Mooners and Shakers: Aussie government gives crypto regulations update; AI coins have good weekend

Token mapping: Pretending to read a map, yesterday. (Getty Images)

Morning Coinheads. Another week, another handful of Satoshis ahead? It’s been a decent run up for crypto, but is that about to change? Bitcoin’s push has slowed a tad, but at least some AI crypto projects are having a moment.

We’ll get to that in a sec, but first a word… not from our sponsors, but the Australian government…

Australia’s ‘token mapping’ update

We didn’t quite get to this late on Friday afternoon, but there was some reasonably significant news regarding Albo and co’s crypto regulations approach.

In an update to its “token mapping” audit on the crypto industry, the Australian government released a consultation paper that asks the public and industry leaders to respond to the questions it poses.

Consultation open! Today we released the token mapping consultation paper. This consultation is part of a multi step reform agenda to develop an appropriate regulatory setting for the #crypto sector. Read paper & submit views @ https://t.co/4W2msjhP9B @ASIC_Connect @AUSTRAC pic.twitter.com/OGHuZEGvDp

— Australian Treasury (@Treasury_AU) February 2, 2023

Just a quick reminder, what is this “token mapping” business?

It’s essentially an information-gathering exercise being carried out in order to understand how to best effectively regulate the crypto industry in Australia. It was first announced and put in place by the Albanese government in August last year.

“Token mapping is the process of identifying the key activities and functions of products in the crypto ecosystem and mapping them against existing regulatory frameworks,” reads the new consultation paper.

The paper reveals that the government is essentially continuing its plans to regulate the industry this year with a “licensing and custody framework for crypto asset service providers in mid-2023”.

‘We need to be faster off the blocks’: Jonathon Miller

One of the main sectors of the industry that’s sweating on regs, and understandably, too, is the on-ramp/off-ramp and trading facilitators – crypto exchanges. Stockhead has received some commentary from a couple of the bigger players here…

“It’s a brilliant start to 2023 and a long-awaited consultation paper,” said Leigh Travers, CEO of Binance Australia.

“This is a great asset for education, particularly for policy-makers and institutions who are in the process of understanding the technical aspects of the crypto industry. This is the entree to the custody exchange and custody license paper main course coming in mid ’23.”

Meanwhile, Jonathon Miller, managing director for the Kraken exchange in Australia still has concerns over the timing/speed of the process:

“It’s excellent to see the Treasury team continue with its consultative approach to the development of a crypto licensing regime in Australia,” noted Miller, adding: “Our concern is that we’re getting further and further behind the rest of the world when it comes to developing a regulatory regime, and the uncertainty this brings does come with a cost.

“The EU has its Markets in Crypto-Assets (MICA) regulation drafted, the UK has the Financial Conduct Authority (FCA) regulatory regime and the British Virgin Islands has the Virtual Asset (Service Providers) Act (aka VASP) in place.

“Process is important, and we’d all much rather have great regulation that doesn’t need amendment, but we need to be faster off the blocks,” emphasised Miller.

“The ideal outcome is that we see the development of a crypto-specific regime in Australia – else we risk pushing square pegs into round holes of existing financial services regulation. Crypto is a global industry, far more than most. The quicker we can get harmonised global regulatory certainty, the better.”

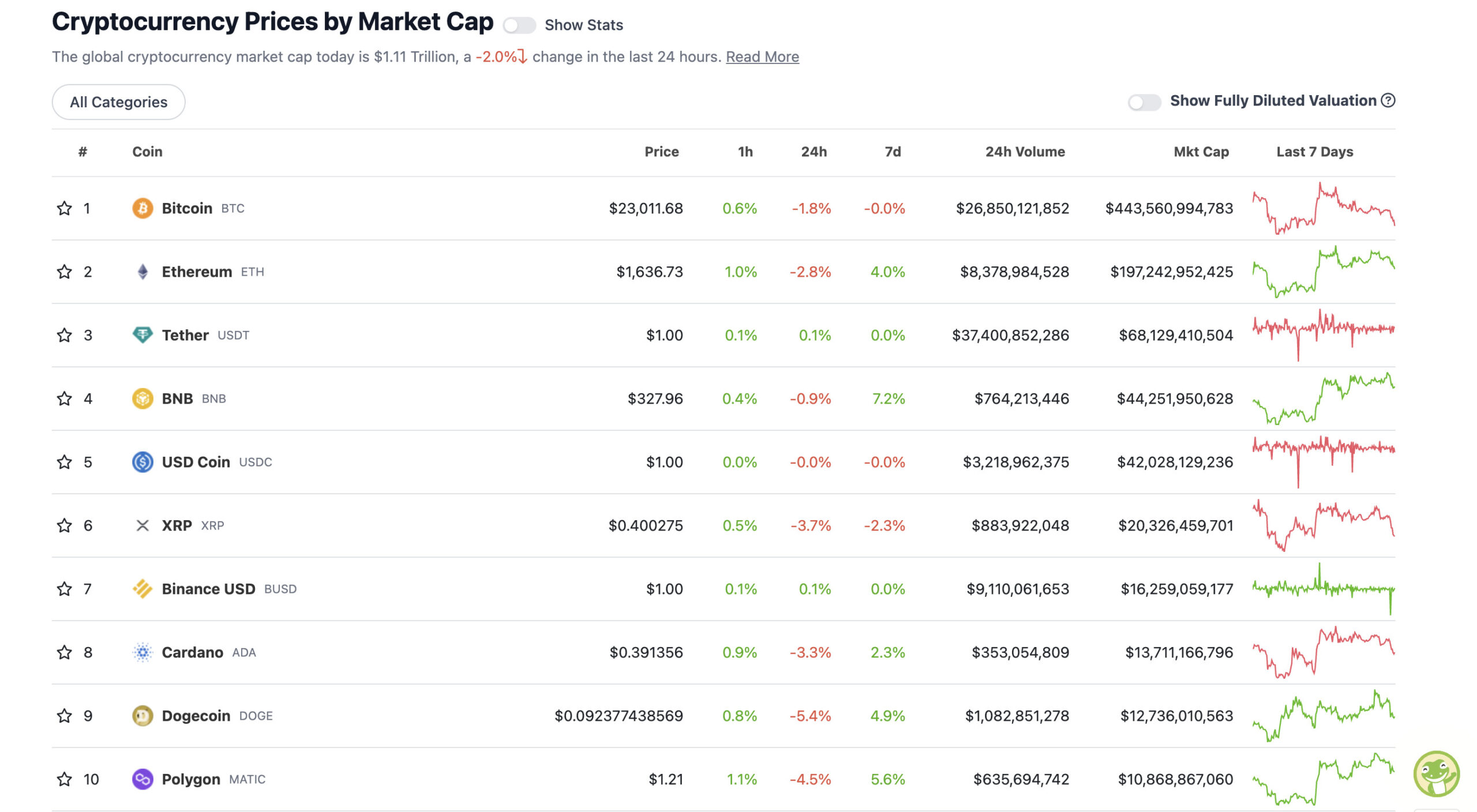

Top 10 overview

With the overall crypto market cap at US$1.11 trillion, down about 2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

So things are looking a little flat as we kick off the week here in Oz, but we’ll likely have a better feel for which way things are heading when Wall Street opens up, as per.

In the meantime, here’s what some analysts have been tweeting. Dutch trader Michaël van de Poppe thinks another US$300 added to Bitcoin’s current price, and we could see some continuation upwards.

#Bitcoin back in the range.

Drop beneath $21.7K is the ultimate liquidity sweep.

Levels at $22.3-22.7K would be a great entry as range low.

Break of $23.3K would mean continuation upwards.

Corrections are still relatively shallow.

— Michaël van de Poppe (@CryptoMichNL) February 5, 2023

Over in the vast, dominant American sector of Crypto Twitter, Roman Trading is also seeing some potential for Bitcoin to continue its rise in the short term…

$BTC LTF

Forming bull divs on H1-H4 with a bullish looking 1D. We’re seeing consolidation which generally implies continuation.

Unless we lose 22.7 and 22.4, it’s likely we continue higher.

Patience.#bitcoin #cryptocurrency #cryptotrading pic.twitter.com/iBtXooZSI7

— Roman (@Roman_Trading) February 5, 2023

Closer to home, though, highly experienced, Australian-based markets analyst Tony Sycamore is pointing to the performance of IG weekend-markets trading being a potential harbinger for risk assets pressure. Just something to keep in mind.

IG WEEKEND MARKETS suggest risk assets will be under pressure in the early stages of this week.#Markets #trading pic.twitter.com/FjIIxZTQ26

— Tony Sycamore_IG (@Tony_Sycamore) February 5, 2023

Uppers and downers: 11–100

Sweeping a market-cap range of about US$10.8 billion to about US$456 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• SingularityNET (AGIX), (mc: US$536 million) +43%

• Fetch.ai (FET), (market cap: US$470 million) +36%

• The Graph (GRT), (mc: US$1.15 billion) +15%

• Baby Doge Coin (BABYDOGE), (mc: US$457 million) +10%

• OKB (OKB), (mc: US$10.8 billion) +7%

As a crypto “narrative”, artificial intelligence is on fire right now, thanks, in part, to the attention the chat bot ChatGPT has garnered.

In fact, we included AI among our top crypto sectors to keep an eye on this year. And two of the category’s leading cryptos are crushing it today – Fetch.ai and SingularityNET.

A couple of positive tweets regarding both, that speaks to adoption and growth…

$FET finally made it into the top 100

Just wait until @BoschGlobal, @festo_global, @CATENAX_AutoNet, @Mettalex, @atomix_defi, and the rest begin to release their products using @Fetch_ai tech pic.twitter.com/iNPkyKYt16

— Levai 👾 (@KianuPicanto) February 5, 2023

#SingularityNET is bootstrapping an ecosystem of projects across multiple industry verticals that will drive platform growth and token utilization: #DeFi, #Robotics, Biotech & Longevity, #Gaming & Media, Entertainment, Enterprise-level #AI.

🔗Learn more: https://t.co/lhGv64iRds pic.twitter.com/XWGxUI4YDN

— SingularityNET (@SingularityNET) February 5, 2023

Meanwhile, GRT continues its recent good form and is now up 113% over the past month. The Graph is an open-source indexing protocol for querying data on the Ethereum blockchain and aims to enable a more efficient and decentralised way of accessing and utilising data.

Some people place it in the AI crypto camp, although “big data” might be the better way to categorise it. Nevertheless, in terms of Google searches for AI coins, it’s led the way over the past 12 months.

1️⃣[🟩🟩🟩🟩🟩🟩🟩⬜⬜⬜]2️⃣

Layer 2 is loading on The Graph Network.

Get ready for significantly lower gas fees, faster transactions & a more scalable decentralized network for all participants!

Stay tuned for news on scaling with L2 👀

— The Graph (@graphprotocol) February 3, 2023

DAILY SLUMPERS

• Lido DAO (LDO), (market cap: US$1.7 billion) -9%

• Fantom (FTM), (market cap: US$1.58 billion) -8%

• Curve DAO (CRV), (mc: US$771 million) -8%

• GMX (GMX), (mc: US$556 million) -8%

• Aptos (APT), (mc: US$2.5 billion) -8%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

What if the government attacks #Bitcoin 🤔

Here’s your answer…pic.twitter.com/vu2krkHSiz

— Bitcoin Archive (@BTC_Archive) February 5, 2023

#Bitcoin still shaking out the tourists before it moves up to $25,000. You really love to see it.

— Mike Alfred (@mikealfred) February 5, 2023

Meanwhile, is this “crypto addiction” rehab offering another potential sign of a bullish market returning? Not sure, but if it ever becomes overrun with clients, then another market top might be approaching fast.

Luxury rehab centres now offer therapy for 'crypto addiction' https://t.co/r6L1RiB74O

— BBC News (World) (@BBCWorld) February 5, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.