Mooners and Shakers: Binance Coin and crypto market slumps after SEC targets Paxos and BUSD

Getty Images

The SEC’s Gary “Pat Garrett” Gensler is at it again, riding in hot and bothered on a blazing saddle and spoiling any chance of a crypto market hoedown. This time, he’s got the Binance stablecoin BUSD and its issuer Paxos in his sights.

If you’re a crypto investor you’re probably all too aware of this by now this morning, as Bitcoin and the whole market took a sharp dip overnight (AEDT). Which was a right roiler, seeing how correlated crypto still is to Wall Street’s Nasdaq and S&P 500 – both closing nicely, if surprisingly, in the green ahead of this week’s US CPI data.

But for those who are in the dark here, in a nutty shell, as reported last night by the Wall Street Journal, the US Securities and Exchange Commission says it intends to sue Paxos Trust, the issuer of the stablecoin Binance USD (BUSD) – the market’s third largest stablecoin.

Gensler once described stablecoins as “poker chips in a Wild West casino“, so perhaps this initial move should come as no big surprise.

The threat came to Paxos in the form of a “Wells notice” letter that alleges the dollar-pegged BUSD is being issued as an unregistered security. On the same day, New York regulators ordered Paxos to cease issuing BUSD.

All this comes only a few days after the SEC’s staking-as-a-service crackdown on the crypto exchange Kraken in the US. And the crypto industry in America is particularly concerned that both actions are precedents of sweeping, stifling, regulatory enforcements to come right across the space.

There has also been confusion about the labelling of the BUSD stablecoin as a security, with regards to the SEC’s adherence to the 1930s era “Howey Test”. Those guidelines state that an asset can be classified as security if there is an “investment of money in a common enterprise and there is expectation of profits derived from the efforts of others”.

“Expectations of profits” on a stablecoin that’s pegged to the US dollar? Things that make you go, hmm. Here’s some reaction from various Crypto Twitter commentators…

Yes, I’m aware that technically it doesn’t need to pass the Howey Test to be considered a security.

The SEC basically has free reign to define an investable asset as a security if it wishes to.

But it undoubtably sets a scary precedent. https://t.co/2y7RoST3wh

— Miles Deutscher (@milesdeutscher) February 13, 2023

Tons of projects (and their lawyers!) desperately *want* to come in and register. But when they do, they’re just told “no.” Or worse, they draw a Wells notice (or, as @HesterPeirce said, a court date). 2/6

— Jason Gottlieb (@ohaiom) February 11, 2023

SEC protected you against:

– BUSD, a fully backed, regulated stable allowing protection from volatility

– Kraken, solvent transparent exchange with real staking servicesSEC allowed you:

– FTX

– LUNA

– Celsius

– Voyager

– 3AC

– many more with 0 chance of getting money back pic.twitter.com/VtEFzH3i4C— Clouted (@CloutedMind) February 13, 2023

Top 10 overview

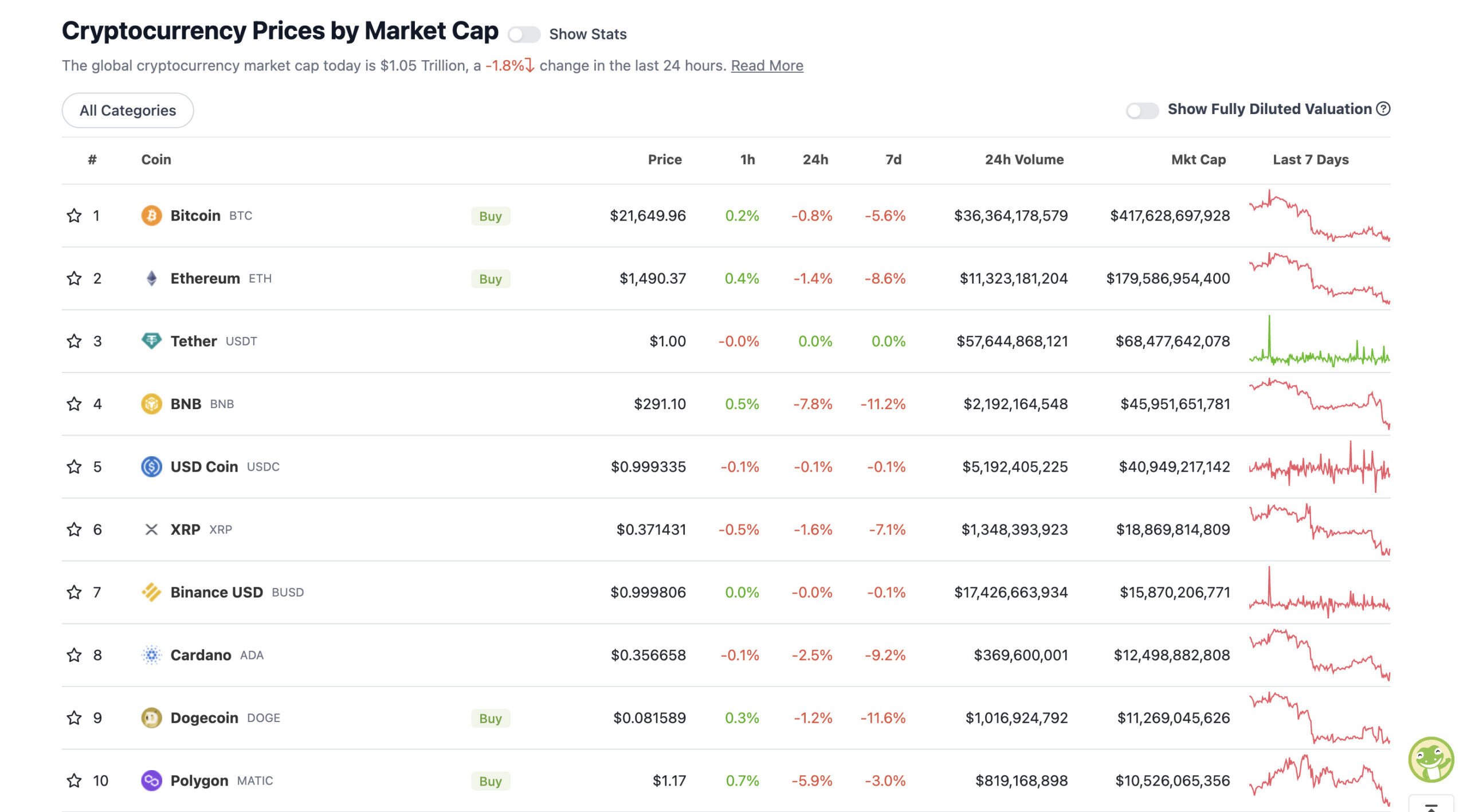

With the overall crypto market cap at US$1.05 trillion, down about 2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Binance Coin (BNB) is leading the blood-letting today in the majors, as you might expect given the ecosystem relationship between it and BUSD and the regulatory scrutiny on the latter.

Polygon’s MATIC is also taking something of a daily tumble, but, more broadly all of the top 10 coins have been dipping over the past week.

Meanwhile, Gary Gensler’s gunslinging aside, keep an eye on the looming “all important” CPI data, as market analyst Tony Sycamore notes. It’s likely to be a key mover for both stonks and crypto.

U.S #stock #markets 💪 ahead of tonight’s all-important #CPI data.

Presuming headline inflation does print at 6.2% (0.4% MoM) or <, it will likely see the #SP500 test and break recent highs. Aware that should it print at 6.5% or >, stocks will be smoked & the #USD rip⬆️ #NDX pic.twitter.com/fYKnz9W03h

— Tony Sycamore_IG (@Tony_Sycamore) February 13, 2023

Uppers and downers: 11–100

Sweeping a market-cap range of about US$9.9 billion to about US$436 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• BinaryX (BNX), (market cap: US$447 million) +12%

• Curve DAO (CRV), (mc: US$776 million) +11%

• Maker (MKR), (mc: US$686 million) +11%

• Convex (CVX), (mc: US$456 million) +9%

• Aptos (APT), (mc: US$2.3 billion) +5%

DAILY SLUMPERS

• Rocket Pool (RPL), (market cap: US$778 million) -13%

• OKC (OKT), (mc: US$467 million) -12%

• Mina Protocol (MINA), (mc: US$762 million) -10%

• Render (RNDR), (mc: US$436 million) -9%

• SingularityNET (AGIX), (market cap: US$442 million) -9%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Some more BUSD/Paxos commentary…

Don’t think this would make it a security but there is 50-50 revenue split between Paxos and Binance. Rev share in general probably is enough for Garry to overstep his jurisdiction

— Larry Cermak (@lawmaster) February 13, 2023

The following is understandable if you’re an Ethereum maxi, but it might be a tad drastic at this stage…

Exiting all stablecoins into ETH to protect myself from the SEC

— sassal.eth/acc 🦇🔊 (@sassal0x) February 13, 2023

The U.S. and USD is important.

But it is not the only country or currency on the planet.

Opting out of the future of money and technology is a choice.

Not a good one, but they can join all the countries that opted out of the internet.

Oh .. wait..— Jamilist (@Jamilist) February 13, 2023

Meanwhile, on a lighter note, David Schwartz, the CTO of Ripple Labs got a decent annual performance review…

Got a raise!

— David "JoelKatz" Schwartz (@JoelKatz) February 13, 2023

… and it looks like Australia’s safe from any impending alien invasion.

Aliens map of earth pic.twitter.com/r8JMt5Lp3t

— BossLogic (@Bosslogic) February 12, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.