Crypto roundup: Bitcoin grabs support, despite US Fed tapering FUD and Liquid exchange hack

Pic: DKosig / iStock / Getty Images Plus via Getty Images

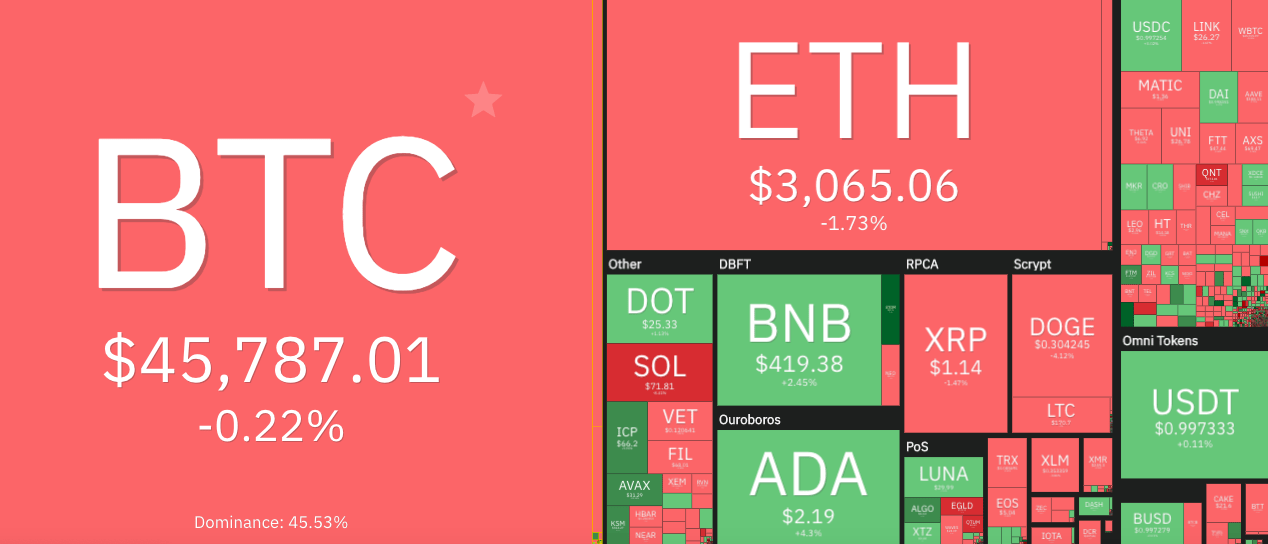

Bitcoin and the crypto market are making somewhat of a recovery at press time, after earlier taking a dip on the back of the US Federal Reserve’s “tapering” talk and the Liquid exchange hack.

While it might be too early to get excited about it just yet, Bitcoin (BTC) has today held the US$44K zone that analysts were talking about yesterday as a “critical support level”, despite looking like it might bust down on the back of bearish news events.

At the time of writing, the entire crypto market had crept its way back above “2 trill” again, and is up 1.02% since this time yesterday.

Bitcoin is trading at around US$45,740, having very briefly dipped to US$43,900 earlier in the day (yeah, we know we said it held US$44K all day… it pretty much has).

We won’t dig up what every Bitcoin analyst on Twitter and YouTube is saying about this support capture. But suffice to say, many of them are pretty positive about it…

Bull season.

— Michaël van de Poppe (@CryptoMichNL) August 19, 2021

Fed fun

Earlier on Thursday, the crypto market seemed to be having a delayed reaction to the US Federal Reserve’s policy minutes from a late July meeting. The minutes were publicly released on Wednesday and first reported then, too.

Maybe everyone was initially too busy trying to buy pixelated llamas to absorb Fed Chair Jerome Powell and friends’ info bombs.

The TLDR on it is this:

The Fed reckons there is a growing consensus that it could soon be time for it to start scaling back asset purchases (specifically US$120 billion of monthly bond buys) and start increasing interest rates. But this is as long as the US economy continues to show signs of recovery.

This is the Fed’s “tapering” narrative, and it’s not one the US stock market likes very much. Consequently the S&P 500 took quite a dip on the news. Bitcoin and crypto, as a significant “risk-on” asset class, is still very much correlated to these macro, traditional financial events. And so, like a shadowy super-coding, hoodie-wearing sheep in sunglasses, it dipped, too.

That said, the crypto market’s recovery from this, and from the news of the large hack on the Japanese exchange Liquid, has been reasonably encouraging so far today.

Maybe it has something to do with some of the more positive institutional movements playing out in the background today (see further below).

In the news: Wells Fargo, JP Morgan, Lloyds Banking Group and more

There’s been more seesawing crypto news in the past few days than you can poke a hardware wallet at. Apart from Cryptohead’s main stories, here are some news bites that caught our roving, screen-glued eye in the past 24 hours or so…

• US mega-bank Wells Fargo has launched its “passive” Bitcoin fund for its wealthiest clients. Who said institutional interest in crypto was dying? (Probably no one.)

• United Wholesale Mortgage, the second-largest mortgage lender in the US, plans to accept crypto payments by the end of this year. BTC and ETH: safe as houses?

• Lloyds Banking Group, one of the UK’s biggest financial institutions, is looking to hire a “digital currency and innovation manager”, according to its new job listing.

• US Securities and Exchange Commission (SEC) Chairman Gary Gensler is coming for DeFi. He told The Wall Street Journal today that DeFi is “not immune” to regulation.

• Former SEC Chairman Jay Clayton, meanwhile, has reportedly joined Fireblocks, a US$2 billion Israeli crypto custody firm. Things. That. Make. You. Go. Hmmm.

• Crypto exchange Binance has hired ex-US Internal Revenue Service (IRS) investigator Greg Monahan as its new global money-laundering reporting officer.

• Fund manager VanEck has added to the SEC’s overflowing in-tray with an Ethereum Futures ETF application, following on from its BTC Futures ETF filing.

• Coinbase has reportedly stockpiled US$4 billion to apparently help see the exchange through regulatory uncertainty and a potential “crypto winter”.

• Banking giant JP Morgan has reportedly blocked account activities involving US Bitcoin-mining firm Compass Mining. Check out this tweet from the Compass CEO…

https://twitter.com/BitcoinBroski/status/1428059569348034564

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.