Mooners and Shakers: Analyst points to on-chain metrics for Bitcoin bottom; Crypto majors remain flat

A bottom-like formation, spotted yesterday. (Getty Images)

Is the Bitcoin bottom in? It’s a question crypto punters have been asking, and an answer pundits have been trying to figure out, pretty much all year. At least one prominent analyst is prepared to call that it’s “very close”.

That analyst is Charles Edwards, founder of quantitative Bitcoin and digital asset fund Capriole Investments, who’s pointed to a series of on-chain (blockchain-based) analytics, which he believes backs up his view that Bitcoin presents an “extraordinary opportunity” at these current levels.

Adoption all-time-high. Despite a $10B fraud by FTX, Bitcoin adoption is screaming higher. We are witnessing one of the highest growth rates in addresses with >0.1 Bitcoin in history, seconded only by 2017. More and more people are locking away 1000s of dollars of Bitcoin. pic.twitter.com/vfsZ7xqv0z

— Charles Edwards (@caprioleio) December 6, 2022

Edwards and his British Virgin Islands-based firm have pinpointed several reasons why they believe Bitcoin is either at or near a bottom for this bear cycle, and here are a few of them:

Bitcoin miner selling stress: This refers to the fact Bitcoin miners are bleeding funds due to their production costs being greater than the price of Bitcoin. It also means they need to sell their Bitcoin in order to keep their heads above water. Edwards says that the current level of BTC miner selling is at its third highest of all time. The other two times represented bottoms in the market.

Hash ribbons and hash rate: The “Hash ribbon” analytic on the Bitcoin hash rate indicates another miner capitulation signal, according to Edwards and Capriole.

“Hash rate” means the total combined computational power that is being used to mine and process transactions on a Proof-of-Work blockchain, such as Bitcoin. It’s a metric that can assess the strength of the Bitcoin network. And hash rates have plummeted lately as more and more miners switch off their rigs.

The analysis that Edwards is pushing, (shown below) indicates that a bottom tends to form before the hash rate begins to improve. Based on the chart below and on Capriole’s thesis, a price floor may have formed around the US$16,915 level.

Deep value. Hash Ribbons has confirmed a miner capitulation. This is perhaps the best performing long-term buy signal for Bitcoin. A price low typically forms during the capitulation. Sometimes the first candle of the miner capitulation is the low. pic.twitter.com/1hY0ihZR8j

— Charles Edwards (@caprioleio) December 6, 2022

Here’s one more…

Long-term Bitcoin holders are remaining incredibly faithful: “We have an all-time-high in long-term hodling,” wrote Edwards in his lengthy Twitter thread. “Those keeping Bitcoin at least 1 year now represent more of the network than ever before, 66%. Prior peaks of long-term holding all aligned with bear market toughs.” (Think he means troughs, although it kinda works.)

We have an all-time-high in long-term hodling. Those keeping Bitcoin at least 1 year now represent more of the network than ever before, 66%. Prior peaks of long-term holding all aligned with bear market toughs. pic.twitter.com/4IXnUg5f3S

— Charles Edwards (@caprioleio) December 6, 2022

‘A historically significant capitulation’: ARK Invest

Cathie Wood’s ARK Invest, meanwhile, has released its own report that aligns with some of Edwards’ analysis.

Describing the FTX black swan as possibly “the most damaging event in crypto history,” the firm’s report also pointed to the resilience of long-term Bitcoin holders in the face of unprecedented negativity swirling around the crypto space.

“We believe this datapoint indicates holders’ long-term focus and high conviction, despite recent events. Today, long-term-holder supply is 72% of bitcoin’s total circulating supply,” reads ARK’s report, adding:

“The ratio between bitcoin’s realized profits and realized losses on-chain hit an all-time low of 7.2% in November 2022. Bitcoin found meaningful bottoms in every previous instance—2011, 2015, and 2019—in which that metric reached <10%.

” November’s realized profit/loss data inform our view that a historically significant capitulation event is underway.”

Top 10 overview

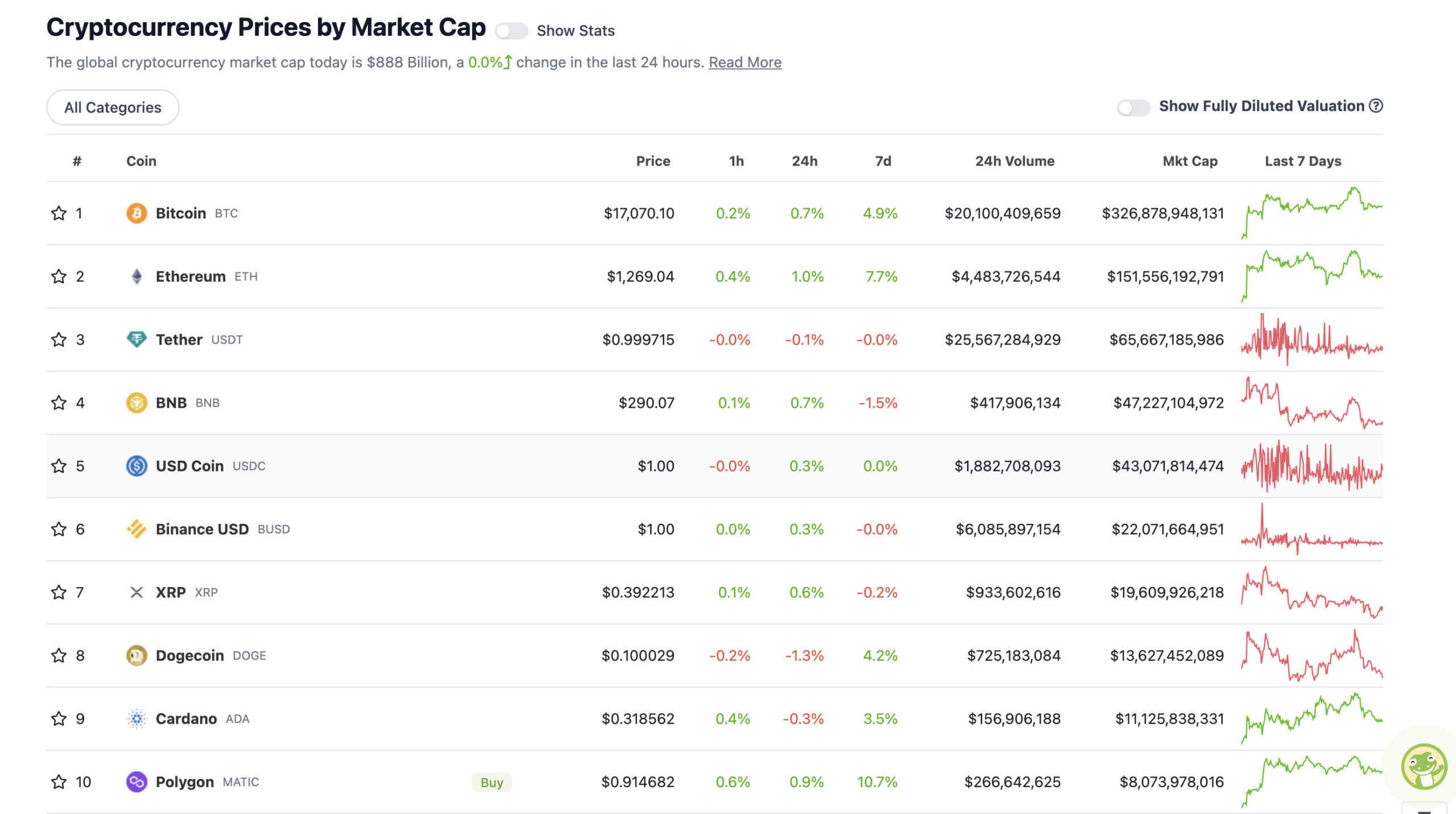

With the overall crypto market cap at US$888 billion, flat as the Nullarbor since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Consolidation City? Maybe. Bitcoin is clinging to the US$17k level again at the time of writing, while Ethereum simply refuses to look beyond about US$1,270.

This may jinx it, but $BTC is down 0.8% this week, while $SPX is down 2.8%.

If #stocks can find a bottom here, it would likely bode very well for #crypto.

— Justin Bennett (@JustinBennettFX) December 6, 2022

There’s not much else going on there on a daily timeframe, although Polygon’s MATIC token is at least in the double-digit green over the past seven days.

Polygon has just announced yet more adoption news. The Ethereum-compatible network is powering a a new music NFT partnership enterprise between Warner Music Group and Web3 startup LGND Music.

https://twitter.com/sandeepnailwal/status/1600252542704705536

Uppers and downers: 11–100

Sweeping a market-cap range of about US$6.45 billion to about US$327 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Radix (XRD), (market cap: US$390 million) +19%

• MultiversX (Elrond) (EGLD), (mc: US$1.08 billion) +6%

• ApeCoin (APE), (mc: US$1.5 billion) +5%

• NEO (NEO), (mc: US$5 billion) +3%

• Solana (SOL), (mc: US$5.15 billion) +3%

DAILY SLUMPERS

• Cronos (CRO), (market cap: US$1.67 billion) -5%

• Quant (QNT), (market cap: US$1.74 billion) -3%

• Aptos (APT), (mc: US$652 million) -3%

• Fantom (FTM), (mc: US$619 million) -3%

• GMX (GMX), (mc: US$412 million) -2%

Around the blocks

Randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

Crypto cold-storage, self-custody specialist Ledger has a new hardware wallet people seem to like. It’s called Stax and one of the things it can do is display NFTs (unlike previous hardware wallet models).

Firmly convinced @Ledger is the Apple of Web3. 🔥

First time trying the Ledger Stax! 🥹 pic.twitter.com/EUMgs41fV5

— Brycent (@brycent_) December 6, 2022

The creator of the iPod, @tfadell announcing @Ledger Stax – unveiling it to the public for the first time displaying @Deadfellaz 🔥🧟♀️

Stax is a product set to change how we interact with our digital assets on a daily basis. Learn more 👇 pic.twitter.com/NuWHIZMQrH— Deadfellaz (@Deadfellaz) December 6, 2022

Uh-oh, batten down the hatches. CNBC’s Jim Cramer is making some big calls again, including this one:

Jim Cramer sees no recession coming. https://t.co/mot5gxMubG

— Sven Henrich (@NorthmanTrader) December 6, 2022

… and this:

Brilliant. Bottom is near. https://t.co/tc3yhtZxsc

— Ben Simpson (@bensimpsonau) December 6, 2022

Meanwhile, it seems that more and more Bitcoin is moving off exchanges, which may or may not back up the strong BTC HODLer thesis Capriole and ARK Invest have been presenting.

Over the last 30 days 200,000 BTC worth ~$3.4 billion have been moved off exchanges.

The great exodus. pic.twitter.com/A6smuSEAHE

— Will (@WClementeIII) December 6, 2022

Cardano founder Charles Hoskinson could probably care less about any of that, though – he’s clearly reached another level of consciousness, texting with his mind…

— Charles Hoskinson (@IOHK_Charles) December 6, 2022

Note: none of the information presented in this article represents financial advice.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.