 26, 2022

There will actually be multiple airdrops, so if you don’t qualify for this one, it’s possible you may still be able to nab subsequent drops. You can check to see if you’re a chosen one via the Optimism Governance Page.

Aussie-founded crypto education platform Collective Shift gives a great lowdown on it all here…

Optimism Token Airdrop Analysis with @MrCartographer_ now! https://t.co/SHIjOSAsj4

— Ben Simpson (@bensimpsonau) April 27, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.