Crypto true believers are still HODLing and accumulating Bitcoin, according to data gurus

"Congrats to our Fund Strategist of the Month, BitBro69, who's working from his Mom's basement today." (Getty Images)

Something is building. Can you sense it? It’s not the light or dark side of the Force, and we’re not talking about NFT cartoon animals, although those are still “building”, I guess. No, it’s Bitcoin, and perhaps more broadly, crypto.

Bit dramatic? Probs, but consider the following:

• BlackRock, the world’s biggest asset manager with close to US$10 trillion AUM has filed for a spot Bitcoin ETF. In this Stockhead section’s opinion is big, and we plan to speak to a few experts this week to get their take on just how big it would be for the crypto market if it comes to pass. BlackRock, after all, has had about a 99% success rate of regulatory approval on its 575 ETF applications to date.

• Fidelity, now, is also rumoured to be in the spot Bitcoin ETF hunt. And they’re a bit massive, too, with US$4.25 trillion AUM. Now, why do you think these two big guns would be pushing for BTC ETF approval at this point in time? That is, amid so much regulatory heat on the crypto industry from the SEC, the very organisation that passes or denies ETFs in the US?

• Is the SEC attempting to, in its view, clean up what it regards as messy loose ends in the industry, before opening the institutional investment floodgates? Is it about to play favourites with the likes of BlackRock and Fidelity?

(Collective Shift’s Ben Simpson seems to think that’s possible/likely, judging by his latest video…)

Why The BlackRock ETF is a Game-Changer.

Coinbase & NASDAQ are reportedly partnering to get this through.

It will open up a huge amount of capital from retirement funds and boomer money (Which should be in Bitcoin anyway)

In the trillions.

But for retirement funds aren't just… pic.twitter.com/ZS05hgF1Iw

— Ben Simpson (@bensimpsonau) June 20, 2023

• Asia, led by financial powerhouse Hong Kong, is making big strides to embrace the crypto industry. To a lesser extent, perhaps, Europe, too.

• And then there’s this…

Bitcoin true believers are HODLing and accumulating

In some of its most recent (July 19) analysis, the widely referenced blockchain data analytics firm Glassnode noted:

“The undercurrent of BTC supply continues to flow out of exchanges, miners and whale wallets, and towards HODLer entities of all sizes at a healthy rate.”

In other words, whales, sharks, dolphins, carp and plankton – Bitcoin believers of all metaphorical marine-life size – are accumulating the OG crypto asset.

These are investors who’d rather sell their stake in that underrated lithium mine, along with a kidney (preferably someone else’s) than their precious Bitcoin.

#Bitcoin Entities with a balance under 100 BTC are increasing their holdings meaningfully, absorbing an equivalent to 254% of mined supply over the last month (2.54 x ~900 BTC/day = 2,286 BTC/day). pic.twitter.com/Vmtm4mfJzW

— glassnode (@glassnode) June 19, 2023

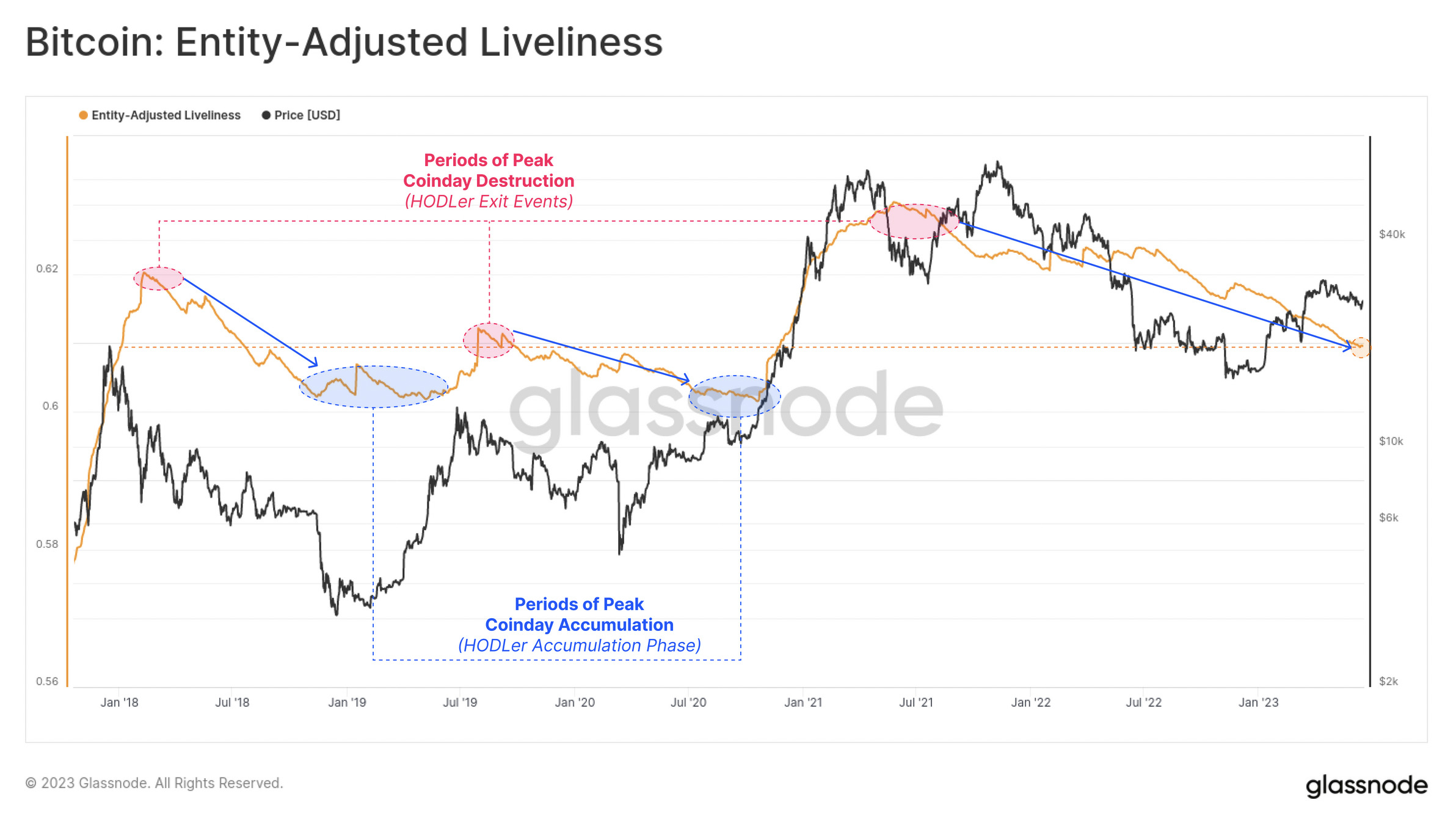

Do you think this is a good sign? Of course it is. And according to Glassnode, this level of accumulation has taken place before all previous Bitcoin bull market cycles (as you can see from the chart below) and leading into all previous “Bitcoin halving” events.

The next halving, however, is still about 300 days away and is set to occur in mid April 2024. Investor patience is key, especially considering previous halving-based price swings to the upside have generally not hit full force till months beyond halving dates.

Glassnode’s analysis also notes that Bitcoin’s illiquid supply has reached an all-time high. And that refers to the amount of BTC held by entities that historically hold onto at least 75% of their coins.

“This observation is further supported by the divergence between exchange balances, and the volume of coins held in illiquid wallets, being those with little to no history of spending,” wrote Glassnode, adding:

“Illiquid supply reached a new ATH of 15.2M BTC this week, whilst exchange balances have fallen to the lowest levels since Jan 2018 at 2.3M BTC.”

However, BTC miners are cashing in?

One last thing regarding Glassnode’s extensive report, and as eToro’s markets analyst Josh Gilbert noted in an email sent to Stockhead this morning, the Bitcoin miner exchange flow has hit a five-year high.

“The shift suggests a large number of miners are looking to cash in on their cryptoasset holdings and ‘readying their powder’ by placing assets on exchange,” noted Gilbert, adding:

“It is difficult to interpret whether this is a good or bad signal for the market – miners may be looking to cash in ahead of an anticipated fall in value or may be betting on a rise in the price of the cryptoasset and preparing to take advantage.

“That being said, miners still hold large amounts of bitcoin, worth roughly $50 billion. Glassnode’s data indicates that bitcoin exchange outflows are ahead of inflows at a three-month low which would suggest investors overall are holding tight with their cryptoassets for now.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.