Monday Fund Day: Katie Haun’s $1.5 billion crypto fund and Bored Apes’ Yuga Labs lead our weekly wrap

Coinhead

Coinhead

Another week, another tsunami of money raised in the crypto industry. March has been mega, to say the least. And here’s where the mega bucks have been flowing in the past seven days or so…

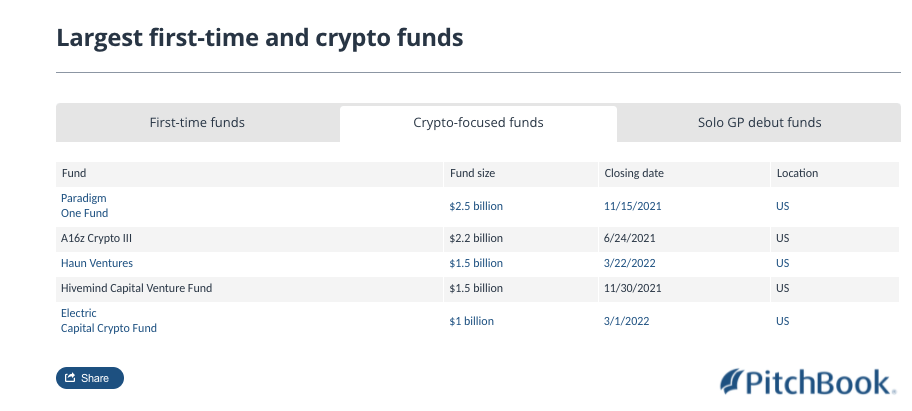

Haun Ventures, a new firm led by former Andreessen Horowitz (a16z) general partner Katie Haun, has raised a staggering US$1.5 billion to invest in crypto-related startups, according to CNBC and several other news sources.

It’s significant not only for its huge size and because its crypto, but also because it’s reportedly the largest initial fund ever raised by a solo venture capitalist, let alone a solo female founding partner VC.

The fund has been formed just months after Haun left her position at a16z and it puts Haun Ventures firmly in the big leagues in terms of massive crypto funds, only behind Paradigm’s US2.5 billion and A16z’s US$2.2 billion funds.

Excuse my French, but FUCK YEAH @katie_haun!!!!!! pic.twitter.com/HWLZVMxBCC

— Bri Kimmel (@briannekimmel) March 23, 2022

In a blog post, Haun said she will focus on investing in teams building in Web3, a term that describes the third generation of the internet and which is sometimes used to mean the crypto industry in general.

Haun’s firm plans to deploy US$500 million into early-stage startups and US$1 billion into “acceleration” or later-stage opportunities.

“It feels, honestly, like a lot of pressure,” Haun told CNBC. “But I think that motivates everyone on the team. Web3 is the new era of the internet, and it deserves a new era of investors.”

As reported by Stockhead last week, the creator of the popular Bored Ape Yacht Club NFTs, Yuga Labs, has raised US$450 million in seed funding at a US$4 billion valuation.

Andreesen Horowitz led the round, which is Yuga Labs’ first, and significant participation also came from blockchain gaming investment and development giant Animoca Brands, crypto-focused fintech Moonpay and exchanges Coinbase and FTX.

.@yugalabs closes $450M Series Seed funding round, valuing the company at $4B. Investors includes @a16z, Animoca Brands, @TheSandboxGame, @FTX & other. Together with top tier game studios they will build #Metaverse project called "Otherside".

Read more at: https://t.co/QRXHobDt9i— Animoca Brands (@animocabrands) March 23, 2022

Yuga has plans to create a media empire built around NFTs and will use the funds to develop brand partnerships and hire more employees. It is also developing a forthcoming massively multiplayer online role-playing game (MMORPG) metaverse project called Otherside, which aims to connect the NFT universe. Check out its teaser trailer below…

See you on the Otherside in April. Powered by @apecoin pic.twitter.com/1cnSk1CjXS

— Yuga Labs (@yugalabs) March 19, 2022

• Acala (ACA), Polkadot’s decentralised finance (DeFi) hub, announced last week that it’s launching a US$250 million “aUSD Ecosystem Fund” to support startups in Polkadot’s burgeoning DeFi ecosystem.

The fund is is backed by several other Polkadot parachains, such as Moonbeam, and more than 30 VC firms including Hypersphere, Pantera, Jump Crypto and Digital Currency Group.

The fund’s purpose is to drive adoption for Acala’s flagship stablecoin aUSD – a crypto-backed stablecoin that aims to become the backbone of DeFi on both the Polkadot and Kusama blockchain networks.

Acala, nine parachain teams, and a group of venture funds have launched the $250 million 'aUSD Ecosystem Fund' 🅰️💸

The fund is seeking early-stage projects from any @Polkadot or @KusamaNetwork parachain with strong $aUSD stablecoin use cases 🚀https://t.co/OJ2V47ZUry pic.twitter.com/NDgLg2bG8N

— Acala (@AcalaNetwork) March 23, 2022

• MEXC Global has teamed up with fellow Singaporean-based crypto exchange Bybit to launch a US$150 million development fund for Fetch.ai (FET), a UK-based, machine-learning-powered layer 1 blockchain.

Seychelles-based crypto exchange Huobi is also said to be backing the fund, which will focus on encouraging developers to build on the Fetch.ai platform and further integrate the protocol with the Cosmos (ATOM) ecosystem.

$FET price turned bullish shortly after https://t.co/LQWjE7jwC3 announced a $150 million development fund and plans to expand https://t.co/LQWjE7jwC3’s presence in the vast #Cosmos ecosystem. https://t.co/DpnDfDdkBI

— Cointelegraph (@Cointelegraph) March 23, 2022

• Nexo, a popular crypto-lending platform and major competitor to Celsius and BlockFi, has established a venture arm with US$150 million earmarked for crypto projects and acquisitions, according to a press release.

Nexo Ventures will reportedly be investing in Web3, DeFi innovation, NFT projects, metaverse and GameFi as well as payments and trading infrastructure and compliance services.

https://twitter.com/Nexo/status/1506516883364790272

• The Avalanche Foundation and NFT launchpad platform OP3N have teamed up to launch “Culture Catalyst”, a US$100 million initiative designed to cultivate arts and entertainment projects within the Avalanche (AVAX) ecosystem.

The fund’s first major project comes from the musical artist Grimes, who has announced plans to launch an “intergalactic children’s metaverse book” on the Avalanche blockchain.

NEW: @Grimezsz is writing an “intergalactic children’s metaverse book” as part of an arts & culture push by @avalancheavax.@LedesmaLyllah reportshttps://t.co/Kci2QkCbjQ

— CoinDesk (@CoinDesk) March 25, 2022

• Tekin Salimi, a former general partner of crypto VC bigwig Polychain Capital, is launching a US$125 million fund for seed crypto investments.

The fund, called “dao5,” will reportedly be announced at the upcoming Avalanche Summit conference in Barcelona and has secured capital largely from “crypto-native” investors.

Salimi plans to convert the fund into a founder-owned DAO (decentralised autonomous organisation) that will invest in seed and pre-seed-stage protocols across layer 1 blockchain infrastructure.

“The goal of dao5 is to explore a new model to bootstrapping a DAO,” says Tekin Salimi. https://t.co/FDlQ7t7ebJ

— Forbes (@Forbes) March 26, 2022

• Qualcomm, a US computer-chip manufacturer and supplier, is launching a US$100 million investment fund that will support companies building out the metaverse using augmented reality, mixed reality or virtual reality.

The initiative, dubbed the Snapdragon Metaverse Fund, also aims to broaden the market for Qualcomm chips, according to the company’s CFO in an interview with the Wall Street Journal.

• ‘Dave’, a US financial services app, has received backing from crypto exchange giant FTX (specifically its VC arm FTX Ventures) to the tune of US$100 million. The deal is designed to enable the platform to begin offering crypto services and expand the digital assets ecosystem in general.

FTX Ventures Invests $100 Million in Money App Dave

► https://t.co/6UU2o8Zvv8 pic.twitter.com/PQYWuz2w4V— Decrypt (@decryptmedia) March 22, 2022

• Worldcoin, a uniquely innovative iris-scanning crypto startup – is reportedly raising US$100 million, which would give the Berlin-based company a valuation of US$3 billion.

According to an article by Information.com, which cited two unnamed sources, investors include Andreessen Horowitz and Khosla Ventures.

Crypto startup @worldcoin is raising $100 million with investors valuing the company's total stockpile of tokens at $3 billion, The Information reported, citing two unnamed sources.@JPRubin23 reportshttps://t.co/YnsGhlSHAv

— CoinDesk (@CoinDesk) March 23, 2022

Worldcoin, which was co-founded by Y Combinator President Sam Altman, is an Ethereum-based project that uses volleyball-sized chrome devices called “orbs” to scan retinas in exchange for crypto. Its aim is to distribute a global, universal basic income of sorts.

• FanCraze, an Indian sports-focused NFT digital collectibles platform, has raised US$100 million in a series A funding round that has reportedly included the participation of Manchester United and Portugal soccer star Cristiano Ronaldo.

The funding round was led by US global private equity and venture capital firm Insight Partners, with participation from B Capital. It follows a US$17.4 million seed round last year that involved NBA Top Shot creator Dapper Labs.

FanCraze last year secured the exclusive rights to create NFTs based on International Cricket Council (ICC) tournaments.

FanCraze has raised $100m from @insightpartners, @BCapitalGroup, Tiger Global, Coatue, and @sequoia, amongst others in one of the largest-ever Series A rounds in Asia.

Global football icon @Cristiano also participated!https://t.co/zwS4xFBhhe

— FanCraze (@0xFanCraze) March 24, 2022