Mooners and Shakers: APE dips upon launch; Avalanche surges; Bitcoin holds above US$40k

Not bored: an ape struggles to stay afloat, earlier. (Getty Images)

Bitcoin and the crypto market in general are holding firm today, as US stocks trade up (S&P 500: +0.5%) and the US dollar trends down (-0.76%), at the time of writing. Meanwhile AVAX has been surging and APE launches with a dip.

Let’s grab a quick bird’s-eye view of it all…

Top 10 overview

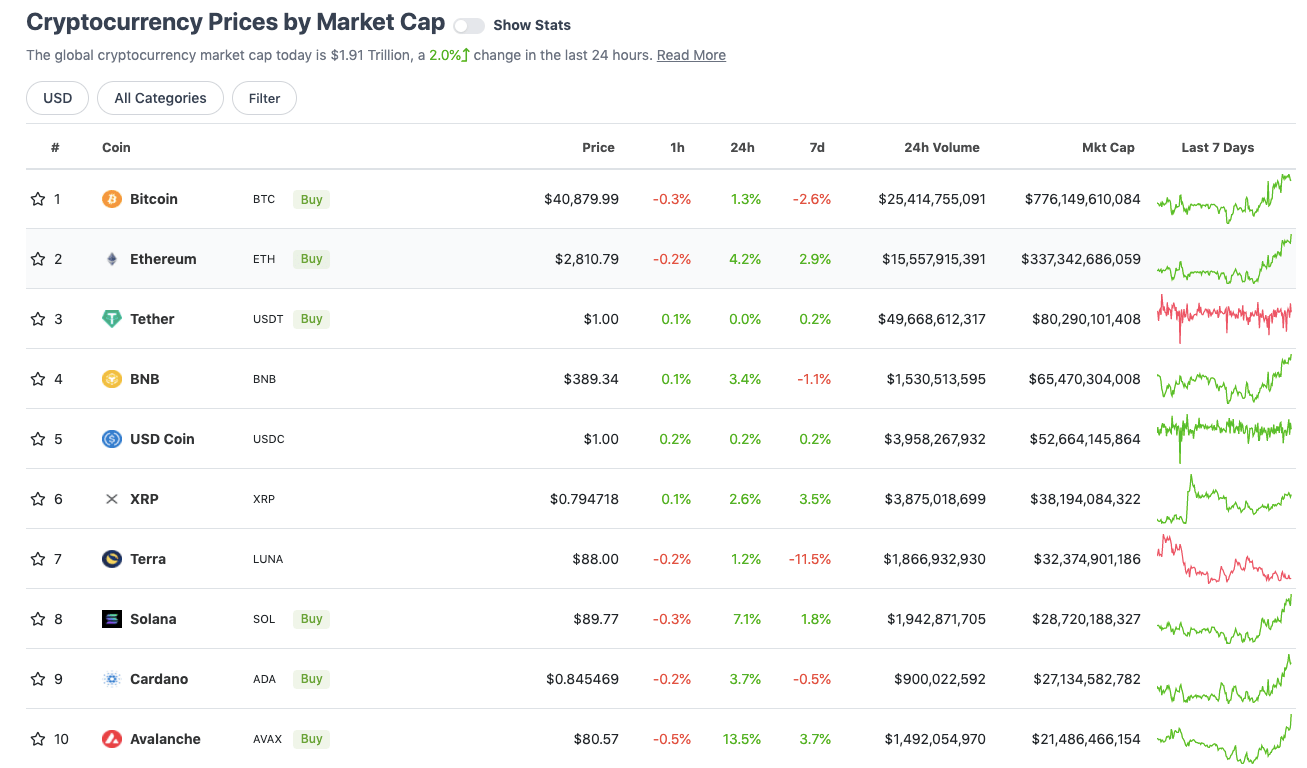

With the overall crypto market cap at about US$1.91 trillion, up about 2% from this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

The big mover in the top 10 today is Avalanche (AVAX), which has leapfrogged Polkadot (DOT) back into the bottom of this chart.

AVAX has risen a good 13 per cent over the past 24 hours amid Terra’s UST stablecoins being deployed on the Avalanche network. Users can now deposit, borrow and earn yields on UST deposits within the Avalanche ecosystem.

Well hello there…

Borrow and deposit $UST natively on $AVAX. pic.twitter.com/aQuOJHl37A

— Harry ⚡️🉐️ (@CryptoHarry_) March 17, 2022

Solana (SOL) is also another strong gainer on the daily timeframe, up about 7%. Coinbase has today added Solana ecosystem tokens to its self-custody “Coinbase Wallet”, which is the exchange giant’s new Chrome browser extension.

NEW: @CoinbaseWallet added support for @solana-based tokens. It's the self-custody app's first expansion beyond EVM chains.@realDannyNelson reportshttps://t.co/sevuFFyttT

— CoinDesk (@CoinDesk) March 17, 2022

Meanwhile, the crypto market’s two main health barometers, Bitcoin (BTC) and Ethereum (ETH), are holding steady for the moment. Yesterday they received a bit of a pump not long after the expected 25-basis-points rate hike from the US Federal Reserve.

If you’re after an extra Bitcoin hopium hit, though, here’s today’s take from Bloomberg Intelligence’s senior commodity strategist. Mike McGlone reckons inflation (and even war) could ultimately help Bitcoin’s “maturation” as an asset class and keep it outperforming gold this year…

Facing the #FederalReserve, inflation and war, 2022 may be primed for risk-asset reversion and mark another milestone in #Bitcoin's maturation. It's unlikely for Bitcoin to stop outperforming #gold, #stockmarket amid bumps in the road as the Fed attempts another rate-hike cycle. pic.twitter.com/4v1kvcq3vd

— Mike McGlone (@mikemcglone11) March 17, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$20.4 billion to about US$877 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Xido Finance (XIDO), (mc: US$1.18 billion) +23%

• Celo (CELO), (mc: US$1.29 billion) +22%

• PancakeSwap (CAKE), (mc: US$1.77 billion) +19%

• THORChain (RUNE), (mc: US$2.4 billion) +17%

• Aave (AAVE), (mc: US$1.96 billion) +13%

DAILY SLUMPERS

• The Graph (GRT), (market cap: US$2.5 billion) -8%

• GateToken (GT), (mc: US$956.6 million) -3%

• Frax Share (FXS), (mc: US$1b) -1.5%

• Monero (XMR), (mc: US$3.36b) -1%

• ECOMI (OMI), (mc: US$1.96b) -0.5%

Uppers and downers: lower caps

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Hector Finance (HEC), (market cap: US$59m) +48%

• STEPN (GMT), (mc: US$409m) +41%

• JasmyCoin (JASMY), (mc: US$103m) +40%

• Navcoin (NAV), (mc: US$14m) +34%

• Popsicle Finance (ICE), (mc: US$37m) +27%

DAILY SLUMPERS

• Ambire AdeX (ADX), (market cap: US$58.5 million) -26%

• ApeCoin (APE), (mc: US$747m) -22%

• MovieBloc (MBL), (mc: US$38m) -21%

• Platypus Finance (PTP), (mc: US$81m) -16%

• Zombie Inu (ZINU), (mc: US$44m) -11%

The Yuga Labs-created ApeCoin (APE) token launched today, which is available to Bored Ape Yacht Club ecosystem NFT holders as a claimable airdrop . You can read a bit more about it here.

It’s not off to the greatest of starts today, though. That said, it’s also hardly an uncommon phenomenon in crypto for new projects to take a dump pretty much straight out of the gate.

Around the blocks

Word of the day goes to Frank Chaparro of the New York-based media outlet The Block. Is US Democratic Senator Elizabeth Warren being “mendacious” when it comes to crypto? We know this much, she may as well be interviewing herself here. Excruciating stuff…

I hear Warren is getting a lot of pressure from other members of her party who see how politically disastrous her anti crypto approach could be for Democrats (from a vote perspective and fundraising perspective). Many are very annoyed with her.

— Frank Chaparro (@fintechfrank) March 17, 2022

— naiive (@naiivememe) March 17, 2022

Many speak about the problem. Few understand the solution.

— Michael Saylor⚡️ (@saylor) March 17, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.