December Crypto Winners: OKX exchange tokens OKT and OKB travelling more than okay; Chiliz and Flow flop

Crypto price-prediction experts, moonlighting another gig, yesterday. (Getty Images)

Crypto’s December. Done and dusted. Like us, did you attempt to drown it all out with as much festive cheer as you could stock in the fridge or esky? In any case, here’s a refresh on which coins pumped and which absolutely didn’t.

Before delving into specifics, though, let’s grab a quick look at how the month travelled overall, using leading crypto asset Bitcoin (BTC) as the market-health barometer. (A thankful nod to Coinglass, for the data.)

There you are, then. It wasn’t tremendous, but it was far from being the worst month for Bitcoin and crypto in 2022. The less said about some of those torrid months the better, really. But just in case you have a lingering, morbid sense of fascination with it all, you can remind yourself about what went down – in a particularly large nutshell here.

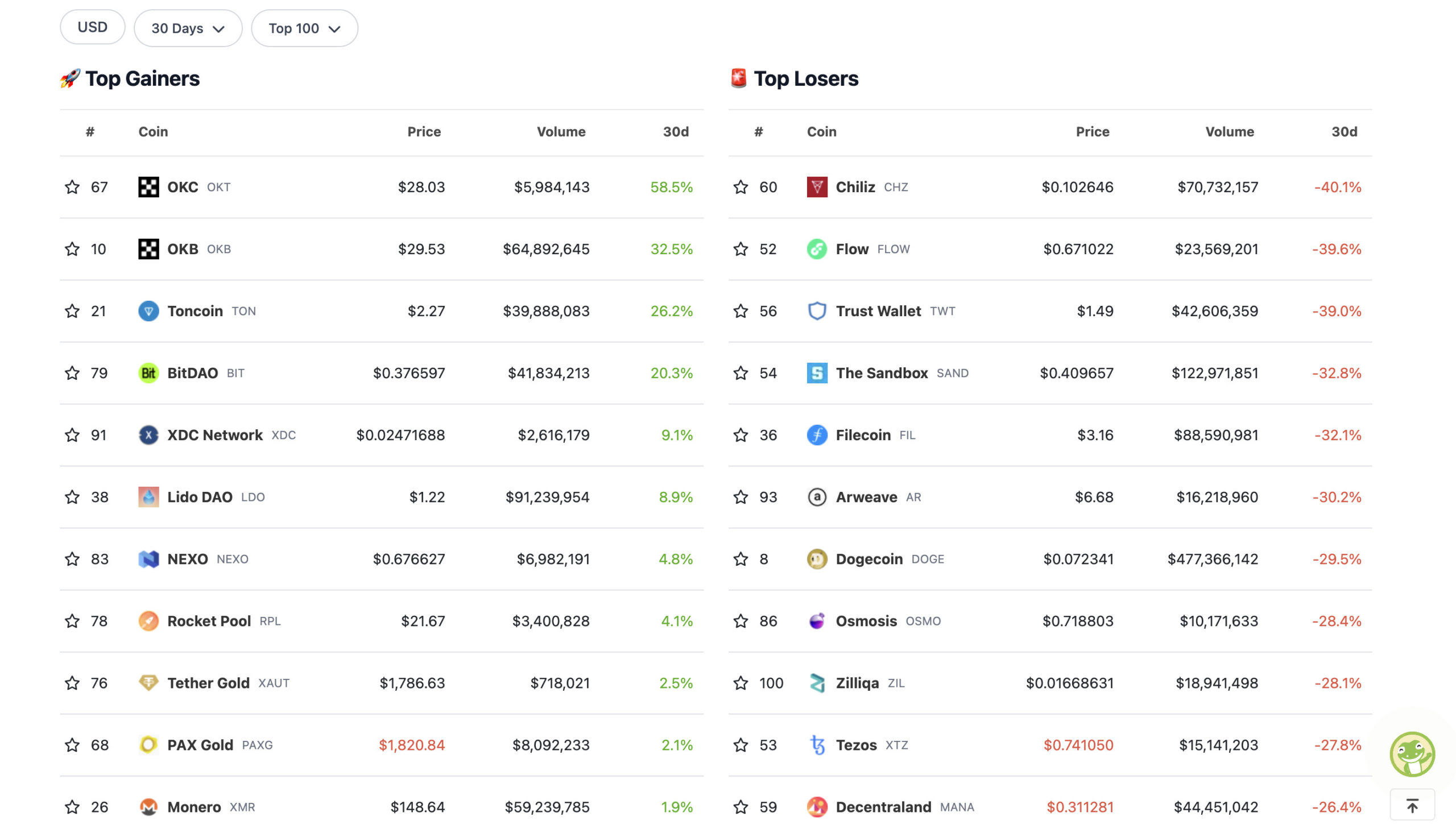

December’s leading gainers and losers in the top 100

OKX, OKC, OKT, OKB – they’re annoying but going…

Okay. Let’s talk about the Seychelles-headquartered (Chinese founded) OKX exchange. Because, really, what the FTX did its confusingly-named dual tokens do to deserve such a good month in the green?

We covered that briefly in today’s Mooners and Shakers update, but let’s delve slightly deeper.

Firstly what’s with the dual tokens? And what’s the difference between OKT and OKB (The top two gainers for the month)?

According to Crypto.com, OKB is the OKX exchange’s utility token. It “enables OKX users to access several features of the crypto exchange. Specifically, OKB computes and pays trading fees, provides users access to voting and administration on the site, and rewards users for staking it.”

OKT, meanwhile, is known as OKX’s “ecosystem” token, which is tied to the development of applications on the OKChain (hence, OKC). Is this confusing as hell? Probably, but think of it as the token for OKX’s Cosmos-built, Ethereum-compatible layer 1 blockchain.

$OKB rose 27.9% in the last 7 days of 2022 & started out as the top 1️⃣0️⃣ coins by market cap in 2023. 🚀🚀🚀

— OKX (@okx) January 2, 2023

Annnyway… In an effort to find out some reasons why these frankly irritatingly named coins are heading this month’s list, we had a quick scour of the internet. Here’s what we could glean:

• OKX Chain (OKC, which has the OKT token) launched its “liquid staking” protocol on December 20. And that was seen as a pretty big deal for the network as it (and don’t ask us how) is apparently able to reward users with an annual percentage rate of up to 40%. Yep… that seems sustainable.

Nevertheless, the price of OKT rocketed since the services’s launch.

• The other major reason for the exchange tokens’ surge could be some gain in market share ever since the FTX exchange titan imploded in the biggest mess since the Major League Eating World Championship was held at Taco Bell. And that market share has reportedly been heavily picked up in Asian markets.

• Interestingly, OKX registered itself as a digital asset trading biz in the Bahamas in November, which was home to the polycule-sex-orgy-loving bankrupt FTX mob. OKX was also granted approval last year from the UAE to branch out into Dubai.

• Finally, like many other crypto exchanges, OKX has been making some public noise about its “proof of reserves”, releasing its latest report late December. The exchange claims its Bitcoin and USDT reserve ratio was at 101% while its Ethereum reserve is 103%. This might have gone some way to increasing consumer confidence late last month.

Chiliz goes cold, while Flow trickles

Quite a few people seemed to have predicted this. In mid-late November, Chiliz (CHZ) had a surge leading into the World Cup in Qatar, but then dropped off in a buy-the-rumour-sell-the-news event. I guess if you were paying attention to it around that time, you might’ve been able to trade that narrative.

Just a reminder… Chiliz is the in-house digital currency for the Socios sports fan engagement platform, which creates specific football-based social/fan tokens, such as the Argentine Football Association Fan Token (ARG). And, incidentally, that token surged according to the fortunes of Messi and co. during the tournament, dropping right off again once the hype died down after the team’s win over France in the final.

You could argue then that CHZ tends to operate with in its own volatility bubble that’s slightly divorced from the rest of the crypto market.

The Flow blockchain, meanwhile, continued a dismal end to the year – a trend that began with it losing 60% of its previous trading volume between September and October and then losing another 50% in November after the project announced it had laid off about 22% of its team due to the bearish market conditions.

Flow is the blockchain that houses the once extremely popular NBA Topshot NFT brand, which has been struggling to maintain healthy sales volume amid the downturn in the NFT space in general over the past several months.

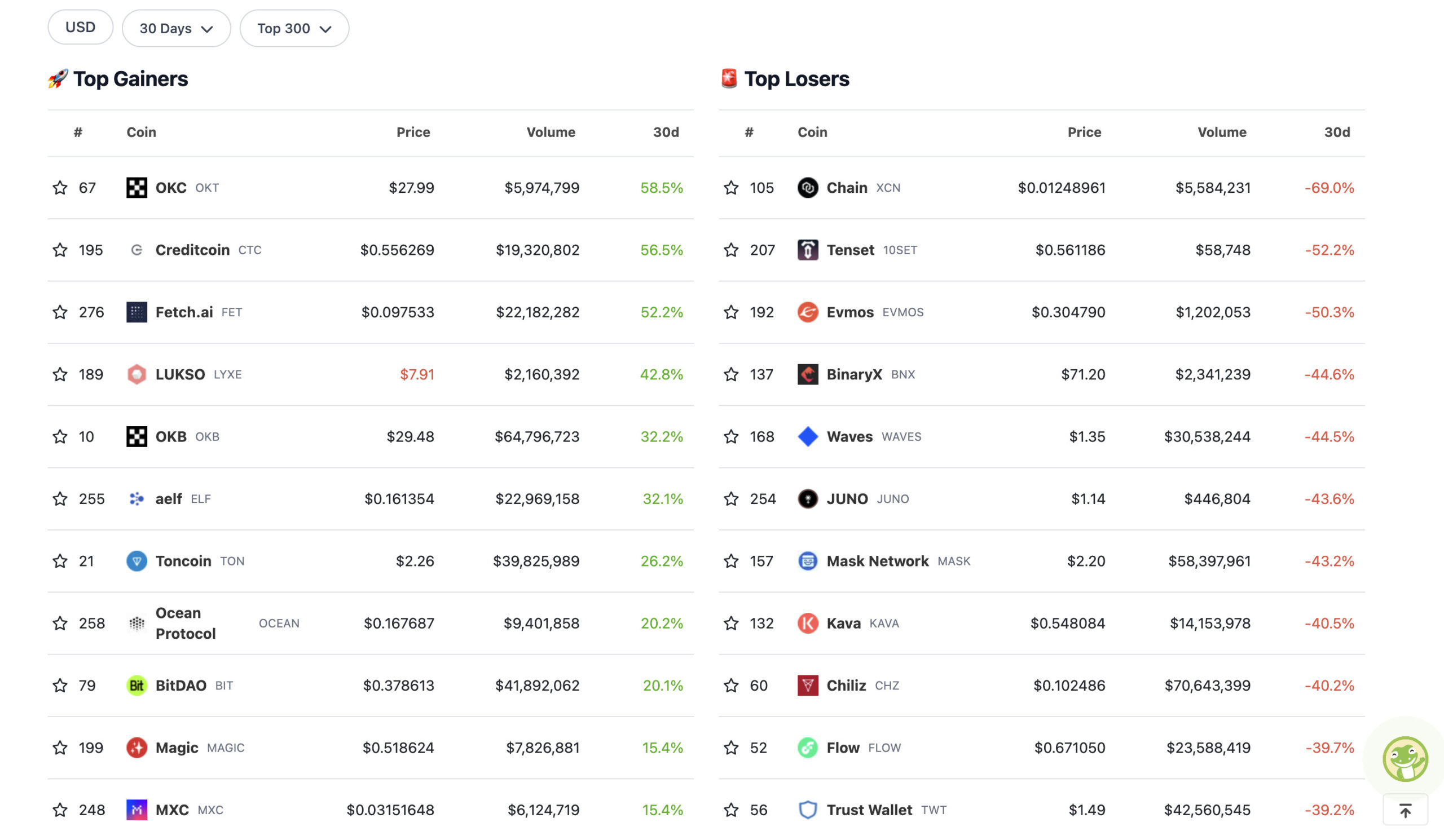

Top 10 gainers and losers in the top 300

Zooming out a tad, here then, were the top 10 winners and losers from the top 300 cryptos by market cap, with thanks again to CoinGecko…

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.