Mooners and Shakers: Bitcoin rises on peace-plan progress in Ukraine; Fed decision lands

"All we are saying": A stock photo of some people pretending to be hippies, yesterday (Getty Images)

It’s been a hopeful afternoon (Eastern Time) in Eastern Europe amid reasonably encouraging peace talks in Kyiv. And a hopium-filled one for Bitcoin and the crypto market to boot. All subject to swift change, but fingers are crossed.

— *Walter Bloomberg (@DeItaone) March 16, 2022

At the time of writing, Bitcoin is back sitting above the US$40k mark, having breached US$41k a bit earlier, too. But let’s not get too far ahead of ourselves (Kyiv peace talks included). As this is typed, US Federal Reserve chief Jerome Powell has just delivered his Federal Open Market Committee inflation-related speech.

And the verdict?

BREAKING: The Federal Reserve just announced they are increasing interest rates by 0.25%.

— Anthony Pompliano 🌪 (@APompliano) March 16, 2022

Inflation is at 7.9% and aggressively going higher.

The FED responds… with a BOUNTIFUL 0.25% increase. 🤣

— Preston Pysh (@PrestonPysh) March 16, 2022

Market participants and keen observers in general had been expecting exactly that from the Fed – a 25 basis-points interest-rate hike in an attempt to combat inflation. Further details, and reactions (including price action) are yet to come, so stay tuned…

Markets dropping on the FED as first response. Gold as well. Indices too.

— Michaël van de Poppe (@CryptoMichNL) March 16, 2022

Top 10 overview

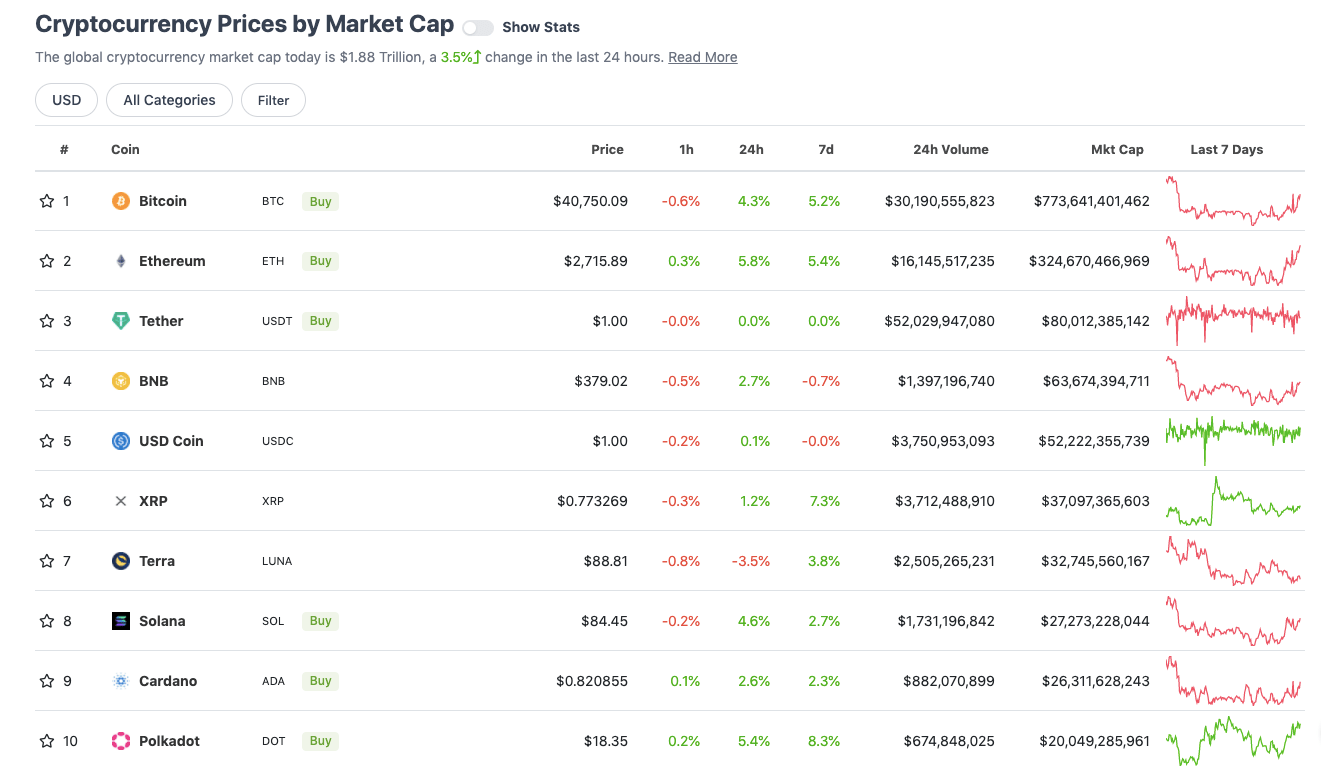

With the overall crypto market cap at about US$1.88 trillion, up about 3.5% from this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

The top two cryptos, Bitcoin and Ethereum, are showing the way among the market’s heavyweights today.

The only leading coin lagging on the daily timeframe is Terra’s LUNA, which may simply be experiencing a small amount of selling pressure after a solid run up lately. It’s still up close to 70 per cent on the month, making it easily the best-performing layer 1 so far this year in terms of price. Most others are in the red.

But back to the market-moving crypto-in-chief, let’s grab some quick expert analysis. Rekt Capital is usually one of the more bullish analysts and traders to be found on Twitter, and he’s been noting a series of higher lows for the OG crypto in March…

#BTC is setting itself for a green-circled Weekly Close at this time

A Weekly Close above the red ~$38000 area, just like in the mid-2021 green circle, could be the confirmation $BTC needs to finally attempt a break beyond $43100 (black)#Crypto #Bitcoin pic.twitter.com/ixpOYtn8Mf

— Rekt Capital (@rektcapital) March 16, 2022

Aside from the first two days of the month, investors have been Extremely Fearful towards #BTC for most of March

Meanwhile $BTC has been making Higher Lows

Higher Lows form when people are happy to buy BTC at a premium whenever it dips#Crypto #Bitcoin

— Rekt Capital (@rektcapital) March 16, 2022

But let’s find a typically polar opposite, bearish trader – for balance. What’ve you got, “Roman”?

The difference between the May crash and Today’s crash is in July we had very clear selling exhaustion: (bullish PA, bullish divergences, etc).

Today we’re not seeing selling exhaustion but rather consolidation for another move to the downside.#bitcoin #cryptocurrency

— Roman (@Roman_Trading) March 16, 2022

Still if you believe in Bitcoin, you probably believe in a long-term, zoomed-out timeframe – and for the following reasons…

Uppers and downers: 11–100

Sweeping a market-cap range of about US$19 billion to about US$864 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Juno (JUNO), (mc: US$1.7 billion) +9%

• Fantom (FTM), (mc: US$3 billion) +8%

• Waves (WAVES), (mc: US$2.8 billion) +8%

• The Sandbox (SAND), (mc: US$3.4 billion) +8%

• Maker (MKR), (mc: US$1.75 billion) +7%

Metaverse/blockchain gaming virtual world The Sandbox is riding higher today on the news that major global bank HSBC has purchased a plot of digital ‘LAND’ today. Full story here.

DAILY SLUMPERS

• THORChain (RUNE), (market cap: US$2.1 billion) -8%

• Zcash (ZEC), (mc: US$1.5b) -2%

• Frax Share (FXS), (mc: US$1.2b) -1%

• Quant (QNT), (mc: US$1.49b) -1%

• Dash (DASH), (mc: US$1b) -1%

Uppers and downers: lower caps

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Popsicle Finance (ICE), (market cap: US$29m) +85%

• Ambire AdEx (ADX), (mc: US$80m) +51%

• STEPN (GMT), (mc: US$407m) +45%

• Unibright (UBT), (mc: US$186m) +27%

• Klima DAO (KLIMA), (mc: US$58m) +22%

DAILY SLUMPERS

• PowerPool (CVP), (market cap: US$24 million) -21%

• Nest Protocol (NEST), (mc: US$28m) -16%

• Synapse (SYN), (mc: US$392m) -11%

• HiFi Finance (MFT), (mc: US$71m) -10%

• Mirror Protocol (MIR), (mc: US$243m) -9%

Final words

Ukraine has Russian tanks in their backyard and you are whining about what clothes he is wearing?

— Benjamin Cowen (@intocryptoverse) March 16, 2022

#Bitcoin succeeding when cash fails 🇺🇦 pic.twitter.com/CL4q60YMGY

— The Bitcoin Historian (@pete_rizzo_) March 15, 2022

Oh, and hang on… news just in (puts hand over one ear)… here’s something interesting…

💥BREAKING: Ukraine has officially legalised #Bitcoin after President Zelensky signed the virtual assets bill into law.

— Bitcoin Archive (@BTC_Archive) March 16, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.