Mooners and Shakers: PEPE soars 100% amid meme coin mania – here’s why

Getty Images

You can’t keep a good frog coin down it seems. Is there such a thing as a good frog coin? If there is, then it’s gotta be Pepe, which has leapt another 100% over the past 24 hours, and is up a stonking 628% over the past seven days.

In case you’ve only just tuned into this nuttiness, Pepe (ticker: PEPE) is a non-utility token created just over a fortnight ago, based on a cartoon frog – images of which have been meme-ing their way through the cryptoverse for years.

In 18 days it’s reached a market cap valuation of more than US$970 million. The thing’s (possibly) on its way to becoming a “unicorn” as we type. We’ll let that sink in for half a sec.

The Pepe the Frog meme was, at one stage, considered a hate symbol by the US-based Anti-Defamation League after alt-right groups, weirdly, adopted it. But in the crypto space, Pepe tends to represent harmless, non-hateful anarchy. (Well, from what we see, mostly anyway.)

Incidentally, the cartoon’s creator, Matt Furie – who has no official connection with the crypto – was the subject of a 2020 doco called Feels Good Man, which followed his quest to “reclaim” the character from dark forces.

If only people watched the Feels Good Man documentary https://t.co/3rz8tpbQFQ.

Right!?

— Adidust.eth (@dustdust213) May 4, 2023

Other crypto meme coins have been doing pretty eye-popping business of late, too, including WOJAK (+1,090% over past week), COPE (+1500% over seven days) and, er, MONG (+22% over the past 24 hours) – which was created late last year in response to anti-crypto Congressmen Brad Sherman poking fun at the space when he mentioned a coin he “just made up” called Mongoose.

Is now the time to ape in with $27 and become a multi-millionaire like that “Pepe Chad” bloke Crypto Twitter keeps referencing?

$doge went to 80 billion in 2021$pepe at 80 billion would make the $27 chad wallet worth 480 million

— borovik (@3orovik) May 3, 2023

Almost certainly not, but then again, it’d only be $27 potentially lost, right? You’ve definitely missed the $27 Pepe get-rich-quick scheme, though. And none of this paragraph, or any other here (especially when it comes to meme coins), should be construed as anything remotely resembling financial advice.

Just a note we should make, though, this Coinhead writer did recently buy some Pepe for slightly more than $27, for sh*tcoins and giggles. And it’s turned out to be easily his most profitable crypto investment, relatively speaking, so far this year.

Does that mean he should sell? Very probably. Does that mean he will any time soon? Probably not, no. Because maybe, just maybe, there will be some large exchanges circling before too long. Binance CEO “CZ”, for instance, when asked recently, didn’t exactly rule out the idea of listing PEPE.

😂🐸💨 pic.twitter.com/78bKBoZr4D

— Viva La Vandal (@viva_la_vandal) May 4, 2023

Why is PEPE surging (again)?

There might be a combo of factors for this.

Whale activity, for instance.

Blockchain data-analysis account Lookonchain, for example, has noticed some pretty extraordinary activity from a large holder of crypto, who appears to have ditched pretty much all his or her assets for PEPE! That might very well be fuelling some confidence and FOMO in the coin from other degen-inclined whales in the space.

We noticed a whale exchanged almost all assets for $PEPE.

The whale exchanged 20.62 $WBTC($590K), 17B $CULT($90K), 44,194 $UNI($235K) and 19.96 $ETH($37K) for 1.72T $PEPE ($2.19M currently).

The buying price of $PEPE is ~$0.0000005533 and made a profit of ~$1.23M. pic.twitter.com/O6BOQMd1EW

— Lookonchain (@lookonchain) May 4, 2023

Then there’s the celebrity factor aping in.

For instance, American rapper DeAndre Cortez Way, aka Soulja Boy, has revealed that he “done got rich off PEPE”. Nicely put.

https://twitter.com/DrJerkoff_/status/1653983447830986752

How long do you give it before Dogecoin-loving Elon Musk hops on board?

But in addition to the movements of a few whales and celebs, the pure power of memes, FOMO and greed, which is what fuels the crypto market masses at the best of times, would have to be the biggest combined factor of all.

The overall meme coin frenzy at the moment is interesting, though, as it comes in the midst of ongoing macro uncertainty.

Intensifying uncertainty, too, as more regional banks in the US face extinction and economists, the Fed and Wall Street turn an eye on the recession gloom cloud hovering above.

The Regional Bank problems aren't going away. This week…

PacWest $PACW: -67%

HomeStreet $HMST: -48%

First Horizon $FHN: -47%

Metropolitan Bank $MCB: -40%

First Foundation $FFWM: -35%

Western Alliance $WAL: -34%

Comerica $CMA: -25%

WesBanco $WSBC: -25%

Zions $ZION: -25%— Charlie Bilello (@charliebilello) May 4, 2023

It proves, however, that there is still a strong appetite for risk within the crypto sector, and perhaps a will of the super-impatient “degen” crowd at play who’ve likely had their fill of dollar-cost averaging and defensive positioning.

The crypto market, broadly speaking, is still a long way down from its all-time highs of the 2021 bull market, but so far, 2023 has been pretty bullish, with several assets outperforming other sectors. Bitcoin, for instance, is still up more than 65% so far this year.

Maybe, as Collective Shift’s Ben Simpson hypothesises here, the banking turmoil has created a “perfect storm for Bitcoin” this year, in which he envisions:

• Rate hikes possibly topping out.

• Positive sentiment regarding the next Bitcoin halving (just one year away).

• More banks collapsing.

• Possible government intervention to fund the deficit or bail out the markets.

Why The Bank Collapses’ Create A Perfect Storm For Bitcoin.

The FDIC (body that insurers American banks) intervened to take control and sell First Republic Bank to JPMorgan as fears grew other regional banks could meet a similar fate.

Here's why I believe it's the perfect storm… pic.twitter.com/aLS6anK9jQ

— Ben Simpson (@bensimpsonau) May 4, 2023

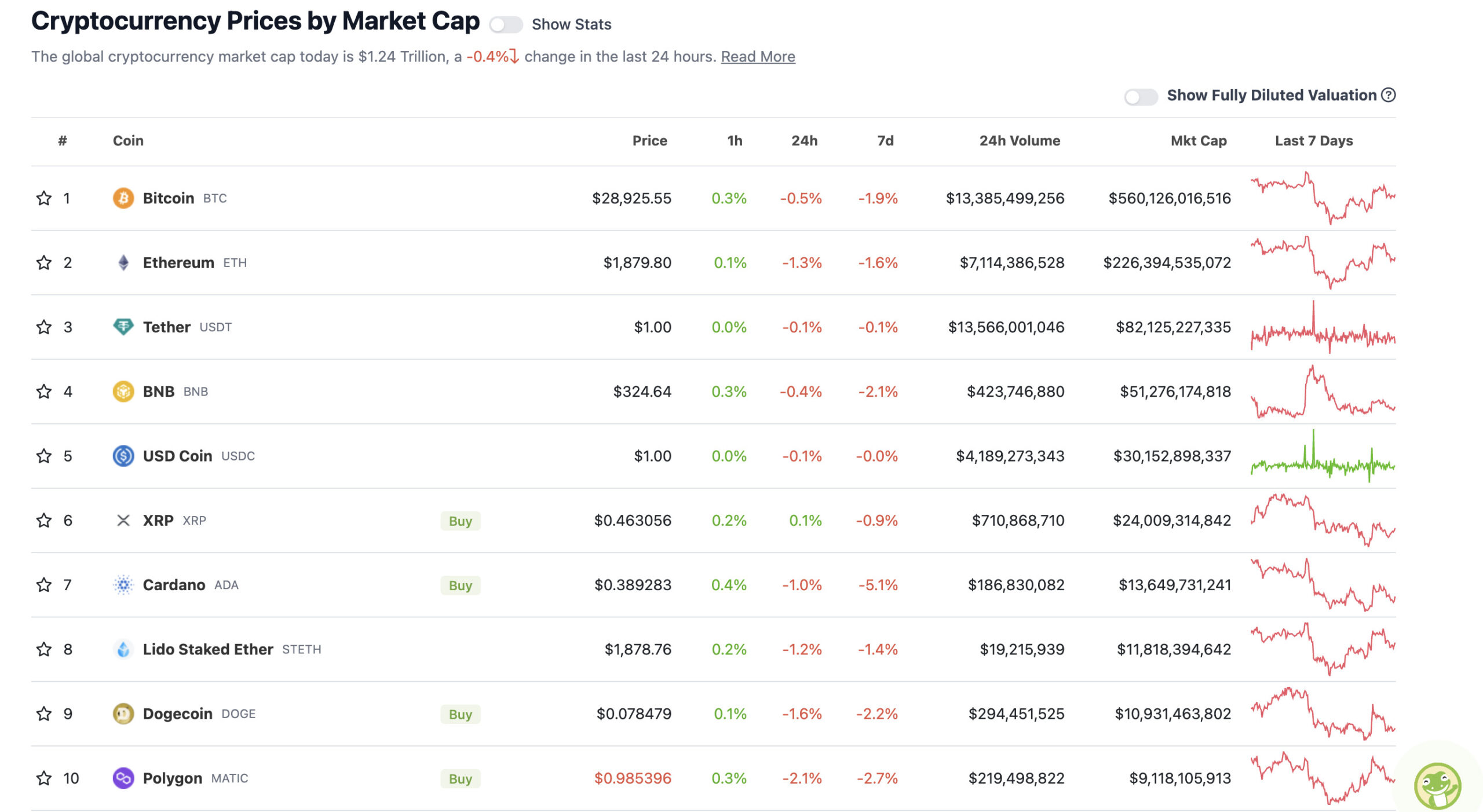

Top 10 overview

With the overall crypto market cap at US$1.24 trillion, down about 0.4% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Well, we were going to mainly write about Bitcoin hovering around US$29k and Ethereum’s half-arsed attempts to reclaim $1,900. But then we saw what the frog was doing, and now we’re just about out of time.

Good thing, too, because Bitcoin has been pretty boring, if comfortingly steady over the past 24 hours.

#Bitcoin is pretty much stuck in between. Bulls are happy, bears are happy and finding arguments.

I would say that a break above $29.2K and definite confirmation through a retest, that' my trigger for new highs.

Banks failing, how hard it may sound, is actually bullish for… pic.twitter.com/hu4vWqQxZa

— Michaël van de Poppe (@CryptoMichNL) May 4, 2023

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Pepe (PEPE), (market cap: US$970 million) +101%

• Kaspa (KAS), (market cap: US$491 million) +3%

• Toncoin (TON), (market cap: US$3.08 billion) +3%

• Flow (FLOW), (market cap: US$915 million) +2%

PUMPERS (lower, lower caps)

• Wojak (WOJAK), (market cap: US$65 million) +55%

• ArbDoge AI (AIDOGE), (market cap: US$143 million) +39%

SLUMPERS

• Sui (SUI), (market cap: US$695 million) -11%

• Stacks (STX), (mc: US$1.01 billion) -9%

• Radix (XRD), (mc: US$845 million) -7%

• Optimism (OP), (mc: US$641 million) -6%

• Lido DAO (LDO), (mc: US$1.67 billion) -5%

SLUMPERS (lower, lower caps)

• XEN Crypto (XEN), (market cap: US$14 million) -18%

• AscendEx (ASD), (market cap: US$71 million) -15%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Bruh…. $pepe now the 54th biggest crypto coin! pic.twitter.com/97P6fgWTfM

— Lark Davis (@TheCryptoLark) May 5, 2023

Are you still fading $pepe? 🐸

This is a screenshot of the $SHIB graph from September 2021

The blue arrow is when @binance listed it at a 3B market cap

I’ll also drop a link with a recording from a spaces the other day where @cz_binance talks about $pepe or meme coins in… pic.twitter.com/KkLLn3JqGT

— L3yum (@l3yum) May 4, 2023

Trading Memecoins can make you 100x

It can also lead you to loose 100% of your money.

Use @bubblemaps to avoid being exit liquidity for scams like $YODA. 🧵 pic.twitter.com/p9Iv5wOgwU

— Emperor Osmo 🐂 🎯 (@Flowslikeosmo) May 5, 2023

transfers to the multi-sig are complete. pic.twitter.com/k3KyeQ9NuA

— Pepe (@pepecoineth) May 4, 2023

Annnd, just a quiet reminder amid all the froth and noise… (Not financial adv… ah, you know.)

NEW🇺🇸‼️48% of US adults are worried about leaving their money at the bank – CNBC

That’s why we buy #Bitcoin 😎 pic.twitter.com/4SNjuHLGds

— Bitcoin Archive (@BTC_Archive) May 4, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.