March Crypto Winners: Bitcoin, XRP, Kaspa and Conflux crushed it, despite Uncle Sam’s killjoy efforts

Getty Images

So, that was March, and Q1 2023, in Crypto Central. All in all, with a 21% monthly surge and near 70% quarterly gain for the leading cryptocurrency, it’s been surprisingly pretty damn good, price wise.

And we say surprisingly, because hoo boy, is it ever increasingly apparent that Uncle Sam (and Auntie Karen) do not like crypto and its nascent, innovative and highly disruptive industry.

— Liv Boeree (@Liv_Boeree) March 30, 2023

What was it that bald bloke in robes once said? It apparently wasn’t actually Gandhi, like so many claim (and pretty sure that includes this columnist in the past).

“First they ignore you, then they laugh at you, then they fight you, then you win.”

Anyway, it’s an appropriate utterance for where the crypto industry is presently at. And, given the US regulatory crackdowns this year from the SEC and CFTC, not to mention the undead “Anti-crypto army” senator Elizabeth Warren is assembling, no prizes are on offer for guessing which stage of the oft misquoted, oft misattributed quote we’re presently in.

First they ignore you, then they laugh at you, then they fight you, then you win.

We are getting closer

— Tegan.eth 🌅,🦩 (@theklineventure) March 13, 2023

Incidentally, according to AP News, here’s the original quote from 1918, attributed to Nicholas Klein, an American trade union activist:

“First they ignore you. Then they ridicule you. And then they attack you and want to burn you. And then they build monuments to you.” To be fair, the other one’s punchier.

And speaking of punching, Bitcoin, the crypto market barometer of health, came out swinging in March. As you can see from this Coinglass chart:

That’s right, bears, it’s the third-best March in the past decade of Bitcoin’s existence as the leading form of magic internet money. Not bad, not bad at all.

And in terms of quarterly performance, it’s also the third-best in the past 10 years. (But, by jingoes, by crikey, how good was 2013? If only we’d been paying attention back then.)

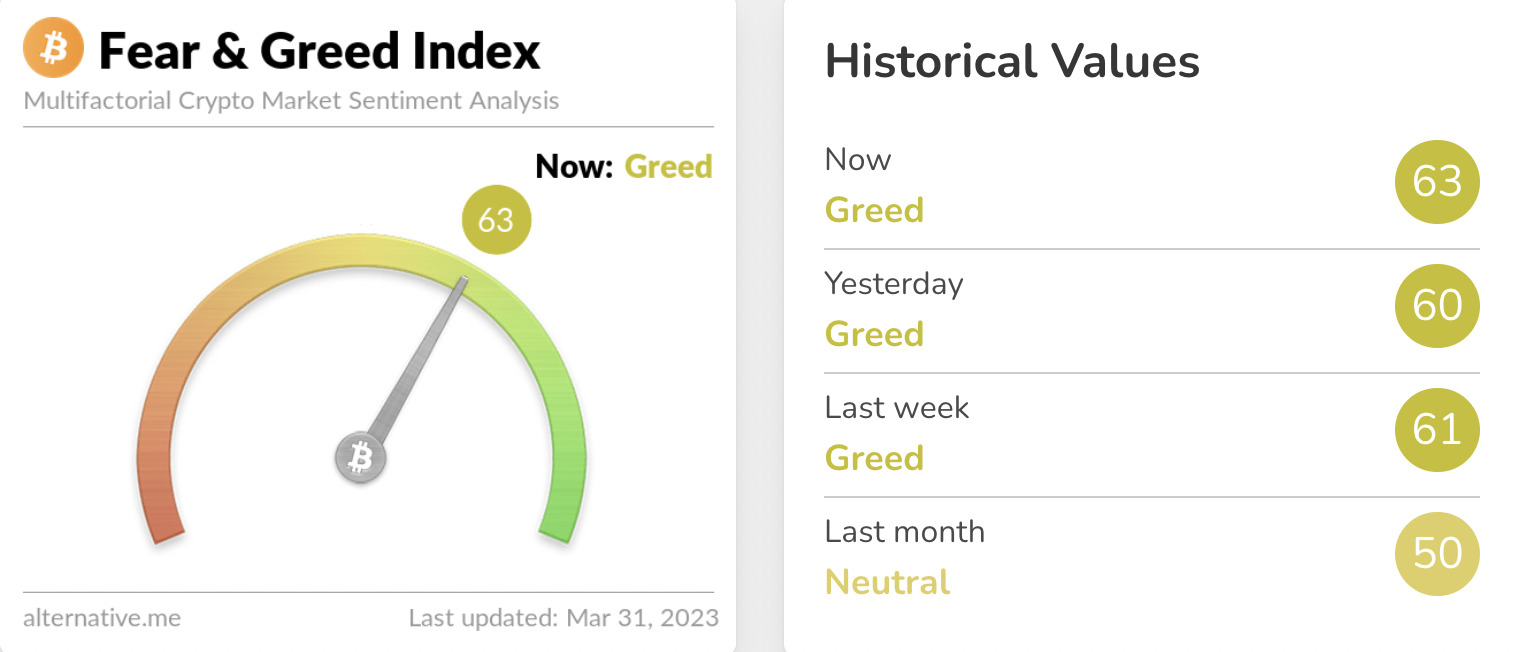

As for leading market sentiment tracker – the Crypto Fear & Greed Index – it’s turned decidedly olive Greed, if not yet Canberra Raiders lime, compared with last month’s tentative, washed-out Wests Tigers orange Neutral.

What can we look forward to in April? Well, time (and unfortunately the most important factor of all – Fed boss Jerome Powell’s interest-rate-hiking rhetoric) will tell.

Judging by this tweet, maybe we can expect one last Fed hike next month before a possible pause/pivot in May…

Powell says one more rate hike over lunch. pic.twitter.com/iaJpFXSatR

— Sven Henrich (@NorthmanTrader) March 29, 2023

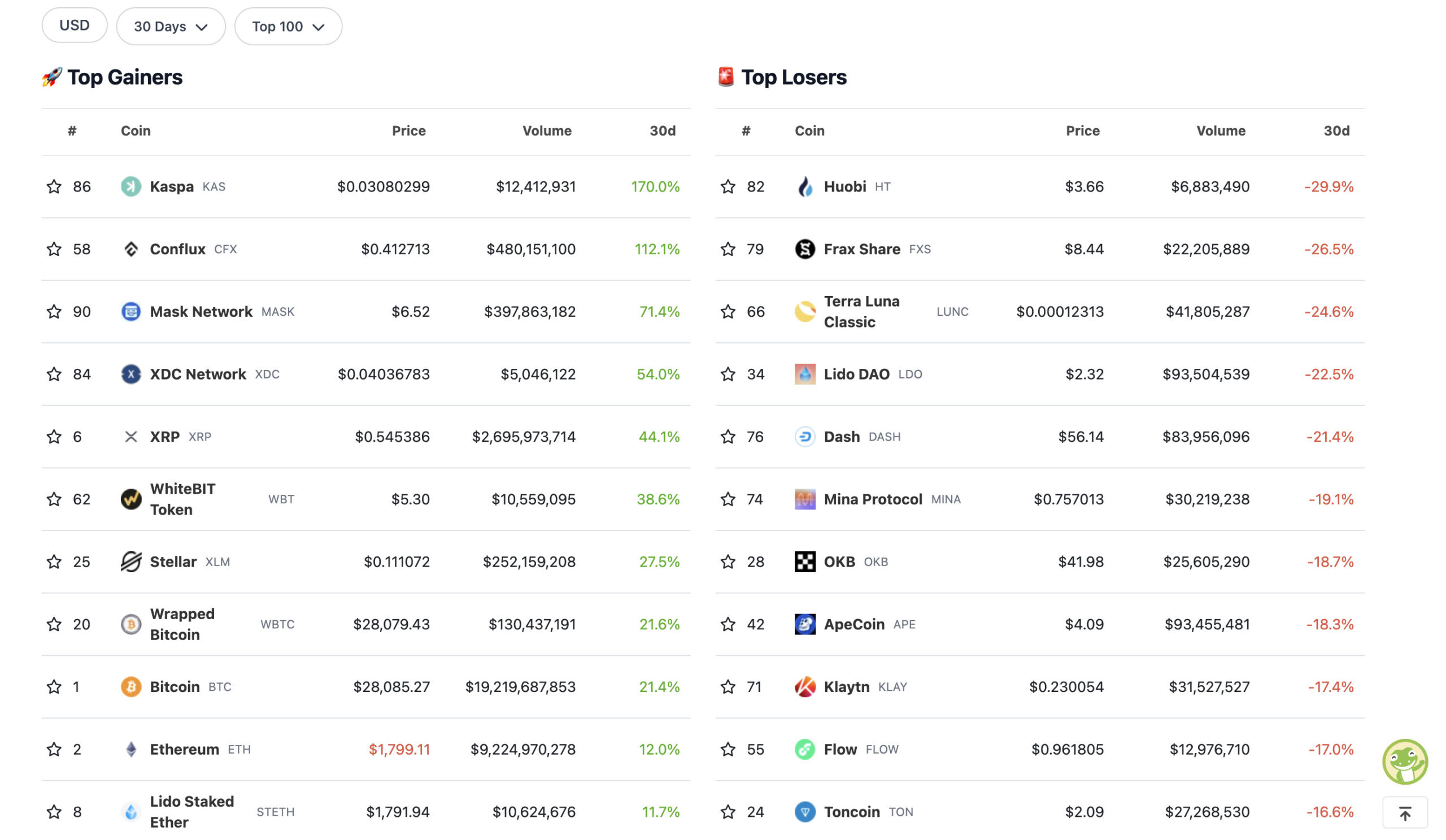

March’s 10 leading gainers in the top 100 (and some losers)

According to CoinGecko data…

So then, the standouts, from our perspective, were as follows:

• XRP: The top 10 major cryptocurrency has been flying (+44%) in March, and we’ve been attempting to work out why in recent editions of our daily morning Mooners and Shakers roundups.

But, as Guy Turner from Coin Bureau says below, it really boils down to quite a good deal of speculation based round a favourable outcome in the Ripple vs SEC legal stoush that’s been going on for, like, forever. And a settlement result is said to be coming to a crypto portfolio near you.

What's going on with the $XRP rally? 🤔 pic.twitter.com/2cSPryHSoU

— Coin Bureau (@coinbureau) March 30, 2023

• Kaspa (KAS) meanwhile, was the out-and-out winner in the top 100 cryptos by market cap, up 170%. Why? We covered some speculative reasoning the other day, based around the Bitcoin-inspired protocol being listed on a couple of exchanges – HotBit and BYDfi.

We’re struggling to believe that’s the only reason, however, apparently HotBit is “one of the top trading exchanges by the number of available markets” according to U.Today, so go figure.

Hmm, could Binance be listing it pretty soon?

https://twitter.com/B1gShoots/status/1641532130265014294

What is Kaspa? It’s a proof-of-work (crypto-mining) protocol and something of a Bitcoin wannabe. You can read a bit more about it in our coverage here, and certainly on its own website > here.

• Conflux (CFX): This one, up 112% over the past 30 days or so, interests us because it feeds into the “China reawakening to crypto” narrative that seems to be playing out over in Hong Kong right now.

Conflux is supposedly China’s only fully regulated, government-backed public blockchain. It’s had a great month on the back of some pretty impressive partnership deals – including China’s second-biggest wireless carrier – China Telecom. Not to mention a collaboration with the “third-largest construction machinery manufacturer worldwide” – XCMG.

XCMG (@XCMGGroup), 3rd largest construction machinery manufacturer worldwide, has teamed up with #Conflux and Zen Spark Technology.

Together, we're pushing the limits of blockchain and #Web3 technologies to explore exciting international use cases.https://t.co/1fzgYJbzH6

— Conflux Network Official (@Conflux_Network) March 28, 2023

Conflux is at the forefront of Hong Kong's Web3 expansion! We partnered with China Telecom, the second-largest wireless carrier in China, to launch a blockchain-enabled SIM card.

Our CTO @spark_ren spoke to @CoinDesk about this cutting-edge collaboration: https://t.co/Nj999DLewD

— Conflux Network Official (@Conflux_Network) March 23, 2023

Conflux is a layer 1 chain that uses a hybrid proof-of-work and proof-of-stake mechanism.

It also pitches itself as a bridge between East and West, which really just means that it’s a protocol that allows users to swap assets across multiple blockchain networks. In other words, it’s a Layer 1 blockchain interoperability play.

March’s 10 leading gainers and losers in the top 300

Zooming out a tad, here then, were the top 10 winners and losers from the top 300 cryptos by market cap, with thanks again to CoinGecko…

Yep, that’s what happens when you zoom out on the crypto market cap. You get something called FUBT Token (FUC) rising to the top, with a +5,000% monthly gain.

What the hell is it? We hit up its website a little nervously, making sure no one was looking over our shoulder, only to discover it seems SFW after all.

Not sure what FUBT stands for exactly, but it calls itself “The Asian Cryptocurrency Exchange”. Apparently it’s been around since at least the great bullrun of 2017.

Buyer beware and all that. Especially after a ridonculous pump like that.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.