How much are top cryptos dominated by whales? New study gives some answers

Getty Images

A constant danger for the minnows of the crypto retail-trading sea – plankton, if you will, which is most of us – is whales and their coin dumpage.

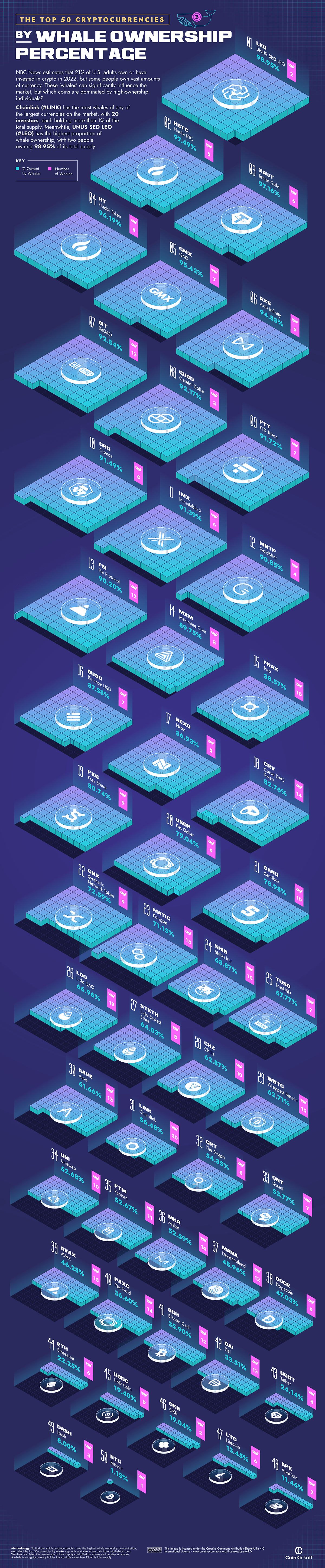

Large holders of individual crypto assets, that is. And, according to a new study of data conducted by CoinKickoff, plenty of the largest cryptocurrencies by market cap have more than the odd whale splashing about and creating price-volatility-related havoc.

Of course, whale action can some time mean a good thing for pumping the tyres of your favourite crypto, too, and many a whale might well be a project’s long-term believer or founder. But there is certainly inherent danger of price dumps when only a small amount hold the keys to the executive bathroom and large amounts of the supply. That’s just the way it goes.

The question is, how much of the top end of a crypto market that currently houses anywhere between 10,600 and 23,900 tokens (according to CoinGecko and CoinMarketCap respectively) is potentially influenced by whales? And which tokens have the highest concentration of whale ownership?

CoinKickoff’s researchers have done a great job putting together its info on this, including a very clear, very long graphic (see below) that takes centre stage in its full Crypto 2023 Whale Index report.

The researchers focused on the top 200 coins only as of earlier this year (so no, they didn’t include recent surgers PEPE or WOJAK or MONG), using data from intotheblock.com to analyse coin-ownership distribution.

“First, we pulled the whale data from each cryptocurrency,” explains CoinKickoff. “Then, we summed the holding percentages from the whales of each coin to discover which cryptos have the highest percentage controlled by whales.

“Following this, we selected the golden whale for each crypto and its holding percentage. Finally, we calculated the percentage of the total supply of each coin that is not controlled by whales.”

“Golden whales” are what the research team calls investors with control of the absolute highest stake in a crypto’s supply.

“The unregulated nature of crypto ownership means that anyone can potentially own the lion’s share of a coin’s supply,” reads the report.

Some of the quick takeways from the research are as follows:

• 72% of crypto’s largest coins have more than half of all supply controlled by whales.

• The industry’s most popular, widely used “oracle” project Chainlink ($LINK) has the most whales of all the largest cryptocurrencies. LINK has 20 investors holding more than 1% of its total supply.

• The coin with the highest proportion of whale ownership, however, is UNUS SED LEO ($LEO), with a whopping 96.97% of LEO owned by a single individual. *

• Conversely, Bitcoin, which is highly decentralised, is the coin that’s least dominated by whale investors. And that’s despite Michael Saylor’s best efforts. It’s actually Satoshi Nakamoto, whoever that is, who still owns by far the biggest proportion of BTC, with 1.15% of the total supply.

(* The CoinKickoff research, we should note, explains that the LEO token has a unique “buyback” and burn scheme, in which iFinex, the owners of the Bitfinex exchange, gradually buys LEO back from the market until there is no circulating supply left. Bit of a head scratcher, that one, but this Capital.com article explains it further.)

Okay, but what about PEPE?

Yep, we can’t shut up about this ridiculous meme coin lately, so we thought we’d add this into the mix here, even though it’s not part of CoinKickoff’s research.

This tweet from “An Ape’s Prologue” referencing data from Thanefield Capital, suggests that, yes, there is very much a good deal of whale action on the surging PEPE token, pointing out a handful or so who bought in super early. As in, minutes after the thing went live.

2/ When analyzing the distribution of trades on Uniswap V2, we spotted some unusual activity.

A group of freshly funded wallets bought $PEPE within just a few minutes after the token started trading, and are still holding them.

Together, they control almost 10% of the supply.

— Thanefield Research (@ThanefieldRes) April 19, 2023

“This behavior raises questions about whether these wallets belong to insiders or the dev team,” continued the thread. “As not only did they have impeccable timing, but they are also holding a considerable amount after a significant run of 1000x.”

Things that make you go, hmmm…

8/ In conclusion, although it's impossible to affirm these wallets belong to insiders, their behavior definitely raises questions.

It wouldn't be surprising if confirmed, given the nature of memecoins and their history.

— Thanefield Research (@ThanefieldRes) April 19, 2023

“On the other hand, it is also impressive that these wallets demonstrate strong conviction by holding onto their positions even after a massive 1000x run,” concludes Ape’s Prologue.

In short, buyer beware when it comes to frothy meme coins… and HODLer beware, too.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.