Crypto roundup: Bitcoin cracks half century (again); more institutional players jump in

Getty Images

The crypto market is having a largely green day, with Bitcoin looking like it might be in a mood to decisively nail down a crucial support level.

The OG crypto has managed to crack US$50K today, hitting as high as US$50,589 about six hours ago, at the time of writing. It’s been ducking and weaving since then, currently taking a breather at US$50,099 – up 5.2 per cent since this time yesterday.

On the whole, the entire crypto market cap is doing just fine, at US$2.26 trillion, up 2.2 per cent in the past 24 hours.

According to analyst Mickrypto’s latest tweets, the level just around and above the US$50K mark has formed strong resistance for Bitcoin, and that’s based off simple chart patterning extending back to the crypto’s all-time high in April. Purely from a charting POV, then, it’s no wonder Bitcoin’s progress is a little stunted in this zone and a bit below for now.

$BTC Resistance#Bitcoin is right now trading at resistance from this downsloping trendline, and also the 0.786 Fibonacci Level from this recent move#BTC pic.twitter.com/E9PIDPNAP7

— The Thrive Index. (@TheThriveIndex) October 5, 2021

Clearly, if BTC can get through this roadblock in a forceful way, then turncoat it from resistance to support, we’re looking at some bullish business ahead. (Possibly.) Yep – some searing analysis of our own, right there.

But back to a full-time chart watcher… Rekt Capital is highlighting a re-accumulation flag structure just below the aforementioned resistance line, with a range bottom close to US$44K.

This #BTC macro Flagging Structure represents a period of extended consolidation

Overall, this Flag represents a re-accumulation range

A breakout from this market structure should precede a new macro uptrend for Bitcoin$BTC #Crypto #Bitcoin pic.twitter.com/Y7AW0VkwNV

— Rekt Capital (@rektcapital) October 5, 2021

The analyst also described Bitcoin’s recent movements as “the ultimate bear trap” referring to a weekly “head and shoulders” bearish chart pattern just been and gone. Head-and-shoulders patterns are generally indicators of negative price movement, but they don’t always play out.

It’s hardly an exact science, this, but it’s still worth paying attention to if you have a vested interest.

#bitcoin is $50K now .. only +26% to $63K https://t.co/tj6SSxaaCp

— PlanB (@100trillionUSD) October 5, 2021

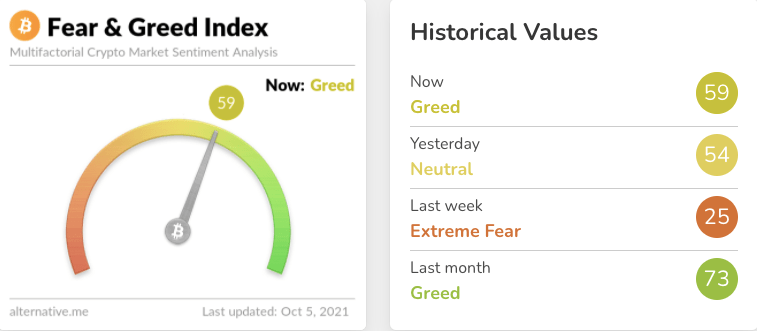

Also worth checking in with now and then is one of the crypto market’s main sentiment tools, the Fear & Greed Index, which is based on a data composite it gleans from various sources including trackers for price volatility, volume, social media and more.

It’s flipped into “Greed” territory today for the first time in about a month. Last week, it was showing “Extreme Fear”, so it just proves how quickly things can turn.

‘Probably nothing’: institutional adoption continues

While there are always serious lurking headwinds swirling, especially from China and the corridors of US governmental power, there are so many big institutional players coming out of the woodwork right now (e.g. Fidelity, Morgan Stanley, Goldman Sachs, JP Morgan and Bank of America) that it’s hard to feel too bearish for long…

Here are two recent institutional-adoption stories packing the crypto hopium bongs…

• America’s fifth-largest bank, the imaginatively titled U.S. Bank, has today announced it’s launching a crypto-custody service for institutional investors, partnering with New York Digital Investment Group (NYDIG). The bank will initially provide support for Bitcoin (BTC), Bitcoin Cash (BCH) and Litecoin (LTC), with Ethereum (ETH) and others likely to follow.

The 5th largest bank in the US is also going to custody a small little coin known as Litecoin. It's probably nothing.https://t.co/Vm61efENRP

— Charlie Lee Ⓜ️🕸️ (@SatoshiLite) October 5, 2021

• Last week, French investment bank Société Générale made a potentially groundbreaking offer to an Ethereum-based DeFi heavyweight. The bank proposes using its securities to take out loans using MakerDAO, the project that enables leading decentralised stablecoin DAI. The bank wants to use covered bonds as collateral to take out DAI. Just massive, if it comes off.

Société Générale, the third largest bank in France, just made a collateral onboarding application to Maker for 20 million USD.

Backed by EUR bonds, proposed by their blockchain subsidiary.https://t.co/hxGEMOIWjy

— Rune (@RuneKek) September 30, 2021

Mooners and shakers

A quick look at what’s on a tear today, then…

Two words… Shiba Inu (SHIB), which has now “eaten another zero” off its price – that’s two this week. The memecoin’s mad pump on the back of Robinhood exchange-listing rumours continues.

It’s currently changing paws for US$0000.1905, up 69.73 per cent since this time yesterday, and is the biggest gainer in the market cap charts’ top 300 coins. It’s also one of the entire market cap’s best performers across the past seven days, with a 175 per cent gain.

Imagine if you’d bought it at its all-time low: US$0.000000000056. The mind boggles.

TWO ZERO'S IN ONE WEEK !!!

"ShIbA iS a SHiTcoIn" 🤣

CRY MORE HATERS!!!

HAIL #SHIB ✅📈 pic.twitter.com/3a9gzR342u

— $SHIB ALEXANDER🔶️ (@ShibAlexander) October 5, 2021

Overly one-eyed, bullish meme of the day

We’ll be back soon with more from the sometimes greedy, sometimes fearful, often inspiring and batsh*t-crazy world of crypto shortly. But for now, we’ll leave you with this…

I'm lovin' it. https://t.co/XOw3jLZvTy

— Material Indicators (@MI_Algos) October 5, 2021

(What, not even the big M is gonna make it unless it joins the crypto party? There must surely be a Salvadoran buying a Big Mac with Bitcoin right about now…)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.