How low can Bitcoin go? Analysts warn more carnage ahead if crucial level breached

Getty Images

There is a lot more pain in store for Bitcoin hodlers if the original cryptocurrency drops just a little more, analysts say.

BTC fell overnight and into this morning to a nearly two-week low of US$40,260, and at lunchtime Sydney time was still down 8.1 per cent to US$40,518.

The drop came amid a dramatic escalation of shelling on the front lines between Russia and Ukraine and as hawks on the Federal Reserve Open Market Committee pushed for aggressive interest rate hikes to combat inflation. On Wall Street, the S&P 500 fell 2.1 per cent and the NASDAQ Composite fell 2.9 per cent.

“Crypto continuing to be driven by movement in equities,” said City Index analyst Tony Sycamore, who on Wednesday had warned that risk assets like cryptos could be under pressure for awhile.

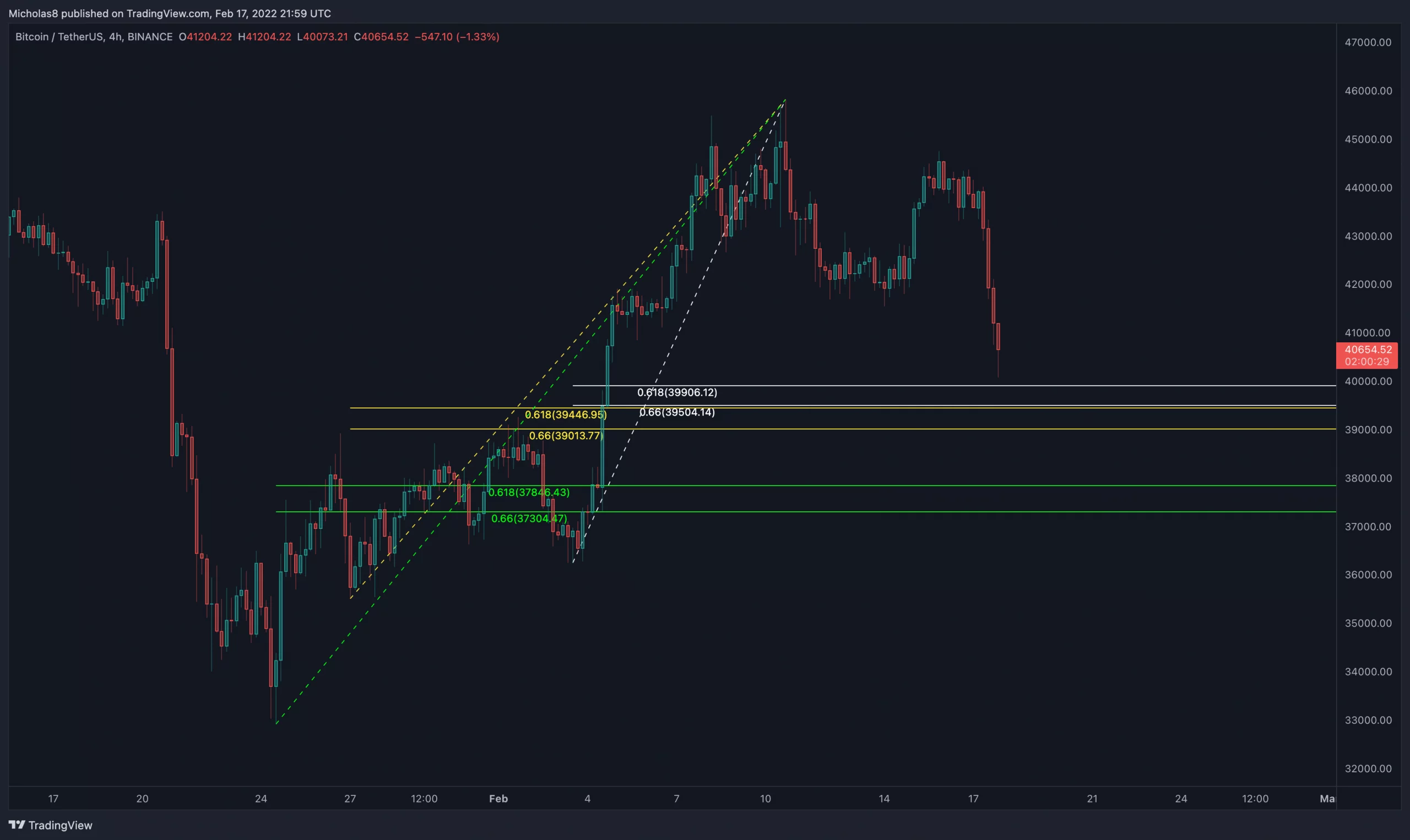

“Bitcoin rejected the trendline resistance at $45k and this keeps risks to the downside, more so if important support at $39.5 breaks,” he told Stockhead.

“If the support at 39.5k goes it should see a retest of the January $32,950 low with risks to $28,500,” he added.

Think Markets analyst Carl Capolingua sees the support level slightly differently but is also warning of a big plunge.

“If we get below $40,000 – that level is absolutely crucial – we’re probably heading back into the low 30s,” he told Ausbiz TV this morning.

While there’s a scenario where the support holds, BTC recovers to $45,600, and the uptrend resumes, Capolingua saw it as unlikely.

“I think it’s going to go down again, retest those lows, and maybe that’ll be the big, meaningful low for 2022.”

A Twitter analyst who tweets under the handle Bitcoin Charts meanwhile posted that Bitcoin “does remain in a bearish position on a macro level for a multitude of reasons.

“And with us now trading at the low of the range, it has become more likely that we continue down.”

But there are several “golden pocket” Fibonacci retracement levels between $40,000 and $37,000 that could serve as support, he wrote. It’s at those levels he was looking to possibly close his short positions and establish longs.

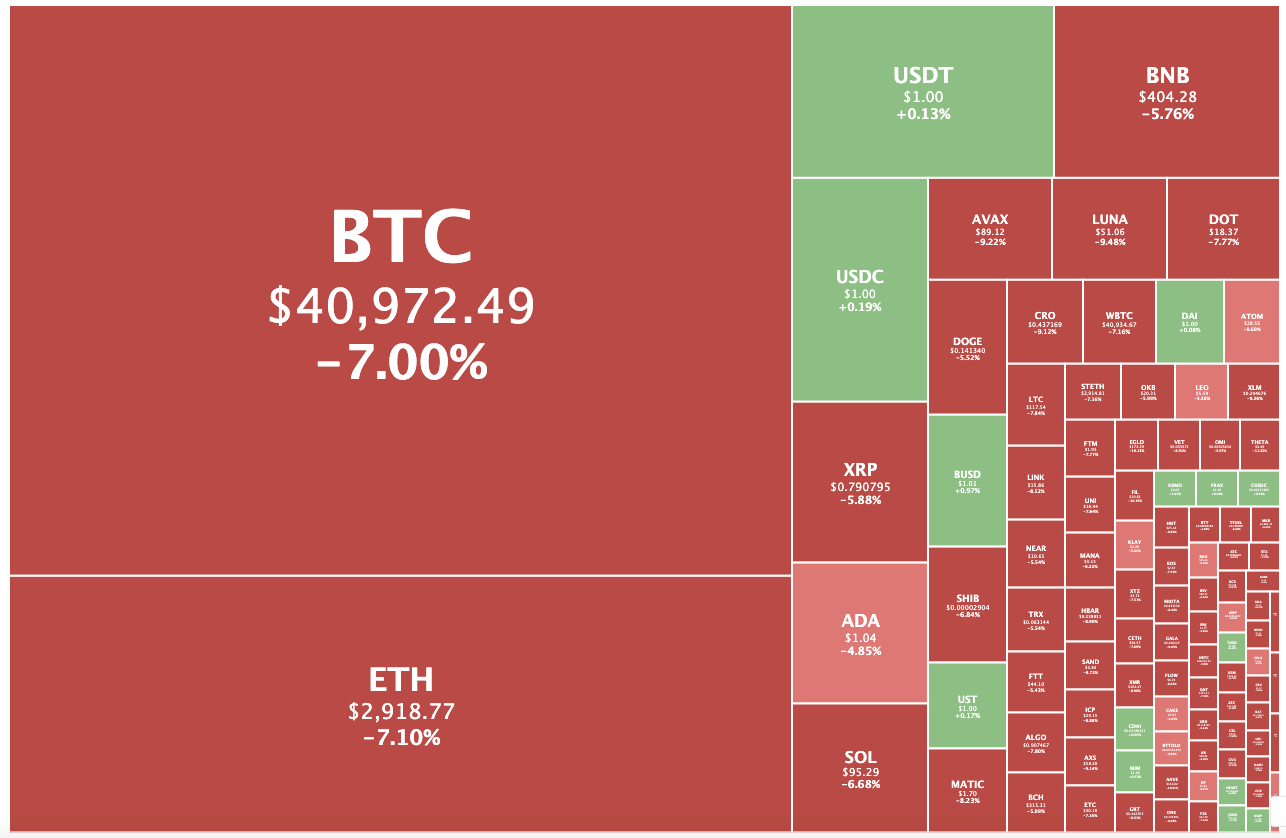

Crypto market down 6.4%

Overall the crypto market was at US$1.95 trillion, down 6.4 per cent from 24 hours ago, with only two cryptos in the top 100 in the green – a new coin called Humans.ai and Osmosis.

Ethereum was down 7.3 per cent to US$2,916.

Kadena, Theta Network, Aave and Elrond were the biggest losers in the top 100, all down by between 12 and 10 per cent.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.