Crypto roundup: Solana stealing show as Bitcoin plays ‘MACD’ support act

News

High-speed, smart-contract platform Solana hit another all-time high today, continuing to steal the show with other notable top gainers this week, Terra and Audius.

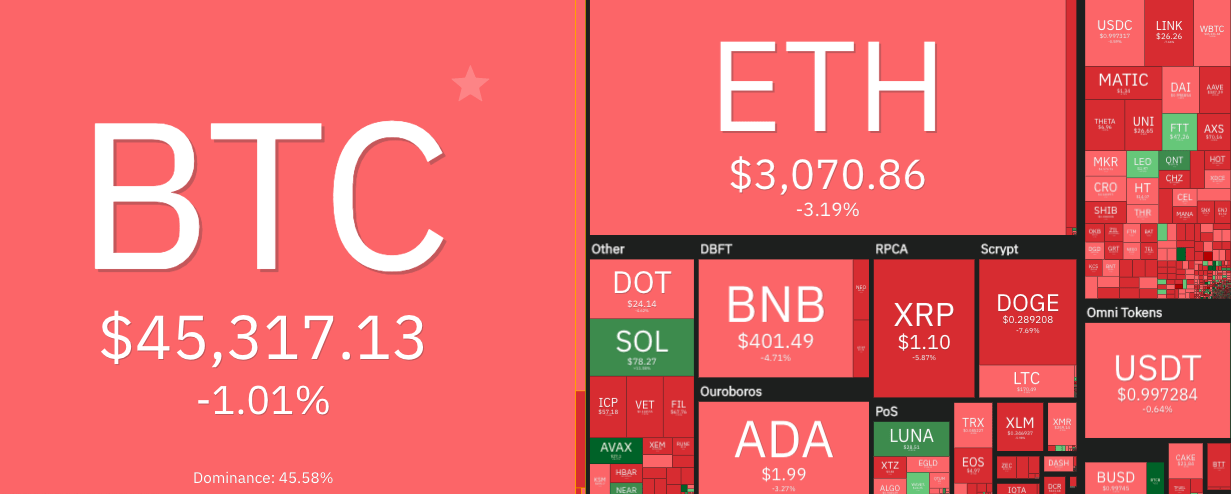

As you can see from the Coin360 market overview below, there are at least a few top coins in the green today at press time, amid a sea of reddish activity. Overall, the entire crypto market cap, according to CoinGecko, had slipped back just under US$2 trillion at the time of writing.

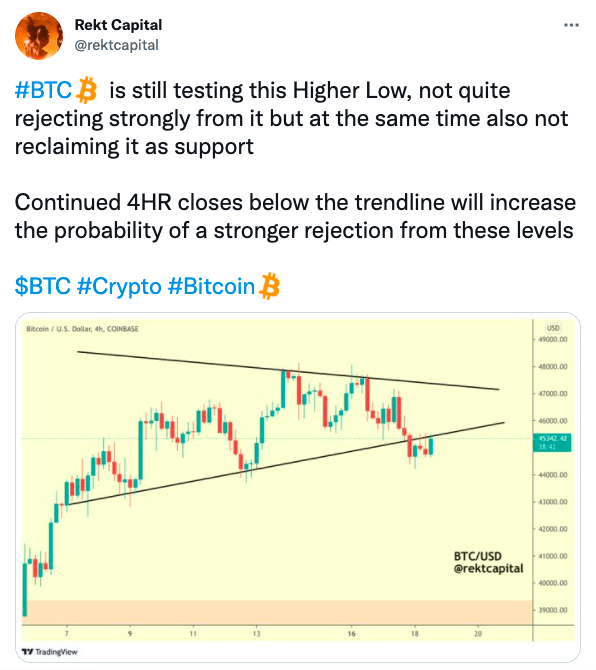

Bitcoin (BTC), meanwhile, is kicking around backstage after an indifferent supporting-act effort. It ultimately gained a “meh” from sections of its audience of chart-tooling analysts when it received a soft rejection around US$45.5K today.

That said, at the time of writing, Bitcoin could still be tuning up for its next set.

According to go-to gun analyst Michaël van de Poppe today, if Bitcoin does drop below its “critical support level” of US$44K, the next levels to watch will be US$43K and then US$40K.

However, there’s nearly always a positive scenario to consider, too. He notes there’s a reasonable chance the no.1 crypto could be showing strength here, in which case he expects this to have a positive knock-on effect for the altcoins.

It still seems too risky to make that kind of call just yet. But there have been rumblings of another “altcoin season” here and there across crypto social media for a little while now. Admittedly, that’s to be taken with a grain of salt.

Today, for instance, you’ll see “MASSIVE buy signal” titles popping up in the video thumbnails of popular YouTube channels such as BitBoy and Crypto Jebb.

And this particular “buy signal” is being talked about elsewhere in crypto media, too. It’s all to do with Bitcoin, as it nearly always is.

It comes in the form of the weekly moving average convergence/divergence tool, also known as the MACD. As reported by CoinTelegraph, this has actually been flashing green since August 8, and appears to be flipping bullish for the first time in 11 months.

You can see a MACD “golden cross” just beginning to play out in the bottom right of this chart below.

If this continues to cross and we start to see a green pattern form (green bars, bottom left), it’s historically a very bullish sign for Bitcoin and the entire crypto market.

As always, time will tell. PlanB likes what’s he’s seeing at the moment, but that’s not exactly unusual.

Both #bitcoin S2F (white line) and on-chain signal (color, not red yet) still indicating a 2nd leg of this bull market. pic.twitter.com/ZthR7sd0BA

— PlanB (@100trillionUSD) August 17, 2021

Ethereum (ETH), has been in a near-identical charting pattern to Bitcoin just lately. It’s holding above $3,000 for now, down 2.81% in the past 24 hours and changing hands for US$3,094.

Number three on the charts, Cardano (ADA) chopped around just below US$2 for much of the past 12 hours or so, but has just reclaimed the level at press time, sitting at US$2.08 and up about 1% on the day.

XRP (-2.69%); Dogecoin (DOGE) +0.17%; and Polkadot (DOT) -1.94% aren’t making any particular exciting moves, although you’d think DOGE might’ve had a bit more action on the back of news about its “Dogecoin Foundation“…

Still processing this information…

Vitalik Buterin & Elon Musk have representation on the board of the #Dogecoin Foundation!

These 2 successful geniuses will join a team of all-stars to help shape the bright future of Doge 🐕🚀

Let that sink in! pic.twitter.com/xXav9UvPgf

— Doge Whisperer 🐕 (@TDogewhisperer) August 18, 2021

Still in the top 10, Solana (SOL) continues its week in the sun, hitting a fresh all-time high a few hours ago, of US$79.57. It’s presently at US$78.21, up 17.6% in the past 24 hours and 82.4% in the past week.

Solana’s ecosystem is picking up, particularly its NFT sector, which is gaining plenty of attention from “shitty at best” launches of buzzy avatar releases such as Degenerate Apes and Sollamas.

Terra (LUNA) +13.9%, and Audius (AUDIO) +10.9%, are also continuing their strong weeks – up 70.6% and 114% respectively over the past seven days.

And other notable top-100 double-digit gainers having fun today include: Quant (QNT) +24.5%; Avalanche (AVAX) +22.4%; and Arweave (AR) +22.3%.

A monumental day for #DeFi and #Avalanche. Some of the most innovative and well known dapps will be available on @avalancheavax for $AVAX holders to explore and leverage liquidity mining opportunities with over $180M in rewards. #AvalancheRush https://t.co/79nP1zJ9SN

— John Wu 🔺 (@John1wu) August 18, 2021

At press time, the only double-digit loser in the top 200 today was Yield Guild Games (YGG), down 10.6%.