Cryptos recover from weekend selloff, but sideways action may persist until mid-March Fed meeting

Getty Images

Cryptos have bounced back from the weekend selloff — but overall seem to be treading water, with one Aussie analyst saying he expects risk assets to remain suppressed until next month’s Federal Reserve meeting.

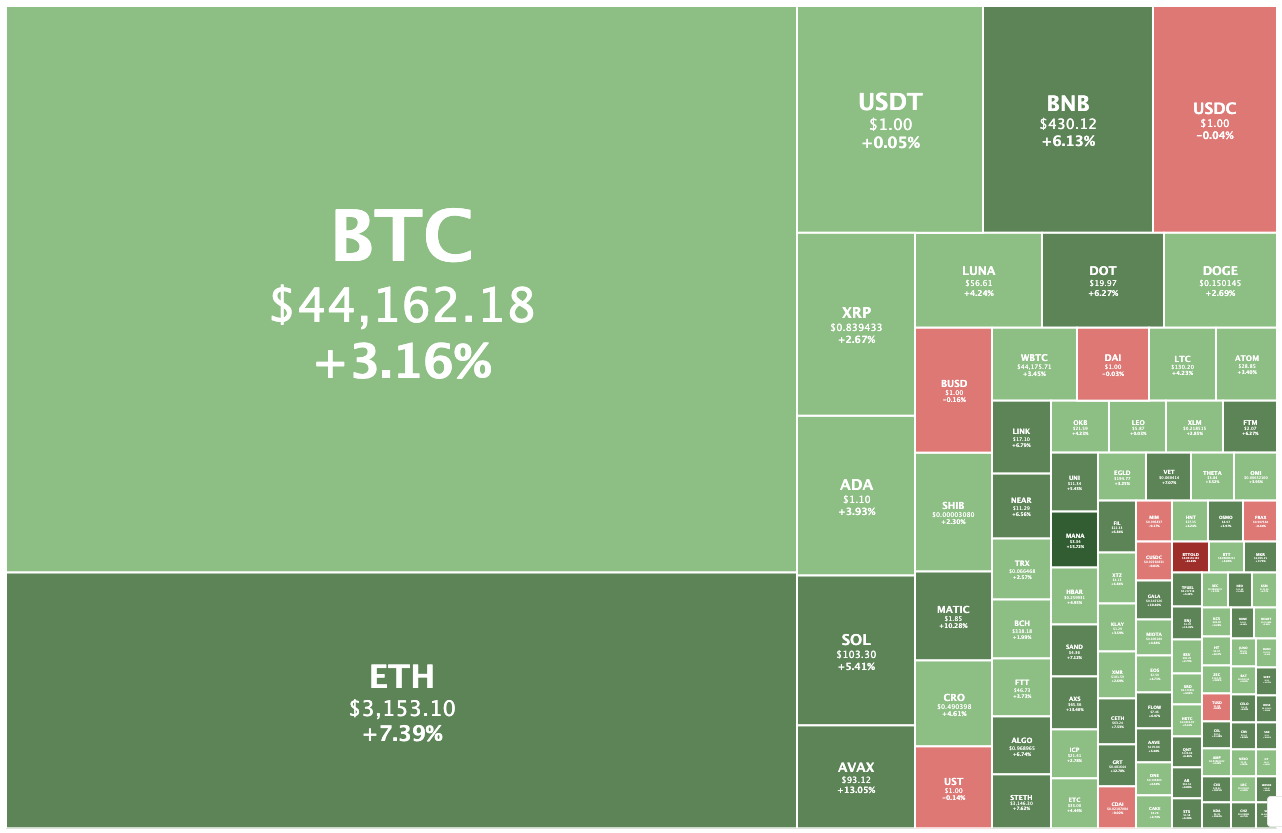

Bitcoin was trading at a four-day high of US$44,154 at lunchtime (Sydney time), up 3.5 per cent from yesterday, while Ethereum was up 7.4 per cent to $3,153, also its highest level since Friday.

Overall the crypto market was up 5.0 per cent to US$2.08 trillion, with all of the top 50 coins (except stablecoins) in the green.

Avalanche was the biggest gainer in the top 10, rising 12.5 per cent to US$93.35.

In the top 100, Decentraland was up 15.9 per cent to $3.34, followed by Secret Network, up 13.6 per cent.

But the gains only put BTC and Ethereum back where they were a week ago. XRP, Cardano and Solana are actually down for the week, with Avax the only significant gainer in the top 10.

Sycamore’s view

Sydney-based City Index analyst Tony Sycamore told Stockhead that the market is waiting to see what will happen at the March 15-16 Federal Reserve meeting.

“It’s going to be important to see if they go 25 or 50bp (interest rate hike) next month,” he said in a message.

“If they only go 25bp would expect to see a relief rally, but (I) think more likely they get the ball rolling with a quick 50bp.”

“That’s going to keep risk assets suppressed I think.”

A Reuters poll of 84 economists queried February 7 to 15 found that all of them expected the Fed to raise rates by at least 25 basis points, while 20 of them forecast a 50 to 75 point hike.

The market is also watching what’s playing out in Ukraine, Sycamore added. US President Joe Biden said today that a Russian invasion was still “distinctly possible,” but a diplomatic solution remained possible.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.