Mooners and Shakers: Bitcoin bounce hits wall; DOGE up after Elon Musk Twitter buy; Aussie crypto ETF delayed

Bitcoin stalls as DOGE bounces (Getty Images)

Elon Musk buys Twitter, Dogecoin pumps, Bitcoin dips and Australia’s Cosmos BTC ETF is delayed. Crypto… “it’s all happening”, as Bill Lawr… ah never mind.

We’ll get to what’s happening with Bitcoin’s price a little further below. But first, a quick catch-up on some of the latest news…

‘The Dogefather’ buys Twitter, DOGE pumps into top 10

Unless you’ve been living under a rock (or just living your life), you’ll probably know by now that Tesla and SpaceX billionaire CEO Elon Musk has become the sole shareholder of Twitter. If you’re a holder of Dogecoin, then you’ll definitely know.

With a 12% rise over the past 24 hours (although dipping with the rest of the market as this is typed), DOGE has bounded back into the top 10 again, surpassing Polkadot and Avalanche, with its sights set on Cardano’s no.9 slot.

After finding US$44 billion down the back of his sofa, Musk finally twisted the Twitter board’s ultimately rubber arm (“Oh, go on then”), which sold the company’s shares at US$54.20 a piece.

🚀💫♥️ Yesss!!! ♥️💫🚀 pic.twitter.com/0T9HzUHuh6

— Elon Musk (@elonmusk) April 25, 2022

Dogecoin’s biggest advocate, Musk says he intends to unlock Twitter’s “tremendous potential”, which for many would mean his freedom-of-speech crusade. DOGE hodlers, however, are probably far more interested in potentially even more exposure for their canine-themed meme-coin investment.

Musk has recently been angling for Twitter’s premium paid services to add Dogecoin as a payments option. Tesla, meanwhile, began accepting DOGE payments for merchandise late last year.

Maybe even an option to pay in Doge?

— Elon Musk (@elonmusk) April 10, 2022

Aussie Bitcoin ETF delayed; Fidelity to offer Bitcoin retirement option

• Just hours before they were due to go live on the CBOE Australia (CXA) stock exchange, the crypto-focused Cosmos Asset Management and ETF Securities funds have hit a roadblock. Although, it could just be a formality-based delay.

The funds include the Cosmos Asset Management’s Bitcoin ETF – which would’ve become Australia’s first Bitcoin exchange-traded fund. (The 21Shares ETF, also set to launch this week will become the nation’s first spot – directly or “physically” backed – Bitcoin ETF.)

“Standard checks prior to the commencement of trading are still being completed,” explained CBOE Australia.

Bloomberg’s Senior ETF Analyst Eric Balchunas garnered some global cryptoverse excitement for the ETFs in some Twitter posts last week…

UPDATE: Looks like 21Shares is actually going to be first out (next week) with a physically backed spot bitcoin and ether ETF. The Cosmos one is a) going to hold Purpose's Canada ETF and b) launch after. None of this was in the article, so correcting here.

— Eric Balchunas (@EricBalchunas) April 19, 2022

• A pretty big deal for crypto’s good old mainstream-adoption narrative… US institutional financial services giant Fidelity Investments has today announced it will be allowing Bitcoin to be included in its investors’ 401(k) retirement accounts. (Think superannuation in Australia.)

It’s the first major retirement-plan provider in the US to make an allowance for Bitcoin or any crypto, and one of the first in the world. It’ll likely come into play some time in the second half of this year.

As @MicroStrategy continues to be a pioneer in bitcoin for corporations, we are planning to offer our employees the option to invest in #bitcoin as part of their 401K portfolio. $MSTR pic.twitter.com/xBFeEugJVj

— Michael Saylor⚡️ (@saylor) April 26, 2022

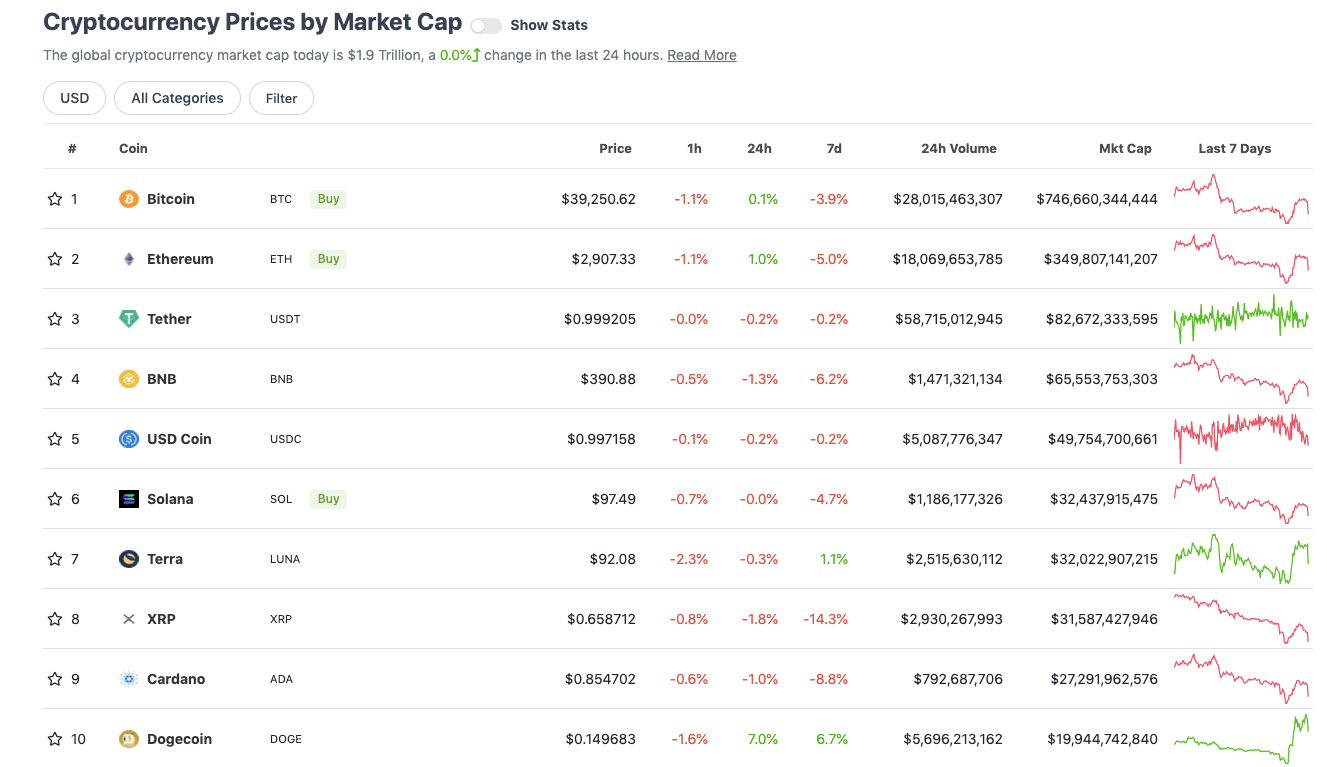

Top 10 overview

With the overall crypto market cap at roughly US$1.9 trillion, flatlining since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Bitcoin (BTC) has lost its psychological support level of US$40k in just the past hour or so at the time of writing.

The market, aside from full-time bears, was obviously hoping for a bit more than just a relief pump, so does this put the OG crypto back in peril of spiralling significantly lower?

Dutch trader and full-time crypto analyst Michaël van de Poppe feels it’s important for Bitcoin to hold support at pretty much the exact level it’s at right now…

This was the crucial one to break for #Bitcoin in the beginning (around $39.2K).

Important to see whether it can sustain support now. pic.twitter.com/1tA6FTRT0P

— Michaël van de Poppe (@CryptoMichNL) April 26, 2022

… But even if the dip continues once again, he suggests Bitcoin has actually been playing in pretty stable territory. And it’s true – despite its famed volatility, the asset has been largely ranging between the high $30ks to mid $40ks all this year so far.

One asset is in a bull market: The Dollar.

But I must say that, despite this massive strength of the Dollar, #Bitcoin remains relatively stable and hasn't been nosediving.

— Michaël van de Poppe (@CryptoMichNL) April 26, 2022

Meanwhile, here’s the extreme hopium POV…

#BITCOIN NEW INTRADAY MARKET BULL RUN SIGNAL ! 🚨🚨

AN HISTORIC BULL MARKET IS ABOUT TO START. 🔥🔥

2W TIMEFRAME.#BTC #CRYPTO pic.twitter.com/RUWjCylZ6z

— AO (@AurelienOhayon) April 26, 2022

… annnnd, the wet-blanket realist POV, as probably a good reminder of a few things (such as global inflation and potential recession)…

It’s amazing when we get a 2% news based pump the entire market turns bullish again.

Remember the external factors:

– recession

– distribution

– capitulationThis market is far from a bullish sentiment.#bitcoin #cryptocurrency #cryptotrading

— Roman (@Roman_Trading) April 26, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$18.9 billion to about US$966 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Synthetix (SNX), (mc: US$1.39 billion) +15%

• The Graph (GRT), (market cap: US$2.7 billion) 14%

• Aave (AAVE), (mc: US$2.35 billion) +6%

• Zcash (ZEC), (mc: US$1.97 billion) +5%

• STEPN (GMT), (mc: US$2 billion) +2%

DAILY SLUMPERS

• PancakeSwap (CAKE), (mc: US$2.2 billion) -13%

• Chain (XCN), (mc: US$1.54 billion) -6%

• Arweave (AR), (mc: US$1.29 billion) -5%

• Waves (WAVES), (mc: US$1.58 billion) -4%

• Maker (MKR), (mc: US$1.5 billion) -3.7%

Uppers and downers: lower caps

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• BEPRO Network (BEPRO), (market cap: US$36 million) +21%

• ZoidPay (ZPAY), (mc: US$405m) +21%

• Gamium (GMM), (mc: US$37m) +18%

• GenesysGo Shadow (SHDW), (mc: US$50m) +17%

• Exeedme (XED), (mc: US$18m) +17%

DAILY SLUMPERS

• LCX (LCX), (mc: US$64m) -53%

• dotmoovs (MOOV), (mc: US$43m) -22%

• Numeraire (NMR), (mc: US$161m) -16%

• inSure DeFi (SURE), (mc: US$141m) -14%

• Waltonchain (WTC), (mc: US$12m) -14%

Around the blocks

✨ 11 years ago today, Satoshi Nakamoto sent his final message then disappeared from #Bitcoin forever

— The Bitcoin Historian (@pete_rizzo_) April 26, 2022

Elon’s goal of creating a platform that is “maximally trusted and broadly inclusive” is the right one. This is also @paraga’s goal, and why I chose him. Thank you both for getting the company out of an impossible situation. This is the right path…I believe it with all my heart.

— jack (@jack) April 26, 2022

#BTC has dipped to the red area & even overextended below it

Technically, this may still be a volatile retest

Past yellow circles show that volatility relative to this red area is not uncommon$BTC needs to 4HR close in the red area for the retest to be alive#Crypto #Bitcoin https://t.co/5lsyrMybBM pic.twitter.com/PBzl9Pgvkp

— Rekt Capital (@rektcapital) April 26, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.